WEG Stock: A High-Priced Opportunity That Should Pay Off

Summary

- WEG S.A. is a Brazilian electric motor powerhouse, with solid fundamentals and moderate growth potential, despite trading at valuation multiples of 35 times its earnings.

- The company has doubled its net income over the last five years and has a robust cash generation, with virtually no debt, due to its global diversification of revenue.

- Investors should consider WEG for long-term growth but be aware of potential short-term bumps in earnings growth that could negatively impact the share price.

onuma Inthapong

WEG S.A. (OTCPK:WEGZY) is a multinational Brazilian company that has grown enormously over the past decades and is still family-owned, with about 65% of the shares in the hands of the three founding families. However, it meets all the requirements of a company with solid fundamentals: a reliable brand, highly profitable and efficient operations, and a global scale delivering added value to its shareholders.

Weg is a global company focused on electro-electronic equipment with a reference position in energy efficiency. In my vision, it is one of the Brazilian companies publicly listed with more solid fundamentals and ample growth potential, especially in the energy sector.

Although it is complicated to say that investing in Weg S.A. is a bargain, considering that the company trades at valuation multiples of 35 times its earnings, investing in Weg on a long-term approach based on its profitability growth trend could lead investors to find alpha.

Weg has been delivering solid results

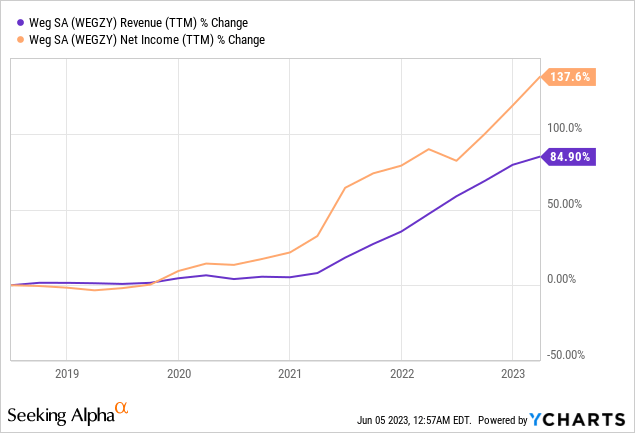

Each quarter, Weg has proven to be a high-quality growth company. The company has doubled its net income over the last five years as well as nearly doubled its revenues.

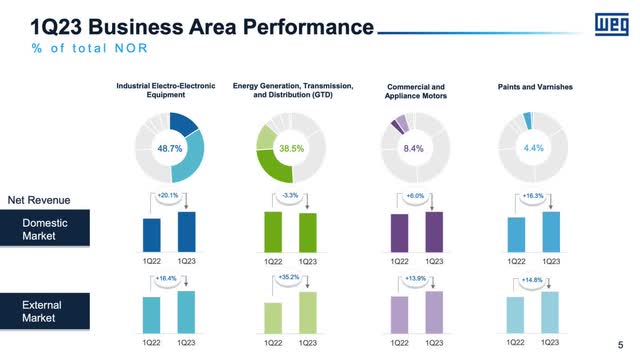

In Q1 2023, Weg reported a 12.7% YoY increase in net operating revenues totaling R$ 7.69 billion (consider 1BRL = 0.20 USD at the time of writing), in line with strong demand in the foreign market segments that rose 20.3%, mainly due to good order in the industrial electro-electronic equipment business. Power generation, transmission, and distribution (GTD) also showed consistently good revenue growth in North America.

Although more timid, growth in the domestic market (in Brazil) of 5% came on the back of national demand for oil and gas, cellulose, and mining reflected in revenues from low-voltage electric motors and automation components. The exception came from the solar energy business, which had a drop in revenues due to changes in national legislation earlier this year.

Another highlight was the growth of Return on Invested Capital (ROIC), where Weg reached 31.4% in the last quarter, an increase of almost 2% compared to the previous period last year. That shows that the company has been improving its profitability mainly through the rise in its revenues and a well-conducted policy of capital allocation.

We are considering that Weg is still in a phase of growth and expansion of its business. In this case, we can observe that the EBITDA can be a good indicator to follow the company's operational performance.

Weg also reported an EBITDA growth of 37% YoY in the most recent quarter. Due to various factors, this significant rise is justified by stabilizing the costs of the primary raw materials and normalizing the global supply chain, such as ocean freight costs. Therefore, Weg's earnings increased by 3% for every 1% rise in revenue.

