Greenbrier: A New Horizon And Big EPS Growth, But Technical Risks Persist

Summary

- The Greenbrier Companies is a hold in my view due to its strong valuation but mixed technicals and soft market situation.

- GBX is significantly undervalued when assessing its current price-to-book ratio to the long-term average and relative P/Es.

- Following its April Investor Day, the multi-year earnings growth appears robust.

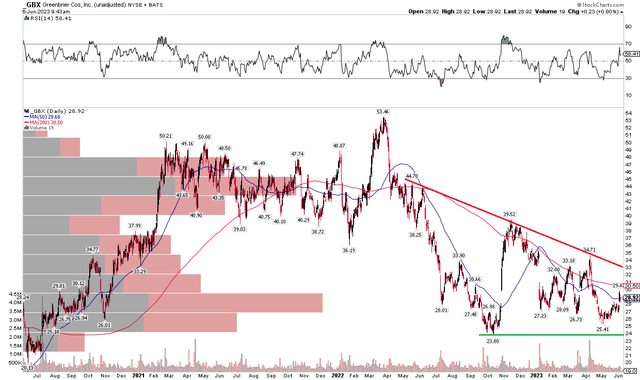

- However, the stock's technical situation remains uncertain, with a bearish consolidation pattern and downward-sloping 200-day moving average.

Tryaging

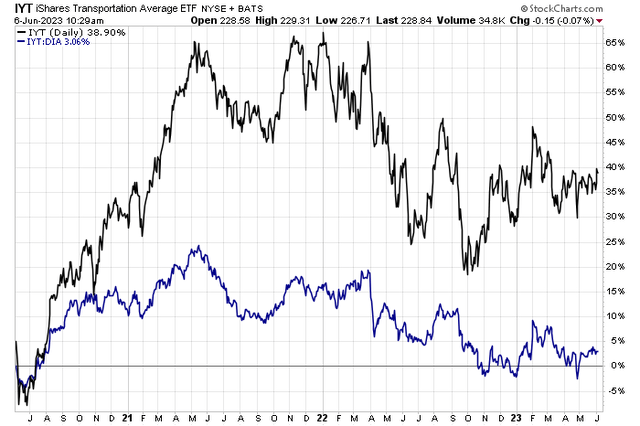

There hasn't been much chatter recently about the Dow Theory. The long-standing market relationship postulates that there's confirmation in markets when both the Dow Jones Industrial Average and the Dow Transports move together.

Lately, the iShares Transportation Average ETF (IYT) has been trending lower compared to the DJIA ETF (DIA). Some say that is a bearish signal since transports sometimes act as a market bellwether.

That casts shadows on rallies in rails and helps explain why I have a hold rating on The Greenbrier Companies (NYSE:GBX).

Dow Theory In Action: Transports Trending Lower Versus DJIA

According to Bank of America Global Research, GBX is a manufacturer of railroad freight cars in North America and Europe and a manufacturer of ocean-going marine barges in North America. The company also offers fleet leasing and repair services for railcars. It has some of the largest railcar leasing companies (TTX Corporation and General Electric) and largest Class I railroads (Burlington Northern and Union Pacific) as part of its customer base.

The Oregon-based $947 million market cap Construction Machinery & Heavy Transportation Equipment industry company within the Industrials sector trades at a high 25.5 trailing 12-month GAAP price-to-earnings ratio and pays a 3.6% dividend yield, according to The Wall Street Journal.

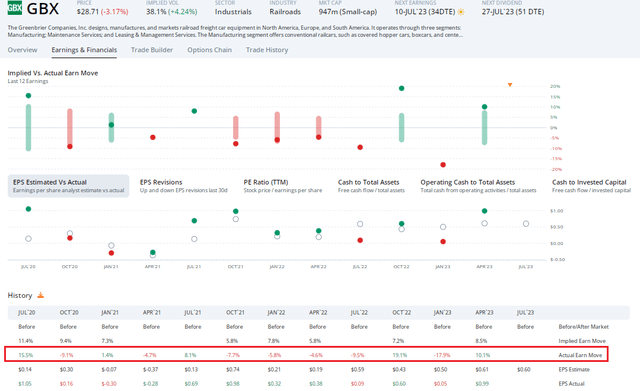

Back in April, GBX reported operating earnings of $0.99, which beat estimates by $0.03, while revenue also verified better than expected at $1.12 billion. The stock jumped 10% after reporting strong results and raising its guidance for 2023.

