MSCI Inc.: Valuation Is Now More Attractive

Summary

- MSCI is a high-growth compounder with market-leading services in index data and ESG information.

- The company's strong performance, unique databases, and potential for AI integration make it an attractive long-term investment, especially with its valuation below its five-year average.

- MSCI's competitive advantage in the ESG space and the growing difficulty of portfolio management support its positive outlook.

islander11

Overview

I've said it before, and I'll say it again: MSCI Inc. (NYSE:MSCI) is a proven high-growth compounder that provides market-leading services in two fast-growing industries: index data and ESG information. When it comes to equity indices and benchmarking on a global scale, this firm is unrivaled. The firm is also the leading provider of ESG research, data, and analytics as well as ESG & Climate indices. I would stress again the importance of proper position sizing for MCI given its current external environment, which includes persistent falls in asset-based fees and potential headwinds in the ESG business. Specifically in the areas of ESG (due to more regulation) and real estate, I believe MSCI is seeing tightening client budgets and lengthening sales cycles. And on a more macro level, I would not be surprised to see a continuation of the AUM decline in the coming quarters as investors become more risk averse and withdraw their capital from the markets. Also, I think that political uncertainty in the United States and regulatory uncertainty in the European Union might continue to be drags on MSCI's ESG business. Nonetheless, I think the best way to evaluate MSCI is to take the long view (remember, this is a business expanding at a rate of 10% annually, with expanding EBITDA margins in the region of high 50%) and appreciate the value of its unique databases. As a result, I intend to take advantage of the recent drop in share price by increasing my holdings, while keeping my options open in case the price drops even further.

Forward outlook

MSIC performance continues to be strong on an absolute basis with its subscription run rate revenue growing a healthy 12% y/y in 1Q23 despite the uncertain macro environment. I'd like to also draw attention to the fact that Climate's organic subscription run-rate grew strongly by 68%. I believe these are indicative of the enduring nature of MSCI's revenue streams and the secular tailwinds stemming from the growing difficulty of portfolio management. However, keep in mind that this is still a company with EBITDA margins of 60%, so there is substantial room for margin contraction. Hence, in the near-term, I expect management to be conservative on their spendings and take risk only when the odds are in favour. I would monitor for management comments for scaling back expenses such as reduce pace of hiring and SBC, in order to protect margins. In contrast, I do not anticipate management to reduce spending on areas that have the potential to drive long-term value, such as opportunities in ESG & Climate, which I have a long-term positive outlook. Due to the ever-changing and often contradictory nature of ESG regulations, I have a very optimistic long-term outlook on ESG and climate change. Despite the fact that many companies and clients are interested in conforming to ESG regulations, few have a clear idea of how to do so. MSCI can help in this situation. Given the inevitable rise in popularity of ESG factors, stricter rules seem inevitable in the future. Working with regulators around the world, MSCI should continue to benefit from this trend. Aside relationships with regulators, I would also note that MSCI has a substantial competitive advantage in the ESG space - database. MSCI has amassed a database of thousands of companies, making it, in my opinion, very difficult to duplicate.

AI impact

Generative AI has been a hot topic these days as ChatGPT become the "database" for many enquiries. MSCI, in my opinion, has a competitive advantage that improves with AI, in contrast to many businesses that could be disrupted by generative AI. MSCI's primary competitive advantage is its extremely difficult-to-replicate proprietary databases. MSCI's "weakness" can only come from inaccuracies in the data that result from human oversight. But I think MSCI will strengthen its moat by adopting AI because it will eliminate all human risk associated with it. Further, MSCI could use AI to create new products by generating fresh insights and analytics with the help of AI and machine learning.

Valuation

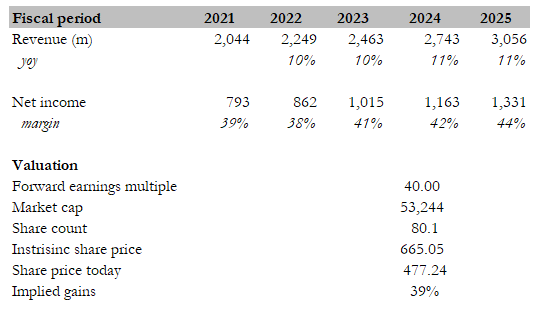

I believe the upside has become more appealing as valuation has fallen below its five-year average of 40x forward earnings. Previously, it was at 42x earnings as such I recommended to size the position properly to take advantage of situation like this. With the stock currently trading at 35 times forward earnings, we now have the added benefit of valuation re-rating back to average, on top of earnings growth. Some investors may be concerned about the high absolute multiple, but peers such as Fair Isaac Corp. (FICO), Moody's (MCO), and Verisk Analytics (VRSK) all trade in the 30+ forward earnings range. They can trade at this level due to their strong moat and high margin profile (MSCI and these peers have EBITDA margins ranging from 40% to 70%).

Author's model

Risks

While I am positive about the long-term outlook for the ESG business, if there are too many regulations forced into the market within a short period of time, it might impact growth as clients would need a longer time to evaluate their best course of action. The same applies to MSCI as they need more time to digest new regulations before they can prepare the team to advise clients.

Conclusion

MSCI presents an attractive investment opportunity considering its unique position in the market and the potential for future growth. Despite challenges in the external environment, such as falling asset-based fees and potential headwinds in the ESG business, MSCI leading services in index data and ESG information, coupled with its expanding EBITDA margins and long-term growth prospects, make it an attractive business to own. The enduring nature of MSCI's revenue streams and the secular tailwinds in portfolio management further support its positive outlook. With the recent drop in share price and a valuation below its five-year average, the upside potential for MSCI has become even more attractive.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.