Stitch Fix: Priced For Disaster

Summary

- Stitch Fix, Inc. reported mixed FQ3 numbers, though the company did beat expectations.

- The online personalized shopping service was cash flow positive despite the revenue dip.

- Stitch Fix stock is cheap, trading at only 0.1x EV/S targets, a big discount to department stores.

- This idea was discussed in more depth with members of my private investing community, Out Fox The Street. Learn More »

Sergey Varfolomeev/iStock via Getty Images

Stitch Fix, Inc. (NASDAQ:SFIX) continues to struggle to turn around the business following covid pull-forwards while facing macro headwinds. The company already uses data science and AI to help personalized stylist selections for customers, providing a quick path to implement any new AI technologies. My investment thesis remains ultra Bullish on the stock, which is trading as if the company is headed towards a disaster while Stitch Fix has solid financials.

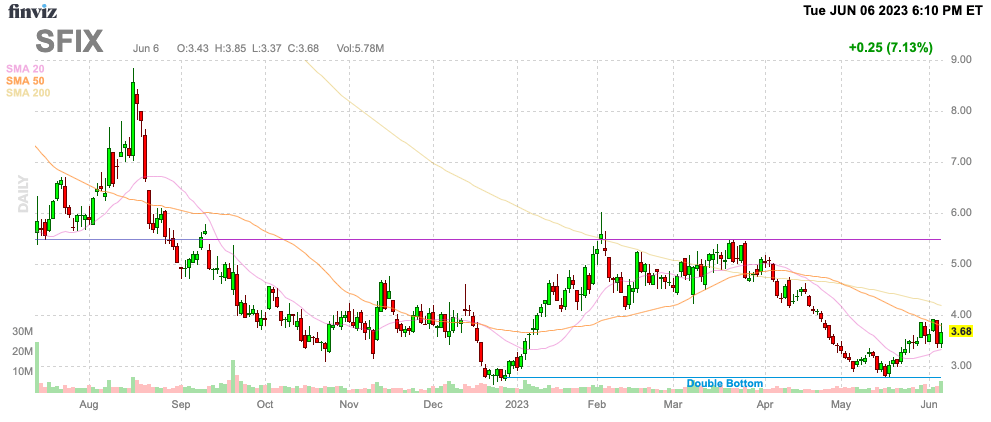

Source: Finviz

Struggles Persist

Stitch Fix definitely reported a mixed FQ3'23 quarterly earnings report as follows:

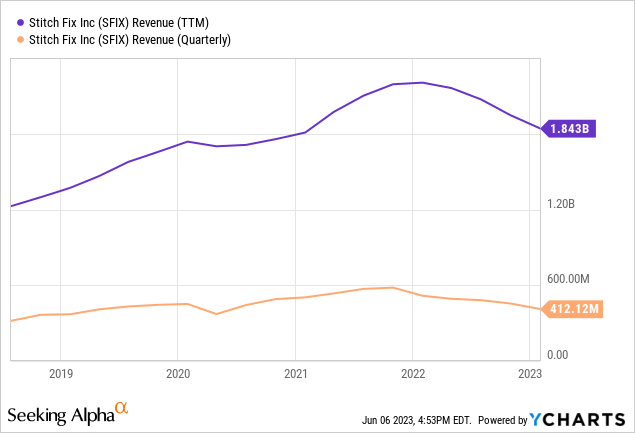

Sure, the online personalized shopping service beat analysts' estimates, but Stitch Fix reported a nearly 20% dip in revenues. The company topped $400 million in FQ3 revenues back in 2019 prior to covid, in an example of how far the business has fallen back to earth following a sizable bump when consumers were only shopping online.

The key here is that Stitch Fix has a roughly $1.6 billion business (prior to exiting the UK) with minor adjusted EBITDA profits. The financials of the company are solid, with Stitch Fix actually producing nearly $22 million in free cash flow for the April quarter and $37 million in operating cash flow YTD.

The UK business is holding back profits with a $15 million adjusted EBITDA loss on only $50 million in annual revenues. The company could quickly boost profits and cash flows by just focusing on the U.S. market and exiting this foreign market that hasn't scaled.

