Petrobras: The Dividend Bonanza Continues

Summary

- Petrobras, Brazil's largest oil company, trades at a low valuation and offers a high dividend yield despite political and macro risks.

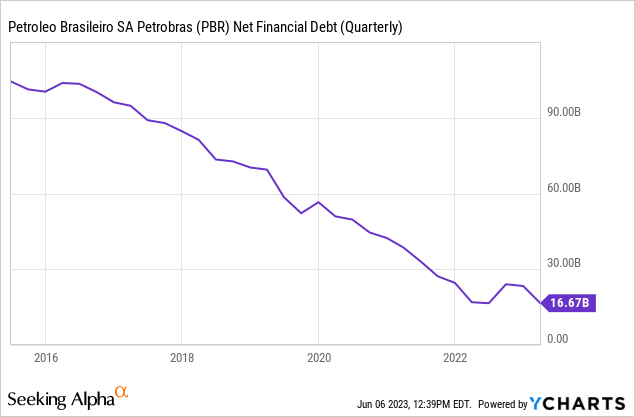

- The company remains highly profitable, generating significant cash flows even with lower oil prices, and has reduced its debt levels in recent years.

- Despite political risks, high dividends are beneficial for both Brazil's government and outside investors, making Petrobras stock a potentially rewarding energy investment.

- Looking for more investing ideas like this one? Get them exclusively at Cash Flow Club. Learn More »

Alexandre Schneider/Getty Images News

Article Thesis

Petrobras, or, more precisely, Petróleo Brasileiro S.A. (NYSE:PBR) (NYSE:PBR.A) is the largest oil company in Brazil. The company trades at an ultra-cheap valuation and offers a gigantic dividend yield. While there are macro and political risks that shouldn't be ignored, they seem to be accounted for at the current valuation.

Petrobras: An Unloved Company

Brazil is a major oil-producing country, with its huge offshore deposits in the Atlantic playing a major role. While several companies are active in the vast country, Petrobras, which is partially owned by the state, is the leading producer.

Petrobras produced 2.68 million barrels of oil equivalent per day during the most recent quarter when we include natural gas liquids and natural gas. That was up 1% on a sequential basis, which can be attributed to the ongoing ramp-up of a new production facility in the Itapu field. Around 80% of Petrobras' production comes from the so-called pre-salt layer of Brazil's coast. Petrobras is partnered with some other oil companies there, which is why its operated production is higher than its net production, at 3.7 million barrels per day. Petrobras has become a leader in offshore oil production technology and expertise over the years, which explains why Petrobras can produce from offshore fields at attractive costs.

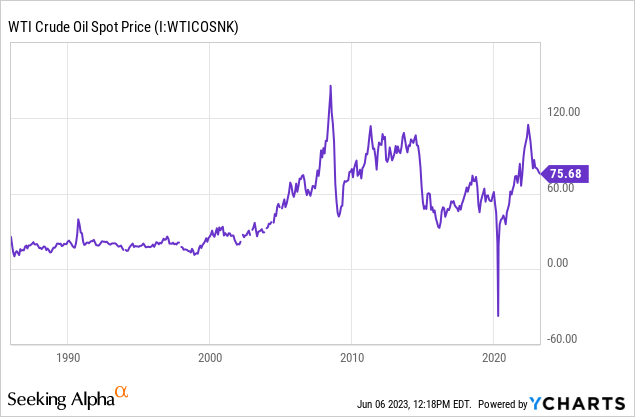

Petrobras does refine some of the crude oil it produces, with an average production volume of around 1.65 million barrels of oil per day during the first quarter -- equal to around 60% of its total oil equivalent production over the same three months. Basically all of the refined products that Petrobras produces are sold on the domestic market. Due to political pressures, Petrobras sells its refined products at prices that do not reflect the international market price at times, which can be seen as a subsidy for Brazilian consumers. The refining business is thus not overly profitable. Luckily, that does not matter too much, as Petrobras' upstream/production business is very profitable. That was especially true during 2022 when oil prices hit multi-year highs, but even at current oil prices, Petrobras is generating hefty profits. During the first quarter, Petrobras generated EBITDA of $14.3 billion, or $57 billion annualized. That was the fourth-highest quarterly total in the company's history, despite the fact that the average oil price was far from the fourth-highest (on a quarterly basis) in history:

In the above chart, we can see that oil prices had been considerably higher than they were during Q1 for entire years, e.g. in the early 2010s. And yet, profits during the most recent quarter easily beat the profits Petrobras generated back then. This can be explained by higher production levels due to investments in its offshore business, while technological progress that made exploration more efficient (and cheaper) also played a role.

Net profits totaled $7.3 billion during the first quarter, while free cash flows totaled $7.9 billion, which pencils out to $29 billion and $32 billion on an annualized basis, respectively. Considering Petrobras is valued at just $77 billion right now, that's a hefty profit and cash flow pace. At current prices, Petrobras is valued at just 2.7x net profits and at an even lower 2.4x free cash flows, looking at the pace seen during the first quarter -- when oil prices weren't especially high, on average.

