On My Mind: Debt Ceiling To Markets - I'll Be Back

Summary

- The US debt ceiling crisis has been averted, but long-term fiscal risks have increased.

- US general government debt is projected to approach 140% of GDP by 2028, and political polarization may make it harder to reach agreements on fiscal adjustments.

- The risk of default threats becoming a more common negotiating tactic could lead to increased market volatility.

Douglas Rissing

By Sonal Desai, Ph.D., Chief Investment Officer, Franklin Templeton Fixed Income

The debt ceiling crisis has been averted—but this short-term relief might come at the cost of greater future peril. Franklin Templeton Fixed Income CIO Sonal Desai analyzes the debt-ceiling resolution and delves into the potential longer-term risks that rising public debt poses to financial markets.

The debt ceiling crisis has been averted, and this should be cause for unalloyed celebration. The bipartisan agreement was reached just a few days before the June 5, 2023, deadline that US Treasury Secretary Janet Yellen stated as when the government would likely be unable to meet all its obligations.

The debt ceiling agreement removes an important uncertainty from the horizon, which is positive for financial markets, for the economy and for the US international standing. And it does so without imposing a major fiscal tightening, which might have caused growth concerns. All this is certainly good news.

The long-term risks linked to the fiscal outlook, however, have in my view become bigger, and market participants would do well to keep this in mind. Let me explain:

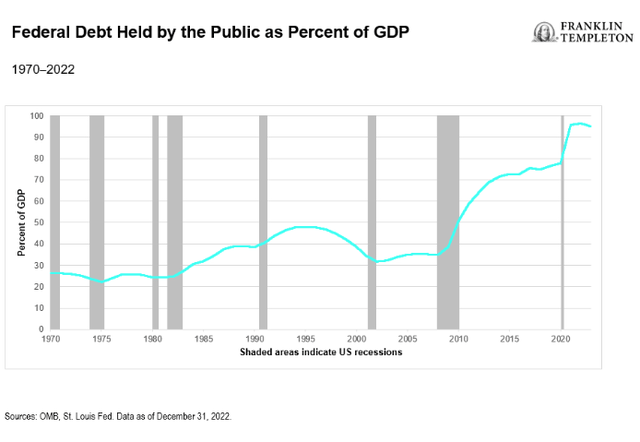

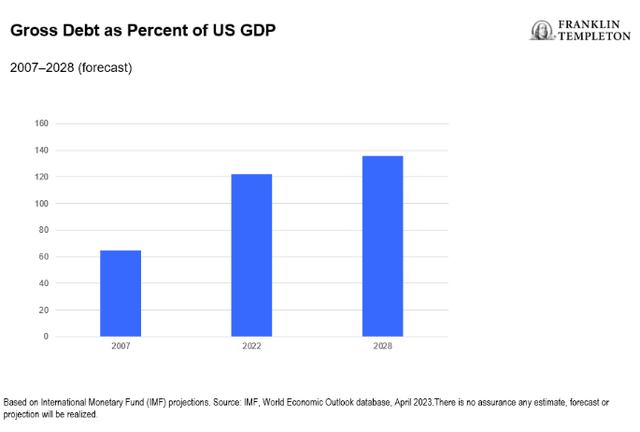

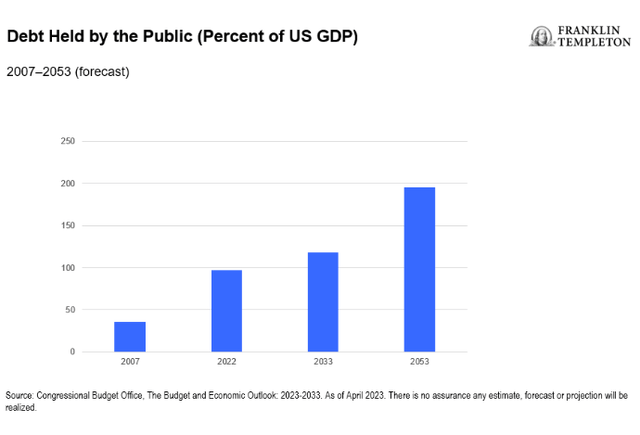

1. The long-term fiscal picture is not getting any better. Based on International Monetary Fund (IMF) data, at the end of last year, US general government debt stood at over 120% of gross domestic product (GDP), twice the pre-global financial crisis (GFC) level (2007) and higher than most European Union (EU) countries. The IMF projects it will approach 140% of GDP by 2028. If we look at debt held by the public,1 the measure more often used in US domestic discussions, the numbers are a bit lower, but the trend looks equally worrying. It stood at 35% of GDP before the GFC, reached 97% of GDP last year, and looking forward, the Congressional Budget Office (CBO) projects it to reach 120% of GDP by 2033 and close to 200% of GDP by 2053.2 (Caveat: the latest CBO budget outlook was released last February and predates the debt ceiling agreement.)

