Alvotech: Precarious Cash Position Dilutes Special Situation Opportunity

Summary

- Alvotech has a resolvable CRL.

- This took down the stock, but when resolved, that could create a quick spike.

- Ordinarily, this would be an opportunity, except for Alvotech's poor cash position.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Carl Lokko

Alvotech (NASDAQ:ALVO) is a vertically integrated biosimilar development company whose business consists of developing biosimilars of known major drugs and partnering with companies across the globe in order to sell those biosimilars in various territories. The company is based in Iceland and it has products approved in the EU, and other countries, but not in the U.S. Its U.S. ambitions recently suffered a setback after it received a CRL on one of its two biosimilar applications - the 351(k); however, the concerns raised were manufacturing related, and appear to be resolvable. However, there has been a sharp drop in share price on this CRL, which may have created an opportunity.

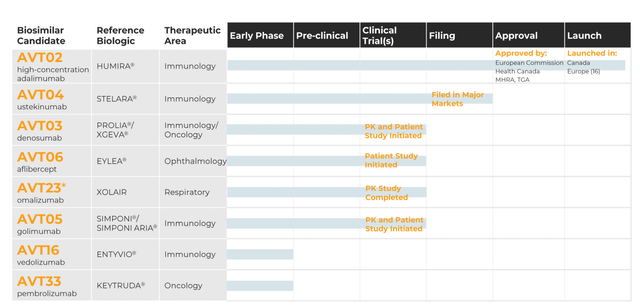

The company’s biosim development pipeline looks like this:

ALVOTECH PIPELINE (ALVOTECH WEBSITE)

Only AVT02 is launched in various geographies; AVT04 is in the filing stage, AVT23, AVT03 and AVT06 are in clinical stages, while the others are preclinical or early stages.

Alvotech was formed in 2013 in Iceland and was incorporated in Luxembourg, a jurisdiction that is more supportive of businesses than their end-users. As the company remarks in its Form 20-F (Foreign companies U.S.. Annual filings):

As there is no treaty in force on the reciprocal recognition and enforcement of judgments in civil and commercial matters between the United States and Luxembourg other than arbitral awards rendered in civil and commercial matters, courts in Luxembourg will not automatically recognize and enforce a final judgment rendered by a U.S. court.

This is not a real concern right now, but this is something to always keep in mind for U.S.-based investors investing in ex-U.S. companies. As long as the going is good, these things don’t matter; but if it gets rough, these companies will be tougher to deal with than a company under U.S. legal jurisdiction.

AVT02 was handed a CRL in April through its partner Teva Pharmaceutical Industries Limited (TEVA) in the U.S. The CRL said that the application could not be approved due to deficiencies in Alvotech’s manufacturing facility that need to be resolved. The company states in a presentation that these two BLAs - one for biosimilarity and the other for interchangeability - are approvable, except the first BLA is held back by satisfactory site inspection. In early April, responses to Form 483 were resubmitted, and are under evaluation. A Form 483 is issued after an inspection when the FDA finds something that it thinks may be a violation of the Food Drug and Cosmetic (FD&C) Act and related Acts. The other BLA has a goal date of January 28, 2023.

According to Fiercepharma:

Last year, the FDA rejected Alvotech’s biosimilar application after finding manufacturing deviations, the presence of bacteria and mold in the company's Reykjavik, Iceland, plant and more.

This time, there were 8 observations that were different from last year's. A re-inspection may be needed for AVT02 to gain approval. Interestingly, as the company points out, AVT02 is sold in 17 global markets and approved in 25 other markets, and there have been no negative safety signals. The company requested a meeting with the regulator to gain more clarity on the deficiencies found. As it looks right now, there is going to be an 8-12 months delay, including a 6-month review, before the CRL will be resolved.

The Company stated in its earnings call:

Both BLA has been reviewed and are deemed approvable with the only outstanding requirement being a satisfactory site inspection.

Alvotech has 18 distinct partners across 90 different markets for its products. These partners are, Teva in the U.S., Stada in Europe, Fuji Pharma in Japan, JAMP Pharma in Canada, among others. The company is working with its partners to launch its next product, AVT04 biosimilar for Stelara (ustekinumab).

Financials

ALVO has a market cap of $2.16bn and a cash position of $116mn, besides $25mn of restricted cash. Total revenue in Q1 2023 was $16mn. The company has a huge debt of $793.7 million, including $23.0 million of current portion of borrowings, as of March 31, 2023. R&D expenses were $50.9 million for the three months ended March 31, 2023, cost of product revenue was $39mn, and G&A expenses were $22.2 million. At that rate, the company is in a precarious financial condition, and does not have cash for more than a quarter.

From their earnings call:

In our previous earnings call in March, we reported that during the first quarter, we had closed on a private placement with Icelandic investors of approximately $137 million in gross proceeds. In addition, during the quarter, we collected the remaining proceeds of approximately $14 million from our convertible bond issuance, which we initiated last December. With this financing activity now completed, we ended the first quarter with approximately $116 million cash on hand as of March 31st, excluding restricted cash of $25 million.

The stock is mostly owned by private corps and PE/VC firms, with a small amount of retail presence. Key holders are Celtic Holdings, Ya II Pn Ltd, and so on. There is no insider transaction data available because this is a foreign company.

Bottom Line

Initially, I thought that the possibly resolvable CRL situation could be an opportunity amid the price drop. However, Alvotech is in dire financial health, and like the company stated, it is looking to raise capital. Thus, there could be a dilution, or there could be other problems stemming from its poor cash situation. These things make it highly risky to invest in Alvotech right now.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important: My Hold rating only means "I will not Buy now." I am not telling *you* to hold, because I see some risks here. But I am also not telling you to *sell*, because, a) the risks are not insurmountable, and b) you may have bought at such a low price that your risk-benefit ratio is acceptable to you. Thus, my “Hold” is a bearish rating, but it is not as bearish as a “Sell” rating.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.