Valuations in the entire energy industry are rather low, but valuations this low are very rare. There thus must be reasons for Petrobras to trade at such an ultra-cheap valuation, and there are, indeed, reasons for that. The market primarily is worried about Brazilian macro risks and political risks. Last year, the current president Luiz Lula da Silva, who had been Brazil's president from 2003-2011 as well, won the election. Lula da Silva is heading a left-wing government, which has caused fears about what the government might do to Petrobras. Petrobras is partially owned by Brazil, thus politicians have a significant impact on the company, its pricing strategy, its exploration strategy, and so on. While these political risks shouldn't be neglected, I believe that the market might be too fearful. At least so far, the new government hasn't made any major moves against Petrobras. The company still earns hefty sums of money, and Brazil's government's interests are actually aligned with those of outside investors, at least to some degree: Petrobras has made hefty dividend payments in the recent past, and that has been great for both outside investors and for Brazil's government. When Petrobras makes large dividend payments, that helps Brazil's government in paying for infrastructure programs, social programs, and so on, after all. Billions of dollars have been flowing toward Brazil's government via dividend payments from Petrobras, and I doubt that it is in the government's interest to stop that money flow.

Of course, there's some risk that the government socializes Petrobras and decides to take all of the profit in the future, but I believe this is not particularly likely. Venezuela and its state-owned PDVSA are a good example of what that might do to the country and its oil company -- other governments in the region likely don't want to experience the same. While politicians will likely continue to argue for fuel subsidies for Brazilian consumers (via low refining and distribution margins, which holds true today as well), I do not believe that the high upstream profits are at risk. And since the government benefits from high dividend payouts, it would not be very surprising if those continue as long as profits remain high. Right now, Petrobras' strategy is to pay out up to 60% of free cash flow via dividends, with the remainder being used for debt reduction. Debt levels have fallen considerably in recent years due to this policy, which is good for investors as it boosts profits (via lower interest costs) while reducing risks, and as debt reduction shifts value from debt holders to equity holders over time, all else equal. We see Petrobras' debt reduction progress in the following chart:

Reducing debt levels further would not be a bad thing, but incremental returns eventually decline, as a company with low debt levels doesn't have to pay high interest rates anyway, and as balance sheet/financial risks already seem pretty low, with a net debt to EBITDA leverage ratio of way below 1.0.

The company has thus recently stated that it might make changes to its dividend policy, as reported here on Seeking Alpha. While we don't know yet what that will look like, but higher dividend payments or buybacks are among the possibilities. It's also possible that Petrobras will increase investments in its assets, which would result in lower free cash flows (in the near term), all else equal. This could, in turn, result in lower near-term dividends. But on the other hand, higher investments would likely result in more production growth down the road and could thus boost future profits and thus also future dividends. Even if increased investments were to be announced, that hardly seems like a disaster for investors.

PBR And PBR.A: Very High Yields

Petrobras has two types of shares trading on the market, PBR and PBR.A. Both receive the same dividends. PBR.A trades at a discount of around 10% relative to PBR, however, resulting in a higher dividend yield and an even lower valuation, relative to PBR. I believe this makes PBR.A the favorable choice for retail investors that likely don't mind the voting power anyways.

Petrobras has declared dividends of $1.91 so far this year, which results in a dividend yield of 15.5% for PBR and 17.2% for PBR.A. This could, however, be a low estimate, as Petrobras could declare additional dividends during the remainder of the year. In 2022, Petrobras has declared dividends of $6.45 per share in four installments, according to Seeking Alpha's data. That would have resulted in a dividend payout in the 50% range for someone owning shares at around $12. Dividends are uneven here, and oil prices have pulled back from the levels seen last year. I thus do not expect a total annual payout comparable to what we saw last year for the current year. Nevertheless, I believe there is a high likelihood that investors will receive at least some additional dividends later this year. Even a $0.30 total payout per share for the second half of the current year, which would be incredibly low relative to the $1.91 H1 payout, would make PBR.A's dividend yield climb to 20% for the current year. If H2 dividends are anywhere close to what we saw in H1, the yield would be in the 30% range. I personally would not bet on that (although I wouldn't deem it especially unlikely, either), but it seems pretty clear to me that Petrobras is a company offering hefty income at the current valuation.

Takeaway

Petrobras remains highly profitable and generates massive cash flows even with oil trading well below the highs seen last year. While there are political risks that shouldn't be ignored, it does not seem overly likely to me that Brazil's leadership will destroy or socialize the company. High dividends are beneficial for Brazil's government due to the country's ownership position in Petrobras, and high dividends are also favorable for outside investors.

Even under conservative assumptions, the 2023 dividend yield on PBR.A is easily in the high teens range, and could be as high as 30%, depending on dividend declarations for the second half.

For those that can stomach the political risks, Petrobras could be a potentially very rewarding energy investment.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

This article was written by

If you want to reach out, you can send a direct message here on Seeking Alpha, or an email to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Club.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PBR.A either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.