XMPT: A Municipal Bond ETF That Invests In CEFs

Summary

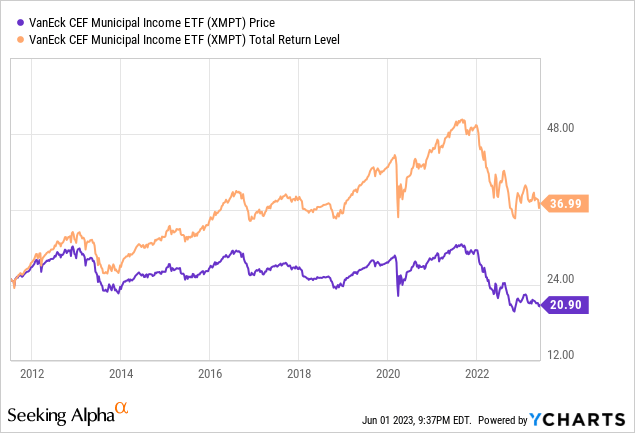

- The VanEck CEF Municipal Income ETF invests based on the S-Network Municipal Bond Closed-End Fund Index.

- Both the ETF and its index are reviewed in detail. I also compare XMPT against both a set of municipal bond ETFs and CEFs.

- The added risk of investing in CEFs is shown when comparing XMPT against three other municipal bond "true" ETFs.

- Based on risk/return ratios, the true ETFs are better choices. For those with short investment horizons for the funds being considered, considering taxable CDs could be your best low-risk investment option.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

zimmytws

(This article was co-produced with Hoya Capital Real Estate)

Introduction

With the US House of Representatives under the control of the GOP, President Biden and Senate Democrats might not get their wish to raise taxes on the "rich", which seems to mean anyone (single or couple not clear to me) making over $400,000 annually. There is also a push is some Blue states to expand the definition of what counts as income. Either enactment would increase the tax-free attractiveness of municipal bond funds.

For investors not wanting to have leverage included in that strategy, while some CEF forego leverage for now, ETFs cannot, but there is a way around that. This article reviews the VanEck CEF Municipal Income ETF (BATS:XMPT), which owns CEF's, some of which use leverage. Like most investments, what each investor's appetite for risk and return will determine if XMPT fits into their portfolio.

VanEck CEF Muni Income ETF review

Seeking Alpha defines this ETF as:

The VanEck CEF Muni Income ETF invests in closed-end funds which invest in tax-exempt municipal bonds issued by states or local governments or agencies. The fund seeks to track the performance of the S-Network Municipal Bond Closed-End Fund Index. XMPT started in 2011.

Source: seekingalpha.com XMPT

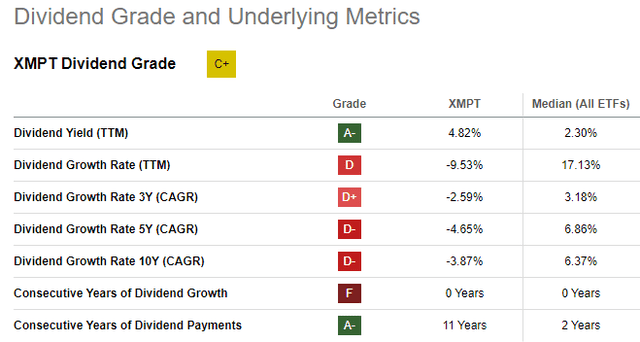

XMPT has $197m in AUM and shows a TTM Yield of 4.82%. Due to owning CEFs, which come with high fees that XMPT have to pay, the overall fee here is 181bps. That will rise in October when the offering cost waiver ends.

Index review

The index provider describes their index as:

The S-Network Municipal Bond Closed-End Fund Index (TICKER:CEFMX) is a mutual fund index designed to serve as a benchmark for closed-end funds listed in the US that are principally engaged in asset management processes designed to produce federally tax-exempt annual yield. The CEFMX employs a modified total net assets weighting methodology designed to assure accurate investment exposure across the various business segments that together comprise the federally tax-exempt annual yield sector of the closed-end fund market. The CEFMX is divided into four main closed-end fund sectors:

a) Leveraged Municipal Fixed Income Closed-End Funds;

b) Unleveraged Municipal Fixed Income Closed-End Funds;

c) Leveraged High Yield Municipal Fixed Income Closed-End Funds;

d) Unleveraged High Yield Municipal Fixed Income Closed-End Funds.

Source: vettafi.com

The also provided a link to the full index methodology PDF.

Holdings review

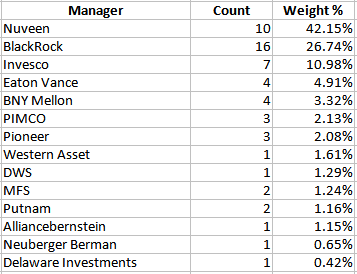

The 56 held CEFs are spread across various managers, listed in portfolio weight order.

vaneck.com; compiled by Author

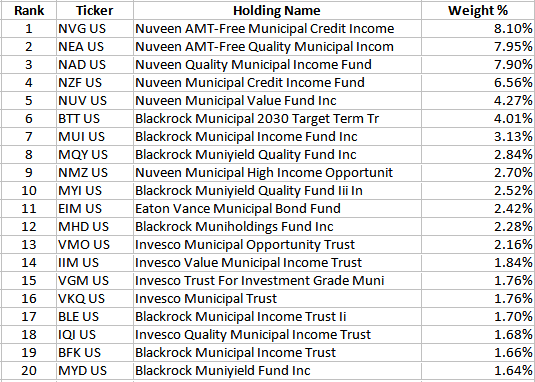

With one exception, Nuveen, BlackRock, and Invesco CEFs comprise the Top 20 CEFs, which account for 68% of the portfolio.

vaneck.com; compiled by Author

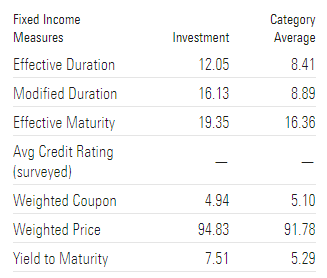

The smallest 20 positions account for only 11% of the portfolio weight. Most of these CEFs have reviews on Seeking Alpha by me or other contributors. I found this data which summarizes the combined holdings of all the CEFs held.

