BYD: An Emerging Automotive Titan

Summary

- Sales have significantly increased since 2020. The company benefits from increased market share for EVs.

- The company is cheaply valued and has tremendous opportunities for international expansion.

- They have rising revenues, improving margins, and sufficient cash reserves.

Getty Images/Getty Images News

Investment thesis

BYD (OTCPK:BYDDF) has become one of the biggest players in EVs in just a few years. The company dominates the domestic market in China, and another future opportunity is international expansion. Furthermore, the company benefits from the fact that the share of EVs compared to combustion cars continues to increase. Even in China, only 1 in 4 vehicles was electric in 2022. The valuation is cheap, given the rapid growth. In addition, the company pays a dividend that is still low, but YoY was recently increased tenfold.

EV market overview

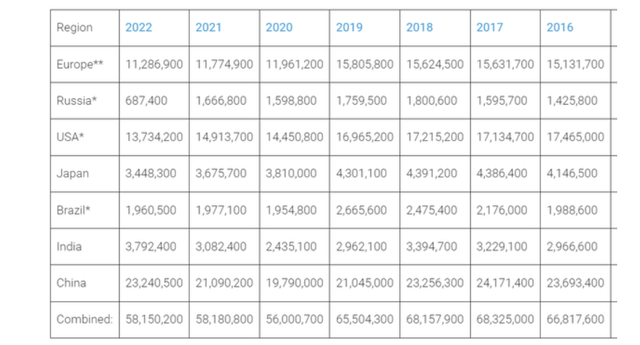

If you look at the car market, you will see that it is not growing; on the contrary, it has declined since 2016. The whole pie is not getting bigger, especially in the developed regions of Europe and the USA. As I am from Germany and travel a lot in general, I can speak well for the European market. More and more people here don't feel the need to own a car because, especially with combustion cars, the running costs are high while traveling by train is often cheaper and perceived as more comfortable. Using car-sharing systems to rent a car only when you need it also becomes more popular, and in the end, you can save a lot of money this way.

But you can further divide the global car market into ICE cars and EVs. But the EV share is still low in most areas. China has one of the highest market shares, but even here, only 1 in 4 cars was an electric vehicle in 2022. If you look at it this way, EV manufacturers are operating in a rapidly growing market, even though overall car sales are trending downward.

Electric car markets are seeing exponential growth as sales exceeded 10 million in 2022. A total of 14% of all new cars sold were electric in 2022, up from around 9% in 2021 and less than 5% in 2020. Three markets dominated global sales. China was the frontrunner once again, accounting for around 60% of global electric car sales. More than half of the electric cars on roads worldwide are now in China and the country has already exceeded its 2025 target for new energy vehicle sales. In Europe, the second largest market, electric car sales increased by over 15% in 2022, meaning that more than one in every five cars sold was electric. Electric car sales in the United States - the third largest market - increased 55% in 2022, reaching a sales share of 8%.

This development was to be expected because EVs are becoming steadily cheaper while the technology, especially the battery and its charging times, is improving rapidly. Government subsidies and even threats to ban ICE cars also contribute to this development. The customer still has a choice, but not many arguments favor combustion cars in my view.

BYD is rising to a global player

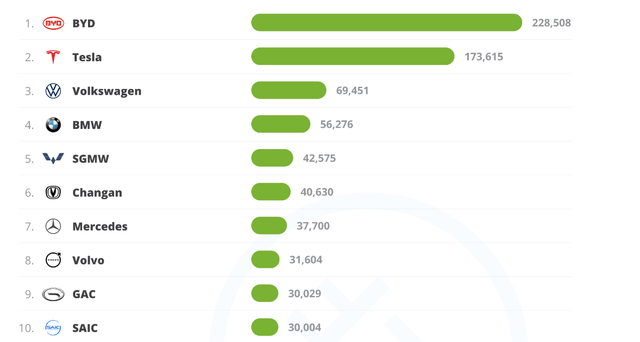

Only three years ago, few people were even aware of this company. The rapid rise to becoming a global player in electric vehicles is impressive. The following statistics show the global electric and hybrid sales in December 2022. The numbers roughly coincide with the data from BYD.

