VVR: Getting Behind This Year's Performance For This 12% Yielding CEF

Summary

- Invesco Senior Income Trust has performed well in 2023, with a flat NAV and a high dividend yield.

- VVR is currently paying a 12% yield, which is fully covered and is expected to be supported in 2023 as rates remain higher for longer.

- The fund's discount to net asset value has been extremely volatile in 2023, mainly driven by market expectations around a Fed pivot.

- Default rates are incredibly low in the leveraged loan space, currently, sub 1%, but rating agencies are penciling in a tick-up in bankruptcies.

- The fund may experience price volatility due to another risk-off move in the market but is predicted to end the year with a total return of around 10%.

shapecharge/E+ via Getty Images

Thesis

The Invesco Senior Income Trust (NYSE:VVR) is a fixed income closed end fund. The vehicle focuses on a floating rate asset class, namely leveraged loans. Lev loans have done very well in the past year due to their low duration, and funds based on this asset class have actually managed to increase distributions as SOFR/Libor moved higher. In this article we are going to look at VVR's performance this year, its drivers, and expectations for future price action.

VVR's Performance in 2023

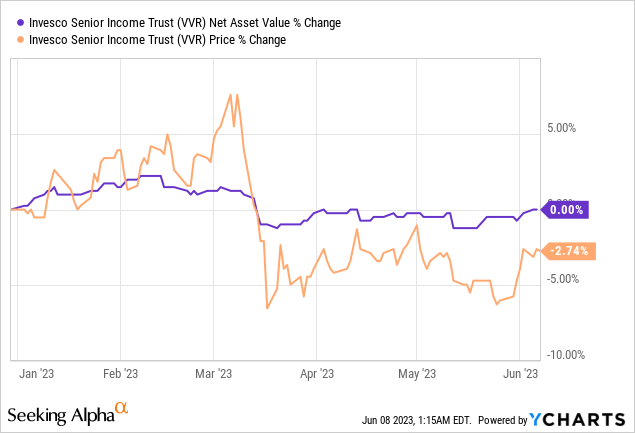

The fund is down -2.7% so far this year from a price perspective:

We can observe that while the fund is down, its NAV has remained constant. This translates into the fund's performance being driven by moves in its premium/discount to NAV:

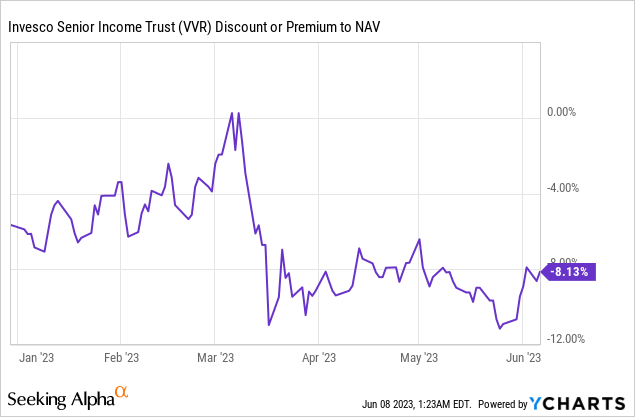

And indeed this is the case, with a year to date discount performance of close to -2%. Premiums/Discounts to NAV can be very volatile in the CEF space, and they usually follow performance. The better the track record for a CEF and its forward, the higher the premium.

What we can observe from the above graph is that the fund's discount narrowed to flat to NAV until the market started pricing in Fed cuts. VVR's total returns are very much correlated with the Fed Funds rate - if the market thinks the Fed will cut, then this will eventually translate into lower SOFR and lower net dividends for the CEF. Hence the widening out of the discount mid-March when the market started seeing signs of a cooling in inflation.

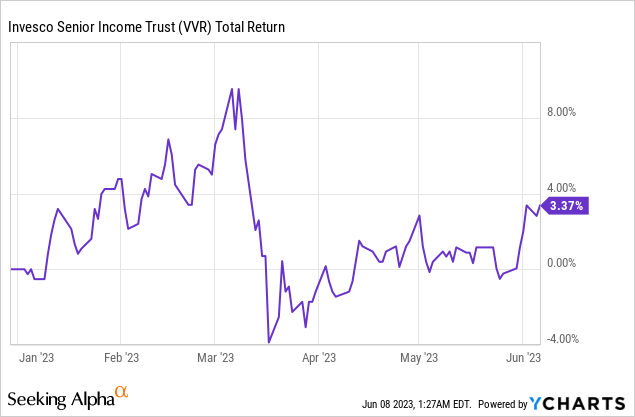

VVR's total return for the year is positive though, given its very high dividend yield:

Please keep in mind that for CEFs a retail investor should always look at total returns, since they include the dividend paid. By their structure, CEFs will pay a high dividend yield, thus it needs to be included. The fund is up 3.37% this year on a total return basis. The NAV is flat, so if we continue this pattern we will get a total return for the year close to the fund's dividend yield (absent any further moves in the discount to NAV).

