Cirrus Logic's Crazy Revenue Signature Just Got Crazier

Summary

- Cirrus Logic's recent financial report showed weaker results than expected, with revenue at $375 million, guidance significantly less and a tax rate increase to 25% from 24%.

- The stock took another hit lower with the report.

- The market and analysts may be grossly underestimating Cirrus' near-term potential earnings.

- At the time of the report, Cirrus is expecting significant higher revenue for the last three quarters of its fiscal year.

- With the stock price hovering near $80, a buy rating might be in order after the next earnings report.

Spencer Platt/Getty Images News

Cirrus Logic's (NASDAQ:CRUS) seasonal revenue signature has been, at times, mysterious and crazy. This past report for the March quarter was no exception. In a recent article discussing this signature, Cirrus Logic's Crazy Revenue Signature, we outlined that this year would be one of those reports. We were correct in thinking, but wrong in magnitude. With the stock price already in significant decline, the report ended up driving the price even further. Whether this represents a buying opportunity or not is matter of investor choice. The report confirmed both negative and very positive news. The market only heard one-side. Shall we head to the glass door and read the signature, together. Sometimes cursive is mysterious.

The Quarter & News

At the March quarter report, Cirrus gave investors its most honest view of the near future. Management formally stated that the new haptics chip targeted at the iPhone is longer being considered. They also noted that Apple (AAPL) made it clear that the Cirrus' chip wasn't the issue. This negative admission was followed by a relatively weaker financial result and a slight negative announcement on tax rates. The results shown in bullet form follows:

- $372.8 million in revenue.

- Non-GAAP earnings of $0.92.

- Tax rate increase to 25% from 24%. (The IRS disallowed foreign tax credits from the UK.) (Remember: The rate will drop over time toward the middle teens.)

- Guided $260 to $320 meaning management expected $330 million at the time of guidance.

- One customer, Apple, represented 81%.

- "GAAP operating expense included $85.8 million in intangibles impairment," non-cash.

In a prior article, we had estimated revenue at $400 million for March and guidance for June at $320-$360 million. The actual results were weaker especially for the June quarter. In the shareholder letter, management noted a new higher ASP CLC, (camera control chip) was coming in the latter half of the calendar year. We sense from past comments that the controllers will add $0.20-$0.40 in additional ASP per iPhone. We also have noticed that during CLC product transitions, Cirrus' March and June quarters, especially June, that revenue can be unjustifiably lower. It happened again.

Looking at the Future

Management noted the status on several important future revenue initiatives.

- New higher ASP CLCs products are coming in September. (Road map going forward includes additional Android customers and additional products.)

- Products designed for laptops are now sampling.

- Future charging products are primarily being targeted at PCs.

- Cirrus won more amplifier products in Android products. Many of the new products beginning shipping the March quarter. More are coming.

- Development of new 22 nm codecs and new boosted amplifiers continue. (The wording regarding boosted amplifiers excludes 22 nm technology.)

- The technology is slated for the second half of next year for ramping.

- The new technology boosts additional ASPs in the $2 range (our estimate).

- Of importance to investors, the 22 nm chip technology likely remains relevant for several years reducing future resource needs.

- At the Cowen Conference, management noted that ASP increases were the direct result of improved performance including designing out of more passive components thus lowering total BOM costs.

What was missing is the guaranteed revenue growth with Apple. More laptops will use Cirrus chips, but will they be the high-volume ones?

Hunkering Down

With loss of the new function in the iPhone, Cirrus chose to hunker down. The guided cash expenses for June dropped to the $110 -$115 million range from $120 in March. More cost cuts appear on the way. Employment openings dropped from 150 to 5. At our last look, Cirrus had zero openings in the U. S. Our experience with openings leads us into this conclusion, the number of employees will drop by 20-25 per quarter from natural attrition. Cirrus' costs per employee equals approximately 300K on average. In four quarters, a loss of 100 employees equals close to $20 million. The company also restructured some assets:

"We have been focused on improving operational efficiency and accordingly have taken a number of steps, including reducing our global real estate footprint, product prioritization, and some restructuring actions. As such, during the fourth quarter, the company recorded $10.6 million of lease impairments and restructuring charges . . ."

The Salt Lake City and San Francisco offices were closed. Other less visible restructuring may have occurred.

Cirrus is likely lowering yearly cash operating costs in the $15 to $25 million range.

Earnings & Cash Generation Over the Next Fiscal Year

Earnings over the next year will likely see increases from several sources including expected revenue growth, lower fixed costs discussed above and significantly lower share count.

Beginning with evaluating revenue growth, Apple and Cirrus have both signaled business strength. Apple, apparently, started production of the display panels in June, one month early, an action that suggests strength.

Cirrus signaled the same. Using two different methods, it is clear that at this point in time, Cirrus management expects higher revenue going forward. Beginning with the first signal, Cirrus management hinted at increased demand in the later part of 2023 into 2024 with this statement,

"Q4 FY23 inventory was $233.5 million, up from $152.4 million in Q3 FY23. In Q1 FY24, we expect inventory to increase from the prior quarter as we begin to build ahead of seasonal product launches in the second half of the calendar year. . . . we expect inventory to remain above historical levels as we balance anticipated product demand and wafer purchase commitments that require us to build inventory on a more linear basis."

