GitLab: Bullish Outlook, Path To Breakeven

Summary

- GitLab's guidance for the rest of the year has been revised upwards, indicating positive prospects.

- The company is making progress but still burning free cash flow, with the expectation to achieve free cash flow breakeven next fiscal year.

- Despite the weak macro environment, GitLab's customer base grew by 43% year-over-year in fiscal Q1 2024, demonstrating a vibrant customer base and potential for growth.

- GitLab discussed AI. A Lot during its earnings call. As you'd expect.

- Deep Value Returns members get exclusive access to our real-world portfolio. See all our investments here »

Luis Alvarez/DigitalVision via Getty Images

Investment Thesis

GitLab (NASDAQ:GTLB) puts out a very strong report that sees the stock sizzle higher by 30% premarket.

The good news here is that its guidance for the rest of the year has been upwards revised. The bad news is that despite making substantial progress, the business is still burning free cash flow, including stock-based compensation added back.

All that being said, management makes the case that next fiscal year, GitLab will be free cash flow breakeven. Even though management had previously made the same assertion, I believe that the improvement in its cash flow profile this quarter provides more credence to that statement.

All in all, there's a lot to be bullish about here.

Why GitLab? Why Now?

GitLab is a platform that helps software development teams work together. It provides tools for managing code, tracking changes, and automating the process of building software. It simplifies collaboration among team members and streamlines the development process.

GitLab provides a complete DevSecOps platform that encompasses the entire software development lifecycle.

Incidentally, rewind the clock two quarters, and GitLab's co-founder and CEO Sid Sijbrandij mentioned AI zero times. Similarly, GitLab's 10-K (the annual report) also mentioned AI zero times. Then, in fiscal Q4 2023, Sijbrandij mentions AI 9 times in his prepared remarks. And yesterday, Sijbrandij's prepared remarks mentioned AI more than 20 times.

Indeed, the earnings call opens up with Sijbrandij's comment:

AI represents a major shift for our industry. It fundamentally changes the way that software is developed, and we believe it will accelerate our ability to help organizations make software faster.

And in an effort to allay some of the concerns that investors have had with the potential impact that AI could reduce the need for developers, this is what Sijbrandij went on to say,

As these developers become more productive, we see software becoming less expensive to create. We believe this will fuel demand for even more software. More developers will be needed to meet this additional demand.

Furthermore, if you've read my work before you'll have seen me say that one should focus on the customer adoption curve, as this provides the best insight into the health and prospects of the company.

In fiscal Q1 2024, base customers increased by 43% y/y to 7,406. This customer growth rate was slightly lower than last year's 64% y/y, but clearly fast enough to show a vibrant customer base.

What's more, given the weak macro environment, I believe anything higher than 20% y/y growth in customers and the business can be viewed as still thriving. Hence, on this criterion, GitLab is thriving.

Next, we'll discuss some positive and negative aspects of this investment.

Revenue Growth Rates Upwards Revised

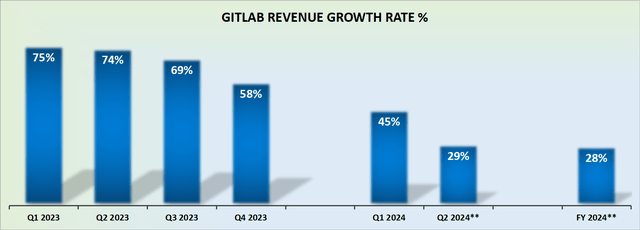

As we headed into the earnings print, investors were expecting to see GitLab's revenue growth rates reporting around 35% y/y revenue growth rates. Obviously, investors wanted to be left positively surprised, and the greater the beat the better.

But investors were not expecting to see GitLab report 45% y/y growth rates. This fiscal Q1 2024 result, when taken together with the full-year raise, suddenly changes the narrative around GitLab.

