Simon Property Group: Fundamentals And Price Don't Align

Summary

- Market Data shows top tier malls are thriving in the years coming out of the Covid Pandemic.

- Simon continues to adapt and invest in growth by investing in undervalued retailers, executing accretive redevelopments, and taking steps to enter the Asset Management business.

- Simon is severely undervalued by almost every observable metric including FFO Multiple, Dividend Yield, and Net Asset Value.

Editor's note: Seeking Alpha is proud to welcome Pearl Investments as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Sam Diephuis/DigitalVision via Getty Images

Value investing put simply is buying more than you're paying for. I believe one of the best opportunities to do just that in the market today is presented via Simon Property Group (NYSE:SPG). Based on my analysis, it is becoming clearer and clearer to me that the fundamentals of the company and the price simply do not align and therefore today is an excellent opportunity to acquire more than what you're paying for.

There are two factors that support this idea:

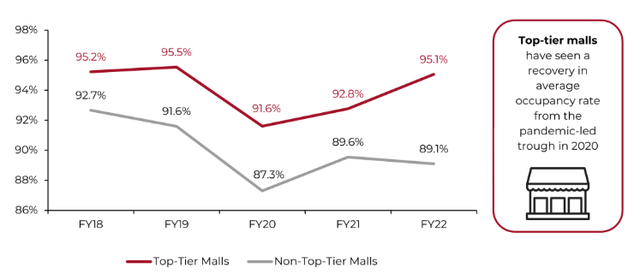

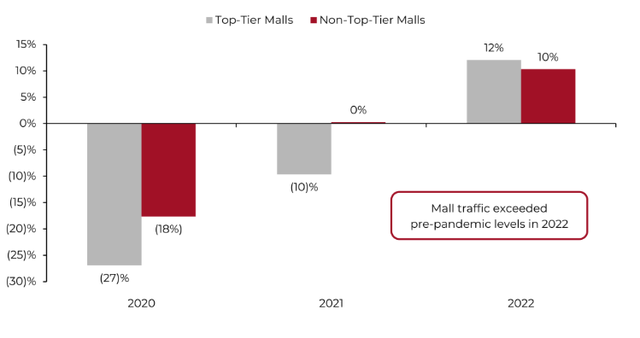

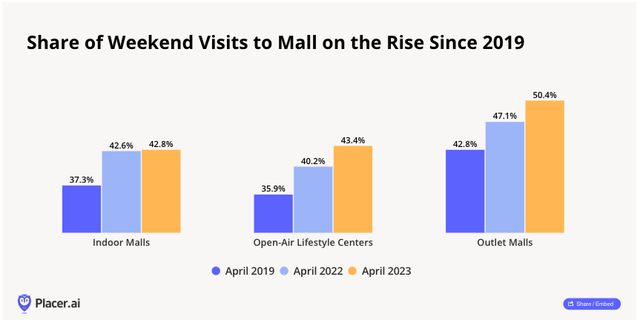

1. Class A malls are alive and well: Market Data shows that traffic at top tier malls is thriving since the Covid pandemic.

2. Simon is more than just a mall portfolio: Simon is actively investing in growth.

Class A Malls are alive and well

“What are you an idiot?! Malls are a dying breed! No one wants to shop in person anymore, all retailers are turning to e-commerce!”

This is true - for some malls. The oversaturated Class B, C, and D malls are dying left and right, leaving less competition for Class A malls to attract high quality retailers.

Class A malls are deemed Class A because they are located in major populous cities, attract the highest quality tenants, and in turn boast the highest Sales per Square Foot ($500+)! Yes, retailers are moving to an expanded online presence, but studies are showing that their retail business is optimized by combining that online presence with brick and mortar stores. And guess where they want those stores to be… around people and other stores! It’s a never ending cycle of demand for Class A mall space. And the numbers are confirming that with every meaningful metric growing since the 2020 Covid plunge and some even surpassing Pre-Pandemic levels.

YoY Occupancy of Malls

YoY Mall Foot Traffic

YoY Weekend Mall Visits

Simon is more than just a mall portfolio

Throughout the years, the retail landscape has continuously changed based on consumer behavior and trends. Simon has been exceptional at adapting to those trends in order to stay relevant and powerful within the industry. During Covid, Simon recognized that retailers with some juice left in the tank were going bankrupt due to the shutdowns and they prudently bought them out of bankruptcy for pennies on the dollar including Brooks Brothers in partnership with Authentic Brands via their joint venture known as Sparc, and J.C. Penney in partnership with Brookfield Properties. Not only did this ensure that these retailers would remain operating tenants in their malls but now they would be able to participate in the upside sales of these businesses when they bounced back. Despite blowback from the markets who interpreted this as a desperate move to keep their tenants paying rent, the investments have paid off with more room to grow. CEO David Simon noted a 60% return on their OPI investments in his Q3-2022 opening remarks.

