VIXY: Time To Pounce On The VIX

Summary

- The S&P 500 Index rallied after the US government suspended its $31.4 trillion debt ceiling, leading to market calm and a drop in the CBOE Volatility Index.

- The sustained rally in the S&P 500 is justified due to downward inflation trends and improving market sentiment.

- Investors may benefit from a long-biased VIX trading strategy to provide uncorrelated returns to equity-heavy portfolios.

- We target buying the VIXY when the VIX is below 15 points. Based on our proprietary research, this level provides the optimal reward-to-risk for taking a long position on the VIX.

- We upgrade our rating on VIXY from "Hold" to "Buy".

EEI_Tony/iStock via Getty Images

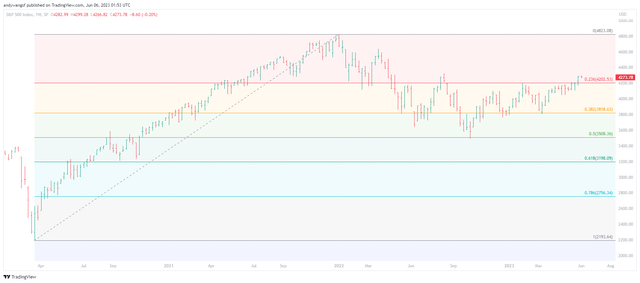

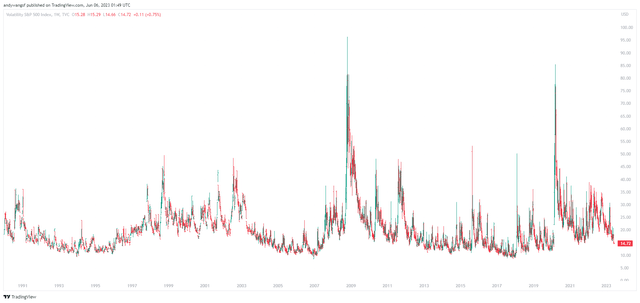

News that the House of Representatives and the Senate have passed legislation suspending the U.S. government's US$31.4 trillion debt ceiling, has led to a decisive rally that saw the S&P 500 Index (SP500) breach its critical 4,200 resistance level. Meanwhile, the renewed calm in the markets also saw the CBOE Volatility Index (VIX) falling below our long-held target entry level at the time of writing.

Readers who have been following our research on the VIX and have waited patiently for the VIX to fall under our entry target of 15 points, should take this opportunity to establish a long position on the VIX. Accordingly, we are upgrading our rating on the ProShares VIX Short-Term Futures ETF (BATS:VIXY) from "Hold" to a "Buy".

TradingView.com, Stratos Capital Partners TradingView.com

The S&P 500's sustained rebound since bottoming out in October 2022 continues to confound the die-hard bears, many of whom are desperately clinging to hopes that corporate earnings will eventually fall off a cliff or that inflation will reignite further monetary tightening by the U.S. Federal Reserve. From our perspective, however, we think that the sustained rally in the S&P 500 is justified given evidence that the economic landscape increasingly resembles that of a Goldilocks scenario.

Not only has inflation remained on a downward trend, but resilient private consumption has also helped to cushion the impact of higher interest rates on the rest of the economy. A fundamental shortage of housing in the U.S. also meant that high mortgage rates have barely dented national home prices. The latest reading on the S&P/Case-Shiller U.S. National Home Price Index shows that home prices nationwide are still up 0.6% year-on-year in March, far from the property market crash that many doomsayers were predicting in 2022.

Why Long VIXY In A Goldilocks Scenario?

To be clear, we maintain a bullish view on the S&P 500 and the index's decisive break above the 4,200 level means we will be working on a separate article to reiterate our bullish view and raise our price target for the S&P 500.

However, we are also cognizant of existing risks to the economy, which we believe will keep investors on edge as the stock market climbs a wall of worry. After all, the economy is still under pressure from tight monetary policy and the Fed has yet to pivot and normalise interest rates. Any indication of a potential resurgence in inflation (even transitory in nature), or rapidly cooling pockets of the economy, is likely to cause the market to overreact negatively. Furthermore, the sustained rally in the S&P 500 in recent weeks suggests to us that retail investors may be keen to take profits at the first sign of weakness.

Overall, we believe that the choppy nature of economic data as we begin to emerge from monetary policy tightening means we will see frequent bouts of volatility and moderate spikes in the VIX. Thus, our long volatility view is not entirely inconsistent with our bullish S&P 500 call. The bull market that began in October 2022 is likely to remain choppy in the coming months, but a bull market nonetheless.

Indeed, it may be beneficial for investors to overlay a long-only VIX trading strategy with their existing portfolio strategy. Provided that the VIX trading strategy has a positive expectancy and can generate decent risk-adjusted returns, overlaying it with one's portfolio should provide uncorrelated returns versus equities and enhance overall portfolio performance over time.

Many Ways To Long The VIX

The VIX is merely an index that tracks the prices of S&P 500 Futures (SPX) options in real time, it does not actually hold any of the options. The VIX also constantly changes the options which it tracks in order to maintain a constant maturity of 30 days. As such, it is technically not possible to buy or sell the VIX. So VIX futures were created by the CBOE in 2004 to allow traders to take a position on the VIX.

For most investors, the fuss-free approach to long the VIX is to buy the ProShares VIX Short-Term Futures ETF. According to fund information, the VIXY provides long exposure to the S&P 500 VIX Short-Term Futures Index, which measures the returns of a portfolio of monthly VIX futures contracts with a weighted average of one month to expiration. Thus, investors who are holding onto VIXY will not have to be concerned with having to roll over VIX futures positions every month in order to maintain their futures position.

This convenience of course comes at a cost. The VIXY has a relatively high expense ratio of 0.95%. However, given that such ETFs are only suitable for short-term trading and that the magnitude of potential returns is high, the high expense ratio should not be a dealbreaker.

In Conclusion

We believe that there is potential in trading the VIX profitably using a systematic approach. However, this would require that traders be highly selective in their entry points by only trading when the VIX is at extreme highs and lows. We target buying the VIXY when the VIX is below 15 points. Based on our proprietary research, this level provides the optimal reward-to-risk for taking a long position on the VIX.

The VIX has now fallen just below our target entry level of 15 points. Accordingly, we upgrade our rating on VIXY from "Hold" to a "Buy".

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VIXY, SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.