easyJet Stock: Undervalued Or Too High Risk?

Summary

- easyJet plc H1 2023 results were much in line with preliminary results shared in April.

- Further recovery for easyJet is expected in the remainder of the year.

- Matching earnings with the share price suggests significant upside, but analysts seem to be assigning a much lower upside to easyJet plc stock.

- I do much more than just articles at The Aerospace Forum: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Bradley Caslin

Airline easyJet plc (OTCQX:EJTTF) recently provided its half-year update. Previously, the airline had already released preliminary results, which I analyzed in a report. In this report, I will be having a look at the actual reported figures and explain whether easyJet stock is a buy.

easyJet Results: Little To No Surprises

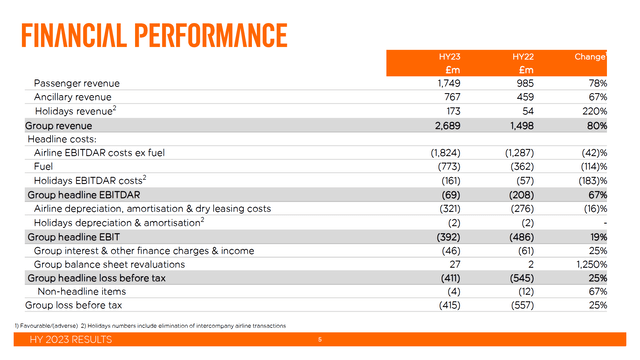

Overall, the reported results were not much different from the preliminary results that easyJet provided in April. Group revenues were £1 million lower while costs were £1 million higher, and the headline loss before tax was £4 million lower than anticipated. So, no big surprises with a 25% trim on the group loss.

At this point, I would say that looking at the per seat revenues and costs are somewhat more interesting. easyJet carried 41% more passengers, whereas 35% growth was anticipated, but the revenue per seat grew by 40% whereas 43% was anticipated. This was driven by ticket yield being 5 percentage points lower than expected which was partially offset by stronger ancillary yield. Costs per seat went up primarily due to airports & ground handling costs, half of which was driven by higher load factors.

Overall, due to inflation, higher crew and navigation costs were to be expected. Normally, as an airline increases capacity, we see the costs come down. In the current inflationary environment, that has proved to be difficult to achieve. On a 32% increase in capacity, costs per available seat-kilometer remained even, while on a per seat basis the costs were up 5%.

For Q3, the airline sees continued strength, with revenue per seat increasing another 20% YoY - and that is compared to a base that was already improving last year, while capacity is expected to increase 9% compared to a previous forecast of 7%. The holiday segment is expected to grow another 60%.

So, with the summer in sight, easyJet is seeing strong demand and pricing, and even though fuel prices are up, the company sees demand strength that translates to higher revenue per seat, allowing for yield expansion.

Is easyJet Stock A Buy?

In my view, easyJet stock has been a buy However, realistically even with recent positive views on profit growth in Europe for the airline industry, easyJet stock has not benefited, losing 5.5% compared to a 3% gain for the broader market.

Big Upside, But Is The easyJet Business Model Considered A Risk?

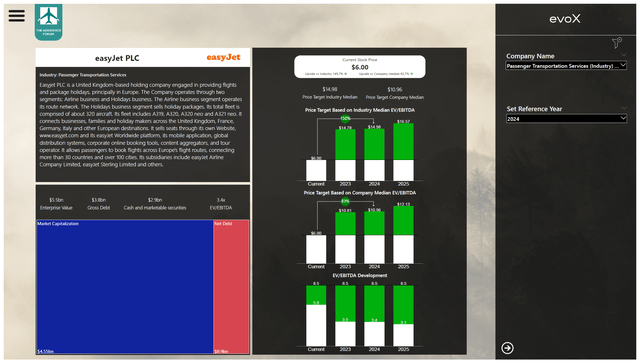

When putting the numbers into the valuation model available to subscribers of The Aerospace Forum, I found that easyJet appears to be significantly undervalued compared to its prospects. Historically, the company has traded at 6.2x EV-EBITDA, and that is 5.8x now. That already provides 7% of upside out of the 18% that analysts see for the stock. The highest target provides 50% upside, and actually much to my surprise my model indicates a price target around $11, which is over 80% higher than today's price.

So, either the market does not believe easyJet will deliver, or its business model, which includes a Holiday business and overall significant exposure to the UK economy, is seen as a big risk that warrants a 4x EV-EBITDA. This means a 50% discount for risk compared to peers and roughly a third compared to the EV-EBITDA that easyJet typically trades on.

I have flown with easyJet as travel restrictions eased, and their price and service were not great. Their choice to service primary airports might be considered a disadvantage compared to low-cost carriers to people traveling for business or travelers who don't want to travel tens of kilometers from secondary airports to destinations where primary airport service is a big pro.

Conclusion: easyJet Is Getting Back On Track

Overall, the easyJet plc results were in line with expectations, with strong load factor improvements, but revenue per seat was somewhat softer than previously guided. The market sees upside to easyJet stock, but significantly lower than what my model would suggest. If the market and analysts are right, either easyJet's business is considered too high-risk or it is set to accumulate debt that I currently have not accounted for. However, I do believe that the current share prices do not accurately reflect the projected earnings going forward, and therefore maintain my buy rating on easyJet plc stock.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.