Tracking David Tepper's Appaloosa Management Portfolio - Q1 2023 Update

Summary

- David Tepper's 13F portfolio value increased to approximately $1.89B, with the number of holdings rising from 23 to 28.

- New stakes were established in FedEx Corp, Select Sector SPDR Financials, NVIDIA Corp, and Tesla Inc.

- The top five positions include Alphabet, Amazon, Uber Technologies, Constellation Energy, and Meta Platforms, accounting for around 59% of the portfolio.

Brad Barket/Getty Images Entertainment

This article is part of a series that provides an ongoing analysis of the changes made to David Tepper's 13F portfolio on a quarterly basis. It is based on Appaloosa Management's regulatory 13F Form filed on 5/15/2023. Please visit our Tracking David Tepper's Appaloosa Management Portfolio series to get an idea of his investment philosophy and our previous update for the fund's moves during Q4 2022.

This quarter, Tepper's 13F portfolio value increased from ~$1.35B to ~$1.89B. The number of holdings increased from 23 to 28. The top five positions are Alphabet, Amazon.com, Uber Technologies, Constellation Energy, and Meta Platforms. They add up to ~59% of the portfolio. To know more about Tepper's distress investing style, check out the book Distress Investing: Principles and Technique.

New Stakes:

FedEx Corp. (FDX), Select Sector SPDR Financials (XLF), NVIDIA Corp. (NVDA), and Tesla Inc. (TSLA): FDX is a fairly large 4.22% of the portfolio position purchased this quarter at prices between ~$177 and ~$229. The stock currently trades at ~$220. The 2.24% XLF stake was established at prices between ~$31 and ~$37 and it is now at ~$33. NVDA is a 2.20% of the portfolio position purchased at prices between ~$143 and ~$280 and it is now well above that range at ~$387. The 1.64% TSLA stake was established at prices between ~$108 and ~$214 and it now goes for ~$221.

ARK Innovation ETF (ARKK) and Match Group (MTCH): ARKK is a small ~1% stake established at prices between ~$30.50 and ~$44.40 and the stock currently trades at $42.68. The ~1% MTCH position purchased at prices between ~$34.80 and ~$54.10 and it now goes for $39.72.

Stake Disposals:

Aptiv plc (APTV): APTV is a very small 0.35% of the portfolio stake established last quarter but disposed this quarter.

Stake Increases:

Alphabet Inc. (GOOG) (GOOGL): GOOG is currently the second largest 13F position at ~12% of the portfolio. It has been a significant presence in the portfolio since Q1 2012 and the original purchase was at prices between ~$14.50 and ~$16.25. The stake has wavered. Recent activity follows: Q1-Q3 2020 saw a ~40% reduction at prices between ~$53 and ~$86. That was followed with a ~60% reduction over the six quarters through Q2 2022 at prices between ~$87 and ~$151. The stock currently trades at ~$128. There was a ~6% increase this quarter.

Amazon.com (AMZN): The large (top three) ~11% AMZN stake was purchased in Q1 2019 at prices between ~$75 and ~$91. The next three quarters saw a ~75% stake increase at prices between ~$84.50 and ~$101. There was a ~50% selling from Q1 to Q3 2020 at prices between ~$84 and ~$177. Q4 2020 saw an about turn: ~40% stake increase at prices between ~$150 and ~$172. There was a two-thirds selling over the next three quarters at prices between ~$148 and ~$187. Q1 2022 saw a ~20% stake increase while during Q3 2022 there was similar selling. There was a one-third increase this quarter at prices between ~$83 and ~$113. The stock currently trades at ~$127.

Uber Technologies (UBER): UBER is now a large (top three) ~10% of the portfolio position. The original large stake was purchased in Q2 2021 at prices between ~$44 and ~$61. Q4 2021 saw that stake almost sold out at prices between ~$36 and ~$48. The position was rebuilt next quarter at prices between ~$29 and ~$44.50 but was again sold down in Q2 2022 at prices between ~$20.50 and ~$36.50. The last two quarters saw the stake rebuilt at prices between ~$24.40 and ~$37. The stock currently trades at ~$40.25.

Meta Platforms (META): META is a large (top five) ~8% of the portfolio stake established in Q3 2016 at prices between $114 and $131 and increased by ~50% in the following quarter at prices between $115 and $133. H2 2017 saw a stake doubling at prices between $148 and $183. The position has since wavered. Recent activity follows. Q1-Q3 2020 had seen a ~40% selling at prices between $146 and $304 while next quarter saw a ~14% stake increase. The five quarters through Q1 2022 had seen a ~55% selling at prices between ~$187 and ~$382. There was a one-third selling last quarter at prices between ~$89 and ~$142 while this quarter saw a ~22% increase at prices between ~$125 and ~$212. The stock is currently at ~$271.

Note: META has seen several previous round trips in the portfolio. The latest was a 3.28% of the portfolio position established in Q1 2016 at prices between $94 and $116 and sold the following quarter at prices between $109 and $121.

Macy's Inc. (M): The fairly large 5.54% Macy's stake was almost doubled in Q3 2021 at prices between ~$16 and ~$25. There was a ~45% stake increase next quarter at prices between ~$22 and ~$37. H1 2022 saw a ~40% reduction at prices between ~$17.50 and ~$28. The stock is now at $15.90. The last two quarters saw only minor adjustments.

