Data Center REITs: Physical Epicenter Of AI

Summary

- Among the top-performing property sectors this year, the Data Center REIT rebound has been fueled by reports of "booming" demand for artificial intelligence ("AI") focused data center chips.

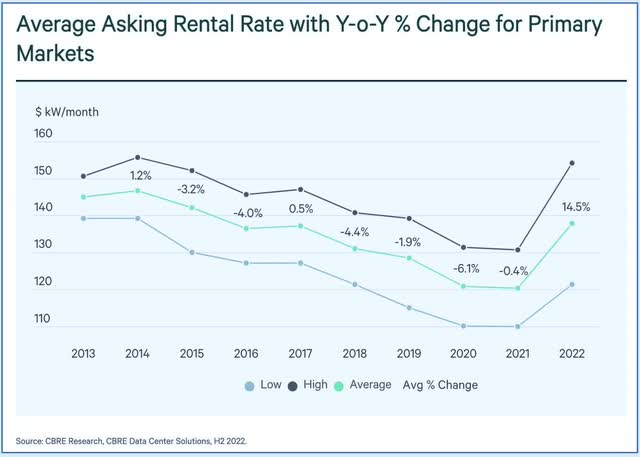

- Even before the Nvidia report, Data Center REITs were on the upswing in early 2023 after an impressive slate of earnings results showed improved pricing power and record-high occupancy rates.

- Ironically, this AI-wave comes just as Data Center REITs became a trendy “short” idea centered on a thesis of weak pricing power and competition from the "hyperscalers" - Amazon, Google, and Microsoft.

- A confluence of development bottlenecks - power shortages, higher cost of capital, supply chain constraints, ecopolitics, and NIMBYism - have created a more favorable dynamic and swung the pendulum of pricing power towards existing property owners.

- Barriers to supply growth combined with AI-accelerated demand should bring some sustained pricing power to a sector long-burdened by near-unlimited supply. With negotiating power tilting back towards landlords, there appears to be enough economic value to be shared.

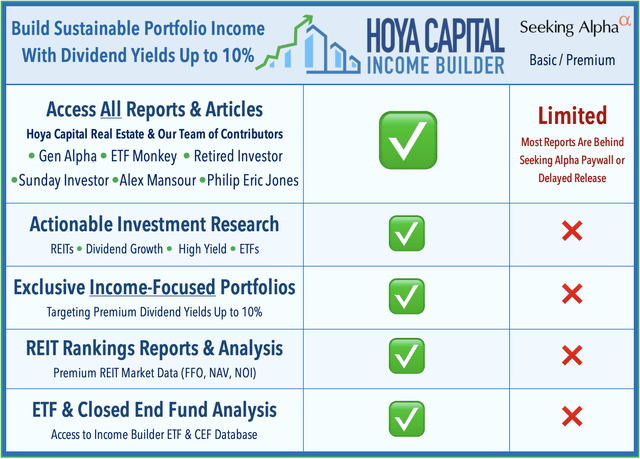

- This idea was discussed in more depth with members of my private investing community, Hoya Capital Income Builder. Learn More »

Jian Fan

REIT Rankings: Data Centers

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on June 6th.

