CLOU: Climbing The Clouds Before A Reality Check

Summary

- Cloud stocks have underperformed the NASDAQ year-to-date due to the rise of the AI-everywhere theme, and market participants exhibit exuberance, disregarding valuations.

- The market is fueled by speculation rather than fundamentals, with most cloud names trading at expensive valuations and offering little margin of safety.

- With the 10-year US Treasury Bond yield close to 4% and an inverted yield curve, it is doubtful that this marks the beginning of a new bull market.

Just_Super

Investment Thesis

Cloud stocks have lagged behind the Nasdaq this year due to the rapid ascent of AI stocks, captivating Wall Street's attention. However, many cloud names are still up double digits since the start of the year despite the heightened volatility. We are now revisiting previous highs, before what I believe will be further declines. Skepticism looms in the market over whether this marks the beginning of a new bull market, or if more challenges lie ahead. As the market witnesses exuberance and speculators chase AI winners, I'm particularly concerned about valuations reaching extreme levels in tech names and negative risk-premia.

About CLOU

The Global X Cloud Computing ETF (NASDAQ:CLOU) is an exchange-traded fund that provides investors with exposure to the rapidly growing cloud computing industry. CLOU seeks to track the performance of the Indxx Global Cloud Computing Index, which includes companies involved in various aspects of cloud computing, such as infrastructure providers, software developers, platform providers, and other related services. By investing in a diversified portfolio of global cloud computing companies, CLOU aims to capitalize on the increasing adoption of cloud-based technologies across industries. This approach allows investors to gain exposure to the entire cloud computing value chain, from infrastructure to software solutions.

CLOU's constituents include both established cloud computing leaders and emerging companies that are driving innovation in the industry. The portfolio is regularly rebalanced to maintain optimal exposure to the evolving cloud computing landscape. This provides investors with a convenient way to access a diversified basket of cloud computing stocks, rather than selecting individual companies.

For further details on CLOU, please check the fund's prospectus.

Charting a Path Amidst Volatility

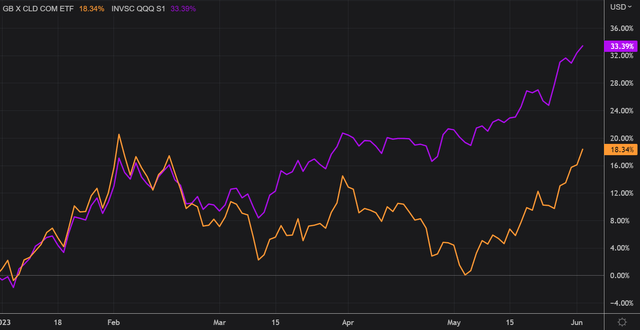

Cloud stocks have underperformed the NASDAQ this year due to the rise of the AI-everywhere theme, the new darling of Wall Street. While both CLOU and the Nasdaq 100 have seen impressive year-to-date returns of 18% and 33% respectively, it's crucial to acknowledge the volatility experienced by CLOU. Just 30 days ago, the fund was flat for the year after reaching a peak in February. This raises the question of whether we are now revisiting previous highs, before another drop.

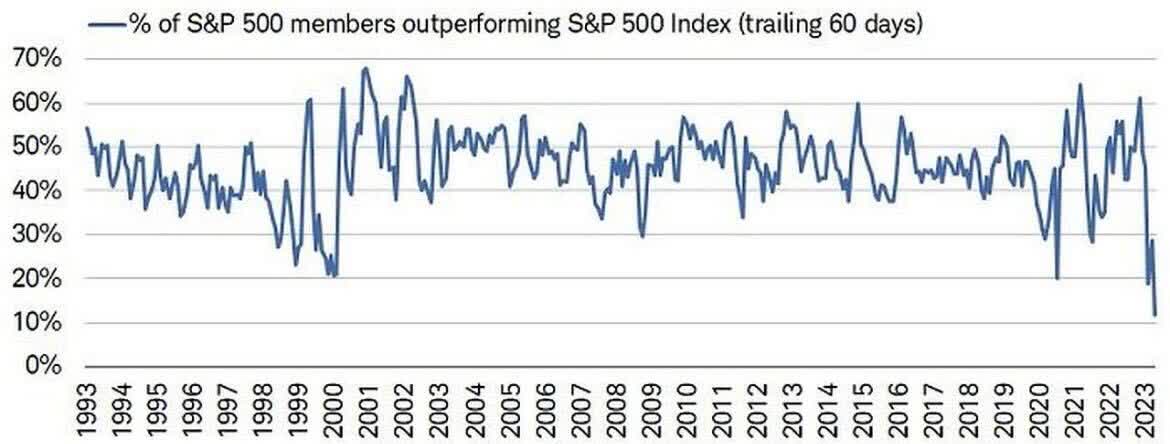

While some believe this marks the start of a new bull market, I remain skeptical about whether the bottom is truly behind us. Market participants continue to exhibit exuberance, which is not typical of an environment characterized by significant capitulation. Although this bear market rally has been one of the longest in history, breadth has been poor recently, with only a handful of tech names leading the charge while small and mid-cap stocks have struggled.

