SkyWest: Short-Term Headwinds, Time To Take Profits

Summary

- SkyWest's stock price has appreciated over 54% since my article in April due to strong quarterly results and rising air travel demand.

- The airline faces near-term headwinds such as deferred revenue recognition and staffing issues, but has favorable long-term prospects.

- Investors should consider selling at least half of their position in SkyWest to lock in gains, while monitoring the situation closely for future adjustments.

aapsky

Back in April, I wrote an article where I made a case for SkyWest (NASDAQ:SKYW) as an outstanding value stock with significant growth prospects. SkyWest, the largest regional airline operator in the U.S., had a strong competitive advantage, a resilient business model, a solid balance sheet, and a favorable industry outlook. I identified that SkyWest was trading at an unreasonably low price-to-earnings, price-to-book ratio, and a high free cash flow yield.

Since then, SkyWest’s stock price has appreciated over 54%, reaching a 52-week high and continuing to find new highs. This impressive performance was driven by strong quarterly results and announcements, as well as rising air travel demand.

In this article, I will update you on what has happened and how it impacts my thesis and strategy for SkyWest. I will also explain why it may be time to take some profits off the table and lock in your gains.

Positive Q1 Results

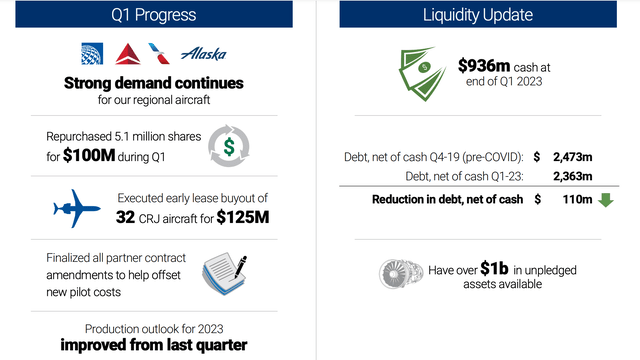

According to its Q1 2023 results, Cash and equivalents rose 9.27% Y/Y. This news, alongside a significant reduction in debt, contract amendments, and significantly improved production outlook, has made for quite the headline. SkyWest also successfully executed an early lease buyout in a remarkable $125 Million deal. Management was extremely productive in acquiring and executing the buyout, a very positive sign for shareholders.

SkyWest Investor Presentation Q1 2023

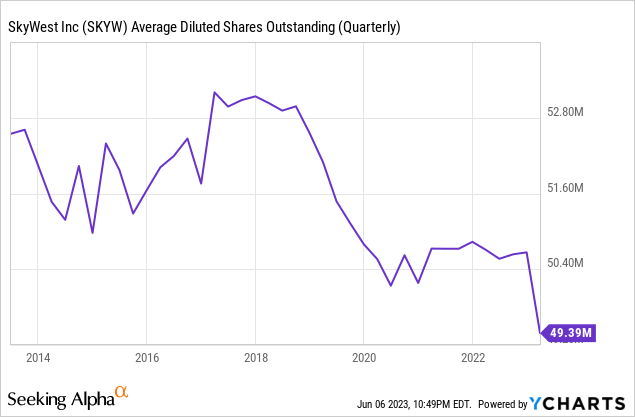

The other headlining news is a 100 Million dollar buyback. Buying back nearly 4% of shares outstanding, a trend that is likely to continue.

Author, Y Charts

I also believe management's share repurchases were responsible, given that the company purchased shares well before they appreciated significantly, and they would have bought well below the book value per share of the company being roughly $45 per share.

SkyWest Benefitted from Rising Air Travel Demand

The second major news that came out after my article was that SkyWest benefited from rising air travel demand in the first quarter of 2023.

Zacks reported, "SkyWest carried 9.4% more passengers in 2022 than the year-ago level. As a result, passenger load factor (percentage of seats filled by passengers) expanded 8.8 percentage points to 83.4% in 2022. With air-travel demand continuing to improve, load factor was above 80% in first-quarter 2023."

They went on to assert an expected load factor of around 83.1% in the second quarter of 2023. The company expects to receive 4 E175 aircraft by Q4 2023. I believe travel demand will continue to improve based on current trends in consumer demand. This bodes well for SkyWest, and the industry in general.

