Rates Spark: Rates Volatility Goldilocks Continues

Summary

- Markets have become numb to central banks’ hawkish comments.

- Low rates volatility looks set to continue, benefitting risk appetite in other markets.

- Eurozone consumer inflation expectations will be the main data point to look out for today.

DNY59

By Antoine Bouvet, Benjamin Schroeder, Padhraic Garvey, CFA

Range trades are a near-term catalyst to our USD-EUR rates tightening view

The Saudi oil production cut and calm market conditions paving the way to another flurry of debt issuance are the two most salient bearish risks for core government bonds this week. That said, the Fed went into its pre-meeting quiet period with the probability of a 25bp hike on June 14 well below 50%, and we think there is little the European Central Bank (ECB) can say to really cause a hawkish rethink of its rates trajectory. We take as evidence the lack of market reaction to various officials - including Christine Lagarde and Joachim Nagel - stating that inflation remains too high. The main reasons, we think, are that markets are already pricing two 25bp ECB hikes by the end of the summer and that central banks have been explicit that economic data will determine the path for monetary policy.

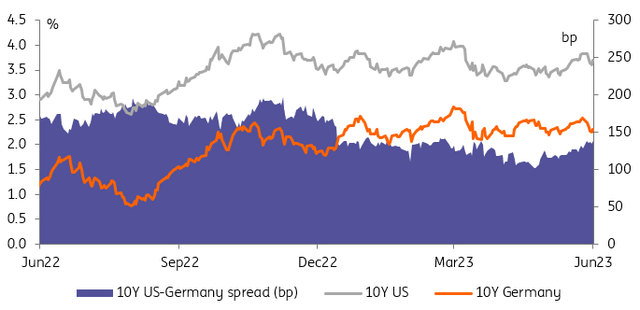

We see this as a recipe for rates to remain within their range. Core bonds erased their early sell-off in the US session yesterday, thanks to signs of a cooling service sector displayed in the ISM services reading. Is this enough to change the prevailing narrative? It isn’t, but Treasuries went into the release very close to the top of their recent range in yields, which we suspect made short-term investors all the more enthusiastic about buying the morning dip. The same cannot be said of Bund yields, which started the week close to the bottom of their range, making them less appealing to range traders.

This state of play - high dollar and low euro rates - happens to contradict our expectation of narrowing rates differentials, and we expect this dynamic to reverse. In the short term because the lack of market direction should limit further US Treasury sell-off and further Bund rallies, and later because tangible signs of a decline in core inflation occurring in the US are so far lacking in Europe. This should allow a fall in USD rates later this year, even as their EUR peers remain elevated for a while longer.

Yields Close To The Bottom Of Their Range Will Make Bund Less Attractive Than Treasuries To Range Traders (Refinitiv, ING)

High but stable rates volatility is a boon for risk appetite

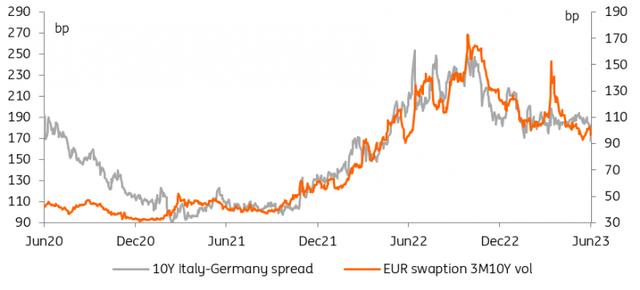

The implication for markets outside of rates is positive. After a year of being tormented by the relentless rise in borrowing costs in 2022, few investors are sorry to see yields lacking in direction. Realised and implied volatility remain high compared to their 2021 levels but well below their late 2022 peak. Until rates make a decisive break lower on a dovish pivot by central banks, current levels of volatility can be thought of as the new normal. This stabilisation has been enough to boost risk appetite in other markets. Whether lower rates volatility is the cause or another symptom of lower macro uncertainty, it has come with valuations in some risk assets that belie recession calls.

This is visible in many corners of financial markets. Eurozone sovereign spreads, much like some measures of swaption implied volatility, are approaching their lowest levels in a year. Similarly, although the factors may also include money market dynamics, swap spreads are shedding their risk premium acquired during the latest bout of US regional banking stress. At the front-end of the curve, the credit premium received by investors is painting an upbeat picture. We will stop short of extrapolating this to other markets, but a continuation of the current rates volatility status quo seems to suit most markets.

Sovereign Spreads And Implied Volatility Are Falling To Their Lowest Levels In A Year (Refinitiv, ING)

Today’s events and market view

The release most likely to move euro markets today is the ECB’s consumer expectations survey and, more specifically, the questions on their inflation outlook. Eurozone retail sales are expected to edge modestly up after their slump in March. There will also be construction PMIs to look out for from Germany and the UK.

Bond supply takes the form of a 30Y gilt sale from the UK, to which Germany and Austria will add respectively 10Y/23Y linker and 10Y/13Y bond auctions. The EU has also mandated banks for the sale of 7Y and 19Y debt via syndication.

Klass Knot, Mario Centeno, and Boris Vujcic are on the list of ECB speakers for today.

Weak factory orders in Germany released this morning add to the sense of anemic growth. We think this is more likely to result in an even more inverted yield curve in the near term rather than significantly lower rates overall, as the ECB is laser-focused on its inflation fight.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This article was written by