ZIM Integrated Shipping: Keep Calm And Buy The Dip

Summary

- ZIM stock prices have collapsed in the last year.

- This is due in large part to the fall in freight prices.

- This is a cyclical business, and it's just a matter of time before ZIM shares trade at a more reasonable price.

- Looking for a helping hand in the market? Members of The Pragmatic Investor get exclusive ideas and guidance to navigate any climate. Learn More »

n.bataev/iStock via Getty Images

Thesis Summary

ZIM Integrated Shipping (NYSE:ZIM) is one of the top 20 global cargo carriers, announced its Q1 2023 earnings report on May 22nd. The disappointing results led to a stock plunge, as the company declared it would not pay dividends this quarter.

ZIM is undoubtedly garnering significant media buzz lately. What is intriguing is the fact that their stock was recently noticed by IBD, who gave the stock a Relative strength ('RS') rating of 93 out of 99. Moreover, according to Investopedia, it was also determined as one of the best-value shipping stocks.

The supply chain crisis that started in the spring of 2022 has contributed to a rough period for shipping companies. The trend may have a reverse potential going into the middle of 2023. Inflation is slowing, consumer demand is steadily recovering, yet rates are declining even further.

Investors interested in ZIM stock may find it valuable to consider the key takeaways from their earnings report and the outlook of the freight market going into 2023.

Earnings Report Overview

The shipping provider presented a surprising earnings report, which considerably missed analysts' estimates. Reported revenue dropped to $1.37 billion from $3.716 in the same quarter the previous year, adding up to 63% year over year. Estimates were missed by more than 13%, as analysts expected around $1.59 billion in overall revenue.

ZIM Earnings overview (ZIM earnings)

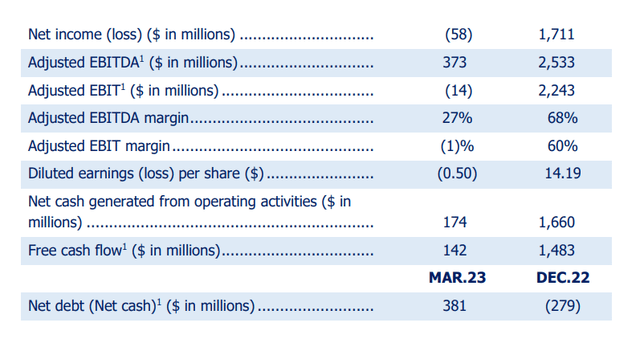

Net Income went from $1.711 million in Q1 2022 to a loss of $58 million in Q1 2023, resulting in a downturn of 103.48% in just one year. Results in EPS also surpassed estimates by a whopping -130.58%, as the company reported -0.50 EPS compared to analysts' predictions of -0.22. As a result of the net loss, ZIM will not pay a dividend to shareholders for the present quarter. Cash Flow from operations also plunged to $174, with a decline of 90% YoY.

Last year's financial results reached record highs for ZIM Freight, but freight rates for this quarter declined by 64% due to low demand. Moreover, In the first quarter of 2023, the adjusted EBITDA stood at $373 million, showing a substantial decline compared to the same period in 2022, when it reached $2,533 million. Similarly, the first quarter of 2023 saw an adjusted EBIT loss of $14 million, compared to an EBIT of $2,243 million recorded in the first quarter of 2022.

Insights from ZIM Integrated’s earnings call

In the company's earnings call on 22 May, CEO and President Eli Glickman and CFO Xavier Destriau discussed the key financial results from ZIM's earnings report and shared some forward-looking statements.

The company's results for Q1 of the year showcased that freight rates for ZIM Integrated Shipping Services continue to move in a downward direction. While there have been price gains in the previous two months of 2023, prices have been dropping persistently, and the growing pressure regarding the rates is expected to remain a concern.

Despite the difficult landscape of the shipping industry and other micro factors, the company predicts it will overcome the challenges. That is why ZIM maintains its guidance for 2023 and forecasts that EBITDA will reach $1.8 billion to $2.2 billion and EBIT $100 million to $500 million.

ZIM also showcased its efforts to contribute to a greener future by actively working to reduce its greenhouse gas emissions entirely by 2050. The environmentally friendly company has published its fifth annual ESG report outlining its activities, accomplishments, and future goals. Its fleet renewal program, including using LNG-powered vessels, contributes to its ESG strategy and offers numerous environmental and financial benefits.

As with many shipping companies, oversupply has been a determining factor for their financial performance. According to ZIM, supply and demand issues might directly affect their actions, but supply growth may be observed with proper scrapping and slippage efforts. Demand patterns are expected to improve in the second half of 2023. The company expects demand to improve in the year's second half as the destocking effect subsides and demand starts to recover.

Freight Market Outlook - How Will it Affect ZIM?

Delving into this topic further, investors find themselves asking how the freight market will affect the ZIM stock and ZIM Integrated's business operations in the future.

The freight market has been grappling with decreased trade volumes, creating a challenging environment for shipping companies worldwide. Unfortunately, there is still no immediate change in demand as it remains low.

The ocean freight market is still underperforming, as data from Freightos suggest that rates are meagre, close to ones from 2019. Rates for Asia-US West Coast, Asia-US East Coast, and Asia-N. Europe are down approximately 90% compared to last year. There still needs to be particular evidence or indication of a rebound so far this year, which raises concerns about the recovery of rates in the near term.

Looking ahead, while inflation appears to be slowing, prices remain high. This could potentially impact consumer spending as financial restrictions persist. However, despite these challenges, experts remain cautiously optimistic that rates will rebound in some form, creating hope for future recovery.

Despite the uncertain landscape and socio-economic factors, ZIM's strategic positioning and operational efficiency have become crucial in steering the freight market's volatility. The company's ability to adapt and leverage its competitive advantages will be vital in controlling the potential effects of declining trade volumes and dropping rates.

Agility and excellence guide our commercial strategy as we continue to adapt our network to change in customer demand and identify attractive commercial opportunities.

Source: CEO Eli Glickman, ZIM’s earnings call.

Valuation

ZIM Integrated has since its stock price collapse, and this can be explained partly due to much lower earnings and revenue forecasts, which are in turn explained by the lower freight rates.

Analyst Estimates (SA)

EPS are expected to enter negative territory this year, and ZIM has already eliminated its dividend for this coming quarter. Meanwhile, revenue is expected to fall by 54% in 2023.

But we must understand that this situation is not permanent. This is a cyclical business, and eventually, we will get a recovery in price. For those investors willing to be patient, these prices offer good long-term potential.

ZIM trades at a P/S of 0.16, and a P/B of 0.32. The sector median PS is 1.27, which implies that ZIM could appreciate by a factor of 10 as the situation normalizes.

Conclusion

As the freight market continues to evolve, all eyes are on ZIM Integrated Services, observing how it will respond to the current market while managing its growth. Though ZIM faces a challenging environment, the stock looks oversold at these levels, and I’d consider adding it.

This is just one of many exciting and fairly priced stocks you can buy right now!

Join The Pragmatic Investor and receive:

- Access to our Portfolio, which features "value tech stocks".

- Deep dive reports on tech stocks.

- Regular news updates

Technology is changing the future, don't just watch it, be a part of it!

This article was written by

James Foord is an economist and financial writer with over five years of experience writing about stocks and crypto. His lifelong interest in monetary policy and innovative technologies led him to specialize in macroeconomics, crypto and technology. Given the current macro outlook, he is focused on commodities, real assets, international equities and value stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.