Yext Earnings: Achieving Growth, Strong Cash Flows, And Improved Profitability

Summary

- Yext delivers better-than-expected outlook, leading to a 12% premarket share jump.

- Despite management changes and workforce reductions, Yext grows revenues and exhibits strong cash flows.

- Yext helps businesses optimize their online brand information for accurate and consistent data across digital platforms.

- Yext's positive revenue growth rates and improved profitability make it a potentially rewarding investment, despite not being all that cheap.

- Deep Value Returns members get exclusive access to our real-world portfolio. See all our investments here »

Galeanu Mihai

Investment Thesis

Yext (NYSE:YEXT) delivered an ever-so-slightly better-than-expected outlook for fiscal 2024, and its shares jumped by 12% premarket.

The key takeaway from Yext is that after the tumultuous year it had and management changes, plus reductions to its workforce, the business still grew its revenues. And its cash flows? Those truly shone through in the quarter.

The negative consideration in this name is that the stock is not cheap at approximately 37x this year's non-GAAP EPS.

On yet the other hand, I believe that YEXT stock is priced at 25x next year's free cash flows. What's more, the business is debt free, with close to 15% of its market cap made up of cash.

But there's more to this story, so let's get to it.

Why Yext? Why Now?

Yext helps businesses optimize the information about their online brand. Seeking to allow businesses to deliver accurate and consistent information across search engines and other digital assets.

Businesses use Yext as a tool to provide accurate and up-to-date information to their customers, such as store hours and contact details, amongst other important details.

Yext aspires to give companies the tools they need to manage their own facts and offer a cutting-edge search experience on their websites.

Moving on, if you've read my work before you'll have seen me declare that the most insightful aspect as to the health of a business is the customer adoption curve.

In the reported quarter, the customer count increased by 5% y/y. This was less than half of the customer count seen in the same period a year ago, where customer count increased by 11% y/y.

That being said, even now, Yext's customer count is going up. Given all the transitions in management in the past year, I suppose that any growth in customers is a positive highlight. This allowed Yext's CEO Michael Walrath to state on the earnings call,

We've hit the ground running in fiscal 2024 and in the first quarter we continued to build awareness for the power of Yext Answers platform and its ability to deliver and generate trusted answers across the full spectrum of digital experiences.

Clearly, customers must trust Yext, otherwise customer growth wouldn't still be going higher.

With that in mind, let's now turn to its financials.

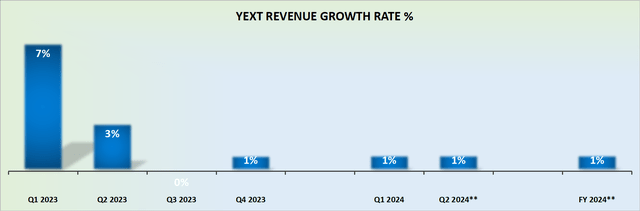

Revenue Growth Rates Remain Positive

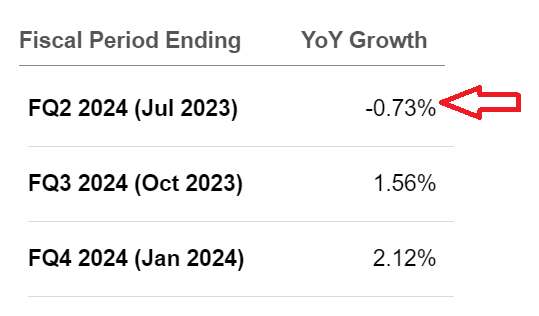

Yext is a very slowly growing company. And therein lies the key operative word, growing. Because prior to yesterday's results, Yext was assumed to guide for fiscal Q2 2024 for either no growth or worse, slightly negative y/y growth rates. See below.

SA Premium

As it stands right now, this means that fiscal Q2 2024 will be growing, and that's slightly better than analysts expected, where the consensus revenue growth rate was at negative 1%.

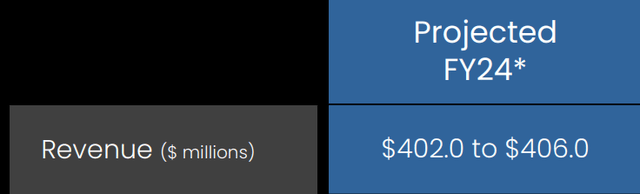

Similarly, consider the outlook for fiscal 2024 prior to yesterday's results.

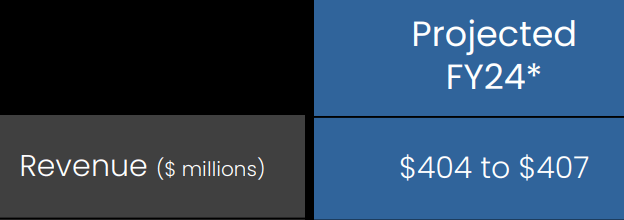

In the best case, at the high end, the business was expected to report $406 million in revenues. But right now, the high end was been marginally upwards revised.

YEXT Q2 2024

Naturally, raising the high end by $1 million out of $400 million is largely immaterial. But it does reinforce that there are some small improvements in the right direction.

What's more, keep in mind that Yext just started its fiscal year. There are still several more quarters to go. And Yext wouldn't want to be too aggressive with raising its outlook and then have no further good news to report later on in the fiscal year.

Next, we'll turn to discuss, what I believe is the bull case for Yext.

Making Strong and Improving Cash Flows

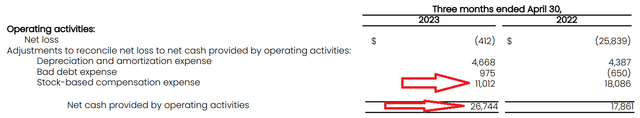

Yext's underlying profitability profile meaningfully improved. The business is now extremely close to being GAAP breakeven. A feat that few software companies of late seem to accomplish.

Furthermore, observe two further characteristics below.

Yext was able to reduce its stock-based compensation y/y. And at the same time, its cash flows from operations jumped significantly y/y.

Yext's free cash flows (not shown above), improved from approximately $15 million in last year's quarter to $25 million this time around.

The counterargument here is that Yext is priced at around 37x this year's EPS. That's not cheap. Particularly given that the business is barely growing on the top line.

On yet the other hand, this is a business that is debt free. What's more, Yext holds no debt and approximately 15% of its market cap is made up of cash.

And this strong cash position allowed Yext to buy back a small sliver of its shares. I won't go so far as to proclaim that buying back less than $5 million worth of shares in a quarter for a business with a market cap of $1.4 billion (including the premarket jump) is meaningful. Rather it's "yet another reason", why the business is likely to be a rewarding investment.

According to my estimates, if Yext continues on the path it's on right now, it's very likely to report about $55 million of free cash flow in fiscal 2025. This would put the stock priced at about 25x forward free cash flows. Which again, is not a bargain basement valuation, given its anemic topline growth.

The Bottom Line

Yext's shares saw a 12% premarket jump after delivering a slightly better-than-expected outlook for fiscal 2024.

Despite management changes and reductions in the workforce, Yext managed to grow its revenues and showcase strong cash flows.

While customer growth slowed compared to the previous year, any growth is seen as positive given the recent transitions in management.

Yext's revenue growth rates remain positive, and the company's underlying profitability has significantly improved. Although the stock is not cheap, Yext is debt-free and holds a significant amount of cash, which has allowed for share buybacks.

Yext is expected to generate approximately $55 million in free cash flow in fiscal 2025, making it a potentially rewarding investment.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.