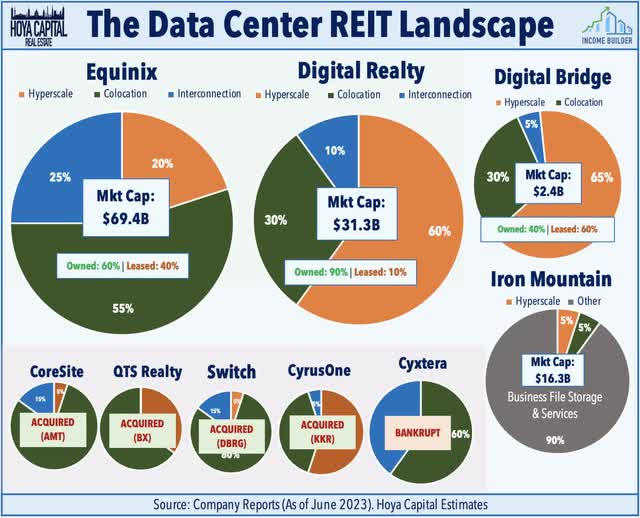

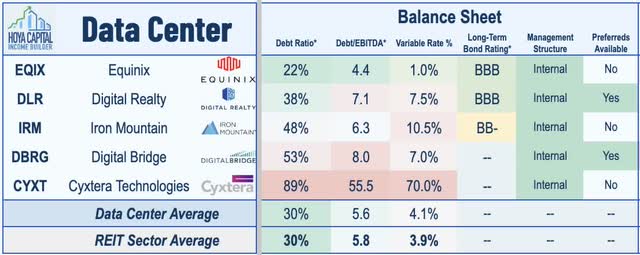

Among the top-performing property sectors this year, the Data Center REIT rebound has been augmented by reports of "booming" demand for artificial intelligence ("AI") focused data center chips. Even before the Nvidia report, Data Center REITs were on the upswing in early 2023 after an impressive slate of earnings results showed improved pricing power and record-high occupancy rates. Within the Hoya Capital Data Center Index, we track the two major data center REITs - Equinix (EQIX) and Digital Realty (DLR) - alongside DigitalBridge (DBRG) - a former REIT that now operates as a conventional c-corp, Iron Mountain (IRM) - a specialty REIT with a growing data center vertical alongside its document storage business, and Cyxtera (CYXT) - a former SPAC that had planned to convert to a REIT before hitting extreme turbulence this year under the weight of its significant load of variable rate debt.

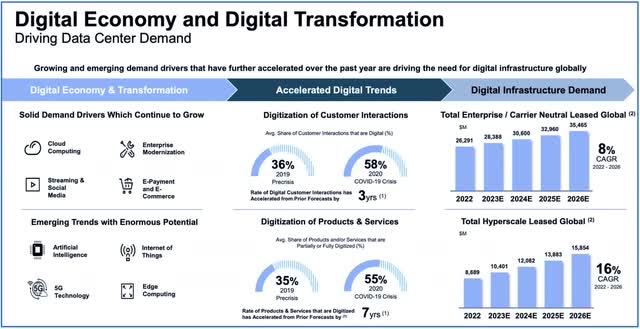

Data Center REITs have been thrust back into the spotlight in recent months - this time in a favorable light as the physical "epicenter" of the artificial intelligence ecosystem - after chip maker Nvidia (NVDA) reported blowout first-quarter results in late-May, driven by strength in its data center business. Nvidia said that it is "significantly increasing its supply of data center chips" to meet "surging" demand resulting from investments in artificial intelligence ("AI"), a technology that leverages the computing power of data centers to search massive datasets and to process intensive computing tasks to produce a seemingly "intelligent" output. In its earnings call, Nvidia commented that it believes that "a trillion dollars" of installed global data center infrastructure will transition from general-purpose computing to "accelerated" computing as companies "race to apply generative AI into every product and service."

