SH: I'd Avoid Shorting The S&P 500 For Now

Summary

- The ProShares Short S&P500 ETF is an inverse fund that allows investors to short the market without using a margin; however, the current bull market may not be the best time to invest in it.

- Despite negative headlines and market volatility, the S&P 500 is up 20% from its low in Q4 2022, and retail outflows have been steady, suggesting a contrarian approach to investing.

- SH is a simple and cost-effective way for retail investors to bet against stocks, with an expense ratio under 1% and minimal concentration risk in its swap positions.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

chaofann

Main Thesis & Background

The purpose of this article is to evaluate the ProShares Short S&P500 ETF (NYSEARCA:SH) as an investment option at its current market price. This is an inverse fund, with an objective to "seek daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the S&P 500". What this means in practice is that when the S&P 500 falls, this fund will post gains. When the S&P 500 rises, then SH will see losses.

While straightforward, inverse funds can provide retail investors with an easy way to go "short" the market without having to utilize margin. Funds like SH have their own limitations, but the reason for keeping these ETFs in mind is that investors don't have to use margin. Buying/selling options is another avenue that investors have at their disposal, which is another preferable method to margin. While "shorting" stocks is perhaps the simplest method to profit off a bearish sentiment, I don't like the idea of paying to borrow funds to accomplish that. It can compound losses when the bet goes awry.

I bring this up because while I am currently advocating avoiding SH at the moment, I do find these funds useful in the right circumstances. Therefore, my "hold" rating on this fund suggests that now may not be the best time to go short the S&P 500 via this ETF, but in the future that could change. That signals keeping SH on the radar makes sense going forward.

We Are In A Bull Market

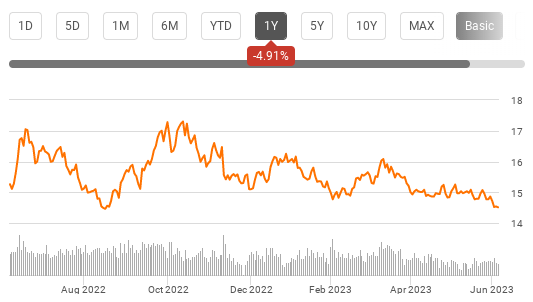

To begin, let's put SH's performance in perspective. This is a fund that has the potential to deliver strong gains when timed correctly. As stocks declined last year, SH got a pop. But 2023's gains have erased that good fortune:

SH's 1-Year Performance (Seeking Alpha)

So investor's in "short" broad market funds have taken a bit of a beating of late. That makes sense when we consider the S&P 500 is actually in a bull market. This may seem surprising, given all the negative macro-headlines concerning Russia-Ukraine, debt ceilings, regional bank failures, and potential recessions. Yet, the fact remains the S&P 500 is up 20% off its low from Q4 2022:

S&P 500 Performance (Yahoo Finance)

This could signal to some readers that now is the time to get short. After all, what goes up, must come down. Right?

Perhaps not. It can make logical sense to start to short/buy SH when the market has risen. A 20% rise for the S&P 500 could suggest stocks are getting a bit too pricey and a reversal is in the cards. To that I would say "fair enough". Nobody knows what the market will do with certainty and selling in to this kind of strength has merit.

But I would suggest more gains are just as likely as a scenario. This is because bull markets often last a long time and signal as the starting point for more gains. In fact, according to research compiled by Hartford Funds, the average length of a bull market is 992 days (over 2.7 years). Again, this is just an average, but we should acknowledge we have been in the current bull market for around eight months. On a historical basis, that makes it a short one, suggesting investors have plenty of reason to stay optimistic.

Retail Outflows Have Been Steady

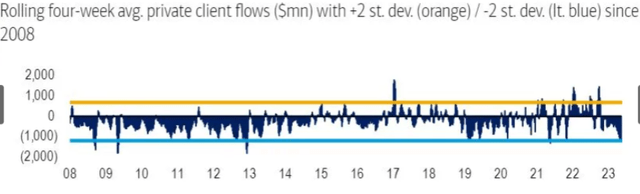

My next thought is a contrarian take on large-cap equities. We are currently in a fairly unloved bull market. Despite stocks rising, recent market volatility and negative headlines are clearly spooking retail investors. According to Bank of America, individual clients have been pulling money out of securities throughout 2023:

Private Client Fund Flows (Bank of America)

This sounds counter-intuitive I am sure. Wouldn't client outflows be a bearish signal? And, if so, that would make SH a buy, not an "avoid".

