My Top Energy Crisis Picks: 2 Dividend Powerhouses

Summary

- I expect oil prices to hit triple-digit dollar prices when economic demand bottoms, creating a perfect storm of rising demand and subdued supply growth.

- I'm gradually adding to my oil position and focusing on value stocks, with a preference for companies with high-quality reserves, efficient production, low breakevens, healthy balance sheets, and dedicated management teams.

- This article highlights two (and a bonus) oil and gas plays that I believe will outperform their peers and add tremendous long-term value to shareholders.

Max Zolotukhin/iStock via Getty Images

Introduction

In this article, I'll guide you through my thoughts as I discuss my preparations for what I believe will be the next energy crisis - or a continuation of the trend that started in 2020.

While oil is currently in a tricky spot as economic growth fears are winning the fight against tight supply, I am using this opportunity to boost my own energy holdings and the ones in the portfolios that I manage.

I will start this article by updating my oil bull case and explaining why I want to be prepared for the next prolonged surge in energy prices and the rotation from growth to value that will likely come with it.

After that, we'll dive into two of my all-time favorite oil and gas plays that - I believe - will add tremendous value to shareholders and outperform their peers on a prolonged basis.

So, let's get to it!

What Did OPEC Just Do?

Two things triggered me to write this article:

- I have discussed a number of oil stocks in the past few weeks, which caused people to ask me where I would put my money.

- OPEC just announced lower oil output, which has implications for an already tight market, despite demand fears.

On Sunday, OPEC made clear that it would cut 1 million barrels of oil per day as part of a deal between OPEC and its allies.

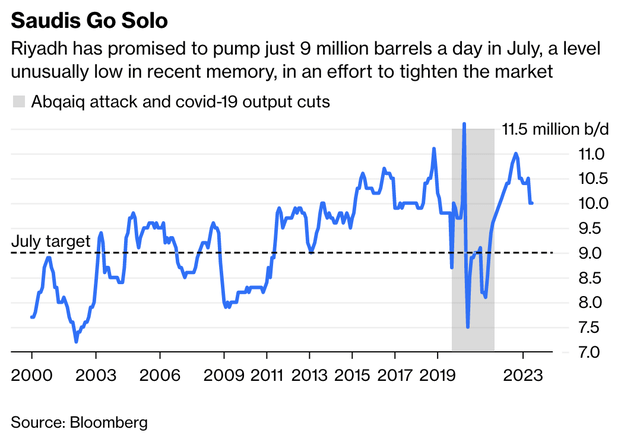

Using data from Bloomberg's Javier Blas, we see that Saudi production will reach levels not seen in the past decade - ignoring the pandemic and attacks on Saudi Arabian supply.

By forfeiting significant production, Saudi Arabia stands to lose a considerable amount of petroleum revenue unless prices rally in the coming days and weeks.

Other OPEC+ members would benefit from the reduced output, while Riyadh aims to keep earnings unchanged.

To achieve this, oil prices would need to surge by more than $10 a barrel, offsetting the drop in production from April to July. While the strategy's effectiveness remains uncertain, the cut signifies the kingdom's effort to rapidly tighten the oil market.

It's a risky strategy.

At this point, it looks like $70 oil is the new $40 oil. During the years when US shale was still booming, we were dealing with these types of cuts at much lower prices. Now, OPEC is looking to protect $70.

One reason is that OPEC knows it has more pricing power.

Supply Growth Is Weakening

Production in the US isn't growing very fast anymore, as I have discussed in dozens of articles since the pandemic - like this one in March.

