Rocket Companies' Platform Is Strong; Depends On Interest Rate/Mortgage Convexity

Summary

- Rocket Companies, a mortgage loan provider, has experienced a decline in revenues but has grown in terms of brand awareness and retail mortgage market share.

- The company faces risks from rising interest rates, which affect its funding capabilities and demand for products, as well as competition from other mortgage providers.

- Despite these challenges, Rocket Companies has a strong operational platform and, if it can execute its integrated strategy effectively, it may be upgraded to a 'buy' in the long term.

- For now, the divergent operational strength of the company and the financial realities it faces lead me to rate the company a 'hold'.

Bet_Noire/iStock via Getty Images

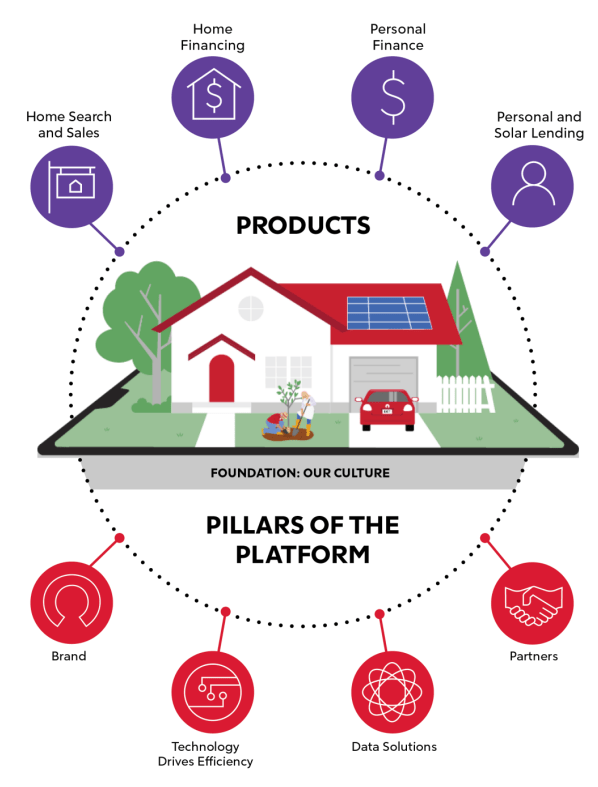

Rocket Companies (NYSE:RKT) is a Detroit, Michigan-based mortgage loan provider, with its highly integrated operations spanning home financing, home sale and search, and other personal finance and lending provisions. Additionally, via brands like Amrock and One Reverse Mortgage, Rocket offers title and property insurance and reverse mortgage services.

Rocket Companies May'23 Investor Presentation

These activities have supported 2022 revenues of $3.85bn- down 61.51% since 2021, due to negative interest convexity and Rocket's wholesale funding methodology- and free cash flow of $10.73bn in the same period. Macro stressors extend into the company's Q1'23 financials, reporting a 39.17% YoY revenue decline to $888.85mn and a -1.35bn free cash flow, largely driven by negative FCF in operating activities and declines in investing cash flows.

Introduction

To enable long-run growth, Rocket seeks to pair its platform offerings with a virtuous cycle of efficient operations, providing unique client experiences through Rocket's integrated real estate platform, utilizing digital products, and increasing client base size and scalability through constant accessibility. Asides from general downsized AUM effects due to increased interest rates, lower mortgage valuations, and reduced mortgage demand, Rocket has successfully grown in terms of brand awareness and retail mortgage market share.

Rocket Companies Flywheel (Rocket Companies May'23 Investor Presentation)

However, rising interest rates continue to pose an existential risk both to Rocket's funding capabilities and demand for products. Due to the confluent upside involved, with strong operational capabilities, and the strong potential risks, with high volatility and sensitivity to extraneous variables, I rate RKT stock a 'hold'.

Valuation & Financials

General Overview

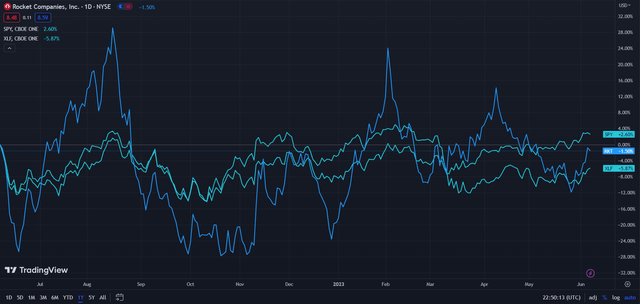

In the TTM period, Rocket Companies- down 1.50%- has experienced growth between the financial services industry (XLF)- down 5.87%- and the general market- up 2.60%.

Rocket Companies (Dark Blue) vs Industry & Market (TradingView)

While the downtrend in the financial services industry was largely a symptom of successive bank crises- thus why Rocket was able to outperform other financial companies, with less exposure to third parties- Rocket is still highly sensitive to interest rate movements.