The fact that it is counter-intuitive is precisely why I am suggesting this is a contrarian move. When the masses start to move in one direction, I take the opposite. We don't have to look any further back than 2022 to see why this would have worked out. Through 2022 that same graphic shows steady inflows. Yet - markets fell across the board. Now in 2023 we see markets rising and investors are pulling out. The opposite of what should be happening. So, in effect, I am saying do the opposite. That means going short the market through SH is not a timely move based on this thesis.

Jobs Market Remains A Positive Catalyst

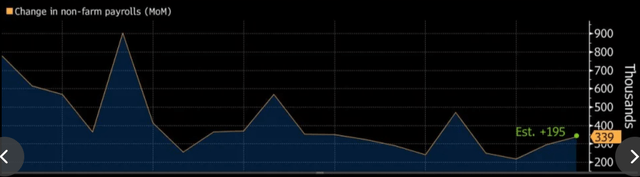

The last positive statement I will make about stocks as a whole (and the S&P 500 by extension) is the U.S. labor market. While calls for a recession keep getting louder, employment numbers are bucking the trend. Last month's payroll growth shot higher (on a month-over-month basis) and exceeded expectations leading up to the release of the data:

US Payrolls Figures (Bloomberg)

This means more Americans working, earning, and spending, and bodes well for discretionary sectors. Consumer-oriented sectors in particular make up about 20% of the S&P 500 index, so seeing a boost to the consumer backdrop through stronger-than-expected job numbers is a positive catalyst for the S&P 500. This is another key reason for my reluctance to use a short strategy through SH at the moment. As long as households have strong employment prospects, it is hard to forecast a recession in the near term.

What I Like About SH

I will wrap up the review by touching on a few aspects of SH that make it a worthwhile option for shorting the market. As a 1X inverse fund for a benchmark index, this fund is not very complicated. The strategy is easy to understand, the underlying index is a common benchmark for investors, and there is not a scary use of leverage like 2X or 3X funds. This makes it a reasonable way for retail investors to bet against stocks a whole.

Further, the expense ratio is under 1%. This tells me it is a much cheaper way to be a bear than paying excessive margin fees that can be quite high at some brokerages:

SH's Expenses (ProShares)

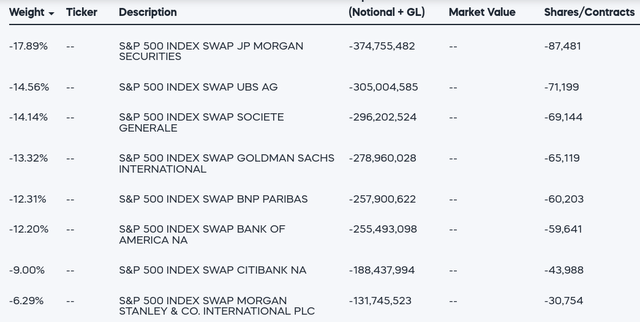

Further, the fund holds its swaps (how it takes bearish positions) with a number of different firms. While the big name banks are not really "at risk" in my opinion despite the negative banking headlines in the first half of the year, I still appreciate the minimal concentration risk this ETF offers:

Swap Positions (SH) (ProShares)

The conclusion I draw here is this is a prudent move by management. Rather than putting all their eggs in one basket they have spread out the credit and counterparty risk across the spectrum of some of the largest banks in the world. That bodes well for the fund being able to deliver to investors on its stated objective of paying out when the market drops.

Bottom-line

There are always reasons to be bearish or be "not invested". This comes with the territory. When negative headlines dominate, retail traders may start to think shorting is an appropriate move. In fairness, it often can be, but I'm reluctant to get too negative here even with all the headwinds on the horizon.

For one, we are in a bull market and that often signals more gains. Two, the U.S. labor market is very strong and that is propping up consumer spending. Three, being long is actually the contrarian retail play here, so I don't see a compelling thesis to be short at this time. What this adds up to is a patient strategy around a bearish market move, and a "hold" rating for SH for now.

Consider the Income Lab

This article was written by

I've been in the Financial Services sector since 2008, which unsurprisingly gives me an invaluable insight in how markets can turn. I was a D1 athlete in college (men's tennis), where I studied Finance. I also have my MBA in Finance.

My readers/followers can trust that I won't pump any investment nor discuss a topic I don't genuinely follow and research. In that spirit, I list my portfolio here for transparency

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU, BUI; VDE, IXC, RYE; KBWB, VFH; XRT, CEF

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, PML, PDO, BBN

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, RSP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.