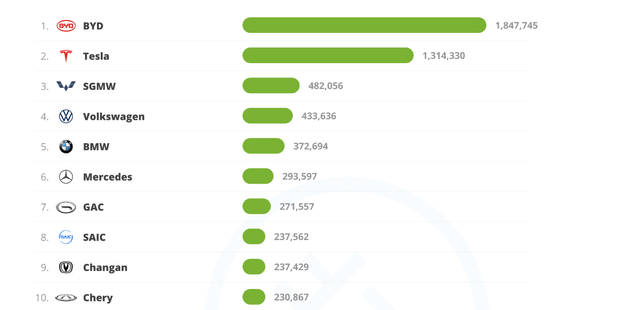

For the full year 2022, the statistics look like this.

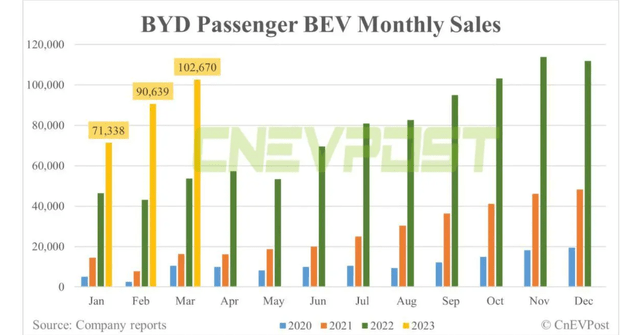

The figure for pure electric cars without hybrids is also given on the referenced BYD website. This number also matches the following statistic, which shows the company's EV sales with yearly increases.

In the past, there were virtually no Chinese manufacturers of ICE vehicles. But now, the Chinese mainly buy EVs from Chinese manufacturers. I have analyzed this development in detail in my article, "Power Shift: China's EV Market, Impact On Western Brands, And Some Trading Ideas". In my opinion, it is a must-read for investors in Western automakers, as the Chinese market is still the largest for most of them. The development I am describing is already manifested in numbers. For example, I recently wrote about BMW (OTCPK:BMWYY) and General Motors (GM), which are already seeing a drop in Chinese sales. However, this development can be generalized to all foreign manufacturers; only Chinese ones are gaining market share.

Projected into the future

As said before, even in 2022, only one of four cars sold was electric. If we combine all these developments, we can conclude that Western manufacturers will continue to lose market share because their sales come mainly from the sale of combustion cars. The only notable exception is Tesla (TSLA). For BYD, this means they have excellent chances to increase their market share even more. If, in a few years, not every fourth but every second sale is an EV, this might favor BYD more and more.

Another opportunity for the company is the export business. On the one hand, to penetrate the established car markets in the West and supply the direct neighboring countries in Southeast Asia or India.

BYD's exports were up four-fold just last year, nearing 56,000 vehicles, led by its Yuan Plus EV, data from the China Association of Automobile Manufacturers shows.

BYD has not announced export plans for the Seagull, which is priced below what is now the best selling EV in China, the BYD Dolphin, which is priced from 116,800 yuan ($17,000) in China. BYD will start delivering Dolphin in Europe from the fourth quarter.

Financial progress & trends

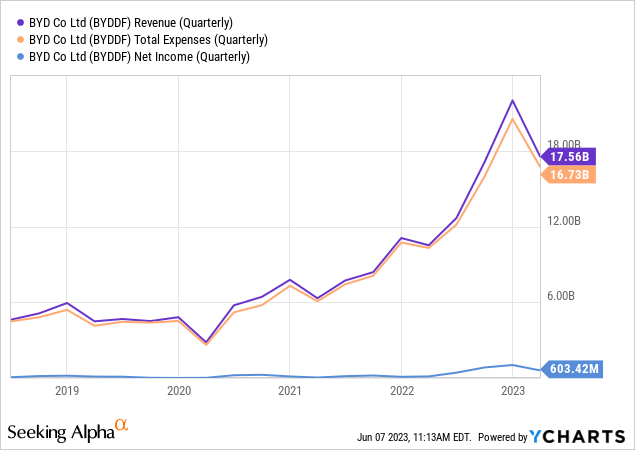

First, a short overview over a longer period for revenues, expenses, and net income. Sales have virtually exploded since 2020.

