Hidden Risks Of Small Caps: Levered Zombie Company Impact On Bull Market Future

Summary

- There's been a lot of talk lately that we are in a "new secular bull market" that becomes driven by small-cap momentum.

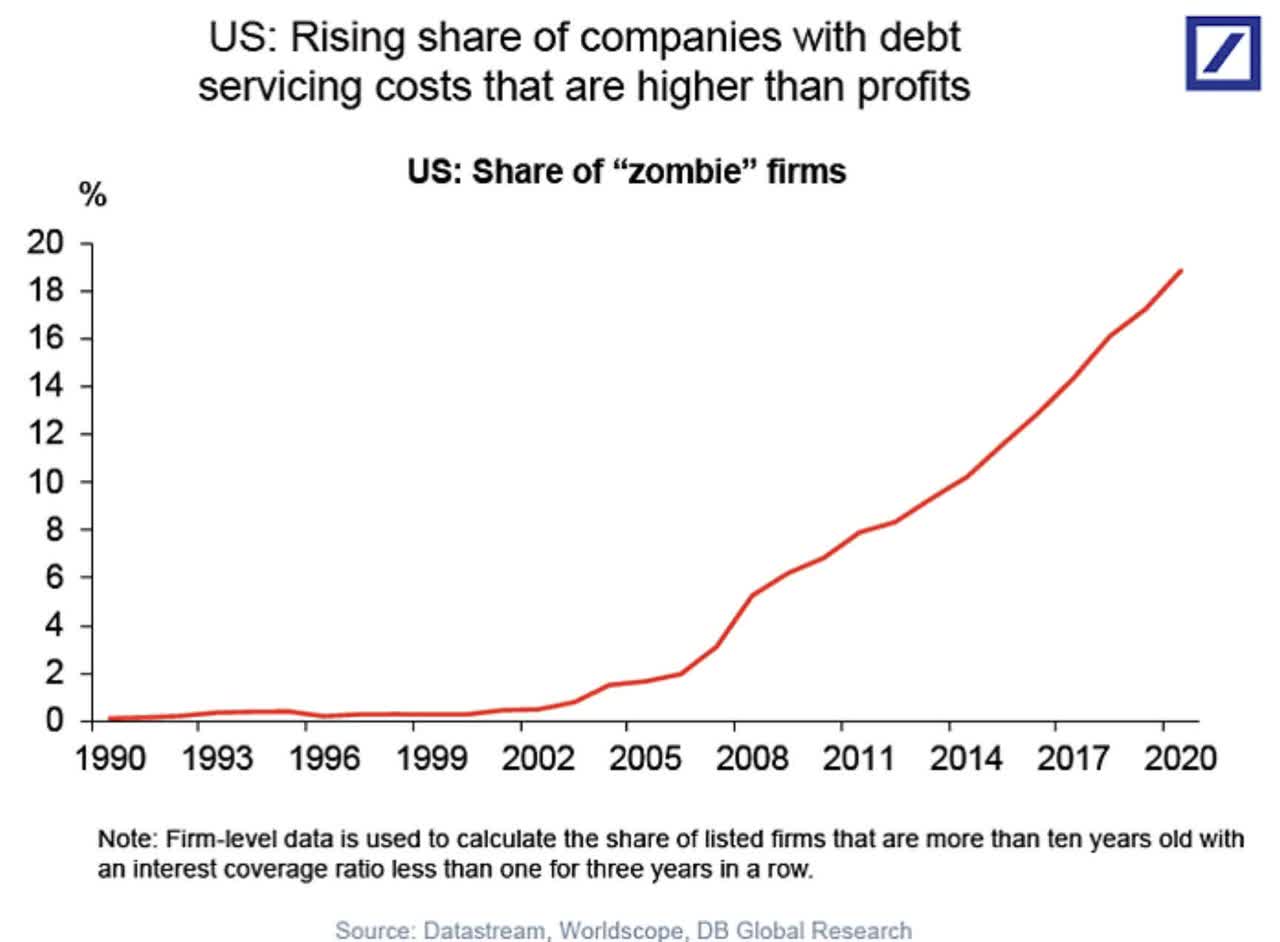

- The problem I have with this is seemingly everyone is forgetting there are a lot of zombie companies that won't survive the longer rates stay elevated.

- A zombie company is a business that is unable to generate enough cash flow to cover its interest expenses.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

gremlin/E+ via Getty Images

Humanity is mind-controlled and only slightly more conscious than your average zombie. - David Icke.

A secular bull market is characterized by a prolonged period of rising stock prices, driven by factors such as strong economic growth, low inflation, and investor optimism. It's during these times that small-cap stocks can experience significant gains, as investors are more willing to take on the higher risk associated with these smaller companies, in the hopes of achieving greater returns. There's been a lot of talk lately that we are in a "new secular bull market" that becomes driven by small-cap momentum. The problem I have with this is seemingly everyone is forgetting there are a lot of zombie companies that won't survive the longer rates stay elevated.

Defining zombie companies

A zombie company is a business that is unable to generate enough cash flow to cover its interest expenses and, as a result, is reliant on external sources of financing to continue operating. These companies are essentially "dead" in terms of their financial health, yet they continue to exist due to the availability of cheap credit, which allows them to roll over their debt and keep their operations running.

High debt companies, on the other hand, are businesses that have taken on a significant amount of debt relative to their assets or earnings. While these companies may not necessarily be "zombies" in the strictest sense, their high levels of leverage can make them more vulnerable to economic downturns, rising interest rates, and other external factors that can negatively impact their ability to service their debt.

Risks associated with rolling over debt at higher interest rates

One of the primary reasons that levered zombie companies have been able to survive in recent years is the availability of cheap credit, which has allowed them to roll over their debt at low interest rates. However, this dynamic could change in the future if interest rates were to stay elevated.

Datastream, Worldscope, DB Global Research

Warning signs for investors: identifying zombie companies in small caps

For investors looking to navigate the potential dangers of small-cap investments, it's important to be able to identify the warning signs of zombie companies and high debt businesses. Some key indicators to watch for include:

- High debt-to-equity ratios: A high debt-to-equity ratio can indicate that a company is heavily reliant on debt financing, which can make it more vulnerable to changes in interest rates or other external factors.

- Low interest coverage ratios: A low interest coverage ratio (i.e., the ratio of a company's earnings before interest and taxes to its interest expenses) can suggest that a business is struggling to generate sufficient cash flow to cover its interest payments.

- Persistent losses or declining revenues: Companies that consistently report losses or experience declines in revenue may be facing structural issues that could make it difficult for them to turn their business around.

Conclusion: navigating the hidden dangers of small caps

The presence of levered zombie companies and high debt businesses within the small-cap sector represents a potential danger for investors and the future of the secular bull market. Yes, small-cap momentum has been strong, and I don't discount the possibility that outperformance persists. But the reality is that we have yet to see the impact of higher rates on companies teetering on the edge. Be careful of narratives, the bear market may not be over.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.