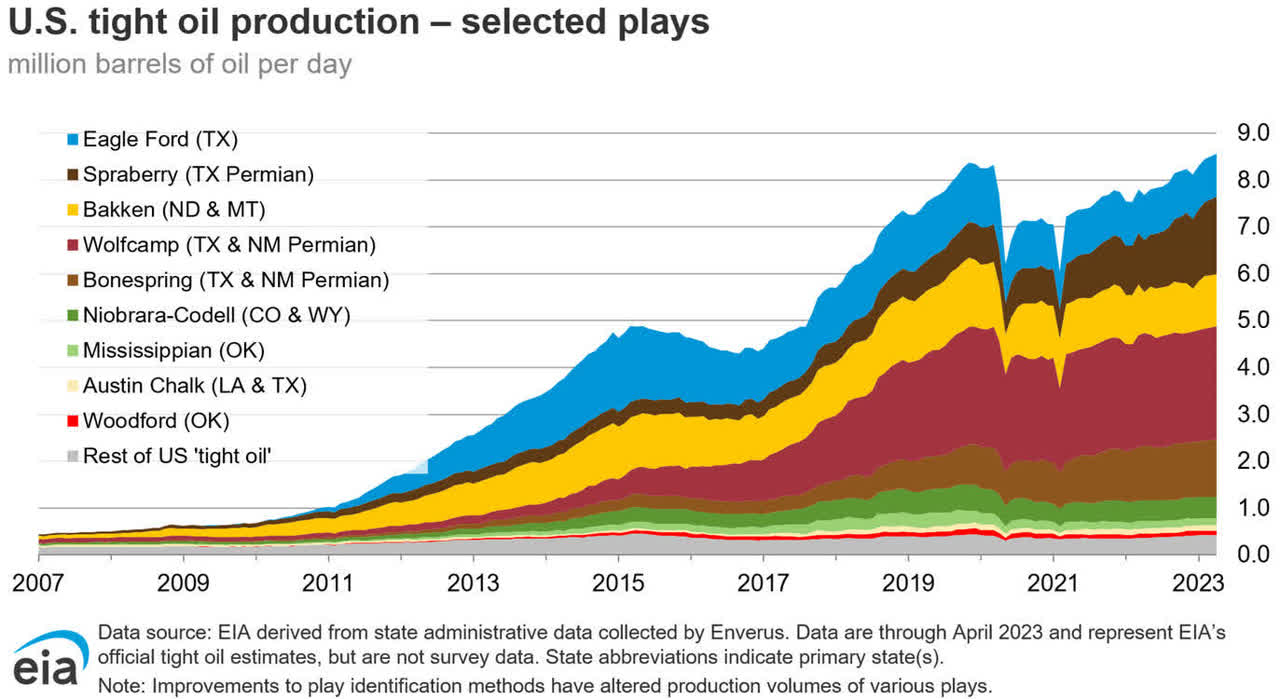

Looking at the chart below, we see that despite higher production, total oil production in the US is still slightly below pre-pandemic levels.

Note that oil production usually quickly rebounded after periods of subdued demand. For example, after the 2014/2015 oil price crash, production accelerated as companies needed more cash to repair their balance sheets.

Between the 2015 and 2020 peaks, oil companies added more than 3 million barrels of oil per day in production. Since 2020, that number has been unchanged.

Energy Information Administration

Oil production growth is subdued for two related reasons.

- It's a way to protect revenues. Oil companies have been through two major downswings since the Great Financial Crisis. They know that boosting production makes oil prices very prone to slower demand. Oil companies know that internal financing (through free cash flow) is key, as outside help is increasingly tough to get. That's mainly due to the forced energy transition and the fact that some banks and insurance companies are retreating from engaging in the oil and gas business.

- Companies are running out of high-quality inventory. The best wells have been drilled in the United States. Unless drillers find new technologies for a new oil production revolution, they will have to be careful when it comes to boosting output in high-quality areas.

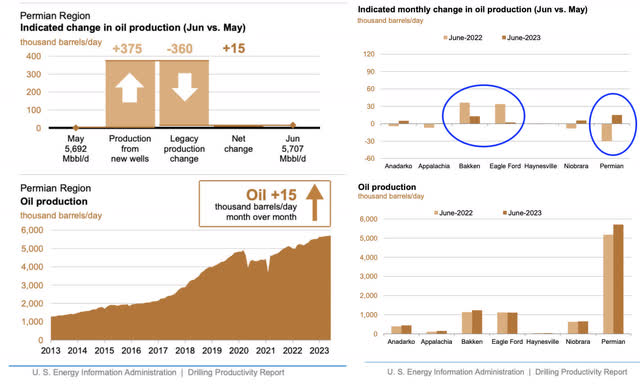

Even the only area that is still capable of strong supply growth, the Permian, is now seeing a significant slow-down in production.

Looking at the left side of the overview below, we see that new wells in the Permian are barely offsetting lower legacy production. While Permian production has risen well beyond its 2020 peak, it's now seeing the biggest decline in growth since the start of the shale revolution.

