Leidos Stock: A Buy After A 16% Plunge?

Summary

- Leidos stock plunged post-earnings on weak results driven by supply chain challenges.

- The company was overvalued late last year.

- The sell-off has created an opportunity for Leidos stock as an upside, driven by fundamentals exists.

- Looking for a portfolio of ideas like this one? Members of The Aerospace Forum get exclusive access to our subscriber-only portfolios. Learn More »

JHVEPhoto/iStock Editorial via Getty Images

Leidos (NYSE:LDOS) stock plunged 16% following the release of its first quarter results. Recently, the stock was marked overweight at Wells Fargo Securities. In this report, I will have a look at whether I think that is justified or not.

Leidos Stock Price Is Struggling For Years

When I heard about the stock price falling post-earnings, my initial thought was that perhaps the stock had a big run up following the invasion of Ukraine which set the stock prices of many defense contractors significantly higher. And perhaps with supply chain issues becoming evident in the results, those valuations now appeared stretched and justified a sell-off. However, the story of Leidos seems different. From its lows in 2019, the company stock price surged only to be brought down by the pandemic and from there the stock has traded in a $75-$115 range. You would have made more money riding the waves and would have made little to no money just holding the stock. In that sense, Leidos is very different from other defense contractors. The company simply did not have the stock price boom we saw with other defense contractors. An unexpected CEO change might also not have helped the company at all.

Weak Q1 Performance For Leidos

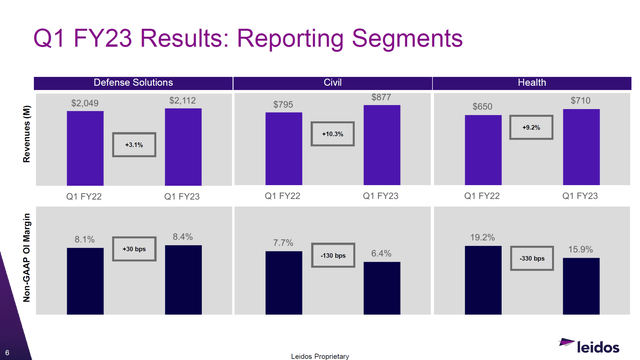

Q1 was just overall a weak quarter for Leidos. Revenues grew 6%, but its adjusted EBITDA declined nearly 3.5% and its earnings per share contracted by 7%, missing the consensus by $0.12. So, those are the clear ingredients for the stock price decline. Defense Solutions saw a 3% revenue increase with adjusted operating income improving by 6.6%. So, Defense Solutions wasn't the paint point and the company expects that it will benefit from a normalization in Defense contract awards.

The civil and health businesses really are what ruined the quarter for Leidos. Civil revenues grew 10.3%, but its earnings declined 8.2%. This was driven by supply chain challenges that triggered penalties and some delays not attributable to Leidos as customers were not ready to take delivery of equipment. Coupled with continued investments that drove down the margins on the Civil side. The Health segment saw revenues increase 9.2% but profits declined almost 10%, which reflected ramp up of new programs. So, overall the results, except for the Defense segment, were weak but also reflected continued investments in the company to serve customers better.

Is Leidos Stock A Buy or Sell?

Looking at the results, I am not fully surprised that the stock sold off as many investors might have had the impression that this stock is not going anywhere, just like it hasn't really moved in a desired direction for over two years now. It's simply not in the investor's nature to keep holding onto a name that doesn't have a great stock price chart and also faces challenges in operating the business.

Seeking Alpha Premium

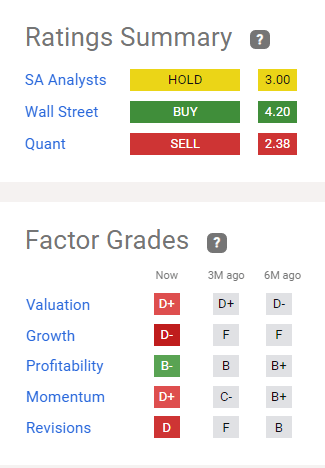

However, the big question is whether a 16% sell-off is justified. One thing is clear and that is that the stock has not rebounded, so there is not a lot of positive momentum for the stock. We also see that the Quant rating is a sell from a prior hold while Seeking Alpha analysts have a hold rating and Wall Street has a buy rating with a $105.69 average price target indicating 31% upside.

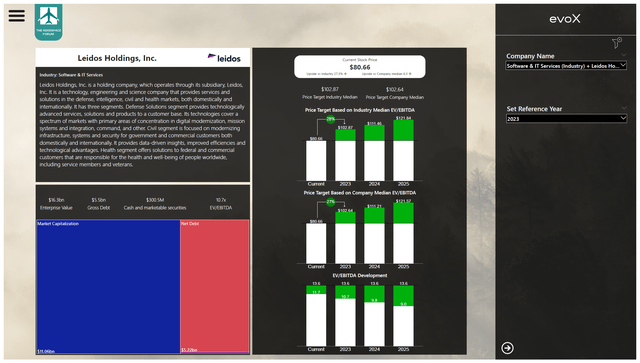

Before I started putting the numbers for Leidos into the model available for subscribers of The Aerospace Forum to calculate the implied share price for Leidos, I expected that I would most likely be rating this a hold. The reality, however, is different. Overall, the enterprise value is expected to be roughly the same with an improvement in EBITDA driving the EV/EBITDA down and creating more upside for the stock. However, what should be pointed out is that strong EBITDA performance is going to be key. A sensitivity analysis showed that a shortfall of 5% in EBITDA and FCF will negatively impact the upside by 7 percentage points. So, execution is going to be key. My price target for the stock is not as high as the Wall Street analyst consensus of $105.69, it does fetch quite well with the Wells Fargo Securities target for Leidos which is $102.

Conclusion: Sell Off Created An Entry Point For Leidos Stock

Leidos's most recent performance was not great, so I somewhat do understand the stock selling off, especially given that it has failed to generate solid gains for investors when viewed over the longer-term. But this is also driven by the pandemic after which the stock has yo-yoed in a $75-$115 range. What has not helped the stock holding more firm is the fact that its dividend is quite low with the company's strategy not pointing at significant chances for annual increases. The post-earnings sell-off in my view has created a buying opportunity, absent that sell-off, the stock would have significantly lower upside and in October 2022 actually entered overvalued territory. So, in some way the market has started to value the company more in line with its fundamentals from December to February, but the market turmoil we saw this year plus the post-earnings sell-off was too steep. With Leidos failing to generate higher stock prices for years, the big question will be whether the market sees the upside in the stock as well.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.