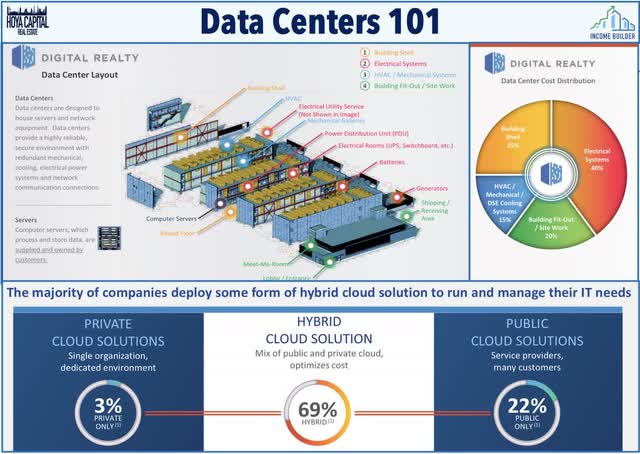

Housed in windowless buildings surrounded by massive generators and cooling equipment, data centers provide the critical infrastructure - power, cooling, and physical rack space - to a variety of enterprise customers with different networking and computing needs. Cloud computing is essentially the "outsourcing" of these computing tasks and data storage from the local device to a far-more-powerful and reliable off-site facility, which has been enabled by the ongoing deployment of high-speed and low-latency internet infrastructure. AI has long been viewed as the natural evolution - and next generation - of cloud computing, which further leverages the potentially "unlimited" computing power of the offsite facility by integrating specialized hardware such as Graphics Processing Units ("GPU") and Tensor Processing Units ("TPU") in addition to the conventional Central Processing Unit ("CPU") tasks.

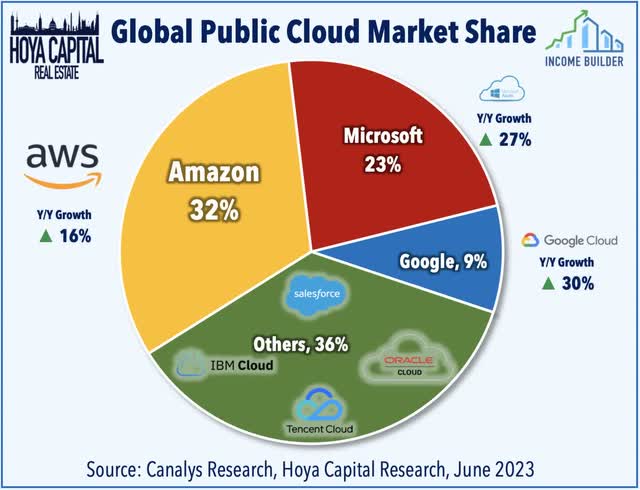

The companies that are synonymous with cloud computing - Amazon (AMZN), Microsoft (MSFT), Google (GOOG) (GOOGL), Alibaba (BABA), Oracle (ORCL), Salesforce (CRM), and Snowflake (SNOW) - are among the largest and most critical tenants of these data center operators, and have become even more critical tenants in recent years as a growing share of leasing activity has accrued to these "hyperscale" tenants which have increasingly dictated the terms of leasing agreements and pricing. While a larger share of leasing activity is indeed accruing to a smaller number of tenants, the overall pie continues to grow. The pendulum of pricing power swings between landlord and tenant over time based on market-level and national supply/demand dynamics, but ultimately we believe that there is enough sustainable economic value to be shared by tenants and property operators alike.

