VOX: Why Communications Services Stocks Underperformed And How This May Change

Summary

- Select communications services stocks may offer a safer investment option amid rising inflation and slower economic growth in 2022.

- Communication services stocks underperformed the S&P 500 in 2022 due to factors such as the popularity of other safe havens and the underperformance of larger growth stocks.

- Many U.S.-based communications companies still have the potential to outperform, with some stocks offering 5+% dividend yields.

Urupong

Opportunity Overview

Select communications services stocks may be safer investments amid rising inflation and slower economic growth this year. In my last article, I noted how select international companies in emerging markets might be a safer bet in this environment, as these companies can grow more robust due to the lower penetration rates in certain frontier and emerging markets. However, many U.S. based companies may be able to outperform, and many of these stocks have 5+% dividend yields. The Vanguard Communication Services ETF (NYSEARCA:VOX) is also an interesting ETF to follow.

Wireless and broadband companies could be safe in this environment, as US consumers will not likely drop these services. Moreover, some of the more disruptive growth stocks could recover following their poor performance in 2022. Both of these factors could allow communications stocks to perform better in 2023 and 2024.

Statista projects that the US communication services industry will only have a 1.4% CAGR through 2028. Therefore, it seems best to focus on higher-yielding companies that will have stable growth this decade. Many of these companies will be increasing prices in 2023-2024, so growth will likely be driven by price increases rather than new customer acquisitions.

However, consumers may be more price sensitive in 2023, especially since many US consumers have had to take on record amounts of debt. Consumer debt rose to a record high of $16.9 trillion recently. Many US consumers are taking on debt to fund their lifestyles. Delinquencies in credit card, auto, and mortgage loans have also increased. Incentives, like the Affordable Connectivity Program, may help support the growth of communication services companies. However, consumers will likely still be under pressure and may be price sensitive to 2023 price increases. Communication services stocks have not performed very well, and earnings growth has been lacklustre in recent years. However, many of these stocks will likely outperform in the coming years.

Underperformance

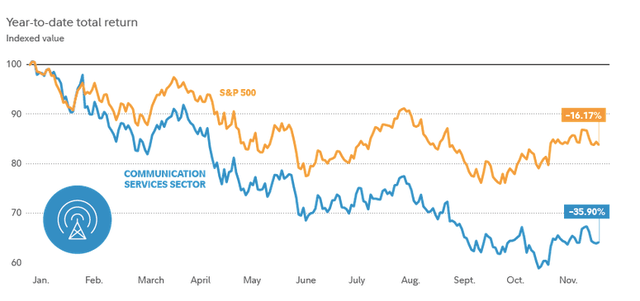

One investment area investors often turn to when global economic conditions become riskier is communication services. However, communication services stocks actually underperformed the S&P 500 in 2022. There are several factors that may have resulted in this underperformance.

Fidelity

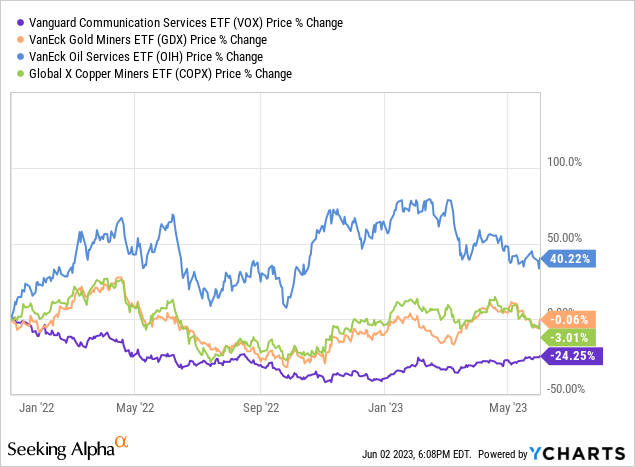

Other safe havens: Other safe havens have become popular in the last 1-2 years, as some investors are turning to commodities and other investments to beat inflation.

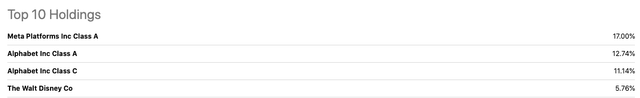

Larger Companies: Most communications services ETFs invest in larger growth stocks, which underperformed the S&P 500 in 2022. The Vanguard Communication Services ETF's top three holdings (in the chart below) significantly underperformed the S&P 500 in 2022. Companies like Meta and Alphabet only had modest revenue growth in Q1 2023.

On a longer timeline, this ETF has also underperformed many ETFs that investors commonly purchase when they are worried about the risk of a recession. Notably, utility stocks have been one of the top-performing sectors in the past decade, and some of these ETFs still have a modest 3-4% dividend yield.

