MLPA: An Energy ETF To Ride Out The Recession

Summary

- Global X MLP ETF offers a less volatile way to invest in the energy sector with a yield of over 7%.

- MLPA holds US midstream MLPs and provides broad exposure to the entire midstream MLP industry.

- The ETF is a suitable investment for the current economic climate, as it provides lower volatility and income during a potential recession.

Olivier Le Moal

Global X MLP (NYSEARCA:MLPA) is an ETF that focuses on midstream MLPs in the energy sector. With AUM of about $1.4B, MLPA is designed to provide income and lower volatility compared to other energy ETFs. MLPA holds 20 midstream MLPs and has an impressive dividend yield of 7.5%.

What I think is great about this ETF is that it provides a less volatile way to invest in the energy sector while providing a yield of over 7%. In today's economy, volatility is a huge issue for me. A recession is almost certainly on its way, and this is why I think MLPA is a great asset to own. MLPA offers an amazing opportunity to reduce volatility as well as provide a stable high yield to help investors wait out the recession. Because of this, I rate MLPA a Buy.

Holdings Analysis

MLPA holds 20 US midstream MLPs weighted by market cap. The holdings are subject to cap restrictions, but currently, none of the holdings are large enough to qualify for that restriction.

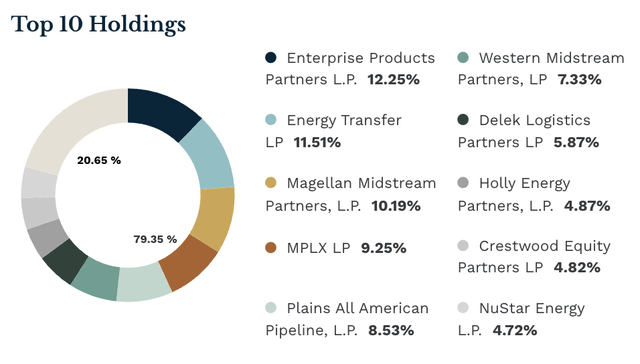

MLPA's top 10 holdings (ETF.com)

MLPA's top 10 holdings make up about 80% of the fund, with its largest holding, Enterprise Products Partners L.P. (EPD), accounting for a little over 12%. This is the kind of diversification I like in an ETF. Researching just the top 10 stocks to understand 80% of this ETF would be much easier than trying to research 80% of SPY's or VTI's holdings. It gives me better diversification than just buying a couple of MLPs but also lets me understand what I'm investing in which is very important.

Another aspect of MLPA's holdings that I like is its diversification within the midstream sector.

MLPA's industry diversification (globalxetfs.com)

It relatively evenly distributes its holdings between the storage and transportation of petroleum, the storage and transportation of natural gas, and gathering and processing operations. This ensures broad exposure to the entire midstream MLP industry.

How MLPA reduces volatility

MLPA is able to provide low volatility because of a few factors. MLPs are lower risk and have lower volatility than most energy companies. This is because midstream MLPs are usually long-term investments that provide slow but stable income due to most of their cash flow coming from long-term contracts.

MLPs are also usually in slow-growing industries; in the case of MLPA, the midstream industry. Midstream MLPs are less sensitive to the influence of energy prices, particularly oil. Because these MLPs don't directly deal with the sale of oil, their income remains relatively stable regardless of oil prices. However, midstream MLPs are still moderately correlated with energy prices, meaning they offer exposure to the energy industry but with lower volatility and higher yield than broad energy industry indexes like VDE and XLE.

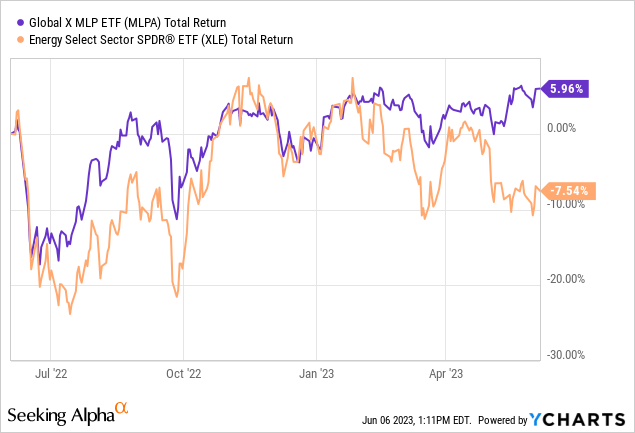

I think the chart from this past year shows this in action very well.

As stated before, MLPA is moderately correlated with oil so it still has significant fluctuation. However, in the past year, MLPA is clearly less volatile than XLE, the energy sector benchmark. When oil prices swing up, XLE, which is highly correlated with oil, will outperform MLPA, and when oil drops down, it will underperform.

Income

Since 2018, MLPA has provided a consistent yield of around 7.5%-8.5%, with the one notable exception being the black swan event of the COVID-19 pandemic-induced recession. This stable history is very impressive. It can be this stable because, as mentioned before, the MLPs MLPA holds have constant and consistent income from long-term contracts.

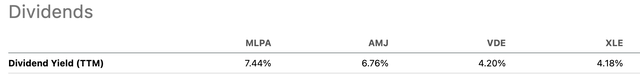

MLPA's yield of about 7.5% is much higher than energy index ETFs like XLE and VDE, but also higher than other MLP ETFs like AMJ.

Why now is the time to buy MLPA

In the current economic climate, I am looking for investments with lower volatility, and that will provide income. I believe at this point, a recession is inevitable within the next year. The economy continues to boom while the Fed is trying to slow it down. The risk of a recession is not behind us. The Fed's efforts to slow the economy have not worked. Inflation, job reports, and consumer spending are still coming in higher than expected. While this may sound positive, the result is that the Fed will have to become even more aggressive, almost certainly pushing the economy into a recession.

In this situation, I want to own something that provides me with less volatility and that can allow me to stomach an economic downturn by providing me with income. MLPA does both of these. I believe it's smarter to own an asset like this than to get completely out of the market because it is hard to know exactly when markets will turn as we enter and exit a recession. Like Ken Fisher said, "Time in the market beats timing the market."

Conclusion

MLPA provides exposure to the energy industry while avoiding high volatility and providing income. MLPA's midstream MLPs will provide much-needed income when the economy goes into recession. MLPA has proven to be able to pay high, stable, and consistent dividends. Along with the income, MLPA's low volatility relative to the energy sector will add stability to shaken portfolios during the recession. Because of all of this, I rate MLPA a Buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.