SolarEdge: Compelling Investment Opportunity With Fair Outlook

Summary

- SolarEdge Technologies, Inc. has a fair outlook for Q2 2023, with de-risked investor expectations.

- Revenue growth rates are moderating, but the company's prospects remain promising.

- SolarEdge's profitability profile is stable, with strong non-GAAP gross margins, but high capital expenditure. The company holds a significant net cash balance.

- In sum, SolarEdge is a cheaply valued solar power optimization solution provider, with a clean balance sheet.

- Deep Value Returns members get exclusive access to our real-world portfolio. See all our investments here »

ArtistGNDphotography/E+ via Getty Images

Investment Thesis

SolarEdge Technologies, Inc. (NASDAQ:SEDG) has guided for Q2 2023 and the outlook is fair.

Indeed, as we headed into the Q1 earnings results, four weeks ago, I concluded my analysis by declaring:

In the past week, SolarEdge Technologies, Inc. stock has already come down more than 10%. Meaning, that investor expectations have already to a substantial extent been de-risked.

Furthermore, compared with First Solar (FSLR), SolarEdge's stock hasn't gone anywhere fast in the past couple of years. Meaning that investors' hope and expectations are not too high towards SolarEdge.

It's within this context that I now continue. That investors are not overly bullish towards SolarEdge and that investors' expectations are somewhat muted. And that SolarEdge has the constructive fundamentals to deliver investors a compelling investment opportunity.

Why SolarEdge? Why Now?

SolarEdge specializes in the manufacturing of solar power optimization and monitoring solutions. SolarEdge's products include power optimizers and monitoring platforms that maximize the energy output of solar systems. At its core, its products seek to optimize inverter solutions for photovoltaic (''PV'') systems (solar panels).

In addition to inverters and power optimizers, SolarEdge has expanded its product offerings to include energy storage systems, as it strives to provide a comprehensive smart energy platform.

SolarEdge continues to gain substantial traction in Europe, but the focus is on how to get a significant market share in the U.S., on the back of IRA credits. Here's a quote from the recent earnings call that highlights this,

Our operational plan includes adding manufacturing sites in the U.S to increase capacity and benefit from the manufacturing credits of the IRA where we are on track to have U.S manufactured products in the third quarter of this year.

Meaning that right now, the investment case is one of being patient, while SolarEdge grows its U.S. manufacturing capacity.

Allow me to put it another way, even though Europe is what management highlights as the bull case, I argue that in the long run, winning the U.S. market will be where the real upside will be made.

Revenue Growth Rates Are Moderating, But What's Next?

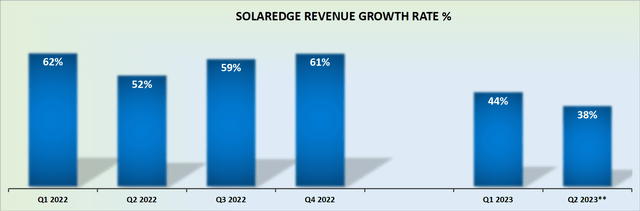

SolarEdge's guidance for Q2 2023 points to approximately 38% y/y growth rates at the high end. This would be a significant moderation from its rate of growth in the same period a year ago.

That being said, keep in mind that in 2022, there was an energy crisis, and this provided SolarEdge with strong tailwinds. Comparing against 2022 was always going to be challenging. Consequently, even if SolarEdge's revenue growth rates are moderating, I don't believe that's where this story ends.

Indeed, in my previous analysis, I said:

I believe that [when] SolarEdge guides for Q2 2023, investors will see a company that has gone from growing at around just under 60% CAGR in 2022, to probably growing at around 35%-38% CAGR in Q2 2023.

And that appears to be exactly what happened. Therefore, this is my contention, SolarEdge can continue to deliver revenue growth rates in line with analysts' expectations, and investors can still be rewarded, given that its valuation is far from stretched.

Next, let's analyze some positive and negative elements of SolarEdge's profitability.

Profitability Profile, A Nuanced Appraisal

SolarEdge's guidance for Q2 2023 points to around 34% non-GAAP gross margins at the midpoint. This is very much in line with the same period a year ago.

Consequently, I believe that looking out over the next twelve months, I believe it's possible that SolarEdge's non-GAAP operating profits could reach close to $900 million of non-GAAP operating profits. This puts the stock priced at approximately 17x forward non-GAAP operating profits.

The bad news for investors is that SolarEdge is quite capex intensive. I believe that over the next twelve months, SolarEdge is likely to deploy around $250 million towards capex.

Consequently, I estimate that SolarEdge is likely to make around $650 million of free cash flow. Meaning that SEDG stock is priced around 25x forward free cash flows.

SEDG Q1 2023

The good news is that SolarEdge holds approximately $1 billion of net cash. So, it can continue investing for growth, without being restricted by its balance sheet.

The Bottom Line

While SolarEdge Technologies, Inc. has gained traction in Europe, the focus is on capturing a significant market share in the U.S. through manufacturing credits (''IRA'').

Although revenue growth rates are moderating, compared to the exceptional growth in 2022 during an energy crisis, the company's growth prospects remain promising.

SolarEdge's profitability profile shows non-GAAP gross margins in line with the previous year. I estimate that SolarEdge will report around $900 million in non-GAAP operating profits over the next twelve months. However, SolarEdge's capital expenditure is high, which I estimate to reach about $250 million over the next twelve months, resulting in approximately $650 million of forward free cash flow.

On the positive side, the company holds a net cash balance of approximately $1 billion, allowing it to continue investing in growth.

Overall, SolarEdge Technologies, Inc. is seen as a cheaply valued solar power optimization provider with a strong balance sheet.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.