Deckers Outdoor: Strong Brand Portfolio, Sales Growth And Financials

Summary

- Deckers Outdoor has experienced strong financial performance with a CAGR of 13.77% in revenue and 35.2% in net income since 2018.

- The company's omnichannel distribution strategy and expansion into Asian and European markets have contributed to its success.

- Despite being relatively overvalued compared to peers, Deckers' attractive financial attributes may justify a premium for the stock, making it a potential buy.

champc

Thesis

Deckers Outdoor (NYSE:DECK) is a global manufacturer of outdoor and fashion-oriented footwear. The company maintains a popular, up-and-coming brand portfolio including UGG, HOKA, Teva, Sanuk, and Koolaburra. Over the past few years, both the HOKA and UGG brands are gaining increasing, widespread consumer attention in the outdoor/running and fashion footwear space respectively.

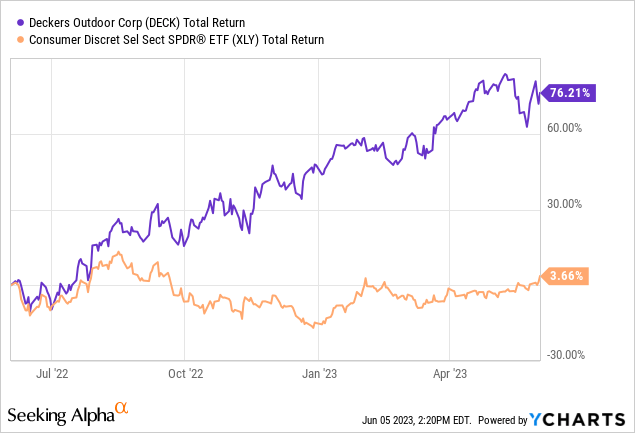

Following a few years of very strong financial performance, DECK's stock price has dramatically increased over the past year delivering an impressive +76.21% total return. Currently, DECK trades at $483 per share ($12.5B market cap), near all-time high levels of $503 per share and pays no dividend.

In this analysis, I will explore the company's impressive growth performance, examine its financial attributes and consider its valuation attractiveness as well.

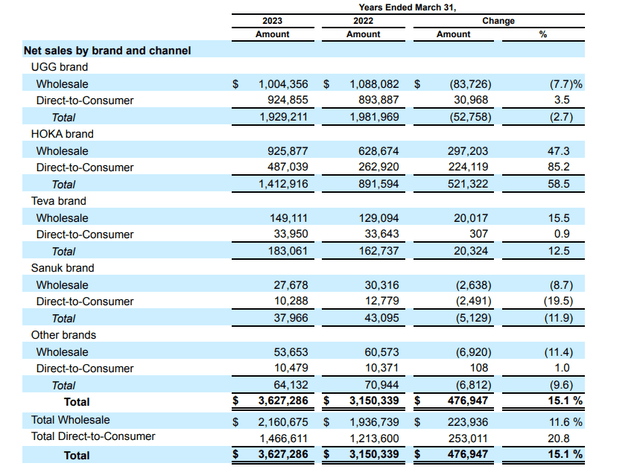

Q4 Results Positively Surprise, Again

For the fourth quarter and fiscal year that ended on March 31, 2023, Deckers was able to once again rubber-stamp its performance attractiveness, by delivering strong financial results. The company recorded high-double-digit growth on an annual basis for both sales and EPS. Gross margins also improved, while HOKA has established a leadership position among the company's brand portfolio, representing over 40% of total revenue. International sales continue to outpace domestic, proving to be a major growth driver along with the company's Direct-to-consumer distribution and marketing channel.

Strong Financial Performance

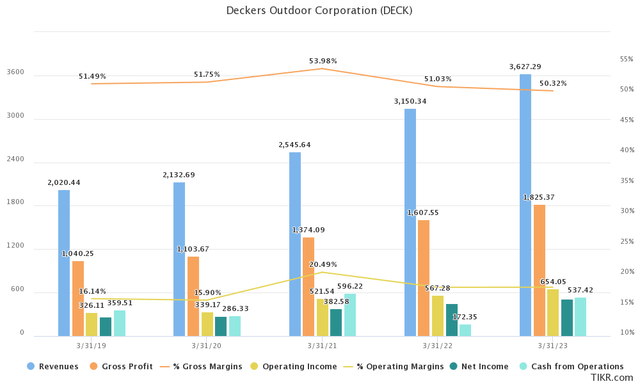

Over the past 5 years, Deckers has been consistently increasing its sales and earnings. More specifically, since 2018, Revenue has increased at a CAGR of 13.77%, Operating income at 20.59% and Net income at an even more impressive CAGR of 35.2%. The company has managed to significantly outperform both the sector and industry averages, reporting for the fiscal year that ended on March 2023, revenue of $3.63B, Gross profit of $1.83B, Operating income of $654M and Earnings of $517M (or EPS of $19.37).

