Profit From The Pfizer Takeover Of Seagen

Summary

- Pfizer is set to acquire Seagen for $43 billion, with the deal expected to close later this year or in early 2024, subject to regulatory approvals.

- The acquisition is part of Pfizer's long-term strategy to add $25 billion in projected 2030 revenue, with Seagen expected to contribute about 40% to this goal.

- Seagen's focus on oncology treatments will complement Pfizer's lineup, and the combined research and development efforts are expected to result in significant synergies.

- The acquisition price of $229 represents a 17% premium to Tuesday's closing price.

peterschreiber.media

Deal Details

In March of this year, Pfizer (PFE) announced that it had bid to acquire Seagen (NASDAQ:SGEN) for approximately $43 billion, or $229 per share in cash. The acquisition was approved by a shareholder vote at the end of May with 99% of shares voting. This is a positive step toward the deal closing, which is now subject to customary regulatory approvals. Seagen and Pfizer expect the deal to close later this year or in early 2024. The acquisition price of $229 represents a premium of over 17% from Tuesday's closing price.

The acquisition of Seagen is part of Pfizer's long-term strategy of adding $25 billion in projected 2030 revenue through business development initiatives. While Seagen is expected to generate about $2.2 billion in revenue for 2023, that figure is expected to grow to $10 billion by 2030, contributing about 40% to Pfizer's goal. Prior to the Seagen deal, and as part of this revenue growth initiative, Pfizer made several acquisitions in 2022 including Arena, Biohaven, GBT, and ReViral. Those four deals combined are expected to add $10.5 billion to Pfizer's revenue by 2030, so by comparison, the Seagen acquisition is significantly larger and far more important to Pfizer and its ability to reach the 2030 goal. To reach or exceed its goal, it is reasonable to expect Pfizer to make another acquisition between now and 2030.

What Seagen Adds to the Pfizer Line-Up

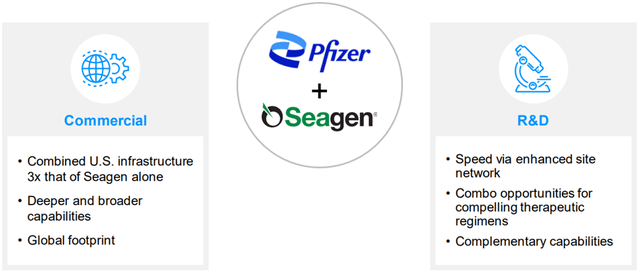

Seagen's focus on oncology treatments will be complementary to Pfizer's line-up. This acquisition is intended to accelerate Pfizer's efforts in the space while also boosting revenue and profitability. Pfizer's infrastructure and distribution is expected to help bring Seagen's treatments to more patients faster than would happen otherwise.

Benefits of Seagen Acquisition (Pfizer)

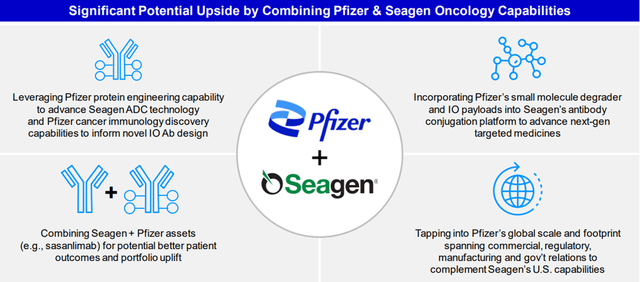

Specifically, Pfizer will own Seagen's ADC (antibody-drug conjugate) technology that is used to treat certain types of lymphoma, urothelial cancer, and cervical cancer. In addition to what is already in the market, several drugs being tested in Seagen's pipeline have shown promise for treatment of breast, lung, and bladder cancers. Combining the research and development efforts will result in synergies that are difficult to quantify at this time, but nonetheless important. It will be interesting to see the growth and progress the combined team will be able to achieve, and what part, if any, the role of artificial intelligence capabilities will play.

Acquisition Synergies (Pfizer)

Impact of Acquisition on Pfizer's Financial Strength

According to Pfizer management, the acquisition will be financed with about $31 billion in long-term debt with the remaining $12 billion primarily provided by cash on Pfizer's balance sheet and a small amount of short-term debt. As of the end of the first quarter, and reported April 2, 2023, Pfizer currently holds just under $20 billion in cash and short-term investments, providing sufficient liquidity to accompany the $31 billion in new long-term debt needed to close the deal. Pfizer management does not expect a change to its credit rating due to the added debt. Pfizer's debt is currently rated A and stable by both S&P and Fitch. S&P has rated the new debt Pfizer will need for the acquisition 'A+'.

Recent Performance

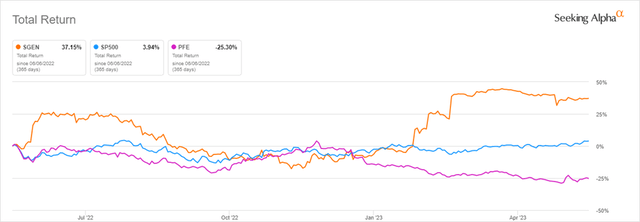

Over the last year, Seagen has significantly outperformed the S&P 500 and Pfizer on a total return basis. For reference, Seagen closed at $172.61/share on Friday March 10, the last trading day before the deal was announced on Monday March 13.

Pfizer's stock performance has diverged from the broader market since the end of 2022 and is now underperforming the S&P 500 on a total return basis over trailing 1-, 3-, 5-, and 10-year periods. In fact, because of Pfizer's weak performance over the last 2 years, its total return over the last 30 years is now in line with the S&P 500, but with greater volatility.

1-Year Total Return: Seagen versus Pfizer versus S&P 500 (Seeking Alpha)

Pfizer's Post-Acquisition Outlook

Pfizer expects the acquisition to be neutral to slightly accretive to EPS by the third or fourth full year afterward, with $1 billion in cost savings anticipated on that same timeline. Pfizer's income statement will benefit from Seagen's growth as the company generated revenue of nearly $2 billion in fiscal 2022 and has grown revenue at a 25% CAGR over the last 10 years. For 2023, Seagen revenue is expected to be about $2.2 billion, a 12% increase year-over-year. Once fully integrated, Pfizer expects sustainable improvements to its long-term revenue growth and profitability. As mentioned above, Pfizer anticipates that Seagen will contribute at least $10 billion to revenue by 2030, a figure that is highly dependent on the approval and success of the drugs in the pipeline.

Risks

The deal has been partially de-risked since the original announcement by the Seagen shareholder vote of approval, and by the favorable credit opinions expressed by Fitch and S&P. The other important risk to consider is whether regulatory approval can be obtained. Without approval from regulators, namely the FTC, the deal will not close. That said, approval seems likely as it is doubtful that the FTC will view this deal as anti-competitive. Seagen's treatments are largely complementary to Pfizer's with little overlap between the two. It is reasonable to expect the combined entity to be viewed positively as Pfizer's greater resources can be used to support and accelerate the development of Seagen's pipeline, providing favorable outcomes for patients.

Final Thoughts

Given the shareholder approval, positive rating on new debt for Pfizer, and perceived low regulatory hurdles, this deal has a high probability of closing, and likely within the next year. In the event the deal does not close, then shareholders in Seagen will continue to own a rapidly growing and innovative player developing cancer treatments. A return to the pre-announcement price would represent a decline of nearly 12% from Tuesday's close. However, the potential 17% gain within the next year for Seagen shareholders provides fair compensation for that risk.

Thank you for reading. I look forward to your feedback in the comment section below.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SGEN PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.