In prior years, the company's tight production capacity limited adding additional business outside of Apple particularly with Android. With new PC business starting to ramp plus new Android wins, it is apparent that Cirrus must level its production through using the whole year. Included next is a table showing past inventory levels in the March and June quarters.

| Inventory (Million) | March | June |

| FS 23 | $235 | $175 |

| FS 22 | $140 | $190 |

| FS 21 | $175 | $200 |

March's 2023 inventory averaged $80 million higher than in the past. On average, June inventory increases another $25 million or more. Management signaled that it is expecting at least another $200 million in revenue for the September and December quarters year over year. Subtracting off the lower June guide year over year of $70 million, an additional $150 million might be expected through December.

Again, in our article, Cirrus Logic's Crazy Revenue Signature, we made a case for September and December adding $100 million of revenue year over year with June slightly lower. This revenue increase resulted from slightly lower unit volumes coupled with significantly higher iPhone ASPs driven by existing content migration and the CLC ASP increase. It excluded revenue from any new design wins. It is clear that through the beginning three quarters of the fiscal year, Cirrus is expecting approximately $150 million in higher revenue. With March 2023 being lower than our guesstimate, an easier year over comparison plus higher average iPhone ASPs creates a more likely outcome for March 2024 revenue to be higher by some value, perhaps $50 million. Looking at FS-2024 for Cirrus, it appears revenue will climb by $200 million from today's vantage point.

Next, lower cash operating costs in the $15 million range seem more than likely and discussed above.

Before continuing, a cash generation balance for next year is in order. Cirrus closed the year with $520 million in cash and spent $25 on repurchases in April leaving it with approximately $500 million. Last fiscal year, Cirrus generated $340 million in cash from operations. Calculating cash flow through a secondary means, earnings times average share count yields $365 million ( $6.42 * 56.75). With what seems to be another $75 million ($200 * 0.50 margin * 0.75 tax rate net) plus $15 million from lower costs investors might expect approximately $450 million for fiscal year 2024.

Management has openly increased earnings through share repurchasing. It has plenty of the cash to continue. At $80 per share, 3 million shares cost $240 million or half of the cash estimate for 2024. A table, which follows, illustrates the company past purchasing history and an estimate going forward.

| Share Count (Millions) | March | Dec. | Sept. | June |

| FS-23 | 55.2 | 56.6 | 57.4 | 57.8 |

| FS-24 Estimate * | 52 | 52.5 | 53.5 | 54.5** |

| Percent Difference | 6 | 7 | 7 | 6 |

* Our estimate uses approximately 1 million repurchase June, Sept., December, minimal after that.

** Cirrus reported at the call that almost 300K shares had been purchased near $90 in April.

Earnings from lower share count will be lifted year over year by approximately 7%.

Total cash or earnings estimate for the year might equal $450 million divided by 53 million shares or $8.50.

Management Stresses

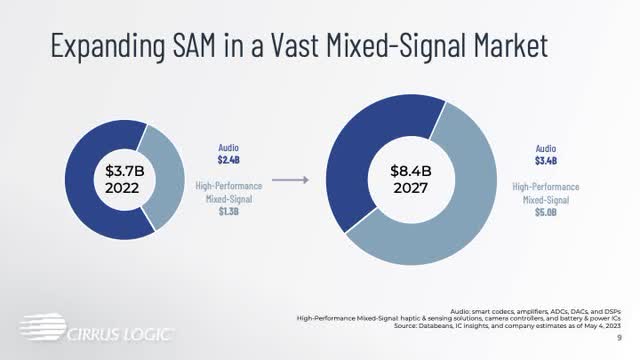

At both the Cowen and Stifel conferences, management stressed that the haptics product loss doesn't change the vision in any significant way. A slide from the last presentation illustrates this perfectly.

Of most importance, the SAM for HPMS now exceeds audio and the total was raised from the $6.5 billion a few years ago to $8.5 billion today. This represents a huge change. Continuing on the subject, John Forsyth, company CEO, at Stifel mentioned areas of growth with one HPMS product line still not announced. And even more, management continues to stress the importance of the laptop business. Management noted that the customers are approaching Cirrus for help, an opposite environment from the past with the very large nature of the SAM being $1.3 billion. We mention this coupled with the continued drum beat from Micron (MU) about the dawning of new and high powered laptops/PCs driven by new AI technology. Micron's view claims that this trend gets underway starting next year. Cirrus will be right in the middle of another massive technology wave with its premium products.

Analysts & the Market Are Drastically Wrong

With our view after defining the business climates for both Cirrus and Apple being moderately bullish, the analysts and market are drastically wrong. The analysts' average for FS-2024 is $6.40 unchanged year over year. For FS-2025, the average is strangely $5. If the market believed that Cirrus would earn over $8.0 in the coming year, the stock price would still be near $100. We fully understand that business environments change, and our estimate could be high, way high. But from the present vantage point, earnings will be significantly higher, significantly. The outside world may have got it wrong, terribly wrong.

Risk & Reward

With Cirrus' price hovering near $80, investors might expect a significant reward. But all of us should remember that risks still exist including market reactions if China should take control of Taiwan. Also, a recession is likely coming. The latest Chicago PMI number tanked. Apple's unit volumes might be at risk. The June guidance was much weaker than we expected, but on the other side strength seems coming. We would wait until the June report in late July before buying additional shares. Of most importance, at the Cowen Conference, management helped Matt Ramsey, Cowen's analyst, and attending investors to understand that the lost socket wasn't a major long-term negative. The vision is still on track. With this in mind, we continue a hold rating until a time more near the next earnings report. Cirrus' crazy signatures continue offering traders and long-term investors opportunities, timed at the right moment.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRUS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.