Is JBS S.A. A Buy On Industry Weakness?

Summary

- JBSAY is the largest food company by revenue in the world, and has recently been sold off due to industry headwinds severely reducing recent profitability.

- Despite the discounted stock price, conservative investors may want to avoid JBSAY as it is trading near our estimates of fair value and is speculatively financed.

- High leverage and Brazilian mandated dividends on profitability may make JBSAY an interesting short term trade, if impending industry tailwinds later become apparent.

Kira Kutscher/iStock via Getty Images

Overview

Meat processing is not necessarily the best industry to invest in, considering the high capital requirements and limited pricing power due to the commodity like nature of the products. As beef margins have been getting crushed after historic pandemic highs, many investors have been bottom fishing on the world's second largest meat processor, Tyson Foods (TSN). I wanted to look more closely at the frequently ignored largest player in the sector, Brazilian JBS S.A. (OTCQX:JBSAY), and see if recent pullbacks provide a good buying opportunity. I believe JBSAY is trading at near fair value at time of writing, though risk averse investors may want to avoid the stock given the high debt load paired with such a volatile industry.

JBSAY's Speculative Financing

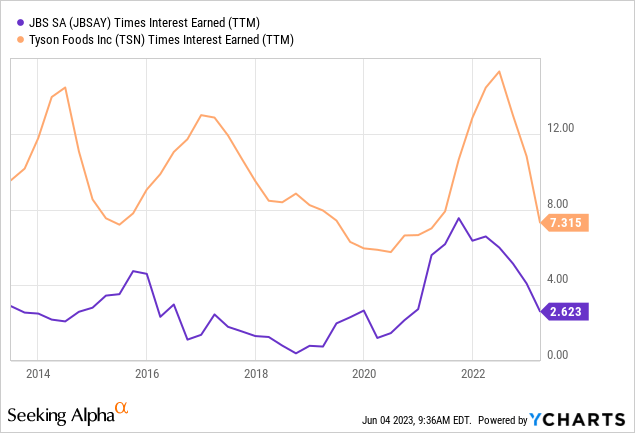

When comparing JBSAY to TSN, the two actually have similar enterprise values but JBSAY is financed largely with debt. This can be visualized below:

Inherently, this makes JBS a riskier investment as the interest coverage ratio is much lower compared to Tyson. This also makes the stock more volatile, as leverage has a pronounced effect on cash flow generation in both bad times and good. Investors may not like purchasing shares in such a volatile business with high leverage.

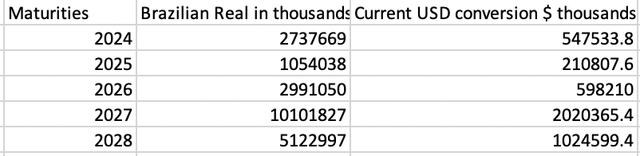

JBS also appears to have drawn down their large US revolver as in the MRQ there was only $2.8 million in revolving credit available compared to $2.8 billion in 2022. They do have $450 million of availability left on their Brazilian revolver as of the MRQ. Tyson, on the other hand, has an undrawn revolver in addition to reasonably termed out debt. Although JBSAY has a high total debt load, the maturities in the near to mid-term appear to be manageable and reasonably spread out, and are as follows:

Company Data

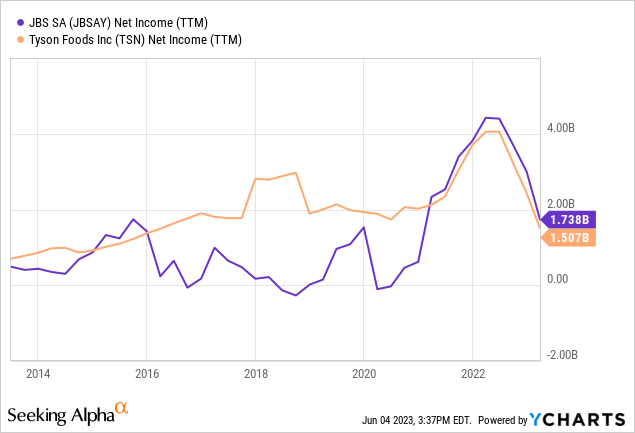

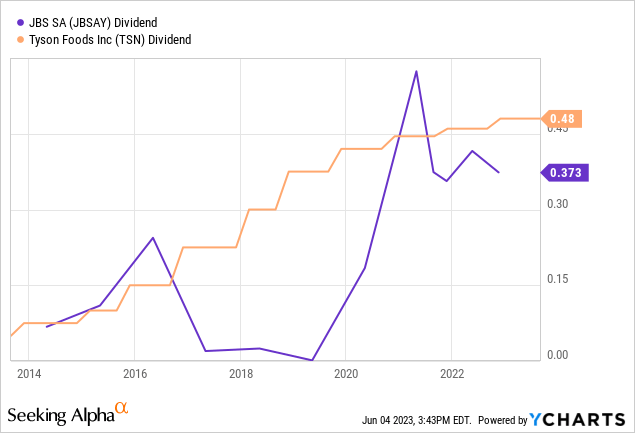

Profitability and Returns to Shareholders

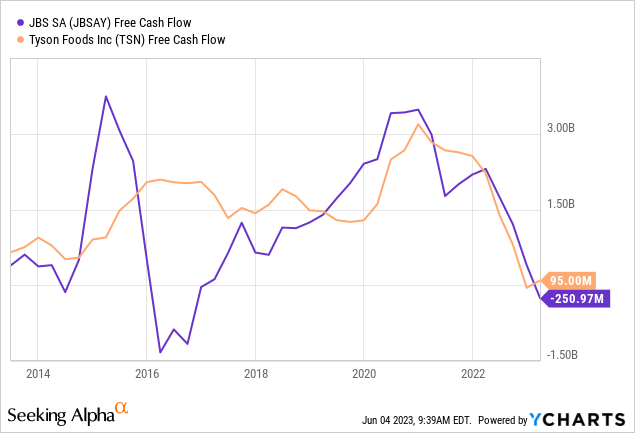

Over the last 10 years, there has been a moderate amount of revenue growth for both JBSAY and TSN, but this has generally not translated to substantial increases in shareholder returns. What more recently increased earnings was the historic beef margins created by meat packing plant shutdowns, something completely out of the companies' control. As beef margins have more recently normalized, so have earnings and free cash flow generation, which are demonstrated below:

Likely because of the more conservative financing, Tyson has more consistent profitability and positive cash flow generation. This is probably why the company appears to trade at such a premium to JBS. Additionally, by Brazilian law JBSAY is required to pay 25% of net income in dividends, whereas TSN maintains a consistent dividend with a greater surplus during good times. This could also account for some of the differences in long-term stock price appreciation.

Near Term Tailwinds for JBSAY?

During the MRQ earnings call, JBSAY management has stated that recent results do not reflect the earnings power of the company in general, and there are a number of industry tailwinds that will buoy them moving forward for the year. Though seemingly upbeat about the near-term future, the company does not give guidance, and also gave no indication that they were anticipating a dividend this year as they had done in previous years. As mentioned before, Brazilian law requires JBSAY to pay 25% of net profit in dividends, so a lack of dividend would indicate a breakeven or negative FY 2023.

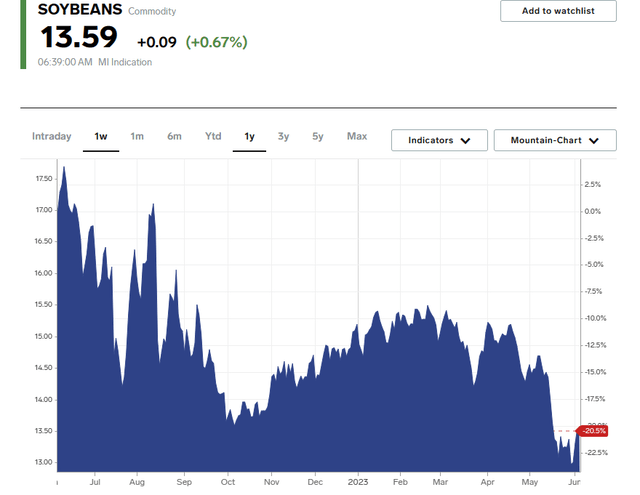

So what exactly could be a boon to investors moving forward? First, a recent reduction in feed prices could have a favorable impact on margins. This is demonstrated below:

Business Insider

Business Insider

Additionally, a reduction in container costs could have a favorable impact on sales to Asian markets. Indeed, container prices hit historical highs due to the COVID-19 pandemic, and more reasonable levels have been restored recently.

Freightos Baltic Index (FBX): Global Container Freight Index (Freightos Data)

Summer months also have a higher historic demand for meat in the US markets due to the grilling season. This normal demand could be somewhat reduced if macroeconomic headwinds continue, and consumers keep switching from beef to pork and chicken.