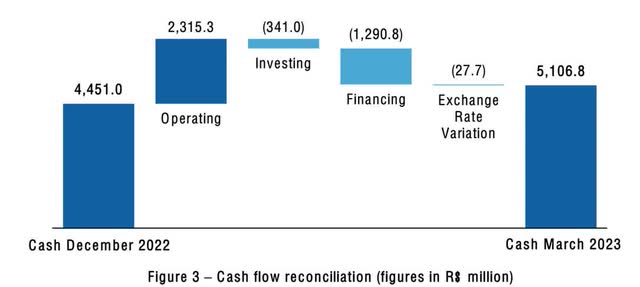

Regarding cash flows, it looks robust as Weg currently has R$5.1 billion in cash on hand. Last quarter, the company generated R$2.31 billion, allocating R$341 million to investments and R$1,290 million to financing.

Even with Weg's debt increasing by R$636.5 million in the last quarter, the company still increased its cash and equivalents reserve by 13%, and with this, the company decided to pay R$1,301 million in dividends and equity interest.

Forward growth paths

The latest results reported by Weg pointed to a growth scenario less cloudy and higher than expected, mainly due to the stabilization of raw materials. This should be key for Weg to resume its growth, especially in the foreign market. With this, Weg is estimated to grow earnings by about 33% and revenues by 18% in 2023.

This year, in North America, where 26% of Weg's business is located, the company should face a more favorable scenario, given the buoyant business demand versus last year reinforced in the previous quarter, especially by the growth of 34% in Transmission and Distribution (GTD) area – segment responsible for nearly 40% of company's revenues.

Weg has also invested in nearshoring initiatives, such as developing production chains for places other than China. That could still provide cost advantages compared to onshoring or maintaining operations in high-cost regions. Of the R$ 343.34 million in CapEx last quarter, R$ 175 million was invested in the production capacity of our motors and transformer factories in Mexico and in expanding the plant in India to produce wind turbines.

In addition, Weg is also working on projects focused on the electric mobility business and powertrains for trucks and buses and recharge stations. In Brazil, Weg has already partnered to be an official supplier of French automakers such as Renault, Peugeot, and Citroën. Also, it started exporting to Argentina to supply electric vehicles for the Stellantis Group.

In 2022, Brazil's sales of electric and hybrid cars increased by 41% compared to 2021, corresponding to less than 5% of light vehicle sales. However, according to the Brazilian Electric Vehicle Association, it is expected that by 2035 about 65% of the vehicle fleet in the country should be hybrid/electric.

In this scenario, Weg has supplied electric traction and battery storage systems for automobiles. At the other end of this chain, the company sees opportunities in manufacturing equipment for recharging stations and network infrastructure to serve the electro pumps.

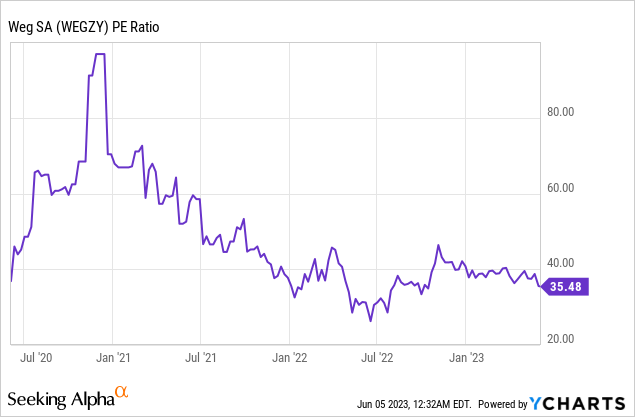

Weg's valuation

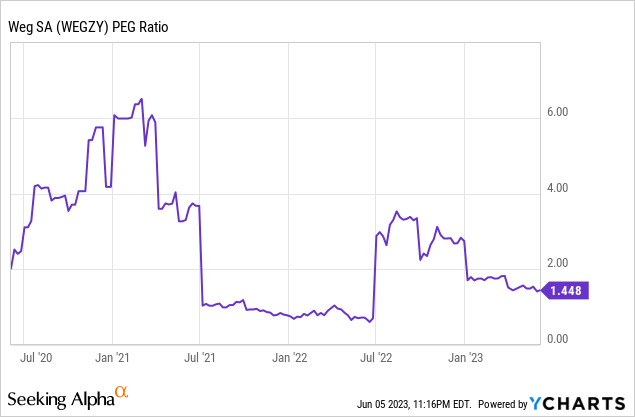

Weg is currently trading near its historic high, reached in 2021. The current valuation of the company trading at a forward price-to-earnings multiple of 35 times makes it clear that Weg is far from being a bargain. Although, shares traded at a much more modest level than they were two years ago when their valuation multiples reached about 90 times earnings.