The takeaway here is that VVR has performed admirably, with a flat NAV and a high dividend yield. The volatility in the fund's market price has been entirely driven by moves in its discount to NAV, which in turn have been driven by investor's views on a potential Fed pivot. Floating rate funds will suffer once the Fed starts lowering rates.

Analytics

- AUM: $0.57 billion

- Sharpe Ratio: 1.36 (3Y)

- Std. Deviation: 5.0 (3Y)

- Yield: 12.5%

- Premium/Discount to NAV: -8.6%

- Z-Stat: -0.16

- Leverage Ratio: 32%

- Composition: Fixed Income - Lev Loans

- Duration: below 0.5 yrs

- Expense Ratio: 2.38%

Distribution Coverage

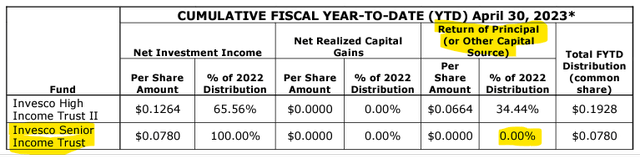

This is one of those rare CEFs which fully covers its distribution:

The CEF structure allows for interest distributions to be covered from the principal or NAV of the fund. An investor can find these figures under the 'Return of Principal' section in the fund's notices. When you see a 0% ROC figure and a high dividend yield, you know you are looking at a winner. In VVR's case the coverage is ensured by the very high SOFR levels. With SOFR at 5% and spreads on lev loans at 4% on average, the fund has a 9% dividend yield before any leverage is applied. Add a 32% leverage ratio and you get a nice, clean well covered dividend yield in the teens.

What should we expect for the rest of 2023?

From a fundamental perspective leveraged loan default rates have been very well contained this cycle:

As we can observe from the above graph, courtesy of S&P, the actual default rate in the asset class has been incredibly low, below 1%. Just think about it this way - you are getting paid 12% and there is a sub 1% drag from actual defaults, if those credits are in your portfolio. These are very low levels that are forecast to rise. We will go with the normalized scenario where defaults move to 2.5%, and hence assume a 1.5% drag from this factor.

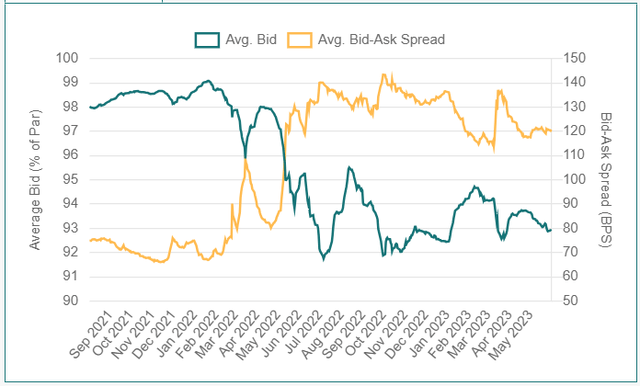

From a price perspective, leveraged loans have rallied in 2023, but not as much as expected:

Average Price and Liquidity for Lev Loans (LSTA)

We can see from the above graph that we have rallied off the October 2022 lows in prices, but not that significantly. As observed with the fund's discount to NAV, there is a close correlation in loan prices with expectations for a Fed pivot.

We expect another risk-off move this year in the wider credit markets, but with prices low already, the impact to VVR should be well contained. Do expect more volatility to return at some point in 2023 and loan prices to take another dive to low 90s prices.

Conclusion

VVR is a floating rate loan CEF. The fund has posted a middle of the road performance so far this year, being up 3.37% in 2023 on a total return basis. VVR's NAV has stayed constant, while its discount to NAV has widened. The factor behind the widening is represented by market expectations around a Fed pivot. As inflation started to cool down, the market began to price in Fed cuts. Lower rates are negative for VVR, since they will eat into the fund's distribution. This CEF is currently paying a 12% dividend yield, which is fully covered. We do not expect a Fed cut this year, hence the dividend will be fully supported in 2023. We do expect however another risk-off move, with the average bid in the lev loan market to revisit the low 90s. That should translate into a bit of price volatility for VVR, but we ultimately believe the CEF will end the year with a total return of around 10%. We hold this CEF and continue to clip the very high dividend.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VVR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.