BIL: Provides Stability In The Ocean Of Volatility

Summary

- BIL gives exposure to U.S. short-term treasury bills and could lend stability in the high volatility and uncertainty of the market.

- I believe that the fund is a good match in order to hedge duration risk and earn attractive return.

- The inflection point in the Fed’s monetary policy appears not far off, and I expect at least 4% yield from BIL’s portfolio over the next 12 months.

Douglas Rissing/iStock via Getty Images

The peak in the interest rate is apparently not far off, but peace hasn’t yet come to the market. Given the high volatility and uncertainty, it’s reasonable to look for an investment instrument that provides a hedge to the interest rate risk, and a stable return. I find SPDR Bloomberg 1-3 Month T-Bill ETF (NYSEARCA:BIL) a good match for these investment goals, as the fund provides access to U.S. T-bills, which are considered one of the safest assets. BIL’s monthly dividend distributions to shareholders increased significantly due to the high interest rates, and I believe the holders could reasonably expect a 4% yield for the fund to earn over the next 12 months.

Fund description

The SPDR Bloomberg 1-3 Month T-Bill ETF exposes its investors to U.S. Treasury bills with maturities ranging from one to three months. BIL tracks the Bloomberg 1-3 Month U.S. Treasury Bill Index, which includes all publicly issued T-bills that have the respective maturities and are rated investment-grade. The fund’s portfolio consists of 18 holdings and aggregates the largest AUM of $29.2 billion amid the ultra-short U.S. government bond ETFs. BIL is characterized by fairly high liquidity and a duration of just 0.15 years.

Like most U.S. ETFs, the fund makes dividend distribution to shareholders consistently on a monthly basis, where the current TTM yield equates to 3.14%.

Dividend history (Seeking Alpha)

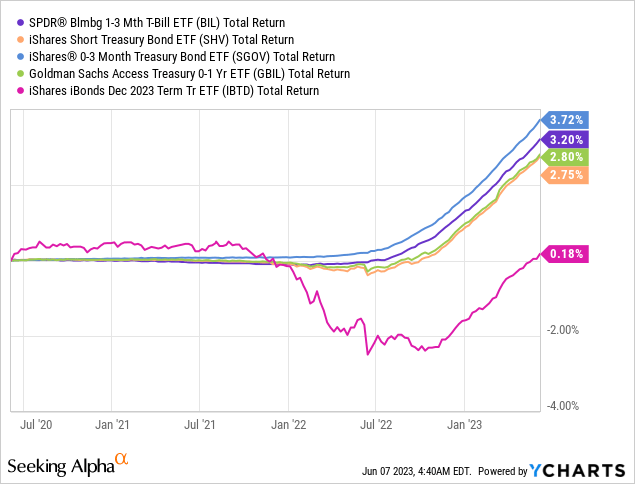

On the above chart we can observe a dip in dividends since the beginning of 2020, which is due to the zeroing of T-bills rates during the period until May 2022. Moreover, the funds return during this period turned slightly negative, which may seem surprising as interest rates were positive even during the post-pandemic recovery of the economy. The point is that the management fee of 0.135%, despite being relatively low, turned out to have quite a significant reflection on performance.

However, since the end of the zero rate environment, BIL achieved a 3.2% return, keeping up with the competitors. Moreover, it appears quite solid against the backdrop of the global debt market being in a dense red zone. It is worth noting that the yield of securities in the fund’s portfolio grew significantly, which brought BIL’s yield up to 4.76%.

Going forward, the performance of the fund is related to the level of U.S. T-bills yields. Specifically, the higher the discount of the treasuries being acquired to the portfolio, the more the funds NAV will increase and the higher dividend pay-out the shareholders will receive. As noted above, the beginning of the sharp and rapid increase in the federal funds rate changed the picture for BIL dramatically. And it’s not just that the yield of securities currently included in the portfolio is above 4%, the point is behind the low duration, which allows the fund to remain resilient to rate movements. This is important as in the context of tightening of monetary policy, interest rate risk has become a real pain for debt investors.

In the meantime, the failure of several banks in a row due to the ongoing tightening of monetary policy could initiate more serious challenges in the economy. The reaction of the U.S. financial regulators gives some hopes that the systemic financial crisis will be avoided so far. And despite the market expectations of the Fed to lean towards softer policy, it’s clear that the risks of financial stability loss limit the potential for a further increase in interest rates.

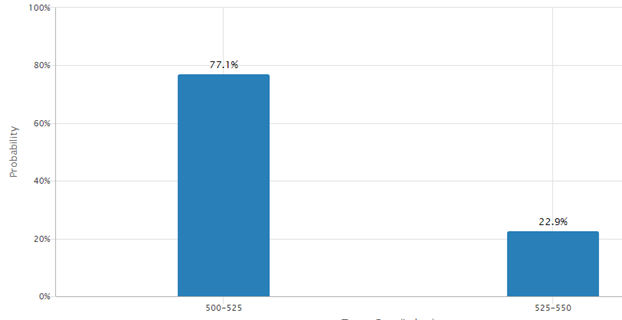

Target rate probabilities (CME Group)

And as we can see from the above chart, the futures market indicates a 77% portability of interest rates to remain flat and a 23% probability for the Fed to come up with a further increase. However, I believe that at least for the next 12 months it is reasonable to expect that BIL could generate a >4% yield.

Risk factors

Although the fund provides access to T-bills, which are considered a safe haven, the chance of US technical default (although hypothetical) could lead to a significant volatility in the market of the subject asset class.

Conclusion

The Fed’s interest rate hike period seems to be around the corner, but market volatility is still high. In the search for protection against duration risk, investors would probably turn their attention to the most reliable instruments, or ultra-short duration bonds and money market funds. Access to the U.S. T-bills is conveniently offered by BIL ETF, and I found the fund’s shares a reasonable tool to hold on to for at least 12 months ahead. The fund is managed by the giant SSGA and provides an attractive yield and superior salvation from duration risk.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.