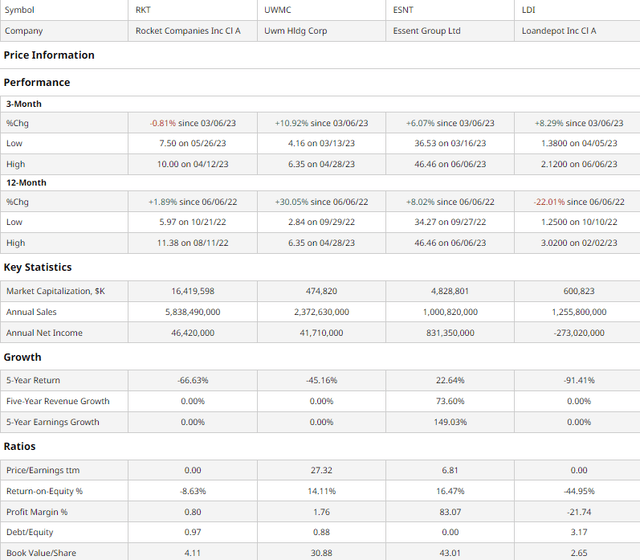

Comparable Companies

The mortgage industry is a highly intensive one, with competition from independent brokers, private providers, and larger banks. As such, without any direct digital mortgage, wholesale-funded competitors, it makes the most sense to compare Rocket with mortgage providers of similar size or capability. For instance, the United Wholesale Mortgage (UWMC), as its name suggests, is a mortgage wholesaler, underwriting mortgages and loans for independent brokers. On the other hand, the Essent Group (ESNT) is a housing finance company with insurance products across the mortgage lifecycle, with its stock price reflecting mortgage price dynamics. And the loanDepot (LDI) operates similarly to Rocket Companies, though on a smaller scale.

Demonstrated above, Rocket has experienced the poorest quarterly and second-poorest yearly price action. As I've previously discussed, this emphasizes Rocket and its revenue and net income weakness to rising interest rates.

Similarly to peer firms, Rocket posted negative ROE and returns over the past five years, emphasizing the macro headwinds mortgage lenders are enduring.

Rocket maintains no distinct value proposition from peers, undergirding my 'hold' valuation; although I believe Rocket companies have superior operational capabilities, I am unsure if this will rectify chronically poor financials.

Valuation

According to my discounted cash flow analysis, at its base case, the fair value of Rocket Companies is $8.93, with the stock undervalued by 4% at its current price of $8.56.

Although Rocket does not necessarily have a high debt/equity, the high beta of the stock implies a greater equity risk premium, thus commanding a discount rate of 10% in my five-year, non-perpetual model. I conservatively estimate 5% annual revenue growth, which is both lower than pre-COVID growth levels and means that I don't expect an instantaneous reversion from record drops in revenue. By doing so, I incorporate continued recessionary risk and expected rate increases, with the Bank of Canada most recently announcing a 25bps rate hike, which I expect the Fed to follow.

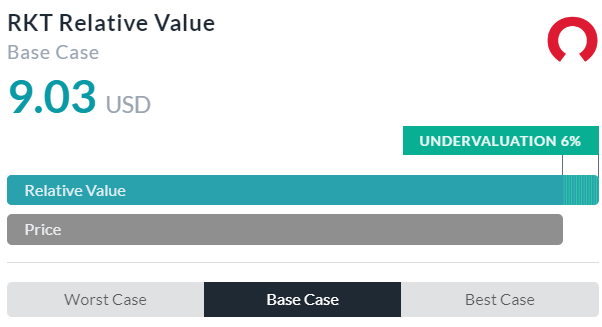

Alpha Spread

Alpha Spread's multiples-based relative valuation tool corroborates my 'hold' thesis, calculating a mild undervaluation of 6%, with a fair price of $9.03.

Therefore, using an average of my DCF analysis and Alpha Spread's relative valuation tool, the fair value of Rocket Companies is $8.98, signalling an undervaluation of ~5%.