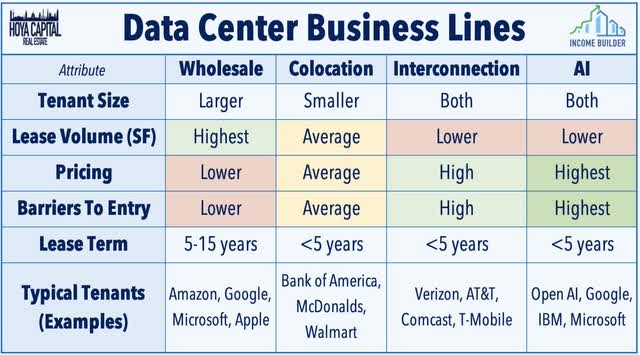

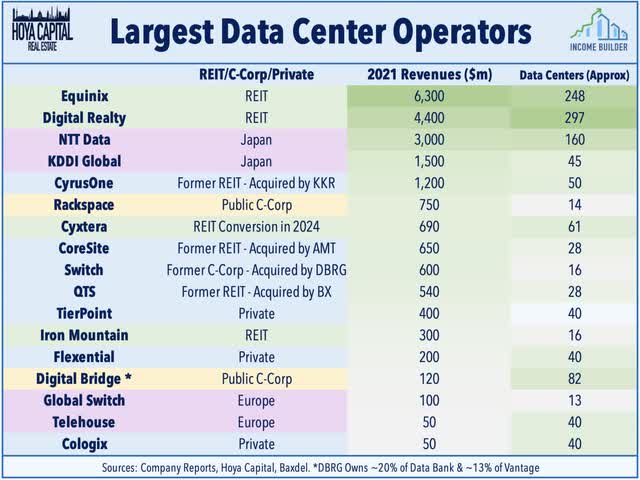

Data Center REITs own roughly 600 data centers - 30% of investment-grade data center facilities in the US - and command roughly a fifth of data center capacity globally. The value of each data center is largely a function of its position along the internet backbone, the physical fiber-optic network that links every connected device across the world. Properties within the backbone, or more precisely at the "intersection" of various networks, are able to provide higher-value and lower-latency network-based colocation and interconnection services, which command higher rent-per-MW and have higher barriers to entry due to the inherent "network effects." Low latency is especially critical for AI applications, which further intensifies the “data gravity” effects and need to be located in proximity to other networks. Properties on the periphery or those lacking a critical mass of interconnection tenants typically provide more ubiquitous enterprise-based wholesale services, including storage and cloud-based software applications.

Interconnection, which relies on "network effects," can translate into a competitive advantage that new entrants have difficulty replicating. Equinix has the highest "quality" portfolio of network-dense assets followed by the smaller CoreSite - which is now owned by American Tower. Digital Realty significantly expanded its interconnection and colocation business through its Interxion acquisition and has staked-out favorable positioning in many of the most critical network-dense data center markets. CyrusOne, QTS, and the majority of non-REIT data center operators focus primarily on the more commoditized wholesale assets. Cyxtera - which filed for Chapter 11 this week - operates a relatively high-barrier portfolio of network-dense assets but only owns two of its facilities and leases its remaining 59 data centers, which was a major factor in its difficulty in refinancing its debt.

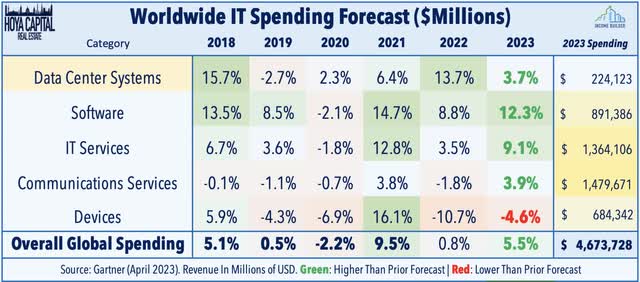

Major players on the hardware side include Intel (INTC), Advanced Micro Devices (AMD), Nvidia (NVDA), and IBM (IBM), which collectively provide the majority of networking equipment utilized by data center tenants. Spending on the "public cloud" by hyperscale providers remains at record-levels - rising nearly 22% year-over-year in the latest Canalys Research report. Spending on the physical hardware - servers and chips - has also seen a notable reacceleration in recent quarters after stalling in late 2021 and into early 2022 due, in part, to the effects of a global chip shortage during the pandemic. In their most recent forecast in April, Gartner upwardly revised its growth outlook for IT spending across the board with the exception of spending on end-user devices. Worldwide IT Spending is now expected to grow by 5.5% this year, led by a 12% jump in software spending and a 9% increase in IT services spending. Spending on data center systems - the strongest category in 2022 - is expected grow another 4% this year.

