JHAA: A 'Drier-Powder' Double-Digit Yield Opportunity For The Rest Of The Year

Summary

- Nuveen Corporate Income 2023 Target Term is a Nuveen target term fund allocated mostly to BBB/BB-rated corporate bonds.

- JHAA is expected to terminate this December, which offers a potential opportunity given the fund continues to trade at a discount.

- Adding up all the fund's key performance drivers into December, we come up with a roughly 10% yield opportunity.

- JHAA offers investors a way to allocate to a low-volatility asset while earning a yield in excess of its risk profile.

- Given down-trending macro indicators and fairly tight credit spreads, JHAA allows investors to clip a high yield while building up a "drier-powder" position into 2024.

- I do much more than just articles at Systematic Income: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on May 30.

In this article we take a look at the Nuveen Corporate Income 2023 Target Term (NYSE:JHAA), which trades at a 2.7% discount and a 2.4% current yield.

On the face of it, these are not very appealing metrics given double-digit discounts and yields available elsewhere in the closed-end fund ("CEF") space. However, JHAA can be appealing for investors thinking about high all-in yield risk-adjusted returns and those who are looking to diversify their "drier-powder" allocation. By all-in yield, we mean not just the distribution rate but also additional performance factors such as underlying bond pull-to-par and the fund's discount amortization.

Quick Snapshot

Arguably, the most important feature for the purpose of this article is the fund's expected termination date around 1 Dec 2023. This feature is important when considering the economics of the fund for investors, particularly, the expected return over the rest of its life.

The fund is doing all the things that are indicative of a termination later this year. It has deleveraged fully, cut its distribution and moved up in quality. The fund used to be a higher-quality HY corporate bond fund and now it appears to have moved 40% of the portfolio into BBB-rated, i.e., investment-grade bonds. Nearly all holdings are due to mature over the coming year.

The very likely base case here is that the fund goes ahead and terminates, something which Nuveen has been doing with their target term CEFs (term CEFs, on the other hand, tend to either terminate or allow a tender at the NAV which is the same thing economically from a discount compression perspective).

For example, Nuveen has terminated the following target term CEFs in recent years:

- Nuveen High Income December 2018 Target Term Fund (JHA)

- Nuveen High Income December 2019 Target Term Fund (JHD)

- Nuveen High Income 2020 Target Term Fund (JHY)

- Nuveen Corporate Income November 2021 Target Term Fund (JHB).

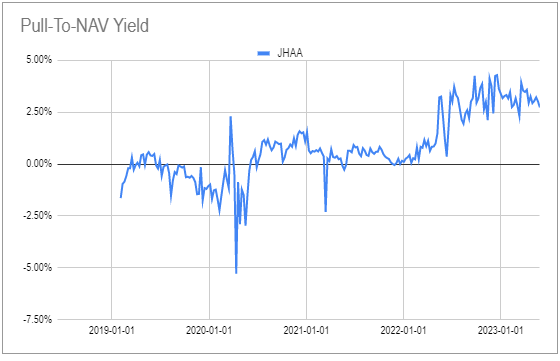

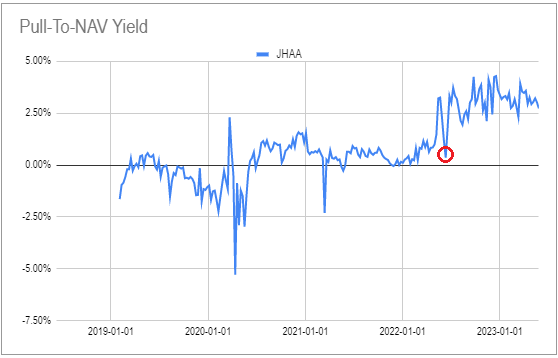

If we (fairly safely) assume JHAA is going to terminate like its previous sister funds, we should expect its 2.7% discount to move to zero around the termination date. This is the additional (non-annualized performance) we can expect relative to the fund's price. On an annualized basis, it's closer to 5%.

