Chimerix: A High-Risk 'Lottery Ticket'

Summary

- Today, we put the spotlight on Chimerix, Inc. for the first time in 12 months.

- The company is advancing its primary oncology candidate in development, has a potentially large market, and sells for less than net cash on its balance sheet.

- An updated investment analysis on Chimerix, Inc. follows in the paragraphs below.

- Looking for a helping hand in the market? Members of The Biotech Forum get exclusive ideas and guidance to navigate any climate. Learn More »

dra_schwartz

You can't unscramble the egg no matter your wisdom and determination" - Kaleb Kilton.

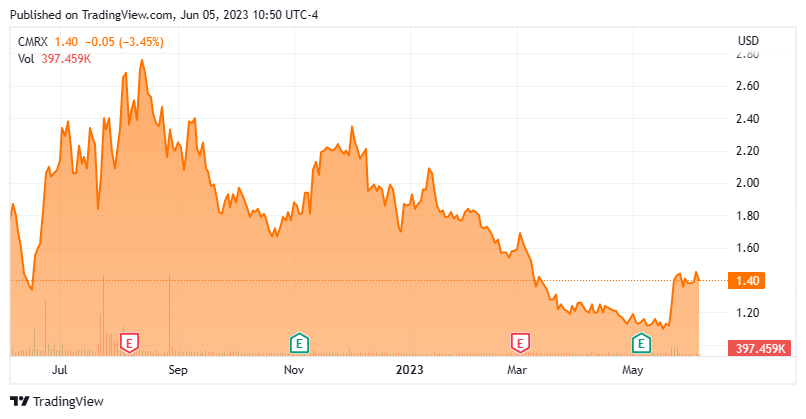

It has been exactly one year since our last look at Chimerix, Inc. (NASDAQ:CMRX). We concluded that article with the following summary:

Chimerix is an interesting 'sum of the parts' story currently. Its roughly $275 million exceeds its current market cap by some $80 million. It has one late-stage asset in development in ONC201 as well as earlier stage compounds in its pipeline. While not adding to my small stake in CMRX, I plan to retain my 'watch item' holding in this stock, pending further developments."

The stock has largely stayed in a trading range over the past year. However, the equity recently was initiated as a new buy at an analyst firm, and it put out a new investor presentation. Therefore, we will circle back to this small developmental firm via the updated analysis below.

Seeking Alpha

Company Overview:

This small biotech concern is based in Durham, NC. The company has several compounds currently in development. Chimerix is focused on developing medicines that meaningfully improve and extend the lives of patients facing deadly diseases.

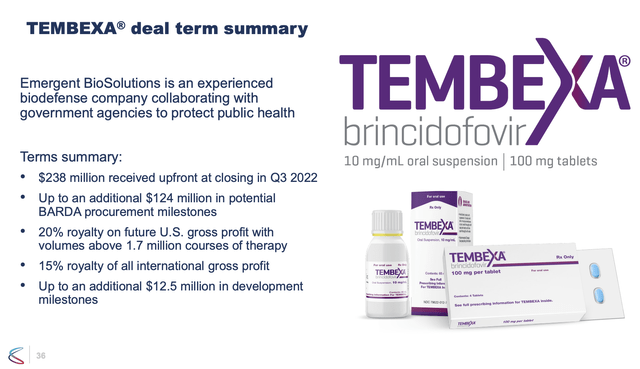

Chimerix had a lipid conjugate through inhibition of viral DNA synthesis that was developed and approved in mid-2021 as a medical countermeasure for smallpox, called TEMBEXA. The company sold and has transitioned the rights to Tembexa to Emergent BioSolutions (EBS). The stock trades at around $1.50 a share and sports an approximate market capitalization of $125 million.