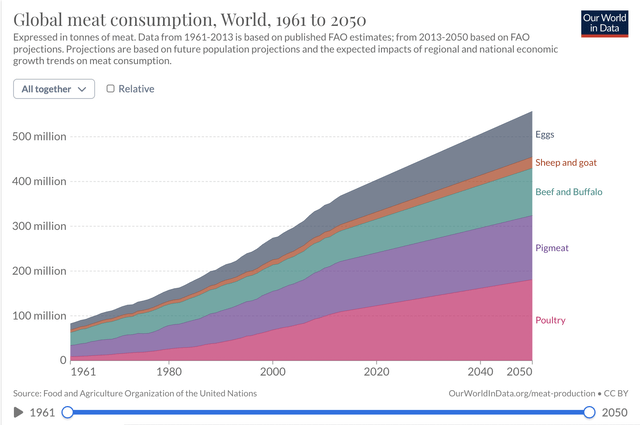

Lastly, it's worth mentioning that global meat consumption is expected to increase in the long run. This could be a tailwind, but it is yet to be seen if this will result in increased profitability for the meat packing industry.

Our World In Data

Valuation

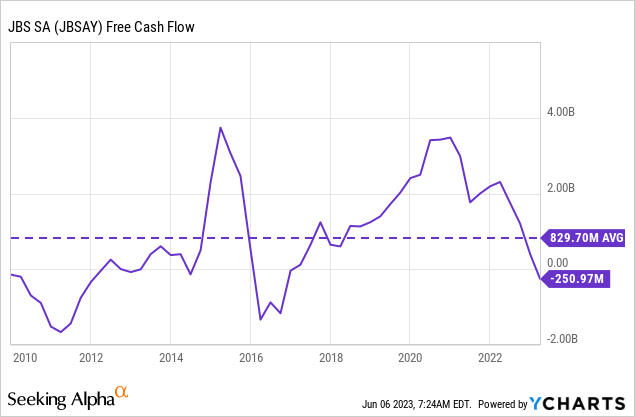

Since the company has demonstrated minimal sustainable growth in cash flow and has such volatile earnings, I believe taking a long-term average is a good approach to valuation. Average free cash flow generation for JBSAY is displayed below:

Additionally, JBSAY spends heavily on growth, so actual "owner's earnings" is likely underestimated with reported free cash flow. In FY 2022 and 2021, approximately 55% of capex was reported as growth capex. In 2022, this makes growth capex spending equivalent to $1.2 billion. Though cash flow to investors is limited by debt, it adds to investor confidence that debt is not being taken on just to maintain the status quo with maintenance capex. If we assume the positives from high growth capex and the negatives from a high debt load offset each other, we can just use the reported average to see the company is trading at a price/average free cash flow of around 9.

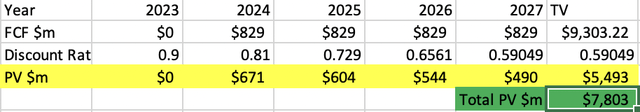

In order to estimate present value, I assumed 2023 would be a breakeven year and 2024-2027 would earn $829 million on average. Since historically the company has not grown free cash flow substantially, I used a 1% terminal growth rate. I used a 10% discount rate which is higher than the company's cost of debt to be conservative and this is likely the minimum return equity holders would demand. This gives us a PV of $7.8 billion, indicating the company is currently trading near fair value.

This Writer, Estimates

Risks

ESG Pressure

A few countries have been culling cattle herds in order to meet climate change targets. Any reduction in cattle supply may increase input prices for JBSAY, without necessarily increasing prices consumers are willing to pay for beef. This trend will likely get worse as time goes on, as more countries are failing to meet their climate targets.

Looming Recession

As mentioned before, companies like Costco (COST) are reporting consumers are switching from beef to more cost-effective options like chicken and pork. This trend could continue and effect beef margins further if it continues.

Historic Margins

Beef margins were at historic highs because of the coronavirus pandemic, and we may not ever see high margins like that again. This could skew our average cash flow estimates higher than reality.

Foreign Exchange Risks

The Brazilian Real has historically performed poorly against the USD, so any further weakness could have a material effect on earnings for US investors. This could be slightly offset, by the international nature of the company and by Brazil pushing for use of the Real in international trade.

High Debt Load

The meat packing business is volatile, with supply and demand inputs and outputs unable to be controlled by JBSAY. Low interest coverage, limited US revolver capacity combined with earnings volatility make it difficult to consider JBSAY investment grade.

The Bottom Line

JBSAY trades near our estimates of fair value at time of writing, so conservative investors may want to avoid the name given the low interest coverage and volatile earnings. It also is much more speculatively financed and volatile than its closest industry peer, TSN. If I knew there were an impending catalyst that would result in industry margin expansion, JBSAY would be a logical choice to harvest the proportional dividend hikes. The stock also will likely rise more quickly with tailwinds, as heavily indebted companies experience more volatile earnings. This could be possible in the near to midterm, with the aforementioned reduction in shipping and feed costs buoying profitability. This may be offset though, by macroeconomic headwinds and increased consumer price sensitivity. For now, JBSAY does not appear to provide fantastic risk/reward potential, though I did purchase a small position prior to completing my analysis.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JBSAY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.