Data Center REIT Fundamentals

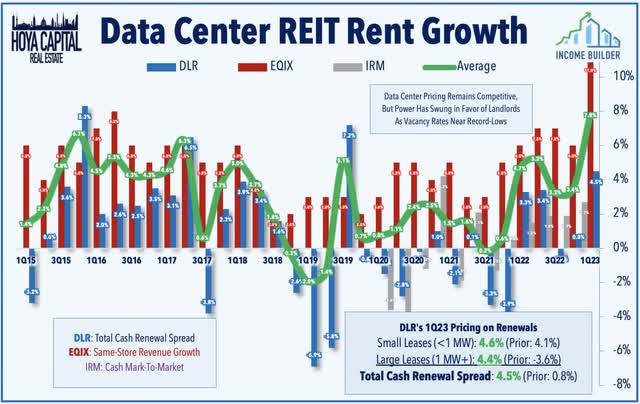

As discussed in our REIT Earnings Recap, impressive pricing power was the primary takeaway from a solid slate of first-quarter earnings results and subsequent REITweek commentary. Equinix recorded its strongest quarter of same-store revenue growth on record at 11% and while some of this revenue growth was attributed to power price increases ("PPI"), EQIX notes that even without these pass-through expenses, the increase was still impressive at 7%, commenting that "pricing is definitely firm...we've raised pricing both on the retail side, space, power and on the interconnection units." Digital Realty reported similarly strong pricing trends, with renewal rent spreads rising 4.5% - the strongest quarter since 2019 - to which DLR commented, "we feel confident that this positive pricing environment is sustainable and here to stay." Iron Mountain, meanwhile, reported cash renewal rent growth of 3.5%, its strongest quarter since late 2020.

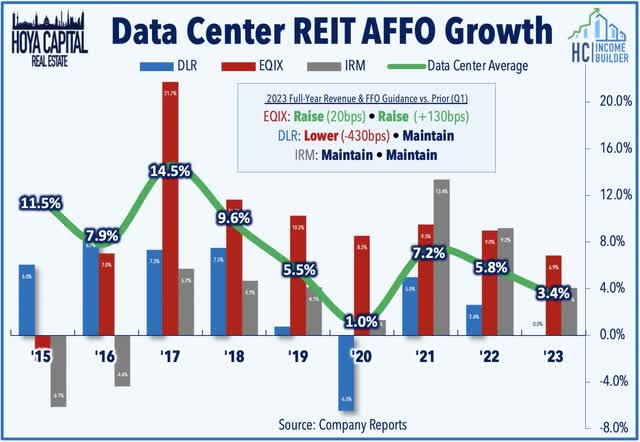

Diving deeper into earnings results, Equinix raised its full-year guidance across the board in Q1 and now projects full-year revenue growth of 13.2% - up 20 basis points from its prior outlook - and sees FFO growth at 6.9% - up 130 basis points. Digital Realty, meanwhile, affirmed its FFO and EBITDA guidance but lowered its expected revenue growth from roughly 23% to 18%, but the revision was due "purely" to lower expense pass-throughs from lower electricity rates. DLR also reiterated its guidance calling for "same-capital" NOI growth of 3.4% for full-year 2023, which would be the first year of positive organic growth since 2017. Iron Mountain maintained its full-year revenue and FFO outlook which calls for growth of roughly 9% and 4%, respectively, and for total data center leasing volume of 80MW.