Strong Operational Platform Depends on Balance Sheet Strength for Long-Term Viability

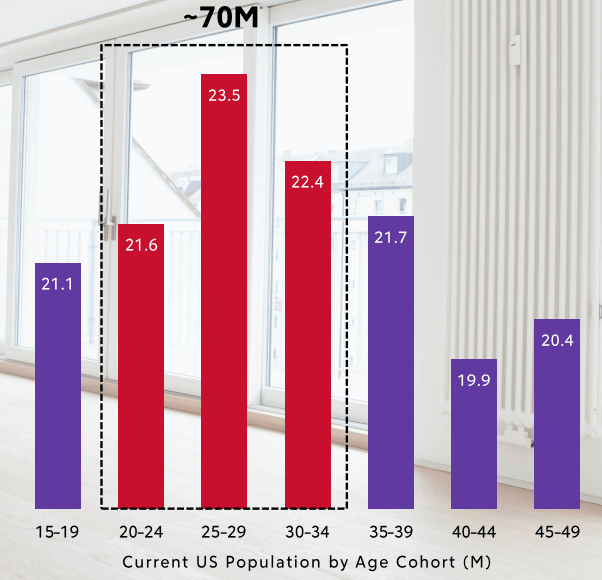

Rocket Companies has operationally positioned itself for maximal, long-run scale growth and profitability. As a premier platform for digital mortgage provisions and periphery services, Rocket has successfully captured market share across younger age cohorts. This builds long-term brand value and lifetime consumer revenues if Rocket is able to convert acquisition to retention.

Rocket Companies May'23 Investor Presentation

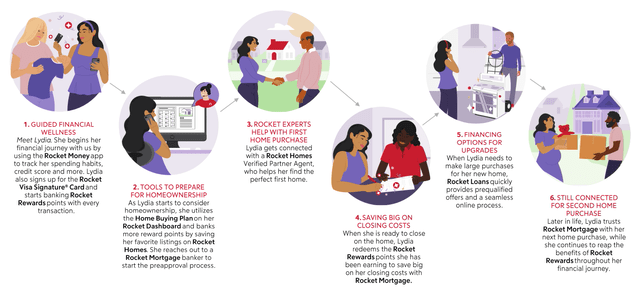

A key path to retaining consumers for Rocket remains its engagement across all its platforms; Rocket's novel Money and Rewards programs enable an upselling strategy and orient consumers towards Rocket's online home services, brokerage, core mortgage business, and insurance businesses, enabling superior consumer retention through ease of use and reduced consumer expenses alongside greater unit-based lifetime value.

Rocket Companies May'23 Investor Presentation

This idea of integrated services for the promotion of scale and consumer value is demonstrated through the Rocket Companies value chain, which emphasizes the financial wellness of clients, an assortment of financial and home ownership tools, an underlining of affordability as a draw for consumers, and upgrades and second home purchase capabilities to ultimately promote a dedicated customer base for Rocket.

Rocket Companies May'23 Investor Presentation

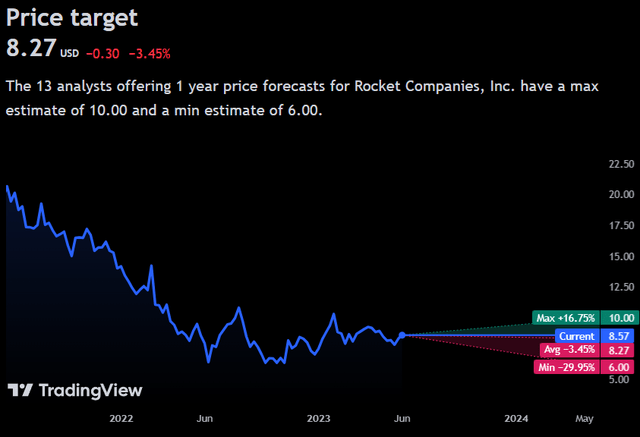

Wall Street Consensus

Analysts largely support my more conflicted view on the stock, projecting an average 1Y price decline of 3.45% to a price of $8.27.

The latter average prediction is paired with a maximum price increase projection of 16.75% and a minimum price projection of -29.95%, reflecting the dependence of Rocket's price on extraneous factors and the sheer implied volatility of the stock.

Risks & Challenges

Interest Rate Driven Beta

As I have extensively covered, interest rates have an outsized effect on Rocket's stock, materially affecting earnings outcomes and governing the firm's ability to provide returns. Even more so than the latter factors, Rocket's high volatility is further exacerbated by interest rate tendencies, leading to a lack of stability and a higher cost of equity.

Continually Poor Management & Financials

Rocket Companies has seen a high number of shifts in leadership as a result of contradictory directions and poor financial management; the divergent beliefs of streamlining the business, shifting its core financing capabilities or expanding it across adjacent verticals have led to an inability to plan for the long term adequately and is reflected in the company's weaker balance sheet and income statement.

Consumer Trust & Competitive Intensity

An inherent barrier to consumer adoption of Rocket's service is its digital-first service, which many consumers see as less trustworthy than physical mortgages. Said barrier is even more significant if consumers see Rocket as financially unstable and with a high degree of competitive intensity from large banks, local credit unions, regional banks, private lenders, etc.

Conclusion

In the short term, I expect Rocket to continue on its middling trajectory, with operational strength putting upwards pressure and interest rates applying downward pressure.

In the long term, if Rocket is able to effectively execute its integrated strategy, I could very much see myself upgrading the stock to a 'buy'.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.