The good news for potential investors is that Weg's price and valuations have de-risked quite a bit over the past two years. And this is mainly without the fundamentals of its business deteriorating; quite the contrary, they have seen considerable development.

The current price-to-earnings ratio of 35 times, combined with earnings per share growth estimates for this year of approximately 32.97%, indicates a price-to-earnings to growth ratio of 1.06 times. This valuation level has not been as attractive since early 2022, at the very least.

What could go wrong

Weg trades at these stretched multiples due to being priced as a moderate-growth company. The company's dividend policy, with a median payout of 50% over the last ten years, implies that just under half its profit is used to invest in its business – even if its dividend yield is still negligible at 0.36%.

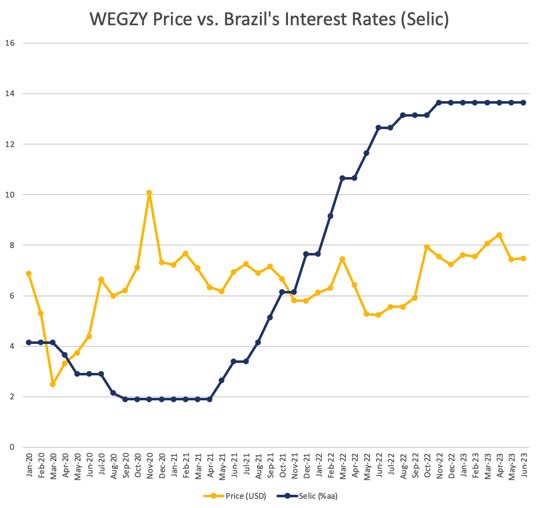

Thus, there is a significant downside risk should Weg encounter obstacles in the path of profitability growth. Over the past three years, macroeconomic risk has weighed heavily on the performance of Weg's shares. With rising global inflation, the Brazilian monetary policy determined an interest rate (Selic) from 1.9% per year in 2021 to 13.65% by the end of 2022.

Yahoo Finance and Brazilian Central Bank, Chart Compiled By Author

Weg shares fell as much as 52% between November 2020, when Brazil's interest rate was around 2%, to June 2022, when it reached levels above 13%. However, as the company reported solid results in the third quarter of 2022, along with Brazil having engaged in three consecutive months of deflation, this offsetting future risks caused Weg's shares to soar to near current levels.

Although there are significant risks concerning the Brazilian interest rate, this trend should ease somewhat for Weg's shares going forward. According to the Brazilian Central Bank, the interest rate projection will end at 12.5%, in 2024 at 10%, and in 2025 at 9%. That is a more encouraging scenario for Brazilian stocks with high multiples like Weg to take off is that the value of short-term cash flows should become lower.

Currency risk can also be a double-edged sword for Weg. The fluctuation can undoubtedly impact the demand in the internal market. But on the other hand, the dollar's appreciation against the Brazilian real was a determining factor for Weg's revenue growth in the foreign market, especially in the past two quarters. That's because Weg has more than half of its revenues from the external market. For example, in Q4 2022 and Q1 2023, Weg reported growth in dollarized revenues from its external markets operations of 22.6% and 20.6%, respectively.

Still, considering that 42% of the company's revenues today come from Brazil, this could put the thesis at risk since there is a considerable country risk mainly due to political instability reflected in the country risk. The perspective of growth in Brazilian operations is that it should grow below the global average, with the IMF (International Monetary Fund) projecting a growth of 1.2% in 2023.

High quality should prevail in the long term

Weg is probably one of the best publicly traded Brazilian companies from the standpoint of its business fundamentals. The company has almost doubled its profits in the couple of years, has a robust cash generation, and has virtually no debt. I attribute much of Weg's success to the global diversification of its revenue, which reduces the risk of dependence on the Brazilian economy.

Moreover, looking ahead, Weg's capital allocation strategy effectively enhances its shareholder value in the long term. The company continues to invest just over half of its profits in growing its business internally for the expansion in industrial motors and electric traction motors, and externally for the production of wind turbines. Thus, I believe an investment in Weg for the long-haul Weg is poised to win while there's still room for growth.

However, investors should set their expectations right since the stock trades at a valuation of 35 times its profit price. And it is very likely that a bump in Weg's road to its earnings growth could negatively impact the company's share price in the short-term.

But for now, the current scenario of inflation cooling down in the Brazilian economy – below 5% after two years – could be a tailwind to unlock the additional value of the company's shares.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WEGZY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.