Enterprise Bancorp: Are Regional Banks Undervalued, Or On The Brink Of Implosion?

Summary

- Enterprise Bancorp is a well-capitalized, conservatively managed regional bank with potential for growth, despite recessionary fears and risks from the commercial real estate market.

- The bank has a high proportion of commercial real estate loans, which could lead to major losses if property values decline significantly.

- Investors should consider the risks of bank runs, recessionary risks, and commercial real estate contagion before investing in EBTC.

- If conditions worsen, the big winners will again likely be the large US banks, and the losers will be regional bank shareholders.

Sakorn Sukkasemsakorn

Overview

Regional banks have experienced indiscriminate selloffs, with plenty of opportunities in the sector due to recent fear of bank runs as well as a high proportion of commercial real estate loans on the books. If contagion can be prevented, regional banks will likely continue chugging along providing their smaller scale loans to local communities. I stumbled upon Lowell, MA based Enterprise Bancorp (NASDAQ:EBTC) by looking at regional banks that have had recent insider buying, indicating a vote of confidence from management. On closer look, it appears to be a well capitalized and conservatively managed bank that will continue to provide services for years to come, as long as it doesn't implode.

A Well Managed Shareholder Aligned Bank?

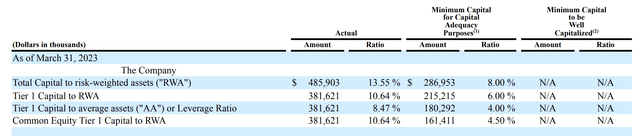

Looking at leverage ratios, the bank far exceeds liquidity requirements to be considered "well capitalized," and these ratios have actually improved since the previous quarter. These improving ratios indicate that even if the bank experienced substantial financial distress, there would likely be enough liquidity to remain solvent.

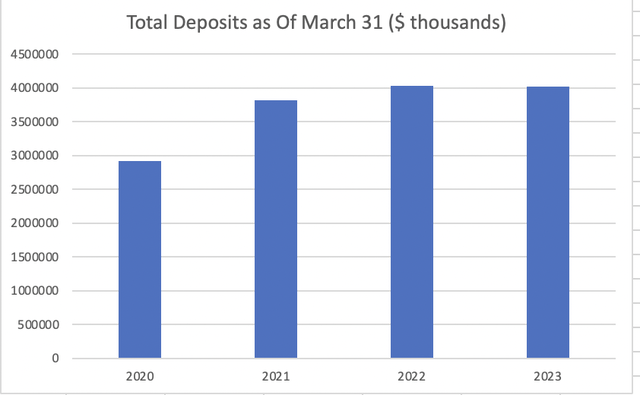

As there has been recent fears of bank runs, a look at total deposits is warranted to determine if any alarming trends are taking place. As can be visualized below, though total deposit has stagnated in recent years, there has been no precipitous decline in bank deposits.

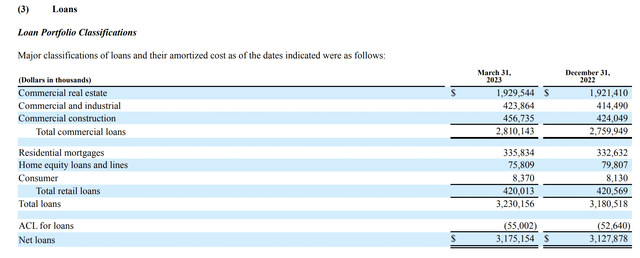

Unfortunately, the majority of loans are commercial real estate loans, as is demonstrated below. This is a large potential risk, given the recent declines in commercial real estate values, and these could decline even further and result in huge loan losses. It has been suggested that further banking consolidation could contain any contagion as regional banks hold a large proportion of commercial real estate. Banking consolidation, would probably not be good for EBTC shareholders.

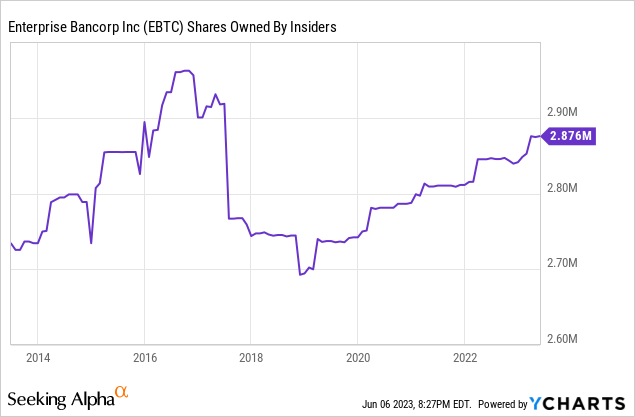

On a positive note, investors can also rest assured that their interests are likely aligned with management when investing in EBTC. Insiders have historically held a large proportion of shares outstanding, with approximately 23% ownership at time of writing, which can be visualized below:

A Quantitative No Brainer?

