After Doubling, It's Time To Trim AMD Stock

Summary

- AMD stock has doubled since I purchased it near the 2022 bottom.

- The stock has probably gotten ahead of itself, but there is a reasonable case that can be made it's fairly valued here.

- I have decided to split my cyclical classification into two parts and sell half of my AMD position, treating the remaining half as a less-cyclical business.

- Looking for a helping hand in the market? Members of The Cyclical Investor’s Club get exclusive ideas and guidance to navigate any climate. Learn More »

Richard Drury

Introduction

I always like to start my articles, when I can, by reviewing any previous coverage I've had of a stock. In Advanced Micro Devices' (NASDAQ:AMD) case, I first covered it in a September 14th, 2022 article titled "Here's The Price I'll Start Buying AMD Stock". In that article, I explained my "Deep Cyclical" investing strategy and I shared the price at which I thought AMD stock 1) had a reasonable probability of hitting during a downcycle, and 2) would also be likely to produce market-beating returns over the medium-term of 3-5 years. This is from the conclusion of that article:

AMD stock peaked at a price of $164.46, which puts my first buy price at $57.56 per share, and my second, deeper buy price at $16.45 per share. As I noted above, these initial positions would be about a 1% portfolio weighting each. I have cash set aside right now that I would likely use for the first purchase, but if we do see that second buy price, I would likely raise cash from a combination of lower-beta and lower-quality positions in my portfolio that wouldn't offer the same sort of potential upside that AMD does.

My "buy prices", which are what I shared in the quote above, are often misinterpreted by readers as "price targets", so let me add some color here before I move on. Price targets are usually prices where sell-side analysts think a given stock has a high probability of reaching about 12 months into the future, give or take. Framed another way, analysts are saying there is something like a 75% chance a stock price will be near "X" price in roughly 12 months, where "X" is their price target. What I am sharing with my "buy prices" is more like "This is a price that at least has a 10-20% chance of hitting within the next 24 months, and if purchased at that price, is likely to produce far better than market average returns over the following 3-5 years."

In the case of AMD where I used two potential entry points instead of just one, usually the shallower entry point, in this case, $57.56 per share, has closer to a 50% chance of hitting, while the lower entry point of $16.45, is much lower, say, 10% chance or less, but should be kept in mind that it's possible during a bad recession because that sort of drop has happened in the past and could repeat.

Usually, the typical returns I aim for with this strategy are +100% to +150% return within 5 years.

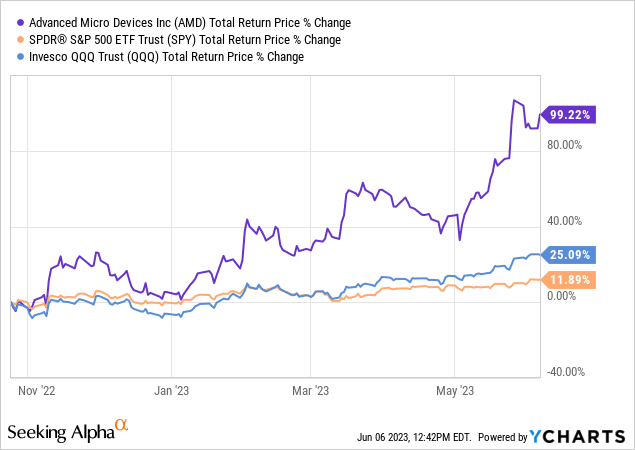

In the last week of October 2022, a little more than a month after I shared the price at which I would buy AMD, the stock hit my first buy price and I bought it. I then shared the purchase in my article "It's Time To Start Buying AMD (Even Though It's Probably Going Lower)" My aim of this purchase was for AMD, even if the stock fell further, to recover its old highs within 5 years and produce a 200% return. That's a CAGR of about 24% if it took the whole five years. Here is how the stock has performed since my buy article:

We are now up 100% in about 8 months' time, much faster than I would have expected and before the US has even experienced a recession. This is obviously more than 100% CAGR.

If it was the case that the economy had experienced a recession and AMD stock had risen 100% on the other side of it, then without a doubt, I would keep hanging on until it reached my 200% return goal. But we've had an unusual amount of optimism for the stock, at least half of which was based on A.I. enthusiasm or speculation. So far, the near-term prospects for earnings haven't improved much. Analysts still expect earnings to fall -19% this year.

I'm also pretty bearish on the overall macroeconomic set-up here, with rising interest rates, and student loan repayments set to pull money out of the US economy starting this fall. When a person gets half their expected 5-year return in 8 months, mostly based on speculation about the future, an investor needs to at least consider making some adjustments to the plan even though I'm pretty disciplined about following my plans, especially with this strategy. So I need to develop a new framework to follow if I'm going to deviate from the old one a bit. That's what I plan to share in this article.