March Company Presentation

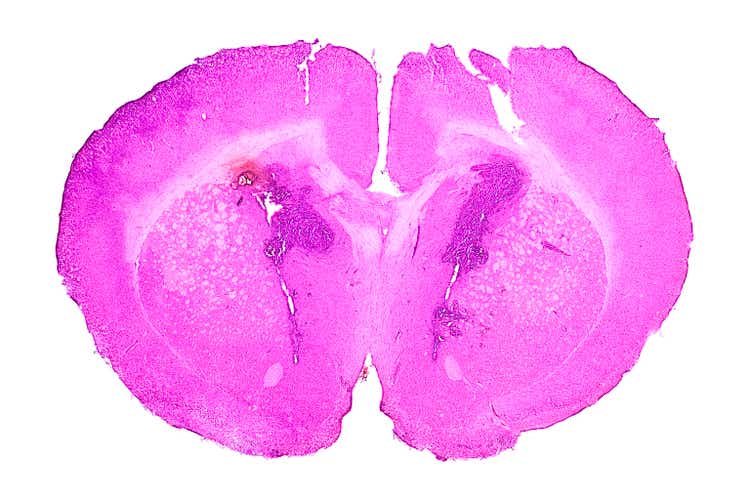

The company is evaluating several assets within its pipeline via partnerships. However, by far Chimera's most important potential asset is wholly owned ONC201. The compound is being focused to treat brain tumors with H3 K27M-mutations. In pre-clinical studies, ONC201 was shown the ability to reverse H3K27 trimethyl loss, being the first known example of a candidate to do so. This is a characteristic which has been linked to tumor growth and poor prognosis.

March Company Presentation

Here is how the company describes ONC201 on its website:

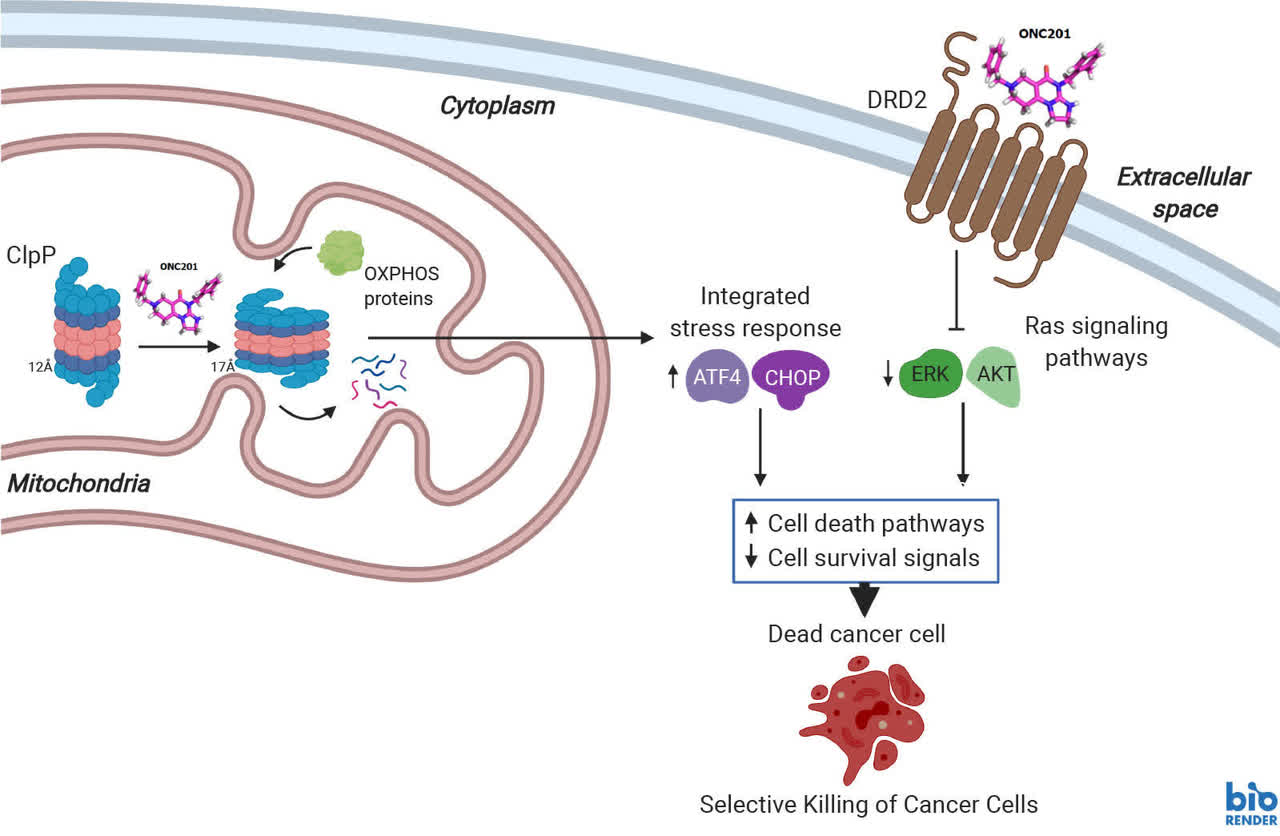

ONC201 is the founding member of the imipridone class of anti-cancer small molecules which selectively targets Dopamine Receptor D2 (DRD2) and ClpP. ONC201-mediated cell death occurs via induction of the integrated stress response and upregulation of apoptotic factors, such as tumor necrosis factor (TNF)-related apoptosis-inducing ligand (TRAIL). It is dosed orally and has been well-tolerated and shown clinical activity in Phase I and II trials for specific advanced cancers. ONC201 has been shown to preferentially induce cell death in cancer cells by binding to and differentially altering activity of DRD2 and ClpP as shown schematically below:"

The company laid off a quarter of their workforce in late 2022 as a result of moving Tembexa to Emergent and as part of their strategic refocus to their oncology pipeline. Phase 2 data produced durable tumor responses and an overall survival advantage compared to other therapies.

March Company Presentation

Chimerix has kicked off a pivotal Phase 3 study, "ACTION." Enrollment is currently ongoing at nine study sites globally. The first efficacy analysis from this trial is due out early 2025, and it will include an initial overall survival assessment.

March Company Presentation

March Company Presentation

The company also has ONC206 is much earlier development. It is also targeting H3K27M. That compound is being evaluated within an open-label dose escalation study to run into the first half of 2024. ONC206 is targeting a much larger potential population than ONC201's potential glioma indication.

March Company Presentation

Analyst Commentary & Balance Sheet:

On May 22nd, Robert W. Baird initiated the shares as a new Outperform with a $7 price target, based on its view that Chimera's phase 3 glioma candidate has a high probability of success (65%). This is the only analyst firm rating I can find on CMRX over the past year.

Approximately five percent of the outstanding float in the shares is currently held short. Several insiders including the CEO and CFO made some small insider purchases in May totaling nearly $200,000 collectively. After posting a net loss of $21.4 million for the first quarter, management described its balance sheet as thus:

Includes $246.1 million of capital available to fund operations, approximately 88.6 million outstanding shares of common stock and no outstanding debt.

Leadership expects to end FY2023 with at least $200 million of cash and marketable securities on its balance sheet. It believes it has funding in place to get Chimerix into 2027 given current planned activities.

Verdict:

Chimerix, Inc. stock currently sells for under the net cash on its balance sheet. This is a stock for the patient investor, as the primary endpoint data readouts from the ACTION study will not be out until 2025. Provided data is good from the dose escalation study around ONC206, a trial to test efficacy should also kick off in 2025.

March Company Overview

If development of ONC201 is successful, Chimerix, Inc.'s stock would seem to be set up to be a "multi-bagger" given the potential market, and what should be a rapid ramp-up. The downside is potential commercialization is 2026 at the earliest. Therefore, CMRX remains a high risk/high reward "lottery ticket." It continues to merit a small "watch item" holding for aggressive investors within a well-diversified biotech portfolio.

It is those who cannot defend their argument who seek to silence those who can." - Craig D. Lounsbrough.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.

This article was written by

Finding tomorrow's big winners in the lucrative biotech sector, The Biotech Forum focuses on proprietary, breaking research on promising biotech and biopharma stocks with significant potential for outsized alpha. It is the fourth most subscribed to investment service offered through the Marketplace on SeekingAlpha.com. Our service offers a model-20 stock portfolio as well as the most active Live Chat on the Marketplace. This is where scores of seasoned biotech investors trade news and investment ideas back and forth throughout the trading day.

• • •

Specializing in profiling high beta sectors, Bret Jensen founded and also manages The Biotech Forum, The Insiders Forum, and the Busted IPO Forum model portfolios. Finding “gems” in the biotech and small-cap stock sectors, these highly volatile spaces proven hugely successful have empowered Bret Jensen's own investing portfolio.

• • •

Learn more about Bret Jensen's Marketplace Offerings:

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMRX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.