Furthermore, when Simon notices that one of their malls is underperforming or is no longer in an optimal position to attract consumers, they utilize their strong balance sheet and credit ratings to adapt the malls to consumer preferences… whether it’s more experiential tenants such as upscale restaurants and spas, or better use of the space such as apartment units, luxury hotel rooms, and Life Time Fitness centers.

As noted in the latest earnings call, Simon is planning to build over 2,000 multifamily units along with luxury hotel rooms throughout planned redevelopments that will be executed over the next 3-5 years.

The Phipps Plaza redevelopment in Atlanta has been an excellent case study. Not only will the redevelopment be an accretive investment of capital but the hotel units have also increased the Phipps mall foot traffic and sales.

Then you have the Jamestown Partnership

In Q4 2022, Simon acquired a 50% stake in Jamestown, a global Mixed-Use development and management company based in Atlanta. Jamestown boasts a strong track record in mixed-use redevelopments and a prestigious Asset Management business. These capabilities and platform will offer significant synergies with Simon's ongoing projects and will allow Simon to expand into the lucrative CRE Asset Management business dominated by the likes of Blackstone and Brookfield.

All this to say, Simon continues to explore and execute on strategies for growth.

And the Q1 2023 numbers back it up. Every meaningful metric demonstrated YoY growth including occupancy, base rent, Sales PSF, portfolio NOI, FFO, and their dividend.

Valuation

Given these factors, the market is vastly undervaluing Simon's cash flow (FFO), dividend, and assets.

FFO Multiple

FY 2023 FFO per share Guidance: ~11.88

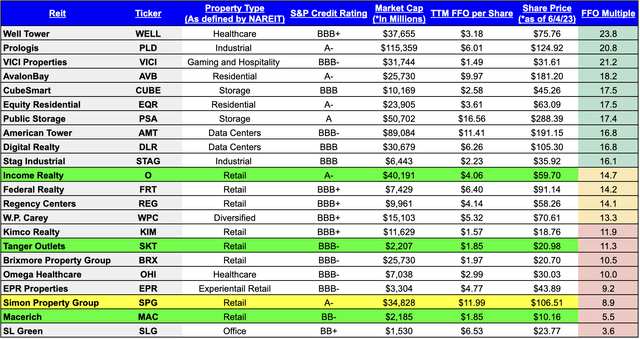

With a current share price of ~$106, Simon's FFO multiple is under 9x... That is an extremely low multiple for a company that boasts a long and successful track record of navigating choppy economic cycles and demonstrating a strong and stable growth story. To give you some perspective, the highest quality REITs trade at a Price to FFO ratio in the 20-25x range. Even some lower quality REITs trade in the range of 10-12.5x their FFO.

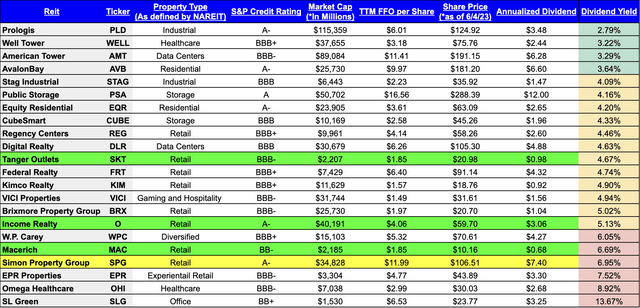

Below is a randomly selected sample of REITs. As you can see, Simon sits near the bottom of the list in terms of FFO multiple.

A 12.5x multiple should be considered low for a REIT of Simon's caliber. That kind of multiple would correspond to a price per share of around $150... once you get into the 15x range which is probably more appropriate for Simon you get to a price per share of around $180. Reaching that level would equate to price appreciation of 45-70% on a stock paying over a 7% dividend yield.

Speaking of Dividend yield...

Dividend Yield

Simon is currently trading at a ~7% dividend yield with a T12 YoY dividend growth of 12% and payout ratio of ~60%. Yes, they decreased their dividend during a once in a hundred year pandemic in which they were forced to close their stores, and yes interest rates are higher with treasuries offering yields in the range of 3.5-4%, but Simon has demonstrated a history of consistently growing their dividend and there is a clear path for them to get back to the pre-pandemic $8.40 per share which would yield around 8% at its current price per share at still only a 70% payout ratio.

Given its low payout ratio, its track record of growth, and strong overall fundamentals, Simon should trade closer to a dividend yield of 5-5.5% which would correspond to a share price of ~$150 today. Should the dividend hit the pre-pandemic annual payout of $8.40, we'd be around a $170 price per share.

