Wolfspeed: High Valuation, Low Certainty

Summary

- Wolfspeed stock seems overvalued with optimistic revenue growth estimations already priced in, and the company has a history of uneven financial performance.

- Despite massive YoY growth in the last eight consecutive quarters, profitability metrics have weakened over the last three quarters, raising concerns about the company's strategic moves.

- The stock is given a "Hold" rating due to high uncertainty regarding future revenue growth and the company's ability to sustain expected growth.

Zocha_K/E+ via Getty Images

Investment thesis

Wolfspeed (NYSE:WOLF) has been one of the hottest stocks, with an almost fivefold increase in 2020-2021. The stock is now close to its pre-pandemic levels, so someone might consider adding it to their portfolios. I would like to warn potential investors because my valuation analysis suggests the stock is overvalued, and very optimistic revenue growth estimations are already priced in. The company has a "rich" history of uneven financial performance, which does not add certainty regarding WOLF's bright future.

Company information

WOLF manufactures wide bandgap semiconductors with a focus on silicon carbide and gallium nitride materials and devices. The company's ultimate markets include transportation, power supplies, inverters, and wireless systems. On October 4, 2021, the company changed its corporate name from Cree, Inc. to Wolfspeed, Inc.

The company's fiscal year ends at the end of June. The company operates as one reportable segment and disaggregates its sales by geographic areas. Revenue generated in the U.S. comprises less than 20% of total sales, according to the latest 10-K report.

Wolfspeed's latest 10-K report

Financials

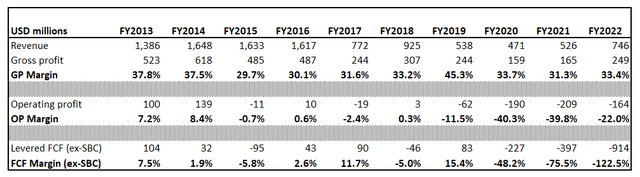

Over the last decade, WOLF faced numerous changes in strategy, the CEO changed, and the segment, which now represents the core of the company's business, was planned to be sold. But the deal was blocked. The company also transformed into a vertically integrated semiconductor powerhouse. Therefore, it is not surprising that the company's financial performance has been very uneven over the last decade.

When I look at these numbers, the first thing that comes to my mind is that the management is doing little to improve the company's financial performance. Profitability metrics significantly declined over the long-term horizon, and the company has been burning cash for three years in a row if we deduct stock-based compensation [SBC] from levered free cash flow [FCF].

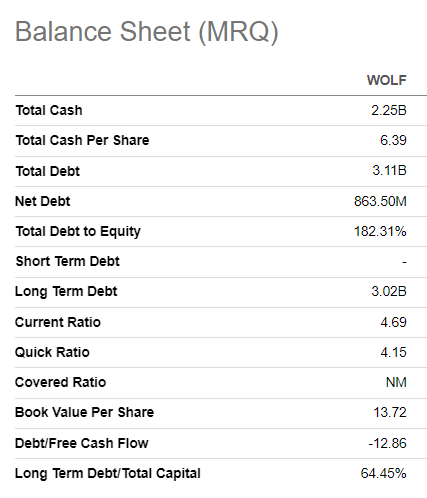

The company's balance sheet looks healthy, with a solid cash balance and good liquidity ratios. On the other hand, the company is in a net debt position which is not suitable for a company with a negative operating cash flow during several quarters.

Seeking Alpha

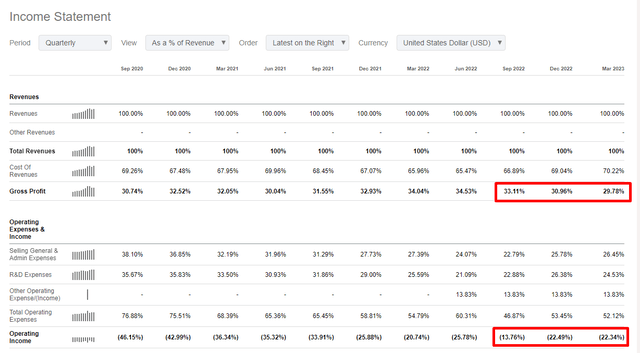

WOLF's bulls might argue that the company delivered massive YoY growth during the last eight consecutive quarters. But I would like to emphasize that profitability metrics weakened over the last three quarters. It should be vice versa - as the company delivers massive revenue growth, its profitability metrics should expand since the economies of scale effect should work. If the business does not benefit from expanding scale, it does not seem good business to me.