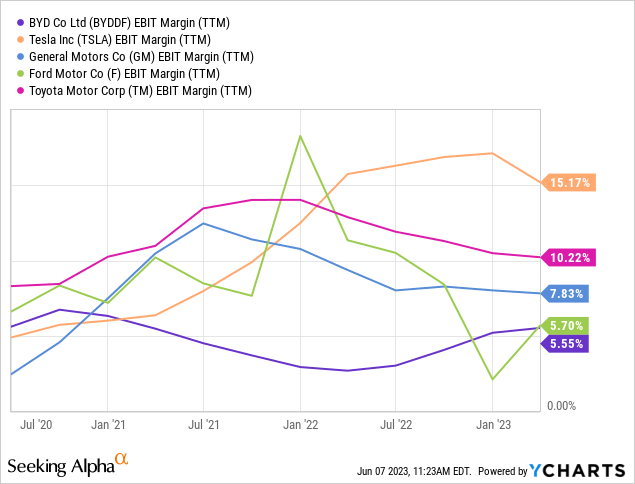

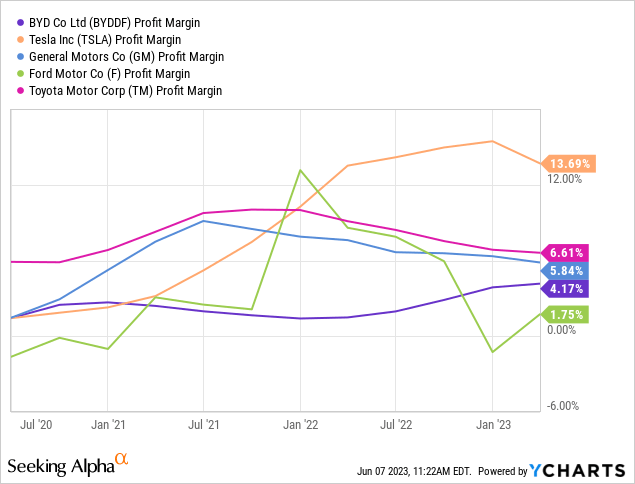

In this context, it is interesting to look at the margin trend and compare it with the competition, here first the EBIT margin, "Earnings Before Interest and Taxes".

Overall, there is a similar trend, as I mentioned in my recent article about General Motors, the companies with pure EV exposure tend to have increasing margins, and the classic ICE manufacturers, who have to spend significant capital on expanding their production to EVs, tend to have decreasing margins. Tesla is an exception because I believe they deliberately lower their prices to put pressure on the competition and gain market share. With the margins, they can afford it, and I assume that Tesla will continue to lower prices.

Valuation and outlook

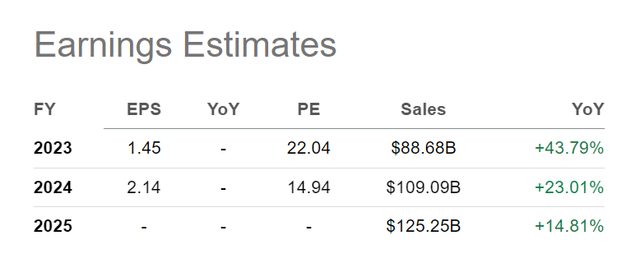

The company is currently valued at an enterprise value of $97B. The market cap is $100B, and the company has more cash than debt. The earnings per share estimates for this and the following years indicate that the "China discount" is already included. A Western company with this growth would be valuated several times higher. Tesla has a forward PE of 64.