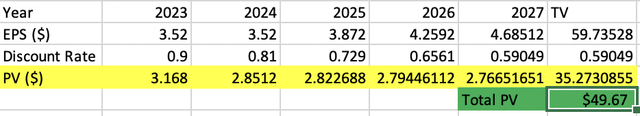

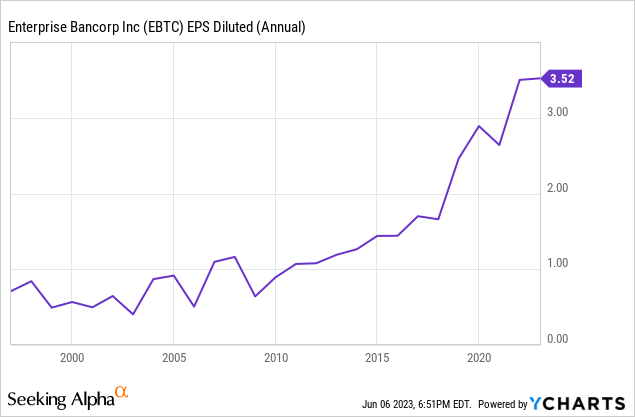

I justified investing in EBTC by considering its growth rate and comparing it to the current p/e ratio. Though, like many other small banks, shares outstanding have increased over time due to stock based compensation, EPS continues to chug along at a fair clip. EPS has increased at an over 15% CAGR over the last 5 years and a 10% CAGR over the last 10. For reference, the company had an EPS of $1.28 in 2012, $1.66 in 2017, and $3.52 in 2022. Historic EPS growth is demonstrated below:

At time of writing, EBTC Is trading at a p/e ratio of 8.5. I think at this kind of discount and growth rate, banks like this are almost like a quantitative no brainer. Let me demonstrate by discounting out some conservative EPS assumption. My model below estimates no growth in EPS over the next 2 years, followed by 10% CAGR from 2025-2027. For terminal value I assumed a 2% growth rate until the company's eventual decline, and used a 10% discount rate as this is likely the minimum return shareholders would expect. I believe these to be extremely conservative estimates, and this puts the PV of EBTC shares at $50.

Risks

Illiquid Stock

I am no large investor, but I needed to use limit orders when I bought shares here in order to prevent rapid price rises. Investors may not be able to enter and exit the trade easily, so should be absolutely sure they would like to take a position in the company before buying shares. There may be other banks with similar prospects that have more liquidity.

Bank Runs

As mentioned before, bank runs are an ongoing concern especially as book value has decreased due to higher interest rates. If something like this occurs, shareholders of EBTC could be bought out at pennies on the dollar by a larger bank or risk total loss of capital. So far though, it appears deposits have stayed relatively strong.

Large Proportion of Commercial Real Estate Loans

Commercial real estate loans are a major concern considering the potential for massive declines in property value given the higher interest rate environment and recent work from home trend. If properties need to be repossessed by the bank, this could result in major losses.

Growth May Not Continue

From the 2000-2009 period, EBTC earnings growth was relatively stagnant. This may be the case moving forward as well, if macroeconomic headwinds continue and the economy contracts.

Conclusion

I think EBTC is a good example of a conservatively managed, shareholder aligned regional bank trading at a large potential discount to intrinsic value. The discount is not without reason though, as there are recessionary fears on the horizon, bank run fears, as well as potential risk of contagion from a collapsing commercial real estate market. The latter two risks could lead to total loss of capital, and I am interested to see how this could unfold. I did buy a small position prior to completing my analysis, though I may sell my shares if macroeconomic conditions worsen. If commercial real estate implodes and regional banks along with it, the big winner here could be large banks which will again get to buy assets for pennies on the dollar. Shrewd investors may be interested in finding regional banks with a smaller proportion of commercial real estate loans.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EBTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.