My New Framework

Rather than wait until the end of the article to share what I plan to do, I'll state upfront that I sold half of my AMD position and I plan to hold the other half until at least 2024 when I can get a clearer read on the current downturn and where the future earnings base for the next upcycle is likely to settle at. Importantly, the idea of doing this isn't about "playing with the house's money" as another famous Cramer likes to say. That is not how I'm thinking about it, and usually not how I invest. In fact, I've written over 400 Seeking Alpha articles and I don't think I've ever written a "trim" article. Mostly because they can be muddled and it makes it hard to track the returns of a strategy in a public forum. I have a strong bias for clear, actionable ideas.

There are a couple of reasons I'm making an exception for AMD. One, is, of course, at least in the near term, the stock price might have gotten ahead of itself, and demand for its products from the economy. The recent run-up seems largely speculative to me. But the other reason is that AMD might genuinely have enough long-term secular growth behind it, that it becomes a less-cyclical business.

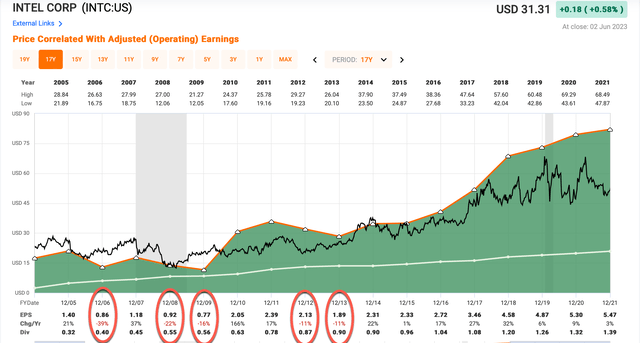

I have two main investing strategies that I write public articles about on Seeking Alpha. One of those is for deep cyclical businesses, and one is for businesses that are less cyclical (called the Full-Cycle Strategy). Semiconductor businesses are almost always deeply cyclical even if the cyclicality takes place within a larger secular growth uptrend. The one exception to this general rule was Intel (INTC) from 2002 to 2021.

I use historical earnings patterns to classify businesses as either Deep Cyclical or Less-Cyclical, and based on that I used different strategies to evaluate them. Intel had a good 20-year stretch where they were a moderately cyclical business, with EPS never falling more than -50% off its highs, so during this period it wasn't really a "Deep Cyclical" business and earnings could be used to value it with reasonable accuracy.

The simple story I have been considering the past year or two is that AMD has perhaps taken enough of Intel's business that it could become a "less-cyclical" semiconductor business, basically taking Intel's place. If that's the case, then we could use earnings to help guide a valuation for AMD, even though normally I would avoid doing so because historically AMD has indeed been a deep cyclical business when earnings fluctuate too much to make them a very useful valuation guide.

I don't think we have enough data to say this is the case for sure though, because we haven't even had a recession in the US, yet, and that is usually when a business's true earnings cyclicality is revealed. My solution is to add an additional AMD position, which I will treat as a "less cyclical" business, while also treating the other two potential positions (which I shared in my original article) as deep cyclicals.

So, the approximate 1% weighting I'm continuing to hold, starting in 2024 when I get a better read on earnings, I'll run an earnings valuation to determine whether to continue holding it or not. The 1% position I'm selling, will revert right back to the Deep Cyclical strategy, and because AMD hasn't reached a new high, yet, the buy price will once again be $57.56 per share for that portion of the money. Then, if there is a bad recession and AMD's earnings turn out to be just as deeply cyclical as they have historically and the bottom falls out of earnings, and the price craters, I will be willing to buy a third 1% position down below $20 per share. If some more time passes and inflation remains pretty high, I might adjust the lowest buy price up for inflation, but I'll decide that if and when the time comes. We aren't anywhere close to that point right now.

Current valuation for a "less-cyclical" AMD

Even though I'm committing to holding my remaining AMD position into 2024 so I can get more earnings clarity, I'm going to share in this section how I plan to value it. This valuation method will be a variation of my Full-Cycle strategy, but it will not include a mean reversion portion of the strategy. Basically what this strategy does is to estimate how much in earnings the owner of the business might be able to collect over the course of the next 10 years based on the earnings yield when purchased and the expected earnings growth over that time period.

