SoFi Technologies: Student Loans Return Is A Turning Point

Summary

- SoFi Technologies' stock is upgraded to a strong buy due to the resumption of student loan payments, which is expected to boost its profitability.

- The company is predicted to reach profitability in Q3, earlier than its Q4 expectations, as more people may refinance their student loans with SoFi.

- Investors are advised to wait for a pullback before taking a new position, as the stock is currently overbought and testing a resistance near $7.10.

KLH49/iStock via Getty Images

SoFi Technologies, Inc. (NASDAQ:SOFI) stock increased 40% since I gave it a buy rating in my last article. Now I think it is time to revisit SoFi especially after the new debt ceiling deal saw the resumption of student loan payments. Since student debt refinancing was a huge chunk of SoFi’s business before the pause, I expect SOFI to reach profitability in Q3, earlier than its expectations of Q4, since many people would opt to refinance their student loans with SOFI. For this reason, I am upgrading my buy rating to a strong buy thanks to SOFI stock’s upside with the resumption of student loans.

New Debt Ceiling Deal

On June 3rd, President Joe Biden signed into law a bill to suspend the nation's debt limit through January 1, 2025, to avert a first-ever US default. With this news, SoFi now can breathe a sigh of relief. The market's perception of SOFI may also change now that the US is regaining its macroeconomic stability, hopefully revitalizing the banking sector.

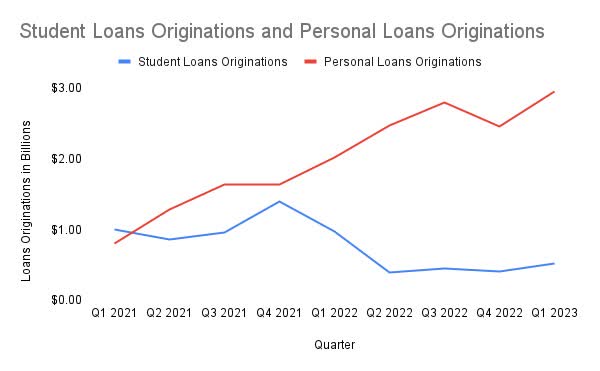

Furthermore, SoFi would regain one of its main revenue streams since student loan payments will resume within 60 days of the deal being signed into law. In 2019, student loans represented 60% of SOFI’s total revenues, but since the student loan payments moratorium it accounted for only 15% in Q1 2023. To deal with this setback, SoFi has worked on increasing its personal loan originations which now account for nearly 84% of SoFi’s loan originations.

SoFi did a great job adapting to the situation in my opinion. Its adaptability is why discussions about its long-term profitability are far from a pipe dream.

SOFI Loan Originations by Quarter (Based on Data in Company Filings)

Profitability On The Horizon

Now that SoFi is returning to normalized operations with access to all its revenue streams, I expect it to reach profitability sooner than expected in Q3. SOFI expected student loan payments to resume towards the end of Q3, but with the new resumption date, consumers would be more inclined to refinance their student loans with SOFI. Therefore this should be reflected in SOFI’s Q3 earnings.

With this in mind, SOFI was already close to profitability in Q1 as it posted a net loss of $34 million. I expect this loss to decrease in Q2 as SOFI may have attracted a significant number of new customers following the regional bank exodus, as I covered in my previous article.

With profitability on the horizon for SoFi, whether in the forecasted Q4 2023 or earlier in Q3 as I expect, SOFI stock could make considerable gains after reaching this turning point.

I expect the market to react similarly to how it responded to Palantir Technologies Inc. (PLTR) after it reported its first profitable quarter in Q4 2022. PLTR is up 100% since posting its first profitable quarter and I am confident investors will respond similarly once SOFI achieves profitability.

Technical Analysis

Looking at the daily timeframe, the trend is neutral as SOFI stock continues to trade within a sideways channel between $4.81 and $8.21. Looking at the indicators, the stock is trading above the 200, 50, and 21 MAs which are bullish indications. Meanwhile, the RSI is overbought at 72 and the MACD is bullish to the upside.

Given that the RSI is overbought and the stock is testing a resistance near $7.10, it's best to wait for a pullback before taking a new position.

But if my theory is correct and SOFI achieves profitability earlier than expected in Q3, I believe this catalyst could push the stock out of its sideways channel. Considering that the new debt ceiling deal will cause student loan payments to resume within 60 days of being signed into law, SOFI has a number of catalysts to watch.

For readers who bought shares at $4.85 after my last article on SOFI, I recommend taking profits on the run-up. But SOFI stock is a longer-term hold for me and I will continue holding most of my position for Q3 earnings.

Risks

Although SOFI’s outlook is, in my opinion, very bullish, one major risk investors should be aware of is rising interest rates. Since SOFI received a bank charter it is able to make loans. However, customers may be less willing to accept loans at higher interest rates which would affect SOFI's loan originations.

While Fed Chair Jerome Powell hinted at the possibility of pausing interest rates this year, the Fed might resort to further rate hikes if inflation continues to show resistance to the Fed’s policy.

Conclusion

Based on its QoQ progress, SoFi is nearing profitability. With the company regaining a huge revenue stream thanks to the debt ceiling deal and increasing its personal loan originations over the last few years, I believe it might reach profitability earlier than its expectations. This combined with SoFi's potential to attract new customers following the regional banks' collapse contributes to the bullish outlook for SOFI stock.

For these reasons, I am upgrading my previous buy rating to a strong buy but I recommend investors wait until SOFI stock cools off before taking a new position in anticipation of its Q3 earnings.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SOFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.