Energy Information Administration

Furthermore, the right side of the overview above shows that the Permian and the Bakken basins are the only basins with notable growth. In this case, Bakken production has come down a lot. The same goes for the Texas-based Eagle Ford basin.

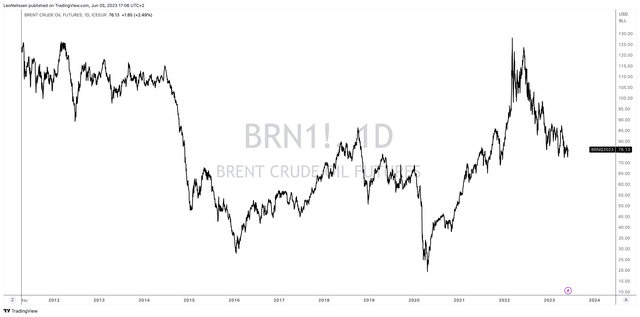

Hence, despite slower economic growth Brent oil is still trading at $76. I believe under normal circumstances, with higher supply growth, we would be dealing with prices at least $15 to $20 lower.

Based on that context, I believe that the market is massively underestimating what oil prices will do the moment we go from pricing in a recession to a rebound.

This brings me to the next part.

When I'm Buying More

While oil is up after the OPEC announcement, it's not rallying as much as one might have expected.

The problem is that economic growth has gone down the drain. Both manufacturing and services expectations are now weakening in the United States.

