Enel Chile: Droughts In The Rear-View, All About PPAs

Summary

- ENIC benefits from secular factors supporting power-intensive Chilean Lithium and Copper industries as well as a more green-agenda friendly government.

- 25% of PPAs will start expiring in 2023-2025, could lead to pricing step-ups consistent with a more inflationary environment with higher supply risks.

- ENIC volumes continue to grow, and plentiful reservoirs mean they can sell stockpiled gas at 2022, pre-arranged prices.

- Indexation in PPAs should become more of a thing of the past, since it created such problems for performance over the COVID-19 and Ukraine War period.

- The company looks pretty cheap on a run-rate basis, and while there are some political risks, the full socialist agenda doesn't seem to be happening in Chile.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Leonardo Silveira

Enel Chile (NYSE:ENIC) is benefiting from the reservoir repletion as they can reduce exposure to more input-price sensitive CCGT assets. They are also benefiting from resilience in production as contract volumes and assets continue to mount with the help of secular, EV-facing industries despite coal retirement. PPA effects should also improve for the long-term starting meaningfully over the next two years to avoid pressures as we've seen the last couple of years in PPA margin. ENIC remains cheap on a run-rate basis, and being positioned for the socialist-led Green Agenda in Chile is a positive. While there are political risks, we think that they may be more limited than the market believes, especially as ENIC has moved away from some key regulated assets like transmission.

Q1 Thoughts

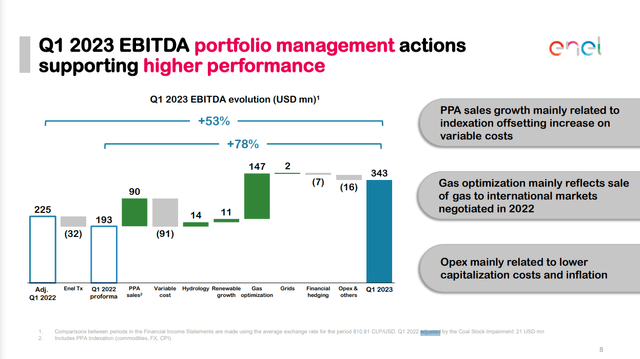

The Q1 mirrors what we've seen in the Q4 - higher EBITDA related to the stabilisation of conditions in the gas market, this quarter focused primarily on the availability once again of LNG, where ENIC had to rely on Argentinian natural gas almost solely last year. The increased optionality of inputs allows for optimisation and the sale of gas onto international markets at pre-arranged 2022 prices, making some commodity trading gains. All of this is possible only because hydrology conditions have improved with rainfall back to above-average levels.

EBITDA Evolution (Q1 2023 Pres)

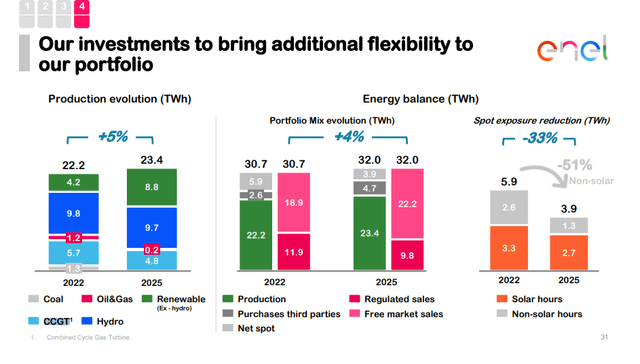

The longer-term gas strategy refers to the fact that ENIC is trying to reduce use of gas as an input. At the moment CCGT production is up, but only because of the shortfall in coal. Production is flat, with renewables mostly responsible for picking up the slack with double digit production growth a little below 20%. The Q1 effects better reflect run-rate conditions save the gas optimisation initiatives, and show that the ENIC multiple is really quite low at less than 5x in PE. Note that the Q1 2022 comp is not particularly weak, and the gas issues only really started in the middle of the year.

Asset Evolution (May Corporate Report 2023)

Bottom Line

After the sale of transmission assets, around 10% of EBITDA is coming from regulated utility assets, since ENIC still operates the distribution concession. This is not the best regulated utility to operate, since it can be the most affected by government initiatives to make power affordable, a risk with a more socialist government under Boric now controlling Chile. Consumer protection initiatives are generally likely if we were to see massive fluctuations in commodity prices again, or major supply side issues. Still, it does create exposure to initiatives to increase the basis for electrification, where the green-friendly government is likely to approve proposals to modernise the grid, and increase ENIC's RAB and help grow the distribution business EBITDA. Also, lower exposure to regulated utilities could be a reason for lessened government risk related to the Boric government and their potentially anti-business policies. While nationalisation isn't really a concern, because nationalisation is not appropriation, and could be a valid exit opportunity for some of ENIC's businesses, the amount of income coming from businesses that would be concerned with nationalisation risk is reduced now.

The rest is coming from classic power generation, and the situation should be pretty good. Chile is home to power-intensive industries like Copper and Lithium mining, and PPAs are going to be arranged with these businesses as the government makes these businesses of strategic importance and an important lever to increase Chilean prosperity. There are risks that foreign investment may be scared off by government ideas to nationalise Lithium, as Copper is already nationalised, but for ENIC it shouldn't be a problem since these assets are both going to have to develop to support the global green agenda.

On the PPA front, we also think things are likely to improve. 25% of PPAs are expiring these next two years which allows for new PPAs with better and more appropriate terms for the current environment. Hopefully PPA effects will be smoothed out in future quarters. Moreover, it could allow for a baseline step up in pricing, with supply concerns and supply security becoming more primary considerations for Chile, helped by a focus on wind and solar development, as well as hydropower always.

The PE is quite low at 5x, taking away commodity gain effects and focusing on the more fundamental economics. This should grow soundly with generation volumes, which now with the punctuated retirement of coal should return to growth. Political risks remain, but the aggressively socialist agenda didn't make it into the constitution, and the liberalism is more plain and less worrisome for international stock investors for now - although issues could return. Overall, ENIC seems reasonably compelling, but for our taste not appropriate anymore due to ongoing political risks, and less volatility-based opportunities around commodity prices.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.