In essence, Stitch Fix has a stabilizing business with positive cash flows. The key is for founding CEO Katrina Lake to build on the base business from here.

The company has cut the advertising expenses to 7% of revenues, down from 12% last year, in order to improve profits. The company used to spend ~10% of revenues on advertising, leading to a savings of nearly $40 million in the last quarter alone.

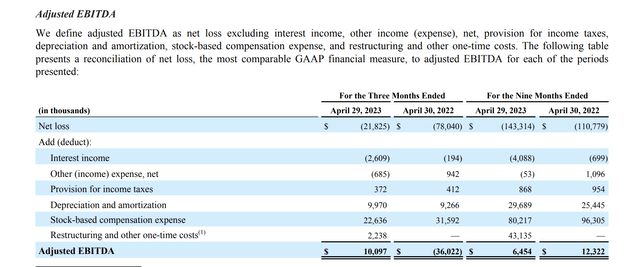

Stitch Fix reported an adjusted EBITDA profit of $10 million for FQ3, beating guidance for nearly flat numbers. The majority of the adjusted numbers are stock-based compensation ("SBC") and depreciation costs. In fact, the adjusted EBITDA measure actually removes nearly $2 million in interest income that would normally be included in a non-GAAP profit measure.

Source: Stitch Fix FQ3'23 earnings release

Priced Like A Department Store

Entering FQ3 earnings, Stitch Fix had a market cap of slightly above $400. The company has a cash balance of $244 million, leaving an enterprise value of only ~$150 million.

The stock valuation is amazing considering the revenue base in the $1.6 billion range. The company is struggling due to market conditions, but Stitch Fix still offers the opportunity to work with data scientists - and now AI - to sell apparel at attractive gross margins in the 50% range.

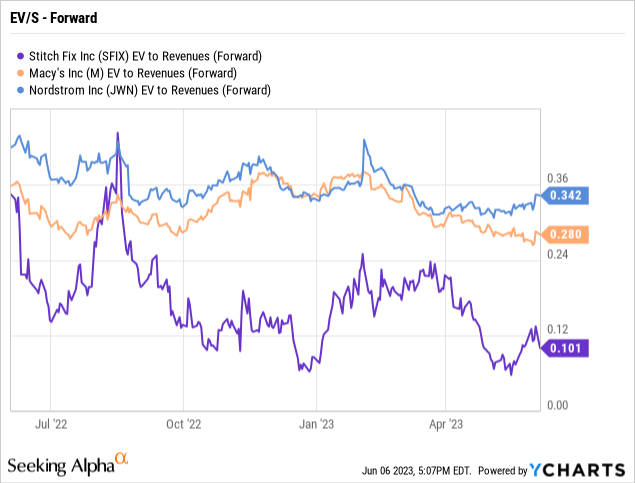

While Stitch Fix has struggled, the stock now trades at forward EV/S multiples far below those of beaten down department stores. Stitch Fix trades at only 0.1x forward sales targets while Macy's (M) and Nordstrom (JWN) trade at triple the EV/S multiple at 0.3x.

Considering the data scientists and personalized styling service offered by Stitch Fix, the goal shouldn't be to trade at just a department store multiple. The stock should obtain a premium valuation multiple, especially once the company returns to growth mode following this difficult period and the likely exit of the money-losing U.K. business.

The FQ4 guidance won't help with a sequential revenue decline. Stitch Fix is guiding to revenues of ~$370 million, but the company is targeting an adjusted EBITDA profit ~$5 million above the original FQ3 target.

The market will like this offset of higher adjusted profits over revenue growth. Of course, the biggest issue is that Stitch Fix continues to trade at new lows due to concerns about business prospects and the ultimate best solution is to return to profitable revenue growth.

Takeaway

The key investor takeaway is that Stitch Fix, Inc. stock is crazy cheap trading at cheaper valuation multiple than struggling department stores. Investors should use the weakness to load up on the stock.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SFIX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.