ON Semiconductor: Revenue Growth Decelerated, But I Like The Valuation

Summary

- ON Semiconductor has demonstrated impressive revenue growth and expanding profitability over the last decade, making it an attractive investment opportunity.

- The company is well-positioned to benefit from the shift to electric vehicles and increased industrial digitalization, with strong relationships with automotive giants.

- Despite potential risks such as economic downturns and geopolitical tensions, ON stock is undervalued and offers significant upside potential.

crstrbrt

Investment thesis

Like most semiconductor stocks this year, ON Semiconductor (NASDAQ:ON) delivered a massive year-to-date rally. The company faces headwinds that adversely affect revenue growth. But I think that challenges are temporary and not secular for ON. Moreover, the company's balance sheet is strong enough to endure headwinds. The stock is significantly undervalued, and I believe the upside potential outweighs the potential risks.

Company information

The company supplies power semiconductors and sensors for multiple industries, including automotive, communication, and consumer electronics. ON operates under the "onsemi" brand name.

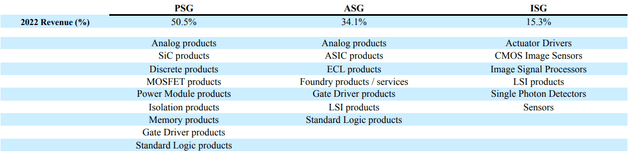

The company's fiscal year ends on December 31. ON's business is organized into three operating and reportable segments: Power Solutions Group [PSG], Advanced Solutions Group [ASG], and Intelligent Sensing Group [ISG]. About half of the company's sales are represented by PSG.

ON's latest 10-K report

Financials

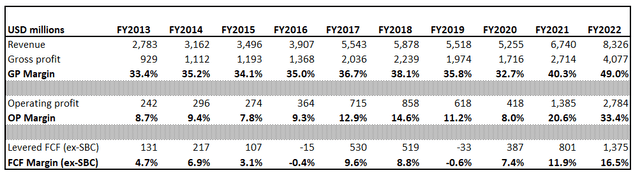

ON demonstrated impressive revenue growth over the last decade. But what I like even more, as a potential investor, is massively expanding profitability. In the below table, you can see that profitability improved significantly. I consider solidly expanding margins as a bullish long-term sign, meaning that the management has effectively absorbed the growth.

Author's calculations

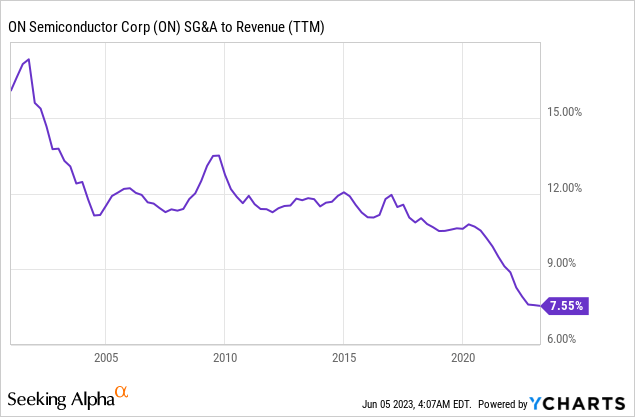

I want to underline here that the operating profit margin expanded almost four-fold over the decade. It was achieved by strong control over SG&A. The company has been constantly working on decreasing SG&A's share of revenues, and in the below chart, you can see that the management's efforts paid off.

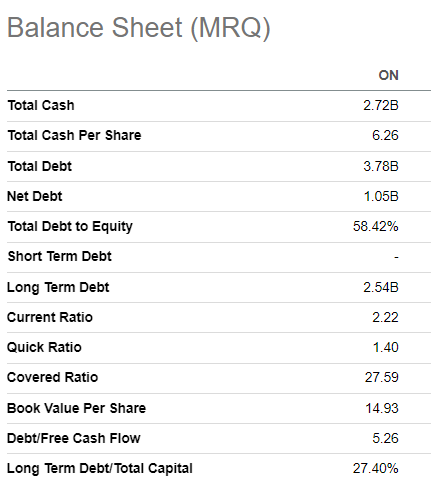

With such strong performance and profitability expansion, the company managed to build a fortress balance sheet with solid liquidity and relatively conservative leverage metrics.

Seeking Alpha

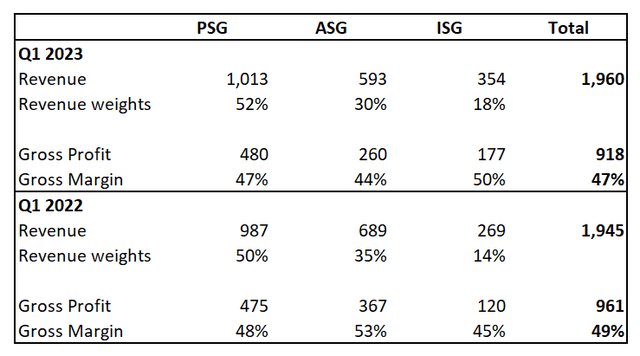

Now let me narrow down to the latest quarter. Earnings were released on May 1, and they were above consensus both in terms of revenue and adjusted EPS. The company's revenue was almost flat and declined slightly sequentially, which might be a red flag, so let me dig down deeper to the latest 10-Q. As we can see from the below breakdown, the company demonstrated YoY revenue growth in PSG and ISG segments. The growth has been almost fully offset by softening revenue in the ASG segment.

