KLA Corporation: Little Impact From China Sanctions On Semiconductor Equipment

Summary

- U.S. sanctions are minimally working, enabling China to promote its drive for self-sufficiency in chip-making.

- In China, KLA has minimal competition as customers use its yield-improving equipment even at chip production above 14nm.

- Globally, KLAC's share is above 60% as customers demand its technology at the 3-7nm node.

- This idea was discussed in more depth with members of my private investing community, Semiconductor Deep Dive. Learn More »

Richard Drury

KLA Corporation (NASDAQ:KLAC), a leading provider of process control and yield management solutions for the semiconductor and related industries. This article aims to provide a comprehensive stock analysis of KLAC while comparing it with its competitors in the semiconductor equipment sector.

KLAC's financial performance has been impressive in recent years. In its latest fiscal year, the company reported revenues of $6.63 billion, representing a 34% year-over-year growth. The net income stood at $1.54 billion, showcasing a significant increase compared to the previous year. KLAC's strong financials indicate its ability to capitalize on the growing demand for semiconductor equipment.

Because of U.S. sanctions, there is a migration to mid-node chip production above 14nm. As Chinese semiconductor companies increase capacity on the worldwide stage, it is common knowledge that yields are low. KLAC equipment is valuable to monitor the production processes that are beneficial to increasing yield.

Clear Winner Against Peers

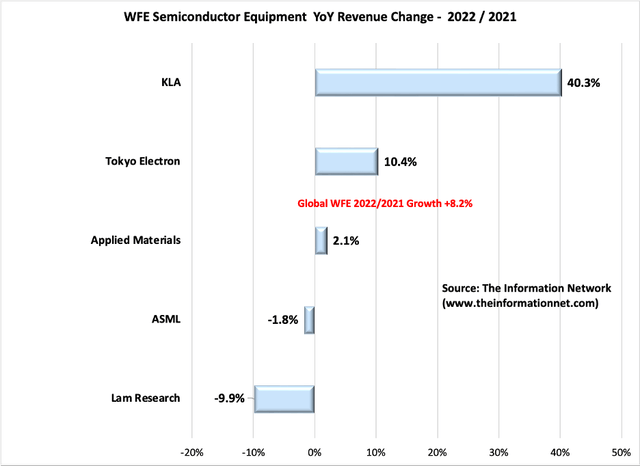

With U.S. sanctions against China on the purchase of leading-edge semiconductor processing equipment, KLAC demonstrated a YoY growth of 40.3% among the Top 5 manufacturers, as shown in Chart 1.

The mean growth for these companies was 8.2%, and only KLA and Tokyo Electron (OTCPK:TOELY) outperformed the mean and the other top WFE competitors including Lam Research (LRCX), Applied Materials (AMAT) and ASML (ASML) underperformed.

Chart 1

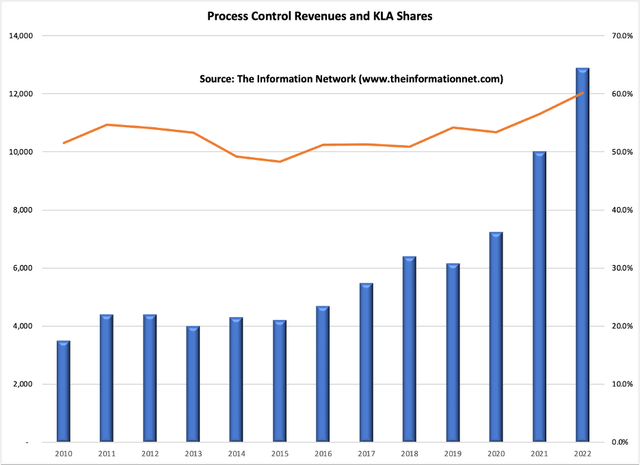

Chart 2 shows KLAC's revenues between 2010 and 2022. It also illustrates its market share dominance in the Metrology/Inspection sector.