Systematic Income CEF Tool

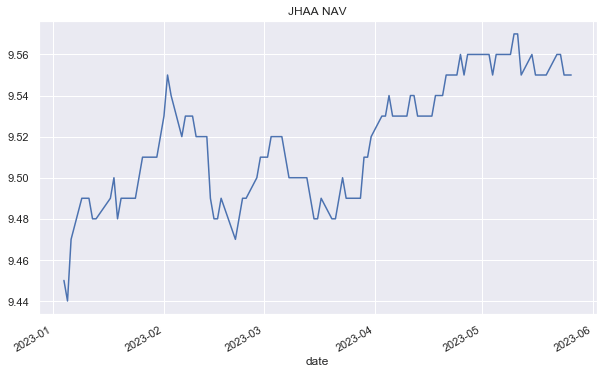

Many investors rightly worry about the possibility that a potential large negative drop in the NAV could swamp the positive contribution from discount amortization. This is unlikely for JHAA given the relatively high quality and low duration of its portfolio. The fund's NAV has been upward trending this year (primarily due to under-distribution) and very range-bound. The difference between the NAV high and low over the last 3 months is just 1%.

Systematic Income

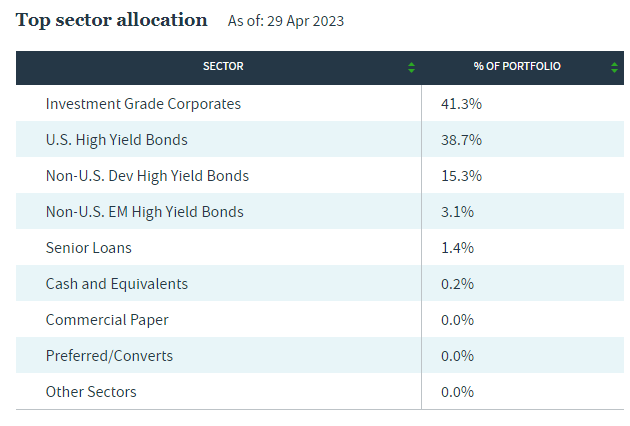

JHAA is allocated about 40% to investment-grade corporate bonds, with the rest in high-yield corporate bonds.

Nuveen

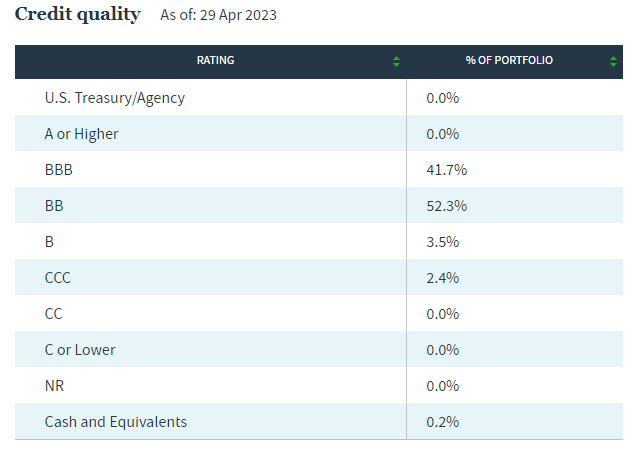

About 94% of its allocation is to bonds rated investment-grade or BB (the highest sub-investment grade rating bucket).

Nuveen

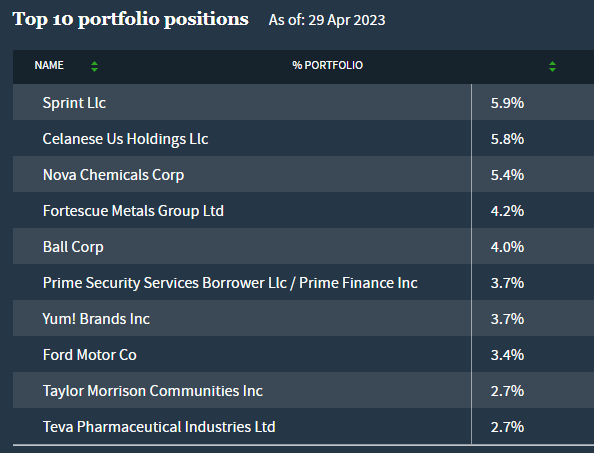

Top positions are mostly in North American companies, many of which are household names.