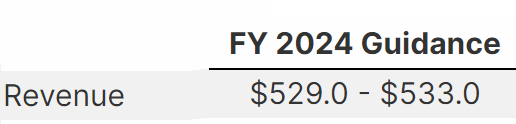

Let's rewind the clock momentarily in order to gain some perspective. At the end of fiscal Q4 2023 (last quarter), this was the guidance offered at the time:

GLAB Q4 2023

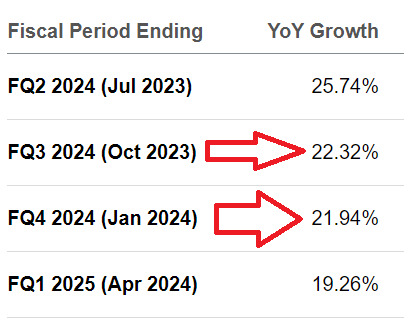

Gitlab was expected to report around 26% y/y revenue growth rates this year. Naturally, this suggested to analysts that they should expect GitLab's revenue growth rates to be decelerating, see below.

SA Premium

However, given the size of the outperformance seen in fiscal Q1 2023, suddenly these growth rates with the red arrows against them look rather timid.

Consequently, in the coming days, I fully expect that analysts will be busy upwards revising their financial models.

Next, we'll turn our focus to discussing GitLab's profitability profile.

Profitability Profile

One consideration that has been weighing down GitLab has been its profitability profile. Narrative aside, the business is clearly unprofitable.

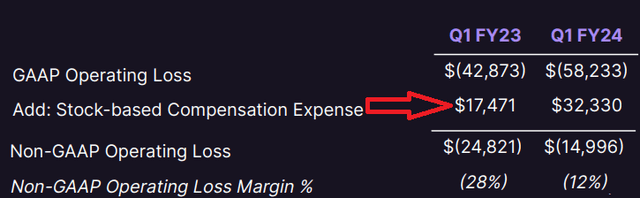

That being said, its heavily adjusted non-GAAP profitability margin does appear to be moving in the right direction, slowly.

Does it matter that management's SBC is up 85% y/y, while revenues only grew by approximately half this figure? Given that the stock is up significantly premarket, I don't believe that investors will be overly perturbed by this matter. At least for now.

Moving on, at the time of its prior results, fiscal Q4 2023, the guidance for underlying profitability this year pointed to negative $0.24 of non-GAAP EPS at the high end.

Now, on the back of its fiscal Q1 2024 results, the full-year guidance points to negative $0.14 at the high end. A significant improvement. Therefore, given this pace of improvement, it looks increasingly possible for GitLab to reach non-GAAP profitability at some point next fiscal year.

This would be a dramatic change relative to investors' expectations headed into the earnings result yesterday.

The Bottom Line

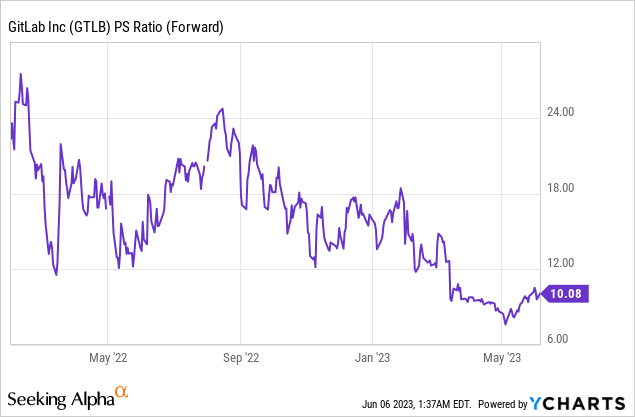

I don't believe that GitLab is particularly cheaply priced at about 13x forward sales. That being said management stated on the call that:

From a free cash flow breakeven perspective, we committed to be free cash flow breakeven in FY 2025. And we've also stated some of the actions that we've taken previously will accelerate our path to profitability, but haven't given a specific timeline on that.

So, it's not so much that the stock is trading at a bargain price. I believe that investors are simply content that the likelihood that GitLab reaches breakeven next year starts to look increasingly likely.

In sum, there's a lot to like here, there's a strong top-line beat, improving profitability, and a share price that has been washed out of a lot of enthusiasm.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.