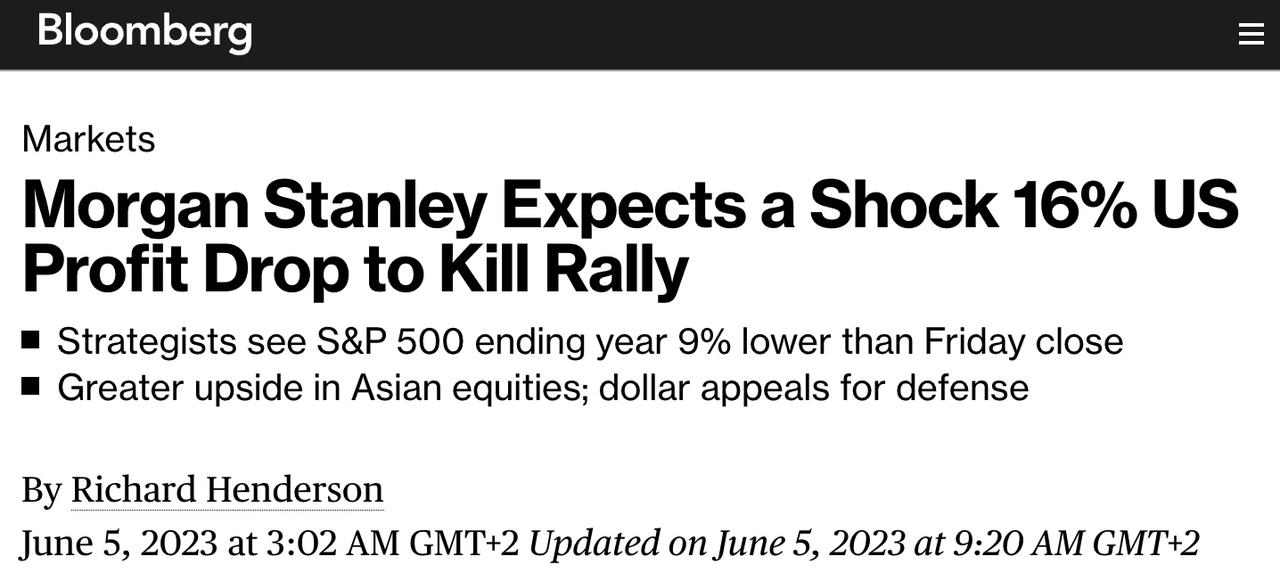

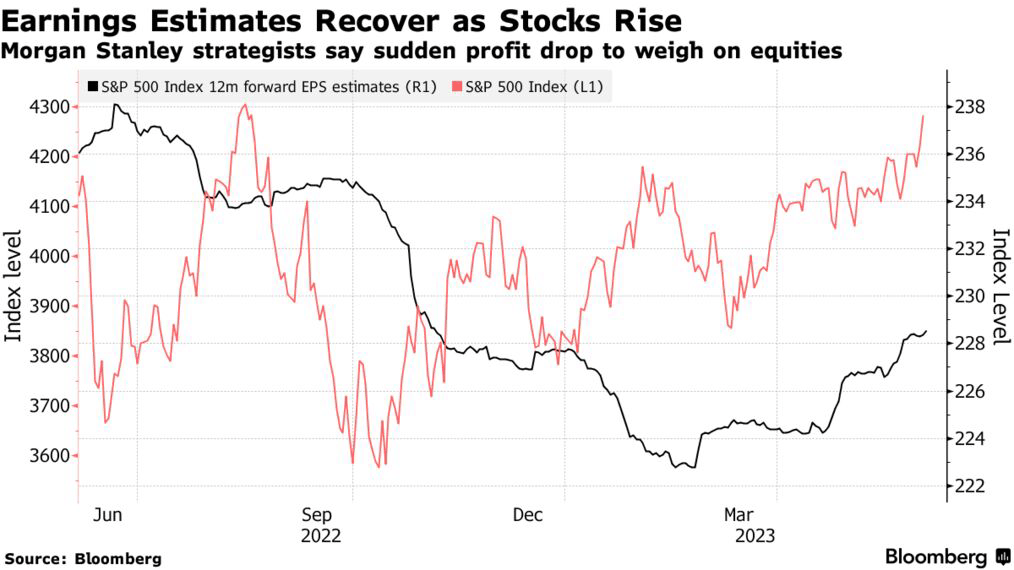

Now, Morgan Stanley (MS) is coming out, making the case for a 16% drop in S&P 500 earnings.

“We think that the downside risk to US earnings is now,” Morgan Stanley analysts wrote in a note published Sunday. “While a deteriorating liquidity backdrop is likely to put downward pressure on equity valuations over the next three months, we also see EPS disappointment ahead as revenue growth slows and margins contract further.”

Bloomberg

I'm sharing this info because it aligns with my view. I, too, expect the market to bottom in the mid-3,000 range, with elevated risks of selling caused by sticky inflation, which is keeping the Fed hawkish despite sky-high recession risks.

That's also why it is not unlikely to expect another leg down in oil.

Hence, I'm gradually adding to my already large oil position as I'm preparing for what might come next.

I expect oil prices to hit triple-digit dollar prices the moment economic demand bottoms. That would create the perfect storm of rising demand and subdued supply growth, likely causing a second wave of inflation and a rotation from growth to value.

So, instead of chasing the latest tech trends, I'm gradually buying value stocks, even if that means averaging down until economic growth improves.

What I Care For When Buying Oil & Gas

In this article, I will share two picks that I like a lot. I own one of them and have the other on my watchlist.

Needless to say, I like way more than two oil stocks. Please don't hesitate to bring up the plays you like in the comment section, so we can continue the discussion. Also, I will continue to cover oil and gas plays, which means I will discuss a lot more attractive plays in the next few weeks, months, and quarters.

In this article, I focused on a number of things:

- I want oil companies with high-quality reserves. This reduces long-term risks like forced M&A to boost reserves.

- I want oil companies with efficient production and low breakevens. This causes satisfying free cash flow, even at subdued oil prices.

- I want oil companies with healthy balance sheets.

- I want oil companies with management teams dedicated to distributing most excess free cash flow to shareholders through regular and special dividends. I prefer this over buybacks. Because I believe in a prolonged bull case for oil, I want to benefit from this through dividends.

- I want oil companies capable of outperforming their peers. Otherwise, we may as well buy diversified ETFs.

Pioneer Natural Resources (PXD)

Pioneer Natural Resources is now my largest oil investment after I sold my stake in Exxon Mobil (XOM). The proceeds of my XOM investment went into PDX because of one reason only: I like that PXD distributes most of its free cash flow to shareholders. I'm still bullish on Exxon Mobil and believe it's a good play for conservative investors. It's less volatile than PXD.

On May 14, I wrote an article titled I Made Pioneer My Largest Energy Investment. In that article, I explained my reasoning.