Nuveen

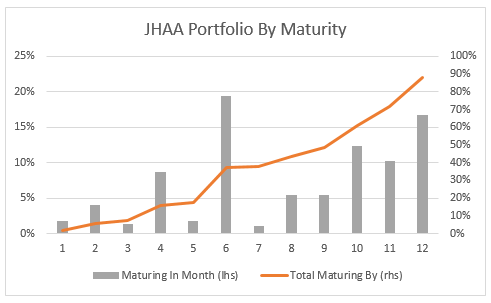

The chart below shows the maturity breakdown of its portfolio. We can see that about 90% of the portfolio is due to mature over the next 12 months and about half is due to mature prior to the fund's expected termination in December.

Systematic Income

The fund has recently deleveraged, as shown below, which reduces its volatility without significantly impacting its underlying yield.

Systematic Income CEF Tool

Getting To Grips With Yield

Getting a sense of the yield opportunity for a fund like JHAA is quite tricky. Here we break down the fund's drivers of yield and performance into its expected December termination. For this relatively short-term opportunity, the concepts of yield and performance are fungible concepts.

Arguably, the key contributor to the fund's overall yield is simply its portfolio yield, or the yield on the fund's underlying holdings. Many investors will look at the fund's unexciting 2.3% NAV yield and leave it at that. However, this is where a quick sense check will set investors on a more sensible course.

We know two things: the fund is basically composed of BBB-rated and BB-rated corporate bonds. We also know that bonds of this rating are yielding around 7.1% and 5.9%, respectively or conservatively 6.5%, keeping in mind that there is a handful of lower rated assets and that the yield curve is inverted (i.e., BB-rated 1Y bonds will tend to have a higher yield than BB-rated 5Y bonds).

If we take fund expenses of around 0.81% into account, we are left with a net yield of around 5.7%, again, fairly conservatively in our view.

The reason the fund’s distribution rate on NAV of 2.3% is not very representative of its actual portfolio yield is that it’s pretty much impossible to find a credit security that has a yield of 3% (i.e., 2.3% + fund fees).

Treasury Bills for the same maturity as the fund’s corporate bonds have yields of 5% and above. Maybe there are some short-dated AAA-rated corporate bonds with yields below 5% (perhaps some investors find it safer to hold near zero default risk corporate bonds than U.S. Treasuries where default remains a non-zero probability), but we would venture to say that there are no BBB/BB corporate bonds with yields below that of Treasury Bills, certainly not enough to fill an entire fund portfolio.

The fund’s monthly net income shows that it is earning a yield of around 3.4%, however, this looks to be understated (not just because it doesn’t pass the smell test) as it still seems to include the cost of leverage in the calculation despite the fact that the fund has no leverage.

For completists in the audience, another way to back into the portfolio yield is by looking at the portfolio's weighted-average coupon of 4.87%, the weighted average price of 99%, and the weighted-average maturity of around 0.8. This (the coupon and the pull to par) very roughly and conservatively gets us to 6-6.5% portfolio yield or about the same as our original 6.5% estimate.

Apart from portfolio yield and fund fees which make up the net yield, it's worth considering the fund's cash allocation which will grow over time as its corporate bonds mature. This will slightly reduce the fund's overall yield as maturing corporate bonds yielding 6-7% are rotated into Treasury Bills yielding 5-6%. The Fed does not appear inclined to take short-term rates lower but if there are changes in short-term rates it will be reflected in the fund's overall yield due to its growing cash position. Overall, the fund's yield will likely fall over time as its bond positions are rotated to Bills however this impact should be small, perhaps on the order of 1% annualized (roughly a 1% yield loss as half of the bond portfolio will mature prior to the expected termination date).