I also add that consensus estimates forecast about $225 million in revenue for the upcoming quarter. It means almost the same 1.5% decline both YoY and sequentially. So I think that the strong revenue growth momentum has gone. Please also pay attention that adjusted EPS is expected to decline significantly YoY from -0.02 to -0.20.

During the last earnings call, Gregg Lowe, the CEO, expressed his confidence in the long-term bright perspectives of the company.

Our strategic vision and expectations for silicon carbide expansion have not changed. Wolfspeed has a deep moat in the industry with a decades-long runway.

Therefore, my pessimism over the company's financial performance might be wrong, but before I invest in a growth stock like WOLF, I need to get more conviction that the company is taking the proper steps to improve profitability and deliver more value to shareholders. When margins are stagnating despite businesses scaling up rapidly, I am not sure if strategic moves are correct and correspond to the environment and market's needs. This road to getting more confidence in the bright future of WOLF might be extended. I think so because consensus estimates forecast that EPS will be negative in the nearest two fiscal years. Massive EPS growth is expected starting the fiscal year 2025, but in the modern fast-changing environment, a lot might happen during a couple of years.

Valuation

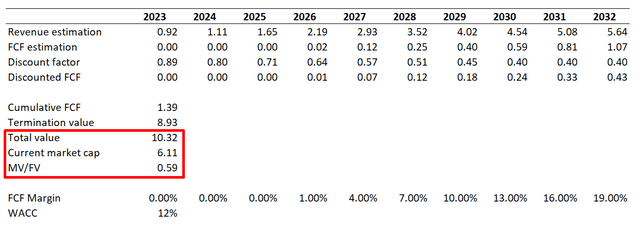

I use discounted cash flow [DCF] approach to the valuation of WOLF stock. Gurufocus suggests the company's WACC is at about 12%. I will run two scenarios because consensus earnings estimates look too optimistic. I think so because about 20% revenue CAGR projected by consensus means revenue will increase about six times over the next decade. If we look back to the past decade, the company rarely demonstrated such rapid growth. I expect the FCF margin to become positive in 2026 and expand by 3 percentage points yearly.

As you can see, the DCF model suggests the business is massively undervalued under these optimistic assumptions. I prefer to use conservative assumptions because the level of uncertainty is very high.

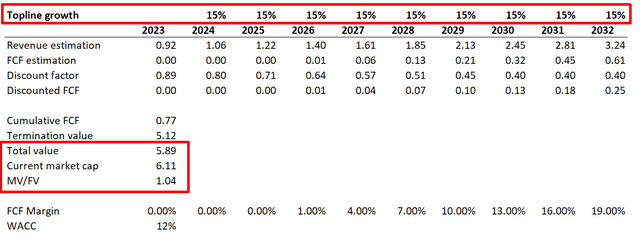

Therefore, I will use a 15% revenue CAGR for the second scenario. Under this more conservative [but still relatively aggressive], DCF suggests the stock is slightly overvalued.

To cross-check myself, I also want to look at the valuation multiples. Seeking Alpha Quant suggests valuation is not attractive at current levels. We can see that valuation ratios are far higher than the sector median.

Overall, the stock seems significantly overvalued, and uncertainty regarding future revenue growth is very high.

Risks to consider

As we know, the company derives about 80% of its revenue from outside of the U.S. Therefore, WOLF faces numerous risks related to international operations.

For example, the company is vulnerable to fluctuations in foreign currency exchange rates. Adverse exchange rate movements can affect the company's financials from the revenue and the cost side of P&L.

Geopolitical risk is also significant. About 30% of sales are generated in China, a country with geopolitical tensions with the developed world, especially with the U.S. These tensions might lead to changes in regulation for American companies operating or trading in China. This might adversely affect revenue.

Also, as seen in the "Valuation" section, the stock might be priced too optimistically since very aggressive revenue growth assumptions are underlying the current market cap. If the company fails to deliver such aggressive revenue growth or margin expansion, the stock will respond with a decline in the stock price.

Bottom line

To conclude, I would not recommend investing in WOLF stock. Very optimistic expectations regarding revenue growth are priced into the company's current market capitalization. Moreover, the company's recent momentum in sales growth seems to be gone. Therefore, there is minimal certainty that WOLF will be able to achieve the expected revenue growth. I give the stock a "Hold" rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.