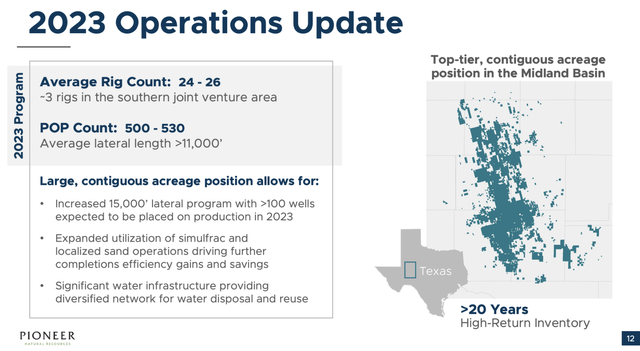

One of the key reasons I believe Pioneer is superior is its extensive inventory of high-quality reserves in the Permian. The company holds more than 20 years' worth of inventory with a breakeven oil price of under $50 WTI, which is industry-leading in the region. This impressive position has even sparked rumors that Exxon may consider acquiring Pioneer in the future.

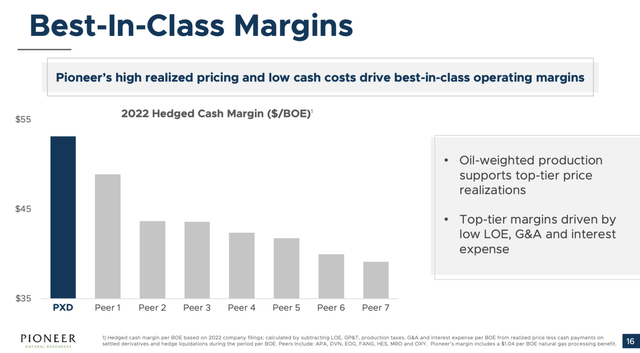

Moreover, PXD demonstrates exceptional efficiency in its operations, resulting in strong price realization and industry-leading production margins.

The company anticipates generating a remarkable $27 billion in cumulative free cash flow over the next five years, assuming an $80 WTI price. This would account for 56% of its current market cap. Even at a slightly lower oil price of $70 WTI, PXD estimates it can still achieve $13 billion in free cash flow, which is 27% of its market cap.

Pioneer's commitment to shareholders is also worth noting. Its capital framework dedicates 75% of quarterly free cash flow to capital returns, prioritizing shareholder distributions over debt reduction.

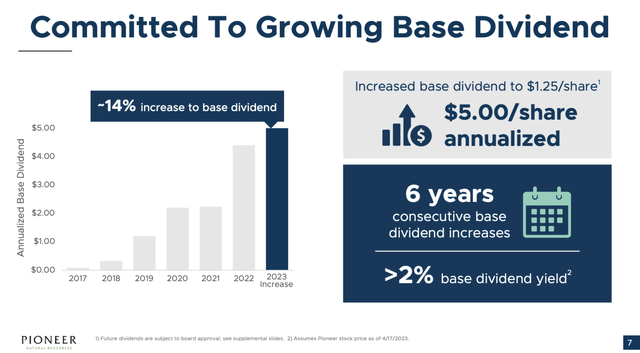

The company aims to provide maximum value by dividing capital returns between variable dividends and share repurchases. While the base dividend steadily increases, it remains moderate. In the first quarter of 2023, Pioneer raised its quarterly base dividend by 14% to $1.25 per share, representing an annualized yield of over 2%.

The estimated total (regular + special) dividend yields based on the current stock price are as follows:

- 14% at $100 WTI,

- 9% at $80 WTI, and

- 4.5% at $60 WTI.

These figures are subject to change based on the company's dividend policy and oil price fluctuations.

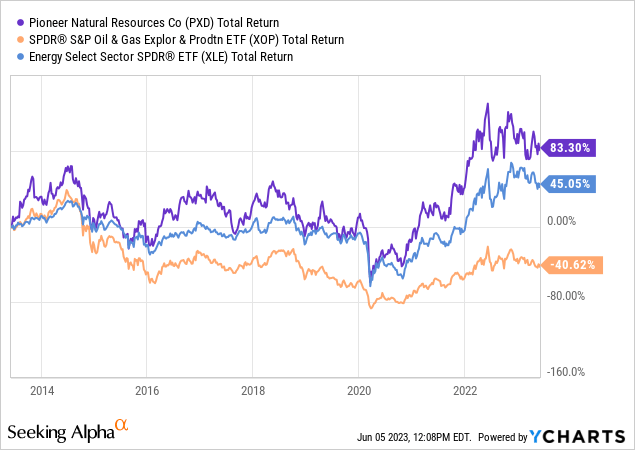

Furthermore, over the past ten years, PXD shares have returned 83%. This includes two major oil crashes. Also, this performance allowed PXD investors to outperform energy (in general) and oil and gas drillers.