Chart 2

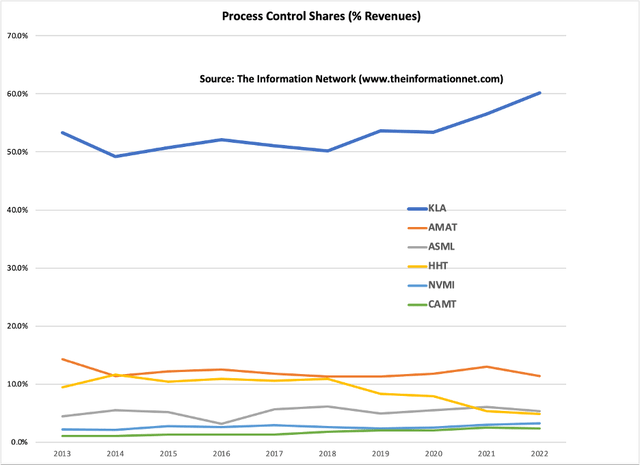

KLAC's dominance in the process control sector extends to other competitors, as shown in Chart 3, according to The Information Network's newly released report entitled Metrology, Inspection, and Process Control in VLSI Manufacturing. Market share is a percentage of the overall global process control market.

Data show dominant market share for KLAC compared to AMAT, ASML (ASML), Hitachi High Tech (HHT), Nova Measuring (NVMI), and Camtek (CAMT). Between 2013 and 2022, no competitor garnered more than 15% in a given year.

Chart 3

Winner in China

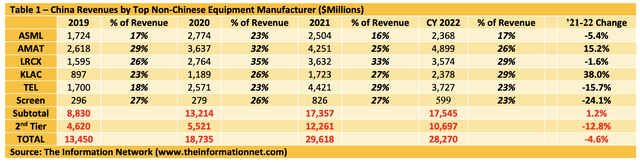

Table 1 shows revenues equipment revenues of the top Non-Chinese semiconductor equipment companies to customers in China. There are several takeaways:

- Between 2021 and 2022, total non-Chinese equipment revenues decreased 4.6%%

- On a percentage basis, LRCX has been one of the companies with the most exposure to China revenues

- On a revenue basis, AMAT had the greatest revenue exposure from sales to China

- Between 2021 and 2022 as U.S. sanctions escalated, only KLAC and AMAT revenues continued to increase

- Between 2021 and 2022, the mean revenue growth of these top six companies grew 1.2%

- Between 2021 and 2022, the mean revenue growth of the 2nd tier companies decreased 12.8%

Investor Takeaway

Chinese equipment suppliers are gaining share in their home market. These market shares are currently small but growing, as discussed in my May 16, 2023 Seeking Alpha article entitled "Applied Materials: A Preview Of Upcoming Earnings In Light Of Severe Headwinds."

But Chinese semiconductor manufacturers are continuing to buy equipment from foreign companies as long as they are able in light of strong restraints on shipping advanced semiconductor equipment to the country, which are:

- Logic chips with non-planar transistor architectures (i.e., FinFET or GAAFET) of 16nm or 14nm, or below;

- DRAM memory chips of 18nm half-pitch or less;

- NAND flash memory chips with 128 layers or more.

KLAC is my Top Pick for investors. The company outperformed all Top peers in Chart 1, and has high exposure to sales of its metrology/inspection equipment in China with minimal domestic competition.

Because of U.S. sanctions, there is a migration to mid-node chip production above 14nm. As Chinese semiconductor companies increase capacity on the worldwide stage, it is common knowledge that yields are low. KLAC equipment is valuable to monitor the production processes that are beneficial to increasing yield.

KLAC's stock has exhibited strong performance over the years, reflecting investors' confidence in the company's growth prospects and financial stability. As of the latest available data, KLAC's stock is trading at around $464 per share, showing considerable growth compared to previous years.