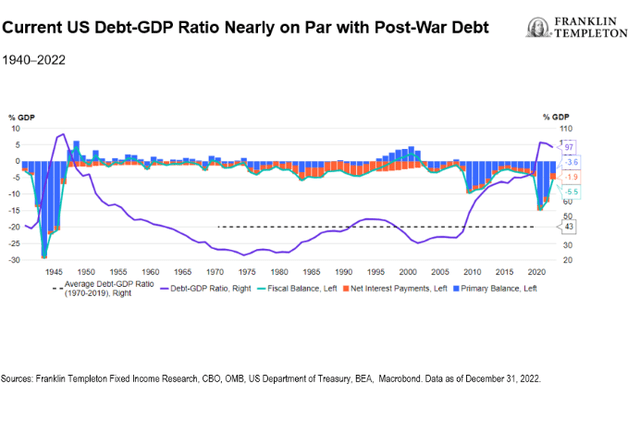

To put things in even starker historical perspective, the debt-to-GDP ratio has almost reached post-World War II levels:

2. The recent contentious discussions on possible spending cuts have highlighted the underlying problem: discretionary spending accounts for just over one quarter of federal outlays, or 6.6% of GDP (as of 2022); non-defense discretionary spending is a paltry 3.6% of GDP—not much room for fiscal adjustment there. The other three quarters of public outlays consist in mandatory spending (16.3% of GDP), mostly entitlement programs such as social security and health care, and much harder to reduce, especially against the background of an aging population. To make matters worse, the days when the government could borrow almost for free are most likely gone, so interest costs on the debt will weigh a lot more on the budget. Net interest payments are projected to rise sharply from the average of the post-GFC period, to account for about half of future fiscal deficits.

3. Political polarization has increased significantly over the past several years, and as of now there is no sign of it going into reverse. This will make it even harder to reach agreement on any durable adjustment to government revenues or expenditures—something that would be a delicate and demanding task even in a more collaborative political climate.

4. This would make for a challenging fiscal outlook in any country. In the United States there is the added institutional complication of a debt ceiling that is fixed in nominal dollar terms. As the economy grows, even just keeping debt stable as a share of GDP therefore requires active decisions to raise the debt limit. As a consequence, high-stakes discussions on the debt ceiling are an intrinsic part of the process. In calmer times, the revision of the debt ceiling should just be the natural outcome of level-headed discussions in the budget process. That, however, is not always the case, as we have seen.

5. Financial markets seem to be getting used to the default threat. Over the past several weeks, investors remained relatively calm even as top government officials like Yellen warned the United States might end up defaulting on its debt. There were occasional tremors in equity markets and some dislocations in the pricing of short-dated Treasury securities, but overall financial markets took the threat of default in stride. After all, it was always an extremely unlikely event, and similar threats in 2011 also came to nothing.

6. To me this flags a risk of escalation. A deteriorating fiscal picture will make political disagreements on spending and taxes even more strident, and the temptation to resort to more extreme brinkmanship will increase, especially if the expectation is that financial markets will stay on an even keel.

The risk therefore is that default threats will become a more common negotiating tactic. Whenever we have a split Congress, the temptation to resort to the “nuclear threat” of blocking a necessary raising of the debt ceiling will be strong, and if financial markets again take it in stride, politicians might be tempted to push each other closer and closer to the brink. At the very least, this might give us further instances of government shutdowns; but we’ve survived similar episodes before. The global image of the United States and of the dollar will suffer, but for the foreseeable future I do not see a viable alternative to the dollar as the primary reserve currency, so here as well the impact might be limited.

The more political parties engage in brinkmanship over the level of debt without addressing the underlying fiscal weakness, however, the greater the risk that at some point this will trigger an unexpectedly sharp bout of market volatility.

The immediate crisis has been averted, but the shadow that rising debt casts on financial markets has gotten more threatening, in my opinion.

What Are The Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the portfolio’s value may decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value.

Footnotes

1. Debt held by public excludes debt held by federal trust funds and other government accounts, for example Social Security.

2. Source: CBO, “The Budget and Economic Outlook: 2023 to 2033,” February 2023. There is no assurance any estimate, forecast or projection will be realized.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by