IPO Update: Cortigent Readies $15 Million Mini-IPO

Summary

- Cortigent, Inc. has filed proposed terms for a $15 million U.S. IPO.

- The firm is developing neurostimulation technologies to treat profound blindness and potentially other conditions.

- Cortigent is a tiny company with thin capitalization and substantial risks; the medical device sector has generally performed poorly post-IPO.

- My outlook on the Cortigent, Inc. IPO is to Sell.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Serhii Hryshchyshen/iStock via Getty Images

A Quick Take On Cortigent, Inc.

Cortigent, Inc. (CRGT) has filed to raise $15 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing a medical device for the treatment of profound blindness and potentially other medical conditions.

Given the tiny size of the company, its thin capitalization, uncertain prospects for success post-IPO and substantial risks, my outlook on the Cortigent IPO is to Sell.

Cortigent Overview

Valencia, California-based Cortigent, Inc. was founded to develop an implantable neurostimulation device to assist patients with various forms of blindness in recovering an ability to process perceptions through specialized training.

Management is headed by Chief Executive Officer Jonathan Adams, who has been with the firm since November 2022 and was previously founder and CEO at BioVie and prior to that was an Associate Director at Searle Pharmaceuticals.

The firm's first system, called the Argus II, was approved years ago through the US FDA's Humanitarian Device Exemption program and has been implanted in hundreds of profoundly blind people.

The company is developing "a more advanced system for artificial vision" that it calls Orion.

Cortigent has booked fair market value investment of $1.251 million as of March 31, 2023, from investors including parent firm Vivani Medical, Inc.

Cortigent’s Market & Competition

According to a 2021 market research report by Coherent Market Insights, the global market for visual impairment treatment was an estimated $4.4 billion in 2020 and is forecast to reach $7.6 billion by 2027.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 8.1% from 2020 to 2027.

Key elements driving this expected growth are a growing incidence of eye disorders and vision loss due, in part, to an aging global population.

Also, the World Glaucoma Association has estimated that the number of persons with glaucoma will rise from 79.6 million in 2020 to 111.8 million in 2040.

Major competitive vendors that provide or are developing related treatments include the following:

Pixium Vision SA

Nano Retina Inc.

Bionic Vision Technologies

Illinois Institute of Technology

MicroTransponder

Others.

Cortigent’s Financial Status

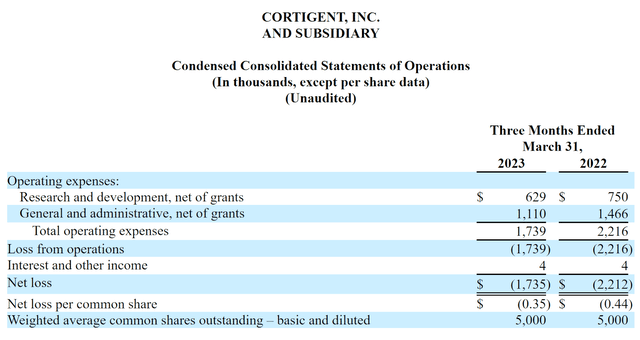

Cortigent’s recent financial results are typical of a development-stage life science company in that they feature no revenue and significant R&D and G&A costs associated with its product development and regulatory activities.

Below are the company’s financial results for the three months ended March 31, 2023 and 2022:

As of March 31, 2023, the company had $821,000 in cash and $4.3 million in total liabilities. (Unaudited, interim)

Cortigent’s IPO Details

Cortigent intends to sell 1.5 million shares of common stock at a proposed midpoint price of $10.00 per share for gross proceeds of approximately $15.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

Immediately after the IPO, the company will continue to be controlled by parent firm Vivani Medical.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $53.5 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 23.08%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

The firm is an "emerging growth company" as defined by the 2012 JOBS Act and has elected to take advantage of reduced public company reporting requirements; prospective shareholders will receive less information for the IPO and in the future as a publicly-held company within the requirements of the Act.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

$2.5 million to repay amounts due to Vivani for funds advanced under the Transition Funding, Support and Services Agreement,

$2 million to manufacture and assemble new devices for use in Orion and stroke recovery systems,

$1 million towards a planned Orion pivotal trial,

$2 million for other research and development, to include the stroke recovery system, and

the balance of proceeds for general working capital.

We plan to use these proceeds over an approximate 18 month period following receipt of proceeds from this offering. We expect to use the offering proceeds to pay for manufacturing devices to be used in the Orion and stroke recovery system clinical studies, to seek FDA clearance to conduct these studies, to select and qualify our clinical trial sites, and for other activities relating to study preparation. We also expect to conduct pricing and reimbursement market research for the Orion and stroke recovery systems and to complete our Orion patient preference information (PPI) study which will help us determine our safety endpoints in cooperation with the FDA. Thereafter we will require additional funding to complete the Orion pivotal clinical study and initial stroke device study. Determining the costs of the Orion pivotal study will depend on such factors as the size of the study, its duration, site selections and site training, writing and establishing protocols acceptable to the FDA, accepted safety endpoints, and other terms and conditions that we will jointly establish in cooperation with the FDA.

(Source - SEC.)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, as a result of opposition actions by competitor Pixium, the firm has had two European patents invalidated but one patent reaffirmed, although that is subject to appeal.

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary About Cortigent

CRGT is seeking U.S. public capital market investment to fund further development of its Orion next-generation system and to pay amounts due to parent firm Vivani Medical.

The firm’s lead product is a second-generation system after the company's first product has been implanted in several hundred patients.

Cortigent is planning a pivotal trial now that its early feasibility results from six patients produced five patients who "performed significantly better on square localization and direction of motion and 2 of 5 had measurable improvement in visual acuity."

The market opportunity for providing assistive devices to the visually impaired is large and expected to grow at a moderately fast rate of growth in the coming years.

Management views its U.S. market size as approximately 82,000 profoundly blind persons, which it estimates is valued at around $4 billion, per a report commissioned by the company and prepared by Fletcher Spaght.

The firm hasn’t disclosed any major medical device firm collaboration relationship.

ThinkEquity is the sole underwriter, and the three IPOs led by the firm over the last 12-month period have generated an average return of negative (37.0%) since their IPO. This is a bottom-tier performance for all significant underwriters during the period.

Risks to the company’s outlook as a public company include the regulatory risks from trials processes for its technologies and the costs associated with trials and with commercialization.

As for valuation expectations, management is asking IPO investors to pay an Enterprise Value of $53.5 million at IPO, below the typical range for a life science company.

Unfortunately, the Medical Devices segment has generally performed quite poorly post-IPO in the past few years.

Given the tiny size of the company, its thin capitalization, uncertain prospects for success post-IPO and substantial risks, my outlook on the Cortigent IPO is to Sell.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.