Number two is on the other side of the border.

Canadian National Resources (CNQ)

The only reason why I don't own CNQ is because of the tax situation. One of my brokers does not offer tax forms that allow me to avoid higher Canadian dividend taxes. As a Dutch investor, I pay 15% on all dividends - including in the US.

However, that issue has been taken care of, which means I can soon start buying CNQ shares.

Canadian Natural Resources is one of the world's largest oil and gas producers. In 2022, the company produced 1.3 million barrels of oil equivalent per day. Of this, 933 thousand barrels per day were crude oil and natural gas liquids.

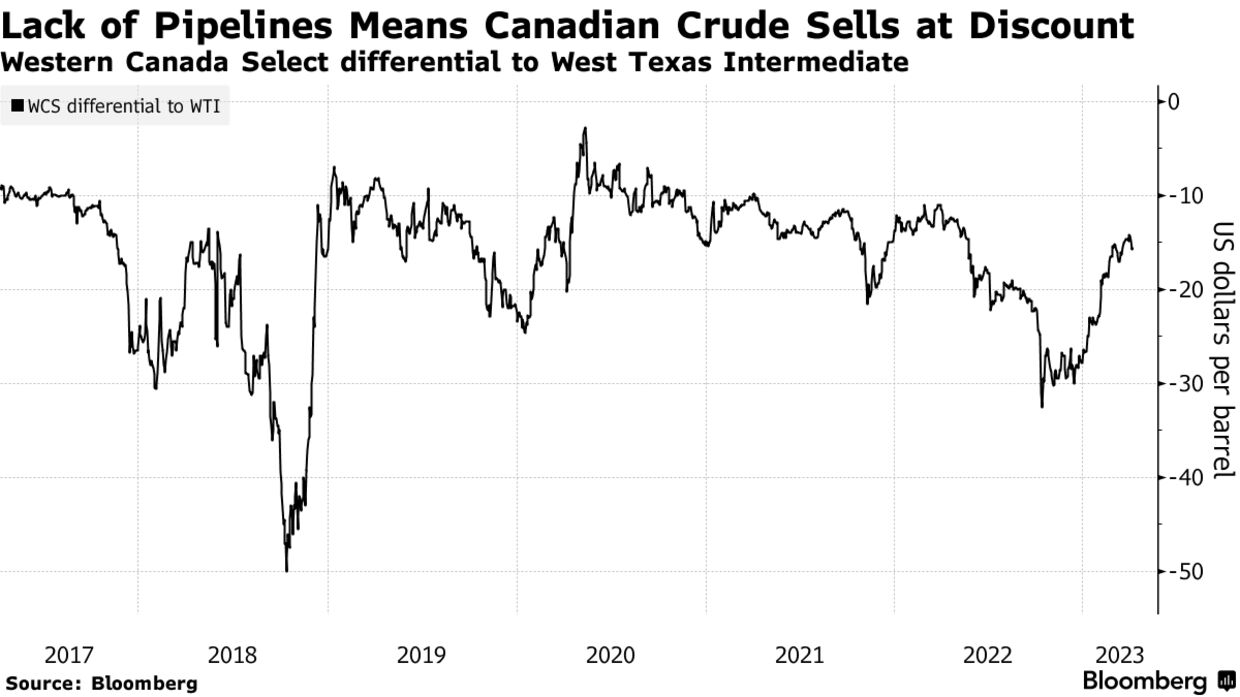

Not only that, but the company is in a good position to boost its production, thanks to massive reserves in Canada's oil sands, which will soon benefit from the Trans Mountain pipeline and a high likelihood of better pricing.

Bloomberg

The company is sitting on 13.6 billion barrels of oil equivalent in reserves, an increase of 6% versus 2021.

The strength and depth of the Company's assets are evident as approximately 77% of total proved reserves are long life low decline reserves. This results in a total proved BOE reserves life index of approximately 32 years and a total proved plus probable BOE reserves life index of approximately 42 years.

