Semtech Earnings: Sees Signs Of Business Stabilization, Covenants Renegotiated

Summary

- Semtech declares that its business is seeing "some" signs of stabilization.

- Keep in mind that this set of results includes the recently acquired Sierra Wireless.

- The best news from this quarter had to be the debt situation, with the debt covenants being relaxed until 2025.

- Deep Value Returns members get exclusive access to our real-world portfolio. See all our investments here »

EuToch/iStock Editorial via Getty Images

Investment Thesis

Semtech (NASDAQ:SMTC) saw its share price soar premarket as investors latched on to its renegotiated debt covenants.

The business ended fiscal Q1 2024 with net leverage of 4.3x, and given that Semtech is still burning through cash flows, investors' expectations had been quite muted as the stock headed into print.

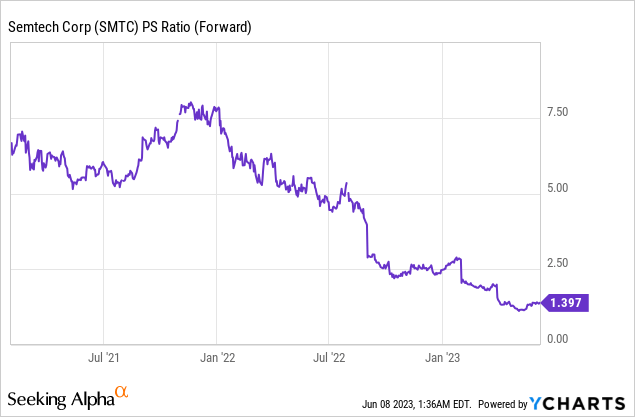

As you can see above, the stock was being priced at 1x forward sales, a fraction of the multiple it held a few years ago.

With investors' expectations so low, anything that wasn't further bad news would have seen shorts being forced to run for cover. And that's what's happened here.

Why Semtech? Why Now?

Semtech is a supplier of high-performance analog and mixed-signal semiconductors. They provide high-performance semiconductors, IoT systems, and cloud connectivity services. Semtech manufactures a range of products for infrastructure serving OEMs.

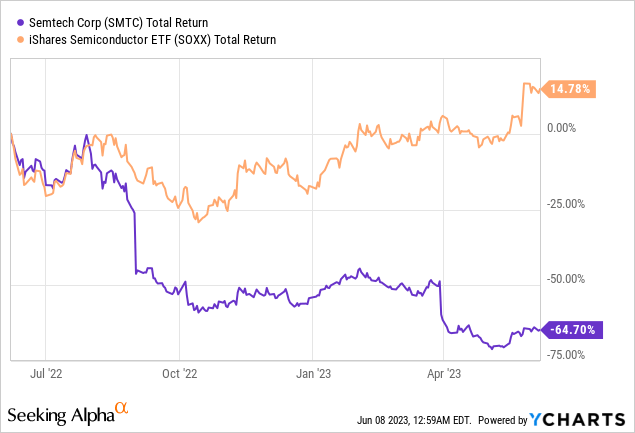

The stock had been out of favor with investors as it headed into the earnings print, see below.

At the same time as the semiconductor ETF (SOXX) continues to hurry higher, Semtech's share price was falling significantly. Investors had been primed to only expect negative surprises. So what should investors look forward to?

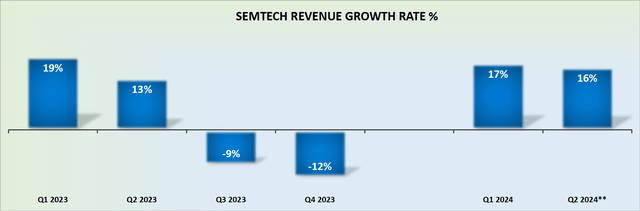

Revenue Growth Rates Expected to Improve in Fiscal H2 2024

Semtech asserts that the business has now started to stabilize, pointing to its Chinese consumer end market having now found a floor.

But as a whole, even as with each of the next several quarters, the comparables become easier for Semtech, that's not what caused the share price to jump.

What investors are now hoping for, is that Semtech is able to put in place measures that will allow it to continue running its operations, without being weighed down by its balance sheet. A topic that we'll now turn to.

Leveraged Balance Sheet

The main concern bears have had when it comes to Semtech had been its leveraged balance sheet.

Semtech ended fiscal Q1 2024 with a net debt position of approximately $1.2 billion. Given that Semtech's cash flows from operation for fiscal 2023 were around $127 million, investors had been cautious that Semtech could perhaps struggle to pay down its debt in a timely fashion.

Furthermore, within that $127 million figure, recall that fiscal Q4 2023 in particular saw its free cash flow being reported at negative approximately $25 million. Meaning that Semtech's cash flows were rapidly moving in the wrong direction.

What's more, since the guidance for this quarter didn't inspire much hope of significant improvement, investors started to shun the stock. There was just too much debt attached to the company.

Also, as had been widely reported in the semi-industry, asides from those with exposure to AI, semis had been suffering from too much-bloated inventory.

Consequently, the expectations for Semtech were that the company would report further cash flow losses this quarter, therefore further pushing its balance sheet to the brink.

In an effort to placate investors, Semtech sought to put in place measures to ensure that its covenant restrictions would impair its near-term prospects. Here's a quote from the earnings call describing this action:

Our gross debt at the end of Q1 was $1.4 billion or approximately 4.3 times leverage on a net basis. We expected to see an increase in net leverage in the first half of the year as we navigate this softer demand environment.

We announced today, that we negotiated another amendment to our credit agreement to get further relaxation through our leverage and interest expense coverage ratio covenants. Given our current projections for revenue and earnings, we now expect to have an adequate cushion through fiscal 2025.

Consequently, as you can see from the quote, Semtech has renegotiated its debt covenants with its lenders, thereby providing a cushion to the business over the next 2 years.

The Bottom Line

Semtech experienced a surge in premarket share price due to the renegotiation of its debt covenants, providing relief to investors.

The company had been facing low investor expectations and a decline in share price. However, Semtech believes that it's seeing stabilization, particularly in the Chinese consumer market.

The main concern for investors had been Semtech's leveraged balance sheet, but the company has negotiated an amendment to its credit agreement, easing covenant restrictions and providing a cushion for the next two years.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.