In terms of profitability, DECK's 50.3% gross margin resembles that of a tech company and is without a doubt impressive for industry standards. An 18.0% EBIT and 14.3% Net margin also emphasize the strong profitability capacities of the business.

While Cash flow productivity from operating activities has been rather volatile over the past years, recently Cash from operations has increased to surpass net income. The company spends relatively low amounts in capital expenditure, while no debt has been issued over the past couple of years. Since Deckers pays no dividends excess cash has been strategically employed in share repurchases, amplifying shareholder returns. For the past couple of years, the company has directed over $300M annually to stock buybacks, reducing the common share count from 30.4M shares in 2018 to 26.2M in 2023. As of March 31, 2023, the aggregate remaining approved amount for the managements share repurchase program was $1.3B.

On the balance sheet side, Deckers maintains a $982M Cash & Equivalents balance as well as strong, 3.84x and 2.59x Current and Quick ratios that indicate ample liquidity for the business. Leverage is also very low (0.1 Long term debt/Total capital) adding little structural risk to the business as well. In fact, DECK shows a negative Net debt balance. Working capital changes were primarily induced, for the closed fiscal year, by increased purchases to support HOKA growth, a higher rate of collections and lower net trade payables.

Deckers has year after year delivered strong financial results that have extended optimism for the company well into the future. In fact, the company has beaten on EPS estimates for each of the past 5 years, showing strong momentum and the ability to capitalize on it.

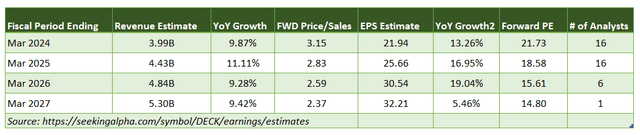

With all that in mind, it is easy to see how expectations regarding the company's future remain elevated today. Analysts expect revenue to grow at around a 10% CAGR in the mid-term, while EPS are forecasted to exceed sales growth performance, growing at mid-double-digits.

Omni-Channel Distribution Strategy

Besides brand quality and effective marketing, DECK has successfully implemented a modern omni-channel distribution strategy that has positively impacted financial results and seasonality trends. Management continues the expansion into the Asian and European markets by raising brand and product awareness. The direct-to-consumer distribution channel is growing compared to the Wholesale channel allowing the company to utilize a more cost-effective customer acquisition strategy. Currently, DTC sales account for over a third of total revenue.

Valuation Attractiveness

While the outdoor apparel market is large and competition is intense across the world, in this segment I will focus on a couple of Decker's competitors, namely Skechers (SKX) and Crocs (CROX), based on comparability.

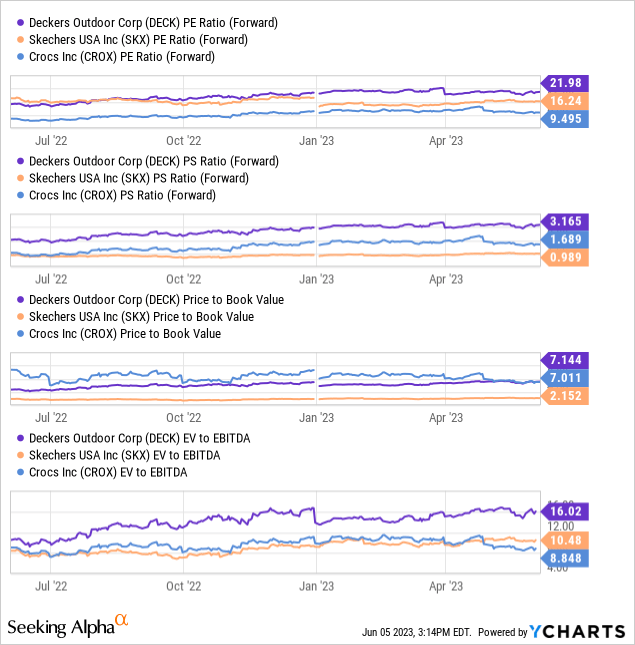

Compared to its peers, Deckers seems relatively overvalued. The company trades at a 22x forward P/E, a 3.2x forward P/S, 7.1x P/B and 16x EV/EBITDA multiples. While all four valuation multipliers are above the ones of Deckers' peers, still, they do not appear really exaggerated compared to market and sector averages. However, it is important to note that both Sketchers and Crocs also exhibit good growth attributes and, therefore, perhaps offer a more attractive valuation opportunity.

Final Thoughts

After all things are considered, Deckers Outdoor appears to be in a beneficial financial position, leveraging a strong brand portfolio for continuous sales and earnings growth, as well as a very efficient operating model for industry-leading profitability. While DECK's valuation metrics indicate that the stock is somewhat overvalued compared to its peers and industry averages, its attractive financial attributes probably justify a premium to be paid for the stock. For these reasons, and especially if a stock price pullback was to occur, I would rate DECK as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.