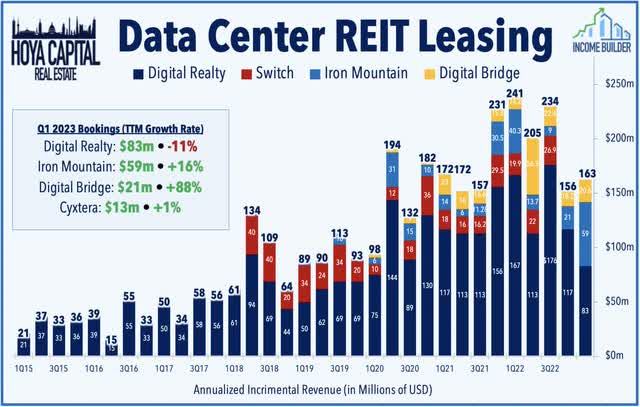

While pricing power has improved, total leasing volume has taken a step back in recent quarters from the record pace seen in 2021 and 2022 as hyperscalers have pumped the breaks a bit. Digital Realty reported $83M of incremental annualized GAAP rental revenues in Q1, which was the lowest since Q1 of 2020, but DLR did notch a record-high for interconnection leasing volume. Iron Mountain has picked up some of the slack, however, signing 52 megawatts of new and expansion leases - its strongest quarter on record for bookings - and well on its way to its 80MW full-year target. DigitalBridge reported $21M in bookings - nearly double its pace from Q1 of 2022 - while now-bankrupt Cyxtera reported bookings of $13M, which was about 1% above its pace last year.

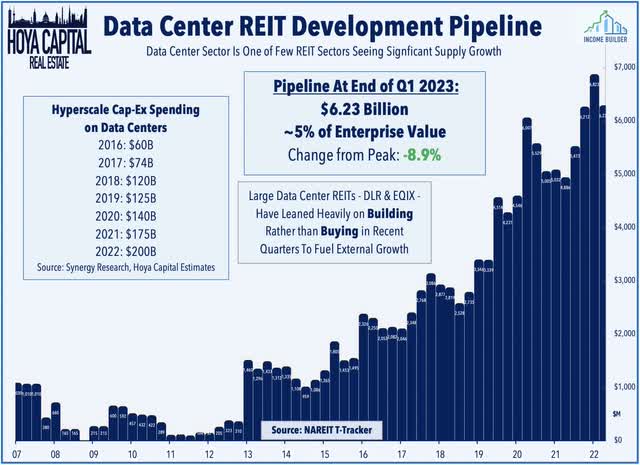

Citing a confluence of development bottlenecks - power shortages, a higher cost of capital, supply chain constraints, and politics/NIMBYism - supply has fallen behind demand in recent quarters, allowing these REITs to achieve record-high occupancy rates and to finally push rent growth. These development headwinds are having a particularly acute effect on Northern Virginia - the data center "capital" of North America - while European markets are also seeing resistance to new development at multiple levels. These REITs reported that the development pipeline stood at $6.2B in Q1, which was 9% below the peak levels from 2022 and commentary suggests that industry-wide development will continue to tail-off through the year given these bottlenecks.

Equinix and Digital Realty were notably quiet on the acquisition front amid the frenzy of M&A activity during the pandemic. Their patience appears to be quite prudent in hindsight, allowing these REITs to de-lever their balance sheets and avoid a more pronounced drag from higher rates, while also positioning them to be aggressors as other more-highly-levered private players seek an exit. High debt loads - and specifically high variable rate debt exposure - appear likely to take down a fourth former competitor in the space - Cyxtera – which had planned to convert to a REIT this year following its SPAC listing in 2021. After failing to attract M&A interest from its larger peers and failing to refinance its variable rate debt, Cyxtera announced this week that it filed for Chapter 11 and plans to restructure through a pre-packaged bankruptcy as part of an arrangement with its lenders.

Three data center REITs were acquired last year, including Blackstone's (BX) acquisition of QTS Realty, KKR's (KKR) acquisition of CyrusOne, and cell tower REIT American Tower's (AMT) acquisition of CoreSite. We're now down to two major REITs after DigitalBridge announced its transition to a conventional C-Corp as it focuses its strategy on its fee-based investment management business. DBRG also reached a deal last May to acquire Switch (SWCH) - an operator that had planned to convert to a REIT by 2023. Other companies operating space include a mix of international, private, and "c-corp" entities, including Rackspace (RXT), TierPoint, Flexential, Cologix, Lumen (formerly CenturyLink), and Global Switch.