Discount compression is another key driver of the overall yield opportunity. The math here is fairly straightforward - a 2.7% discount compression to zero from today into the termination date or about 5% annualized. Obviously, investors who acquire the fund at a different discount will see a different performance.

Another factor to consider is the potential termination cost for the fund as it unwinds its portfolio. Some slippage from its marks is very likely however given the quality and short maturity of the assets, this slippage should be minimal.

Finally, it's important to consider any potential credit losses into termination. There are no assets trading below $95 (the bond trading at $95 is an investment-grade bond with a very low coupon which makes sense). This means we shouldn’t expect any drags from defaults.

Overall, if we consider all the key drivers of the fund's yield, we get to a roughly 10% annualized figure into its expected December termination date.

JHAA vs SHYG

A good question came up on the service - why does it make sense to hold JHAA over something like the iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) if both funds hold similar assets but JHAA has a much higher fee?

If we agree that JHAA termination is pretty close to 100%, then the key difference between the two comes down to 1) the discount and 2) the fee differential. If we look at this comparison with respect to the Dec-2023 termination date then JHAA gives you a 3% higher return but charges you around 0.5% higher fee. Net net JHAA is ahead by 2.5%.

Relative to SHYG, JHAA has a higher-quality and a shorter-maturity portfolio. The higher-quality aspect pushes the yield lower and the shorter-maturity aspect pushes yield higher (because the yield curve is inverted). Net net JHAA portfolio yield is likely a bit lower than that of SHYG, perhaps by 2-3%.

However, the JHAA portfolio is unlikely to have any losses whereas SHYG could have some losses. SHYG has 11% in bonds rated CCC while JHAA has 2%. These losses could offset the yield advantage of SHYG.

Where this leaves JHAA is that it has a yield roughly comparable to that of SHYG or even higher (once you take into account future losses in SHYG due to its 11% CCC allocation) with a higher-quality and shorter-duration portfolio.

Stance and Takeaways

A slowing economy, fairly tight credit spreads and uncertainty around the direction of longer-term Treasury yields makes a fund like JHAA fairly attractive in our view. Its high-quality, extremely short duration and high total yield makes it a great choice for investors looking to build up a drier-powder allocation without giving up on yield. The fund is very likely to terminate around December which, along with its underlying portfolio, should deliver a total yield of around 10%+.

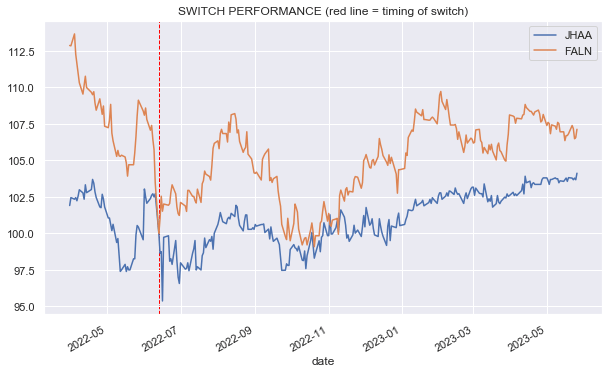

We held a position in JHAA for sometime over 2022, however, we opportunistically rotated into another fairly high-quality corporate fund iShares Fallen Angels USD Bond ETF (FALN) which holds primarily bonds that were recently downgraded from investment-grade. We rotated out of JHAA just when its discount moved very close to zero in the middle of last year.

Systematic Income CEF Tool

Since our rotation, FALN has outperformed JHAA as the following chart shows (both total return lines start at 100 on the switch date).

Systematic Income

However, if JHAA discount remains wide or pushes wider, we would look to reenter the position once again.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.