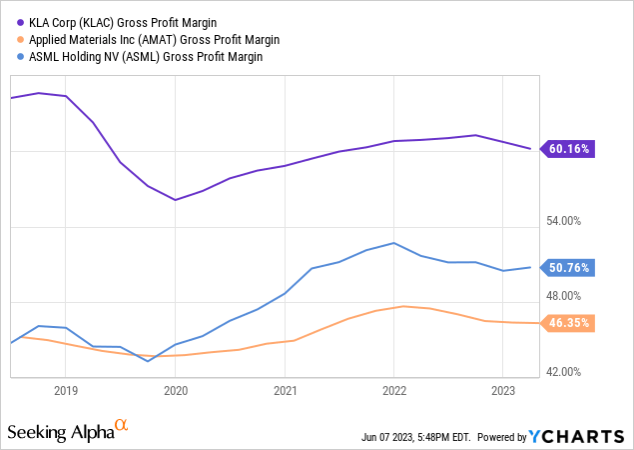

KLAC has demonstrated strong profitability. The company's gross profit margin has remained robust, averaging around 60% over the past five years, as shown in Chart 4. These are compared to AMAT and ASML.

YCharts

Chart 4

Net income has also shown steady growth, with a CAGR of approximately 11% over the last five years, reaching $1.53 billion in fiscal year 2022.

KLAC maintains a healthy balance sheet, with a strong focus on liquidity and financial stability. As of the end of fiscal year 2022, the company reported cash and cash equivalents of $1.83 billion, providing a solid foundation for potential investments, research and development, and strategic initiatives.

KLAC places significant emphasis on R&D, continuously investing in technological advancements and innovations to meet evolving customer needs. In fiscal year 2022, the company invested approximately $1.07 billion in R&D, reflecting its commitment to staying at the forefront of the industry.

KLAC's market capitalization, a key indicator of the company's overall value in the stock market, has witnessed notable growth. As of the latest data, it stands at approximately $63 billion. The market capitalization growth reflects the market's positive sentiment toward KLAC's business model, financial performance, and future prospects.

KLAC has a history of returning value to its shareholders through dividends and share repurchases. In fiscal year 2022, the company paid dividends of approximately $192 million and repurchased shares worth $1.18 billion, demonstrating its commitment to enhancing shareholder returns.

KLAC has established itself as a prominent player in the semiconductor industry, driven by its strong financial performance and stock market success. The company's consistent revenue growth, profitability, robust balance sheet, and strategic investments in R&D contribute to its overall financial strength.

KLAC's stock market performance, with a rising stock price and growing market capitalization, reflects investors' confidence in the company's future prospects. As KLAC continues to innovate and expand its product portfolio, it is well-positioned to capitalize on the increasing demand for process control and yield management solutions in the semiconductor industry.

I rate KLAC my Top equipment company and give it a Buy rating.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here.

This article was written by

Dr. Robert N. Castellano, is president of The Information Network www.theinformationnet.com. Most of the data, as well as tables and charts I use in my articles, come from my market research reports. If you need additional information about any article, please go to my website.

I will soon be initiating an investor newsletter. Information to register will be online on my website.

I received a Ph.D. degree in chemistry from Oxford University (England) under Dr. John Goodenough, inventor of the lithium ion battery and 2019 Nobel Prize winner in Chemistry. I've had ten years experience in the field of wafer fabrication at AT&T Bell Laboratories and Stanford University.

I have been Editor-in-Chief of the peer-reviewed Journal of Active and Passive Electronic Devices since 2000. I authored the book "Technology Trends in VLSI Manufacturing" (Gordon and Breach), "Solar Panel Processing" (Old City Publishing), "Alternative Energy Technology" (Old City Publishing). Also in the solar area, I am CEO of SolarPA, which uses a proprietary nanomaterial to coat solar cells, increasing the efficiency by up to 10%. I recently published a fictional novel Blessed, available on Amazon and other sites.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.