Peers

Simon Property Group doesn't have any true peers in terms of market cap, portfolio allocation, strategy, and fundamentals. Two obvious candidates would be Macerich (MAC) and Brookfield Asset Management (BAM). However, Macerich has been plagued with declining earnings and high debt levels and though Brookfield owns malls, it is a diversified investment manager with a different overall strategy. I would argue a more appropriate peer could be a very well known REIT of similar size, reputation, and exposure to retail, Realty Income (O). Of course, Realty income has a very different business model and portfolio composition. That being said, Realty Income floats around a dividend yield of 5.2%. Though Realty Income perhaps has demonstrated superior dividend stability, their payout ratio is higher than Simon's at ~75%.

Another peer to be considered could be Tanger Outlets (SKT). Though much smaller in market cap, Tanger has a similar exposure to retail in the form of outlet centers. Tanger is trading at a dividend yield of just 4.67% at the time of this writing.

Below is the same sample set as the FFO multiple sample set above and as you can see Simon again ranks towards the bottom of the list.

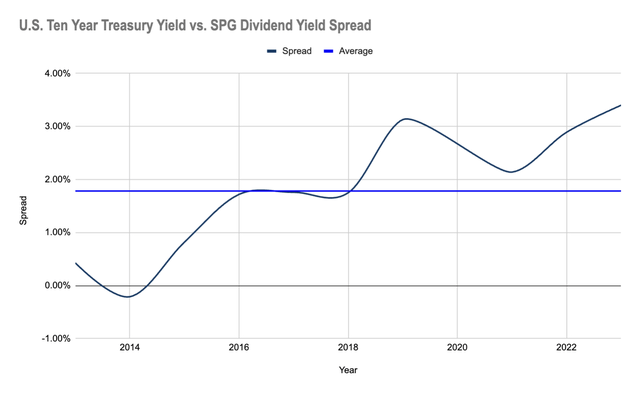

U.S. Ten Year Treasury Spread

Another comparison one could make is SPG's dividend spread compared to the Ten Year U.S. Treasury yield. For analysis purposes I removed the year 2020 as it was a clear outlier.

As seen below, the current spread between SPG's dividend yield and the ten year treasury's yield is the highest it's ever been (other than 2020) at ~3.4%, 162 basis points over the ten year average spread of 1.78%. All else equal, at the average spread today, Simon's yield would float around ~5.6% equating to a price per share of ~$133.

Net Asset Value

If nothing else, Simon owns a high quality portfolio of cash flowing real estate. The value of real estate can simply be defined as "whatever the top bidder will pay for it..." Until that is known via a full sales process, we can use the income approach to value real estate by dividing the portfolio's NOI by a market cap rate.

Unfortunately there aren't many recent sales of Class A malls to pinpoint comparable cap rates. Though a bit stale, in August of 2022 Unibail sold a California mall at a ~6% cap rate. Given the economic disruptions since then we could even conservatively assume as high as a 7% cap rate today.

So Simon's annualized Portfolio NOI of $5.5B divided by a very conservative 7% cap rate equals ~80.0B. Subtract the ~$25B of long term debt and you get a Net Asset Value ("NAV") of ~$55B, equating to around $170 per share...

SPG is currently trading at a ~$35B market cap or ~106 per share, over 35% below its Net Asset Value.

Risks

I'm no economist and therefore will stay away from macro-economic forecasting, but it doesn't take an experienced economist to recognize that there have been many chaotic economic disruptions taking form over the last few years including a world pandemic, a large scale European war, the quickest rate hikes in U.S. history, banking collapses, a U.S. debt ceiling crisis, and more.

If all this were to lead to a recession then some of the first spending to be reduced would be discretionary consumer investing such as luxury retail. This could cause financial distress to Simon's tenants making it more difficult to afford rental payments. This would also reduce revenue from Simon's percentage rent and their direct investments in retailers.

Conclusion

Yes, it seems we are headed for a recession. Yes, consumer spending may decline causing a downturn in retail sales. But Simon has a strong track record of navigating choppy economic waters and their business model continues to boast excellent long term fundamentals with a continued focus on stable growth.

Market Data shows that Class A malls are continuing to thrive throughout these economic disruptions. Furthermore, Simon continues to explore and implement growth strategies including buying retail OpCo's, executing accretive redevelopments, and partnering in the asset management business.

It seems to me that Simon is significantly undervalued by any observable metric with an FFO multiple of under 9x, a dividend yield of ~7% (and growing), and a NAV discount of over 35%.

Management has proven to be responsible, resilient, and excellent strategists and allocators of capital over their decades long family operation. 2022 was a great year for Simon’s comeback from Covid, sales per square foot reached all time highs, and their cash flow experienced another year over year boost. Q1 2023 was more of the same story. Overall Simon continues to represent a sound business model with excellent management and an unmatched expertise and brand in their competitive landscape.

For these reasons, Simon is the largest position in my portfolio and I continue to rate it a strong buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.