Some of these ETFs could also be solid additions, as the Vanguard Communication Services ETF has historically underperformed other themes like utilities.

SA

If you are bearish on larger growth stocks, then it is also best to potentially shift to other ETFs. Meta Platforms (META), Alphabet (GOOG) and the Walt Disney Company (DIS) account for around 46% of this ETF's assets.

Other ETF Options

If you compare the Vanguard Communication Services ETF to other similar ETFs, most of the top holdings will be the same. This ETF, and other peers like the Fidelity MSCI Communication Services Index ETF (FCOM), both track the MSCI USA IMI Communication Services 25/50 Index.

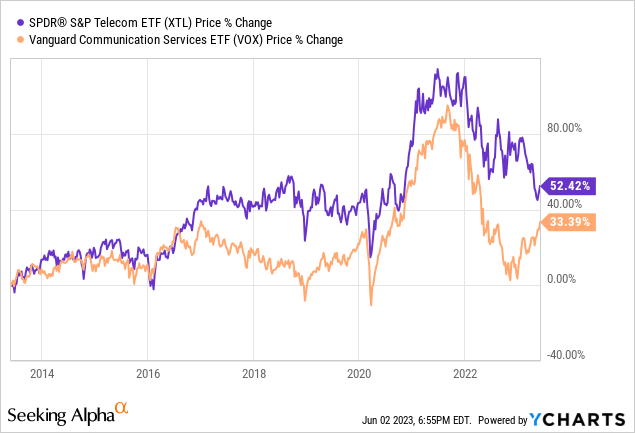

One relatively unique offering to consider is the SPDR S&P Telecom ETF (XTL).

SA

This ETF has outperformed the Vanguard Communication Services ETF during the past decade. This ETF also substantially outperformed following 2020, which is somewhat surprising since the Vanguard Communication Services ETF invested in a large number of leading growth stocks that performed well in this period.

Finding Yield and Value

All three previously mentioned telecom ETFs have a dividend yield below 1%, as they primarily invest in large, growth stocks with lower yields. This fact may deter some investors, who typically associate communication services with a conservative, high-yield investment that can be safer during an upcoming recession. There are a number of higher-yielding stocks that these ETFs invest in, but not all of them are top 10 holdings. Below are several Vanguard Communication Services ETF stocks with a relatively higher dividend yield. Some of these stocks are not in the top 10 holdings.

Stock | Dividend |

Verizon | 7.3% |

Cogent | 6.1% |

AT&T | 7.0% |

Comcast | 3.0% |

Source: Seeking Alpha

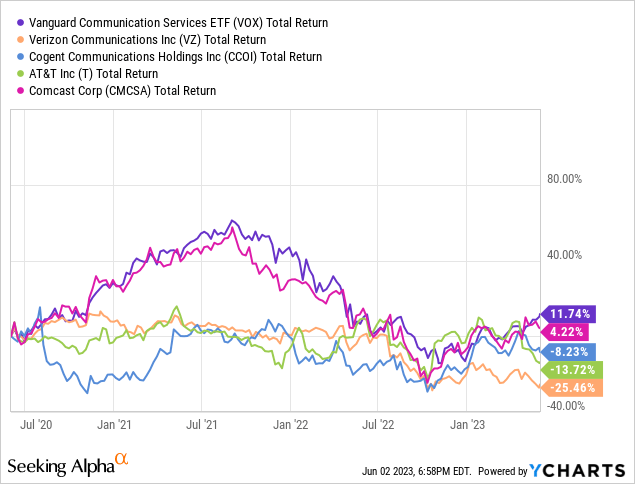

However, all of these stocks have underperformed the Vanguard Communication Services ETF in the past three years.