Author's calculations

Gross margin shrank YoY, but I consider it fair in the current challenging environment and do not think it is a secular trend. What I like is an impressive 32% revenue growth for the company's emerging ISG segment. ISG contains image sensors mostly aimed at the automotive industry, especially necessary for electronic systems like cameras and robots. I think this segment is well-positioned to benefit from the secular shift to electric vehicles [EV] with major EV automakers aiming to achieve self-driving levels. I consider this niche as a "blue ocean" for ON, where the company is a leader. The company has a strong advantage in this segment with a staggering 50% gross margin, which demonstrated a five percentage points expansion YoY.

I also see the other two segments benefit from the secular shift to EVs and more industrial digitalization as well. According to the latest earnings call, automotive and industrial accounted for 79% of total revenue, as compared to 65% in the quarter a year ago. I consider this as strong evidence that the management is taking the right steps in improving and diversifying the product mix. The company has strong recognition in the automotive industry with strong relationships with automotive giants like Hyundai Motor (OTCPK:HYMLF) and BMW (OTCPK:BMWYY).

Apart from long-term multibillion agreements with automotive giants, recently the company signed a 10-year long-term supply agreement with Vitesco Technologies. The agreement worth is about $2 billion, which is significant for the company.

Valuation

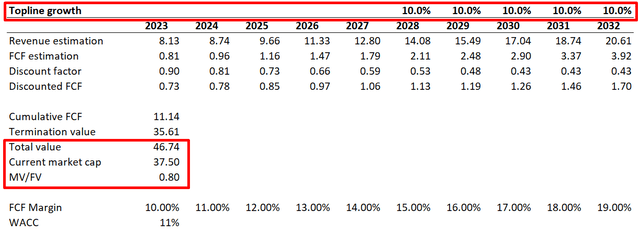

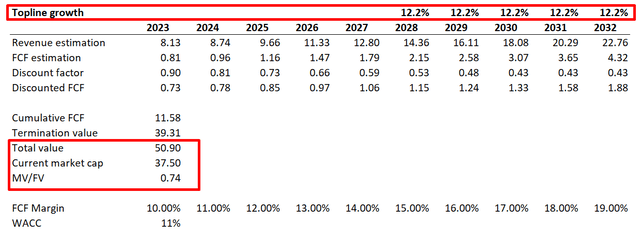

I use discounted cash flow [DCF] approach for ON valuation analysis. I round up the company's WACC to 11%, based on the estimation provided by Gurufocus. Seeking Alpha provides consensus revenue estimates up to FY 2027. For years beyond FY 2027, I have implemented a 10% revenue CAGR. I think it is conservative given the expected semiconductor industry long-term CAGR of 12.2%. I use a relatively conservative 10% FCF margin for FY 2023, and I expect it to expand by one percentage point yearly.

Author's calculations

Under conservative assumptions, the stock is substantially undervalued, according to my calculations. I would also like to simulate a more optimistic scenario with revenue growth equal to the overall industry expected pace of 12.2%. If it is the case, the stock is even more undervalued with about 50% upside potential from current levels.

Author's calculations

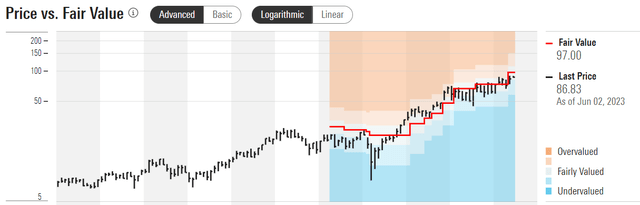

According to Morningstar Premium, the stock's fair value is $97. Historically, the stock has been trading in line with the range considered fair by Morningstar analysts, which you can see in the chart below.

Morningstar Premium

Risks to consider

The general economic downturn is the primary risk for ON, in my opinion. The semiconductor industry is inherently cyclical, meaning the companies' earnings from this business are vulnerable to adverse changes in the broader environment. On the other hand, ON looks hedged against cyclicality with analog chips and sensors, which serve more mission-critical applications, according to William Kerwin from Morningstar.

Also, being a company providing cutting-edge technologies together with fierce competition in the semiconductor industry means the company faces high risks of technology obsolescence. Customers are highly likely to switch to competitors' products in case ON's products become inferior compared to other industry offerings. This will lead to a market share loss, ultimately resulting in a sharp decline in earnings.

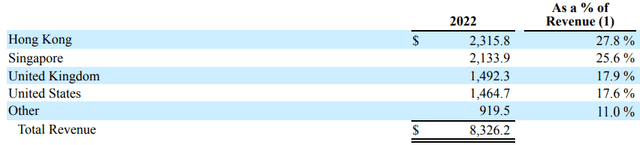

The company generates only 18% of its revenues in the U.S., meaning ON's financials are highly vulnerable to adverse changes in foreign exchange rates.

ON's latest 10-K report

Generating more than 80% of its sales outside the U.S. also means the company is vulnerable to geopolitical tensions and changes in international trade regulations.

Bottom line

To conclude, despite decelerated revenue due to temporary headwinds, I believe that the stock is a buy. The management has a solid track record of success and improving profitability which gives me high conviction about my valuation analysis. Under relatively conservative assumptions, the DCF analysis suggests an attractive double-digit upside potential. I believe it outweighs the potential risks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ON over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.