Microsoft (MSFT): The ~4% MSFT stake was built in 2020 at prices between $152 and $232. The two quarters through Q2 2021 had seen a ~45% selling at prices between ~$212 and ~$272. Q1 2022 saw a ~25% stake increase at prices between ~$275 and ~$335 while next quarter there was a roughly one-third reduction at prices between ~$242 and ~$315. The stock currently trades at ~$334. There was a ~11% stake increase this quarter.

Antero Resources (AR): The 1.56% stake in AR was established in Q1 & Q3 2021 at prices between ~$6 and ~$19. There was a ~55% reduction over the last three quarters at prices between ~$17 and ~$48. The stock currently trades at ~$21. This quarter saw a minor ~2% increase.

Stake Decreases:

Constellation Energy (CEG): CEG is currently at 8.67% of the portfolio. It was established in Q2 2022 at prices between ~$53 and ~$67 and the stock currently trades at $89.56. There was a ~22% selling in the last three quarters at prices between ~$54 and ~$97.

Note: Constellation Energy is Exelon's (EXC) power generation and marketing business that was spun off last February.

Salesforce.com (CRM): CRM is a ~3% of the portfolio position established in Q2 2022 at prices between ~$156 and ~$221 and the stock is now at ~$213. There was a ~60% stake increase last quarter at prices between ~$128 and ~$165. This quarter saw a minor ~3% trimming.

HCA Healthcare (HCA): HCA is a ~2% of the portfolio position that saw a ~140% stake increase last quarter at prices between ~$185 and ~$245. The stock currently trades at ~$271. There was a ~22% reduction this quarter at prices between ~$243 and ~$264.

Kept Steady:

Energy Transfer LP (ET): Energy Transfer Partners merged with Energy Transfer Equity and the resulting entity was renamed Energy Transfer LP. The transaction closed last January, and terms were 1.28 shares of ETE for each ETP. Tepper held shares in both and those got converted to ET shares. There was a stake doubling in Q4 2019 at prices between $11 and $13. Next three quarters saw the stake again doubled at prices between $4.55 and $13.75 while Q2 2021 saw a ~45% selling at prices between ~$7.70 and ~$11.35. The stock is now at $12.91, and the stake is at 6.72% of the portfolio.

EQT Corp. (EQT): EQT is a 4.30% of the portfolio position built over the two quarters through Q3 2021 at prices between ~$16 and ~$23. There was a ~50% reduction over the three quarters through Q3 2022 at prices between ~$20 and ~$50. The stock is now at $37.36.

UnitedHealth (UNH): UNH is now a 3.75% of the portfolio position. The stake was built in Q4 2020 and Q1 2021 at prices between ~$305 and ~$377. The next five quarters saw a ~45% selling at prices between ~$367 and ~$546. The stock currently trades at ~$488.

Chesapeake Energy (CHK) & wts: The 2.31% net stake saw the leverage through the warrants decreased and the common stake increased last quarter. The original position is from the conversion of senior debt they held as the company emerged from Chapter 11 bankruptcy in Q1 2021. Since then, both the common and warrant stakes have been reduced substantially.

Walt Disney (DIS) and Caesar's Entertainment (CZR): The 1.59% of the portfolio DIS stake was purchased last quarter at prices between ~$84 and ~$107 and the stock currently trades at ~$92. CZR is a 1.10% of the portfolio position established last quarter at prices between ~$32 and ~$54 and it is now at $48.26.

Alibaba Group Holding (BABA), ALPS Alerian MLP ETF (AMLP), Enterprise Products Partners (EPD), MPLX LP (MPLX), and Sysco Corp. (SYY): These very small (less than ~1% of the portfolio each) stakes were kept steady this quarter.

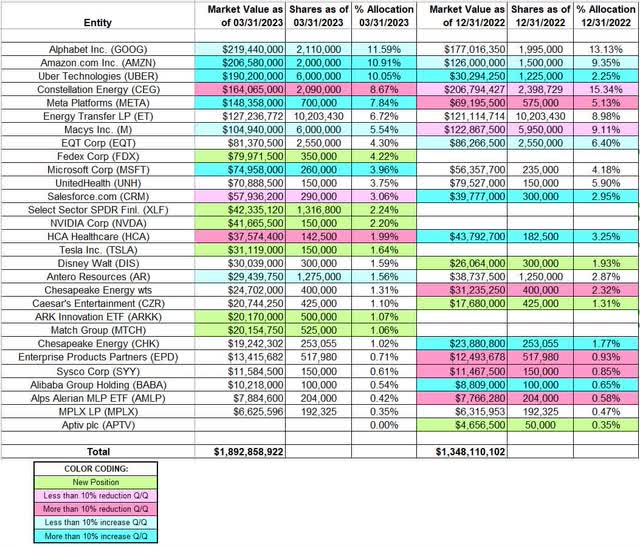

The spreadsheet below highlights changes to Tepper's 13F stock holdings in Q1 2023:

David Tepper - Appaloosa's Q1 2023 13F Report Q/Q Comparison (John Vincent (author))

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.