Unexpected Headwinds In The Near Term

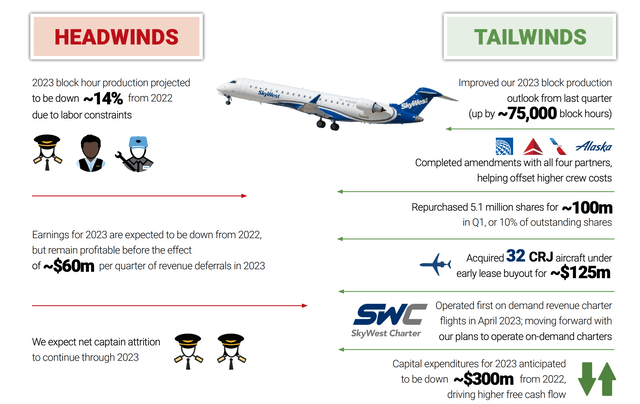

The third and not-so-positive major update that came out after my article was that SkyWest deferred recognizing $63 million in revenue. The revenue was associated with cash payments received during Q1 2023 under its flying contracts, which means that it will recognize this revenue in future quarters. This may negatively impact stock performance in 2023 and early 2024. An expected headwind was a significant staffing issue that remains present within the company and industry. The company expects captain attrition to worsen, which is also in line with competitors' headwinds.

SkyWest Investor Presentation Q1 2023

The news is not all bad, though. The tailwinds are incredibly favorable for long-term performance. The company is acquiring aircraft, initiating an on-demand charter program, and reducing capital expenditures very efficiently. Of course, the near-term headwinds and long-term tailwinds are cause for an adjustment of our investing outlook.

How to Adjust Your Strategy for SkyWest

So what does all this mean for your strategy for SkyWest? Well, it depends on how you view SkyWest’s future prospects, and how much risk you are willing to take. When I provide an update on an investment, I like to remind investors of a simple truth that is easily forgotten. Ultimately, your investment strategy should depend on your personal risk tolerance, time horizon, and other factors. I think it would be irresponsible to provide a narrow investment strategy that may not reflect investors' circumstances. Thus I will explain potential reasons to maintain a position for the long term or to sell for guaranteed short-term profits.

If you are bullish on SkyWest and think that it still has room to grow and that it can overcome any potential headwinds, such as rising fuel costs, labor shortages, or competitive pressures, then you can hold your position though I do not advise one add more shares. However, you should be aware that this strategy involves more risk than before, as SkyWest’s stock price has already appreciated significantly and may face some volatility or correction in the short term associated with the aforementioned headwinds it faces this year and the next. I don't advise this for the faint of heart or for someone looking to retire next month.

Alternatively, there is an approach for less confident investors in SkyWest holdings. Acknowledging that SkyWest will face many challenges in the near term, such as lower margins, volatile capital expenditures, or untenable staffing issues, then you should consider, at the very least, reducing your position. However, you should be aware that this may leave some gains on the table, as SkyWest’s stock price may still rise further if it continues to deliver solid results and buyback shares.

I can provide all of this information, and I will provide my opinion. In the end, however, As an investor, it is up to you to decide what is best for your strategy. I can say with certainty I will be monitoring the situation closely and adjusting my stance accordingly as new information comes out.

The Takeaway

As for me, I am of the opinion that most investors should sell at present levels. This opinion in no way reflects my views on the company, which I believe to be a very strong regional airline. Sometimes short-term investment returns outweigh one's optimistic view of a company. I also do not believe that one could not make even more than the profit that could be realized at present. However, I think with the short-term headwinds at hand and such an incredible profit in such a short period of time, it may be wise to at least reduce one's position and lock in an incredible return. I think that SkyWest may still have room to grow, but it may be time to take some profits off the table and lock in my gains. I think that SkyWest has done a great job of navigating the pandemic and positioning itself for recovery, but I also think that it faces some headwinds and uncertainties in the future. I also think that SkyWest’s stock price has already reflected most of its positive news and expectations and may not have much upside left.

Therefore, for most investors, I would recommend selling at least half of one's position in SkyWest at present values, netting an over 54% return since I wrote my article in April. Whether you decide to Keep some of your position as a long-term investment, in my opinion, should depend on if you have confidence in SkyWest’s resilient business model, solid balance sheet, and investor-friendly management. Most importantly, I strongly advise anyone who decides to continue holding shares to monitor the situation closely and adjust the position accordingly as new information becomes available.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.