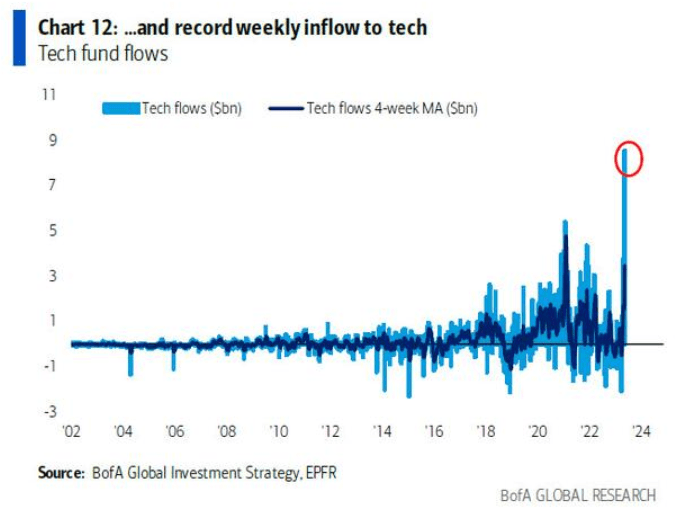

Disruptor

Similar to the typical behavior of bear markets that drain capital from investors until the very end, there has been a consistent flow of investments into tech stocks throughout 2022. Notably, we observed a substantial increase in investment activity last week. It appears that investors and speculators who arrived late to the party are now fervently pursuing the AI winners, disregarding valuations entirely.

Bank of America

We haven't witnessed such behavior from market participants for some time, probably since the dot com bubble. While there are several parallels, this new generation of investors is willing to pay any price for these popular names, just like in previous bubbles. In other words, this market is fueled by speculation rather than fundamentals. I believe this phenomenon has also affected tech stocks with different products/services from core AI, like cloud companies. This is best reflected in the expensive valuations at which most of the Cloud names are trading at the moment. I've counted less than five names in CLOU trading at less than 20x earnings, while an overwhelming number of stocks are trading at 30-40x earnings, for those that even have earnings.

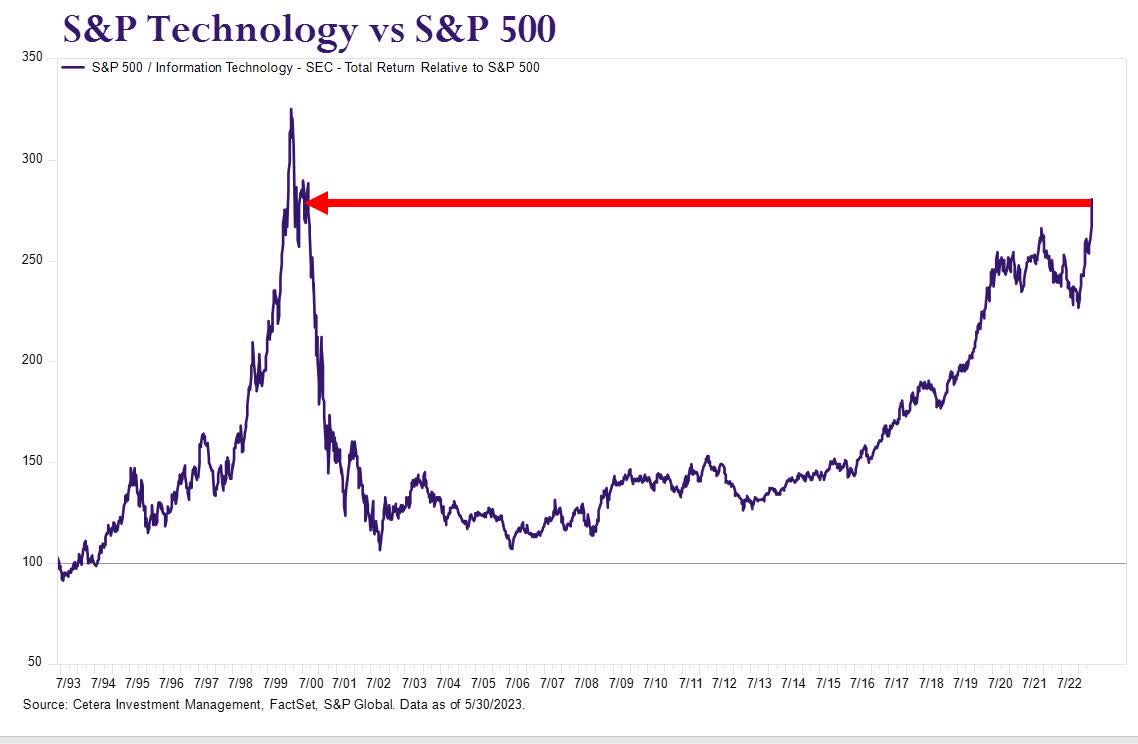

The chart from Cetera captures the divergence between tech names and the rest of the market pretty well in my opinion. From the looks of it, it appears that we haven't truly experienced a bear market since late 2021. The 2022 episode appears more like a correction on the path to a larger bubble that is on the verge of bursting.

Cetera Investment Management

Needless to say that if this trend reverses (as it always did in the past), investors will be left with little to hang on to. High valuations in CLOU offer little margin of safety, and with the 10-year US Treasury Bond yield close to 4% and an inverted yield curve, I remain doubtful that this marks the beginning of a new bull market.

Key Takeaways

While the Nasdaq has soared to new heights, cloud stocks have faced challenges in keeping pace so far, despite a remarkable 18% YTD for CLOU. The recent volatility experienced by CLOU serves as a stark reminder of the inherent uncertainties facing this market today.

The exuberance and speculative frenzy surrounding AI stocks raise valid concerns about valuations and the sustainability of this trend. The echoes of past bubbles, such as the dot-com era, resonate strongly in my opinion. The expensive valuations of many cloud stocks further compound the risks at hand. As we navigate the uncertain terrain ahead, a prudent approach is to be hedged ahead of another drop.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not investment advice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.