Two days later, at its Investor Day, the management team laid out plans to double its recurring revenues while maintaining mid-teens margins with a focus on the shareholders. Still, downside risks are many, including slower railcar demand, labor disruptions, reduced load levels that could come from slower economic growth and uncertainty with international inroads.

On valuation, analysts at BofA foresee earnings rising sharply this year, but EPS is then expected to stabilize at a steadier growth rate through 2025. The Bloomberg consensus forecast is about on par with what BofA projects. Dividends are seen as holding at the $1.08 level. With a robust pace of per-share profit growth, the teens P/E ratios are attractive. The company also trades at a lower EV/EBITDA ratio compared to the broad market. Free cash flow, however, is negative for 2023.

The Greenbrier: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

Given solid earnings growth, I assert that GBX deserves an earnings multiple comparable to its sector peers. If we assume next 12-month operating earnings of $2.40 with an 18 P/E applied, then GBX should be near $43. The stock is also about 20% undervalued when assessing its current price-to-book ratio to the long-term average.

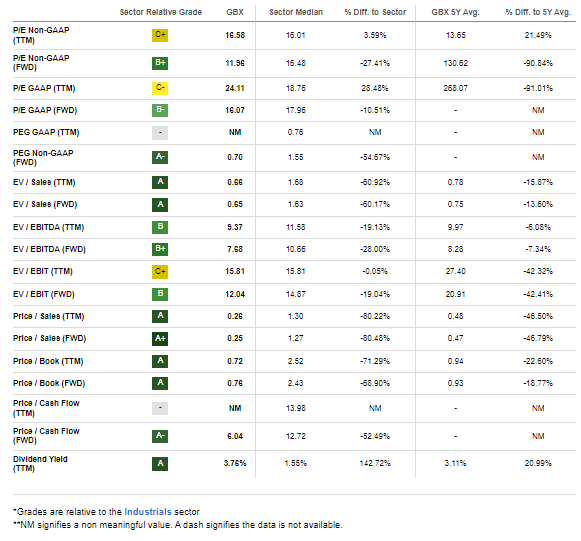

GBX: Strong Valuation Grades

Seeking Alpha

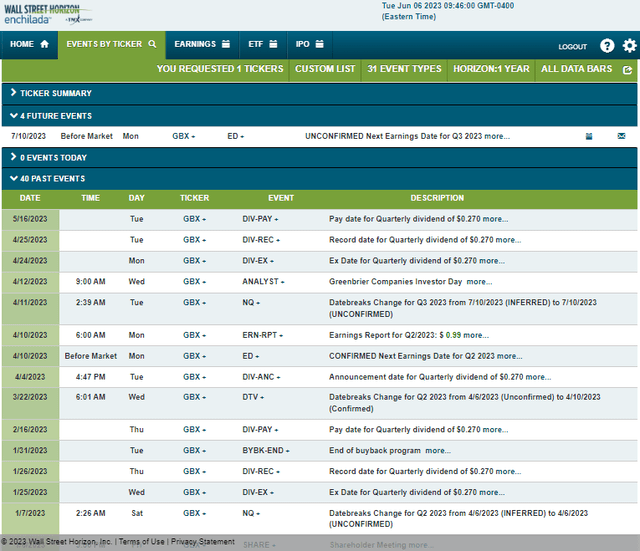

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Monday, July 10. The calendar is light on volatility catalysts until the reporting date but be on the lookout for a preannouncement since Greenbrier made that move earlier this year.

Corporate Event Risk Calendar

The Options Angle

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.60 which would be a big jump from just $0.09 of per-share profits earned in the same period a year ago. But what catches my eye is how dramatically the stock has tended to move post-earnings. The last four reporting dates have seen an average change of a whopping 14%. So, while implied volatility, per ORATS, is just 38% currently, we could see fireworks on the Monday after the 4th of July.

GBX: Massive Earnings-Related Stock Price Reactions

The Technical Take

But where might GBX go post-earnings? Notice in the chart below that shares are in a consolidation pattern. I see support at the October 2022 low just below $24 while resistance is seen at a downtrend resistance line off the Q2 2022 rebound highs. Moreover, the long-term 200-day moving average is downward sloping, so that tells me the bears are in control for now. In general, I would like to see GBX rally above $35 and hold that level to help confirm a bullish break in trend. A stop under $23 makes sense for those who are long. While I like the valuation, the momentum is not strong and there are mixed technicals at best.

GBX: Bearish Consolidation

The Bottom Line

I have a hold on GBX. I definitely like the valuation, but the technical situation remains soft. I would like to wait for price action to confirm the sanguine intrinsic value stance before putting a buy label on it.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.