Morningstar.com

Distribution review

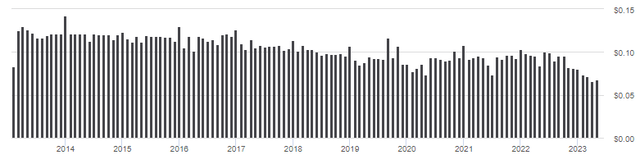

The general direction in payout is downward almost from XMPT's starting date; not a good indicator for income-growth investors. I assume of the strength of the yield and not missing any payouts, Seeking Alpha give XMPT an overall grade of "C+".

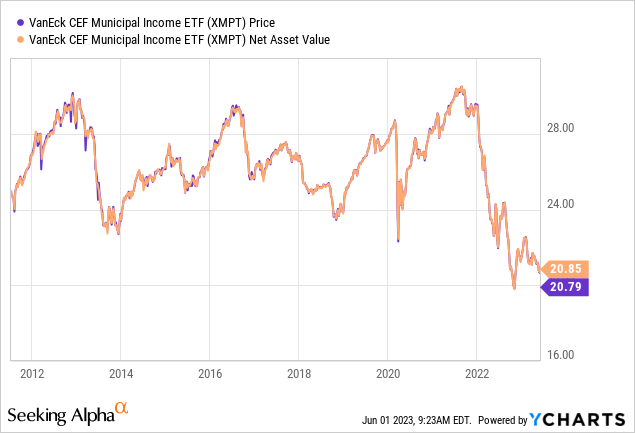

Price versus NAV

So while the underlying CEFs will trade at a premium or discount over time, those differences are apparently reflected in XMPT's price thus its price and NAV show little difference. The average discount of the Top 4 holdings is 14%, which is one of the factors used to weight positions.

Comparing XMPT against true muni-bond ETFs

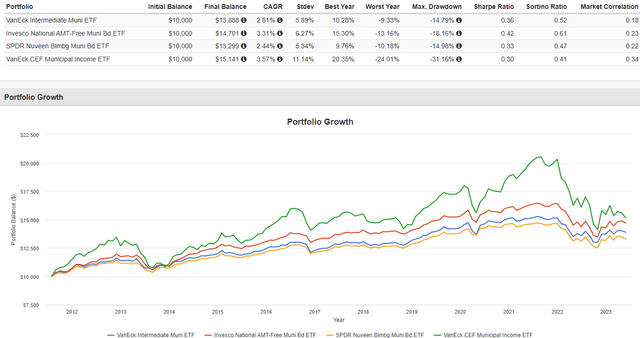

Here I picked three ETFs that invest in municipal bonds that pre-date XMPT:

- VanEck Intermediate Muni ETF (ITM)

- Invesco National AMT-Free Municipal Bond ETF (PZA)

- SPDR® Nuveen Bloomberg Barclays Municipal Bond ETF (TFI)

So while XMPT had the best CAGR, its higher risk results in the lowest Sharpe and Sortino ratios. PZA has the best risk/return results.

Portfolio strategy

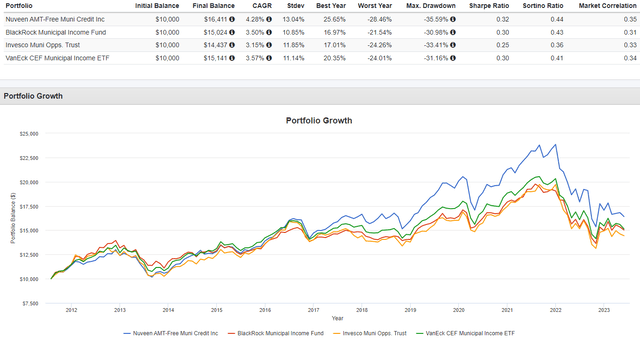

The main reason to own a ETF like XMPT is spreading your holdings over a wide range of managers. The potential downside, especially when the CEFs are index-based, you get the bad with the good. To see how that might be with XMPT, I picked the largest holding that pre-dates XMPT from the three primary managers. Those CEFs are:

- Nuveen AMT-Free Municipal Credit Income Fund (NVG)

- BlackRock Municipal Income Fund (MUI)

- Invesco Municipal Opportunity Trust (VMO)

These three CEFs account for 14.4% of the portfolio and, while a small sample, show the difficulty of picking the better CEFs than holding the wide set held by the XMPT ETF.

A big advantage of directly owning the CEFs is the ability to concentrate one's allocation to both the better performers but also the ones where their discount might be deeper than its historical level.

Final thoughts

Any of the other ETFs make for better choices for investors wanting no leverage exposure. For those with short investment horizons for the funds being considered, considering taxable CDs could be your best low-risk investment option. For investors who want someone picking and weighting their CEF exposure to the municipal bond market, XMPT meets that goal.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.