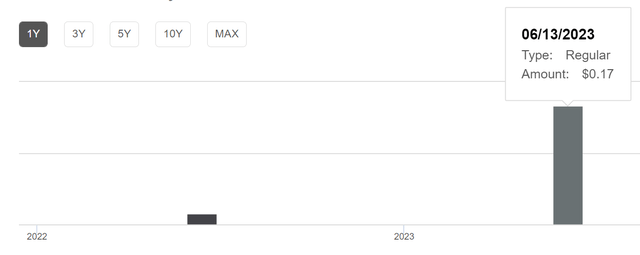

The company also pays a dividend (distributed once a year), even if it is still very low. At the current share price, $0.17 yields 0.5%. But at least the dividend has increased tenfold compared to the previous year.

Risks

Of course, there are also several risks.

- international expansion is possible but will most likely be challenging for the company. So far, you hardly see Chinese vehicles driving around in Western countries, and it is also not sure if customers will accept Chinese cars or if Europeans will continue to prefer European brands and Americans U.S. brands.

- overall, the company doesn't have that global branding like Mercedes or Ford. Building up this global branding takes decades.

- so far, the company has had weak margins because it has focused on offering low-priced brands and capturing market share. How this will develop in the future and what strategic direction the company will have in the long term is uncertain.

- in general, the usual China risk point applies. The transparency for Western investors is not as good as with American or European companies. In the past, there have also been doubts about the credibility of the data itself for several Chinese companies.

Share dilution, insider trades & SBCs

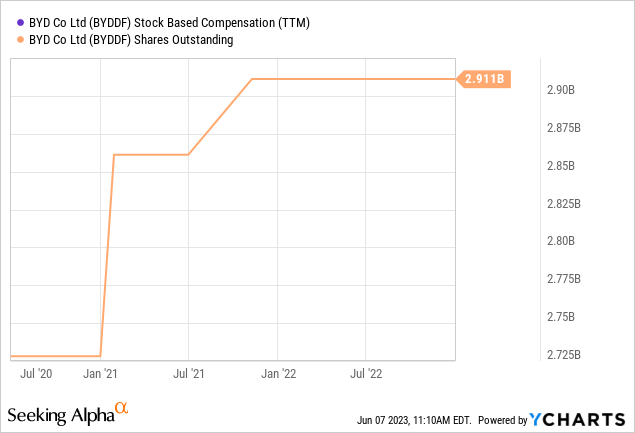

For me, these three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can put us, shareholders, at a disadvantage. In addition, insider trades sometimes contain valuable info about the confidence of management itself.

I have not found any information about insider trading, and apart from the increase in January 2021, the number of outstanding shares is relatively constant. YCharts also does not show any information about SBCs. These things are often not shown or do not exist for Chinese companies; it's just a different investment universe. If such things exist, then probably on the Hong Kong Stock Exchange (ticker: 1211:HK).

Conclusion

From my point of view, the company is on its way to becoming one of the largest car manufacturers in the world. This is mainly due to its strength in the Chinese market, and China is arguably the world's most significant automotive market. International expansion is a bonus opportunity for the company, but gaining a foothold there will be more difficult than in the Chinese market.

I am aware of the risks, but I think the risk-reward ratio is excellent given these opportunities. Furthermore, the company is a car manufacturer and is also active in other areas, such as producing electric bicycles, trains, batteries, and solar panels.

I plan to buy the stock in the next few days but will probably not buy the US-listed stock but on the home exchange in Hong Kong.

| Investor's Checklist | Check | Description |

|---|---|---|

| Rising revenues? | Yes | Increasing over longer time periods |

| Improving margins? | Yes | Possible competitive edge |

| PEG ratio below one? | Yes | PEG ratio below one may suggest undervaluation |

| Sufficient cash reserves? | Yes | Vital for the survival & growth especially of unprofitable companies |

| Rewards shareholders? | Yes | Returning capital to shareholders |

| Shareholder negatives? | No | Actions that disadvantage shareholders |

| Stock in uptrend? | No | Trading above its 200-day moving average? |

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BYDDF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.