Stocks to Consider

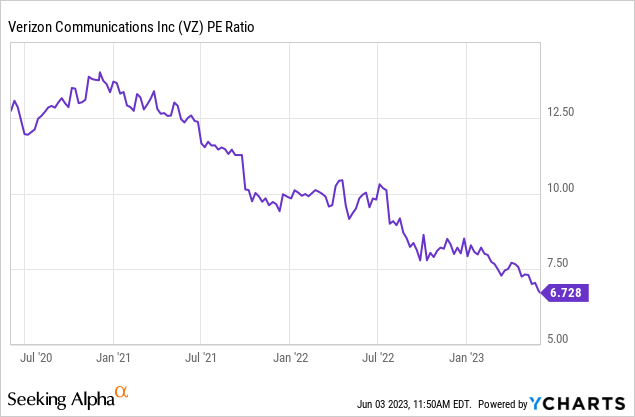

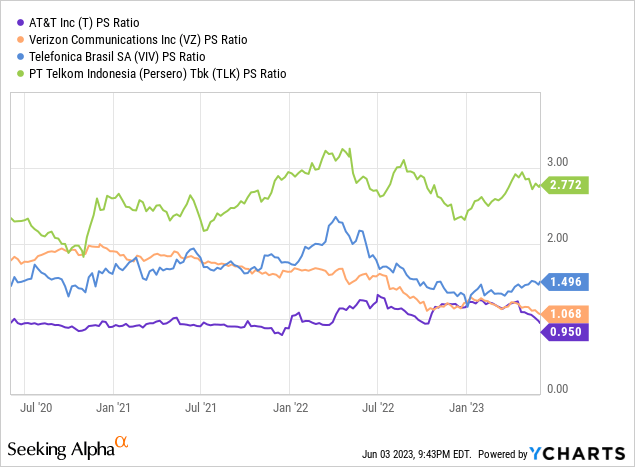

Betting on some of these higher yielding stocks, which are in the top 10 holdings, could be a solid, long term strategy. Verizon is an interesting pick. This stock has a circa 10% free cash flow yield now, even after its free cash flow declined by 27% in 2022. This stock's PS ratio also fell from a three-year high of 1.8x to around 1.1x now and trades at less than 7x earnings now.

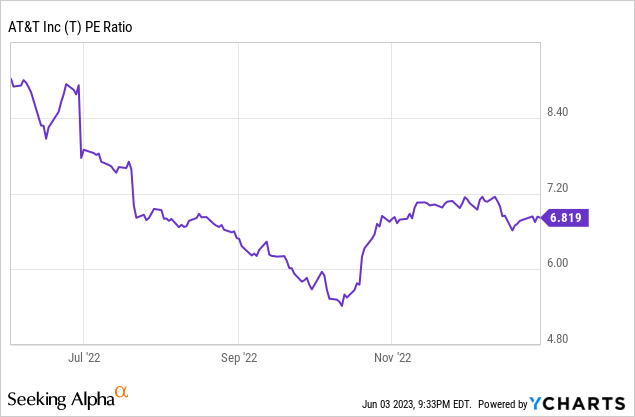

AT&T is also relatively attracted on a P/E and P/S basis (0.95x), but shares have come under pressure recently.

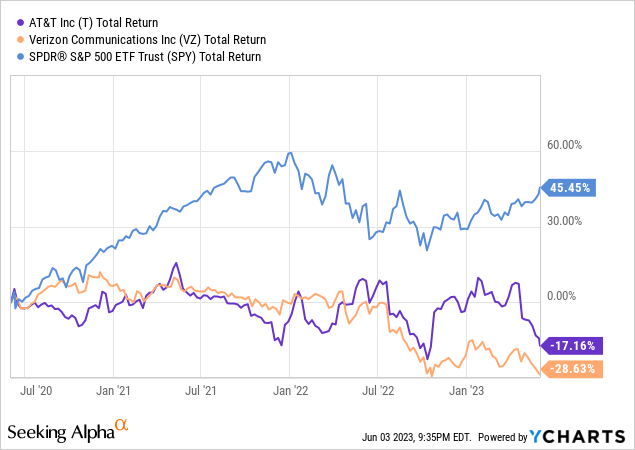

Traditional telecom companies like Verizon (VZ) and AT&T (T) may face pressure from a new plan by Amazon to offer mobile services to its prime customers. Both stocks declined by over 3% last Friday, while the S&P 500 rose by 1.4% due to positive news about the debt ceiling. These stocks could experience further selling pressure this year, even if it is only based on speculation.

Global Benchmarks

It is intriguing that stocks like AT&T and Verizon now trade at a discount to some emerging market telecom companies on a price/sales basis. One reason for this include the stronger growth prospects and higher market share that these EM companies have (39% and 59% market share).

Why I am waiting

Many other S&P or growth funds have some of the same top holdings, so this ETF does not offer that much diversification if you hold other index funds too. Some of the top growth names had relatively slower growth last quarter, and these stocks were extremely volatile in 2022.

The SPDR S&P Telecom ETF (XTL) may be a superior choice due to its diversified holdings and historical long-term underperformance. I may invest in this ETF if there is any additional selling pressure this year.

Emerging market telecom stocks are very intriguing because these companies typically have 30+% market shares and face less competition.

This is not a good ETF if you are interested in dividend income. Other telecom and utilities ETFs have higher dividend yields.

I think it makes more sense to look at some of the top 10-20 holdings of this ETF, such as Verizon or AT&T, and collect dividend income while waiting for industry sentiment to improve. Both of these companies still collectively control around 32% of the US cell phone market.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.