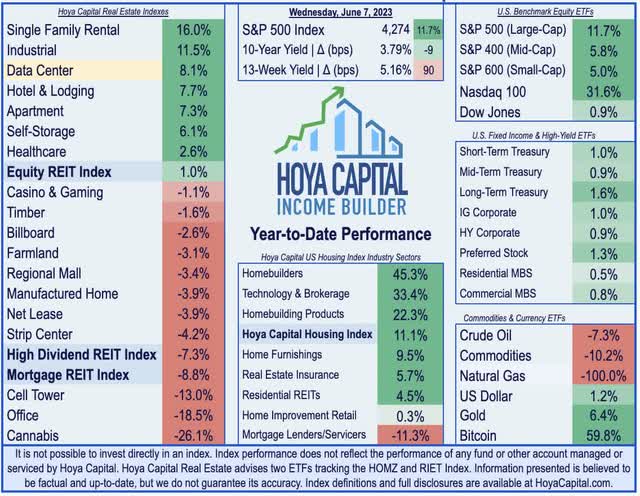

Data Center REITs Performance

As noted above, Data Center REITs are among the top-performing property sectors this year, a rebound that has been augmented by reports of "booming" demand for artificial intelligence ("AI") focused data center chips and by strong earnings results from these REITs showing impressive pricing power. So far in 2023, the Hoya Capital Data Center Index is higher by 8.1% - trailing only the Single Family Rental and Industrial REIT sectors - while outpacing the 1.0% gain from the Vanguard Real Estate ETF (VNQ). Data center REITs are still among the better-performing REIT sectors over most longer-term measurement periods, with 5-year total returns of roughly 9.7% - roughly six percentage points above the broader REIT average during that period.

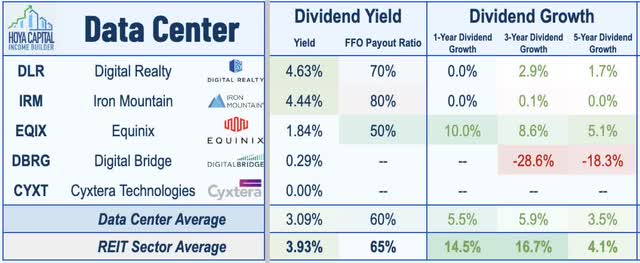

Data Center REIT Dividend Yields

Few property sectors have delivered more consistent dividend growth than data center REITs, as Equinix and Digital Realty are among a small handful of REITs that raised their dividends every year through the pandemic. Still very much a "growth-oriented" property sector, data center REITs pay an average dividend yield of 3.1%. DLR commented at REITweek that it "does not see the risk to the dividend," pushing back on recent speculation from a contingent of short sellers that have had data center REITs in their cross-hairs since mid-2022. Specialty REIT Iron Mountain pays a dividend yield of 4.44% while paying out 80% of its FFO. Equinix pays a yield of 1.84% while paying out just 50% of its FFO. DigitalBridge, meanwhile, reinstated its cash dividend at $0.01 in the third quarter last year, fulfilling a pledge made to reinstate the dividend that the firm made before its decision de-REIT.

Takeaways: Positive Inflection in Fundamentals

Even before the AI-driven rally, Data Center REITs were on the upswing in early 2023 after an impressive slate of earnings results showed improved pricing power and record-high occupancy rates. Ironically, this AI-wave and improving fundamentals comes just as Data Center REITs became a trendy “short” idea centered on a thesis of weak pricing power and competition from the "hyperscalers." Instead, a confluence of development bottlenecks - power shortages, higher cost of capital, supply chain constraints, ecopolitics, and NIMBYism - have created a more favorable dynamic and swung the pendulum of pricing power towards existing property owners. Barriers to supply growth combined with AI-accelerated demand should bring some sustained pricing power to a sector long-burdened by near-unlimited supply. The market concentration of data center REITs shouldn’t be discounted either as these REITs have built relatively dominant platforms through M&A and new development, and market share gains are more likely to increase rather than decrease in an environment of constrained capital availability.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DLR, EQIX, RIET, HOMZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry. This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing. The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized. Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receive compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.