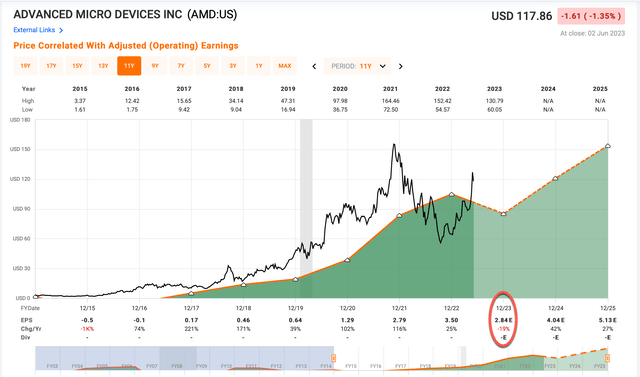

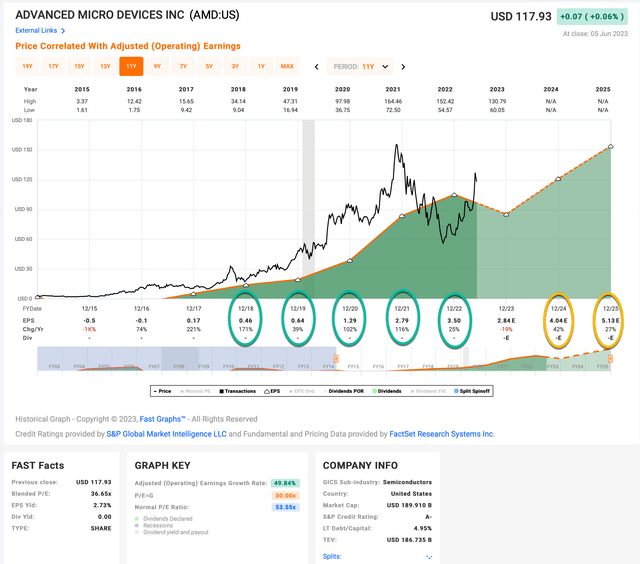

Usually, I base my earnings growth estimates on what the business has actually done over the course of the previous economic cycle, but we don't really have good data for that for AMD because it was a deeply cyclical business back then. More recently, as I think everyone knows, they have grown earnings at an extremely fast rate. This means I need to come up with my own earnings growth estimate. As a matter of principle and conservatism, I limit the maximum earnings growth assumption on the high end for this valuation technique at 20% earnings growth over a 10-year time period. The reason I do this is that it is extremely difficult for any business to actually grow earnings at a 20% CAGR for 10 years. In AMD's case, I am going to give them the benefit of the doubt and assume they can grow at that 20% rate on average for the next decade.

In the 5 years leading up to this year, AMD has grown earnings more than 20% per year. Analysts expect that after this year's downcycle, earnings will continue to grow more than 20% for the next couple of years. So, 20% seems like a reasonable estimate for the next upcycle, even if I consider it optimistic.

The next factor in this valuation estimate is important, which is the current earnings yield. 2023's earnings estimate is $2.84. If we use next year's it's $4.04. Personally, I think the next 18 months of earnings are a huge question mark and I don't think anyone really knows (which is why I'm just committing to holding until I see more information). But, if I was forced to make an estimate I would average these two expectations together, which produces $3.44 of EPS. At today's price, that corresponds to a P/E ratio of 36, and an earnings yield of +2.78%.

The goal here is simple: We want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today's prices and kept all of the earnings for ourselves. There are two main components of this: the first is the earnings yield and the second is the rate at which the earnings can be expected to grow. Let's start with the earnings yield (which is an inverted P/E ratio, so the Earnings/Price ratio). The current earnings yield is about +2.78%. The way I like to think about this is, if I bought the company's whole business right now for $100, I would earn $2.78 per year on my investment if earnings remained the same for the next 10 years. The next step is estimating the earnings growth, which I have already explained I will assume is 20%.

I'll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. The way I think about this is, if I bought AMD's whole business for $100, it would pay me back $2.78 plus +20% growth the first year, and that amount would grow at +20% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $186.65 including the original $100. When I plug that growth into a CAGR calculator, that translates to a +6.43% 10-year CAGR estimate for the expected business earnings returns.

When I'm only using business earnings to value a stock, my buy/sell/hold range is below a 5% CAGR is a sell, above a 9% CAGR is buy, and between a 5% and 9% CAGR is a hold. A 7% 10-year CAGR would be the midpoint of "fair value". Using these assumptions and this scale AMD stock looks slightly overvalued, but not enough to consider selling if the earnings estimate and growth rate are close to being correct.

Conclusion

I've done very well with AMD stock, essentially buying it right at the near-term bottom. Only investors who purchased it during the heart of the pandemic in early 2020 or sooner have done better with regard to total returns. Chances are the market is getting ahead of itself here, so I think if we assume AMD remains a deeply cyclical business (or even a deeply cyclical stock) taking some profits here makes sense. However, if we assume AMD is "the new Intel", at least for the next decade, it might indeed be one of the rare examples of a deep cyclical business that becomes more of a moderately cyclical one. This creates a danger for an investor who is selling here, that the stock price might not decline as much as it did in 2022 in the future. I honestly don't have a strong view of how this will turn out. I naturally have a strong bias that "this time is not different", because that mantra has served me well many times in the past, but there is some evidence that this time could actually be different.

Putting all this together, I'm splitting the difference, selling half my position, and treating the other half as a less-cyclical business with a strong secular growth tailwind.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor's Club. It's only $30/month, and it's where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.

This article was written by

My analysis focuses on the cyclical nature of individual companies and of markets in general. I've developed a unique approach to estimating the fair value of cyclical stocks, and that approach allows me to more accurately buy near the bottom of the cycle.

My academic background is in political science and I hold a Bachelor's Degree and a Master's Degree in political theory from Iowa State University. I was awarded a Graduate Research Excellence Award in 2015 for my research on conservatism.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.