Efficiency is another aspect that sets CNQ apart. The company boasts a breakeven point close to $40 WTI.

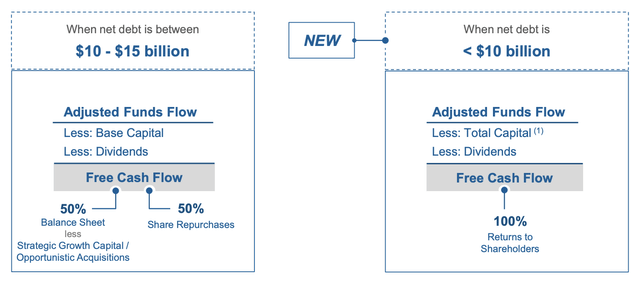

Meanwhile, the company aims to allocate half of its post-dividend free cash flow toward buybacks when net debt falls between $10 billion and $15 billion, while the other half will be dedicated to debt reduction. If net debt falls below $10 billion, 100% of the excess free cash flow will go to shareholders. By the end of 2022, CNQ had already reduced net debt by approximately $10.7 billion and expects to reach a net debt level of $10 billion later this year.

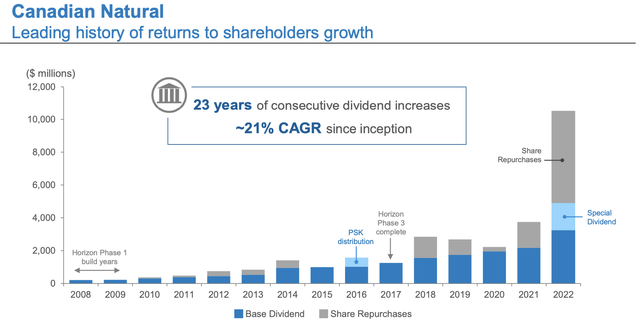

Adding to that, CNQ has hiked its dividend for 23 consecutive years. In 2022, the company increased its dividend twice.

Furthermore, CNQ paid a special dividend of $1.50 per share last year.

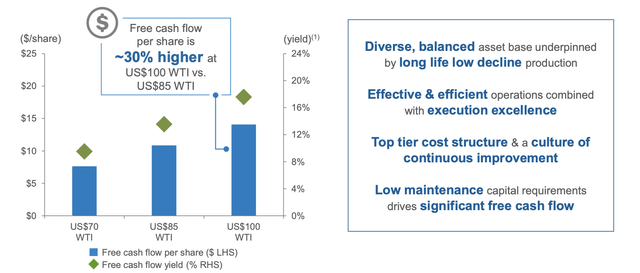

Needless to say, CNQ's potential for aggressive dividend hikes remains high, especially if oil prices reach or exceed the projected target of $100 per barrel.

A $100 WTI scenario could enhance CNQ's free cash flow by 30%, potentially generating close to $15 in FCF per share and implying an 18% FCF yield.

In other words, CNQ is an efficient cash cow with a healthy balance sheet, massive reserves, and the dedication to let shareholders benefit from its success through consistent growth in its regular dividend and special dividends.

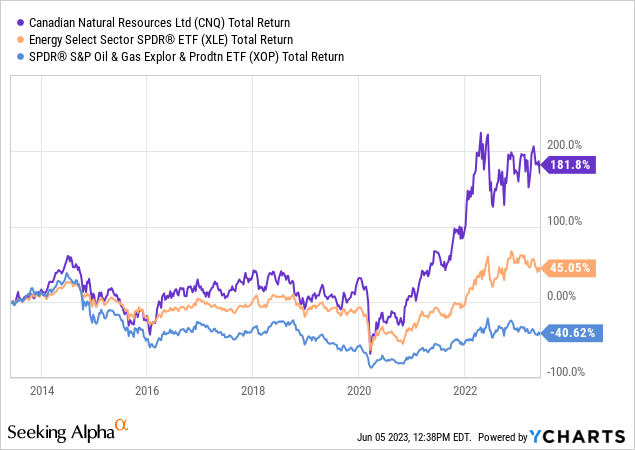

Moreover, just like PXD, CNQ has outperformed its peers over the past ten years. I expect that to continue.

Before I get to my takeaway, I need to add one more thing.

Another honorable mention.

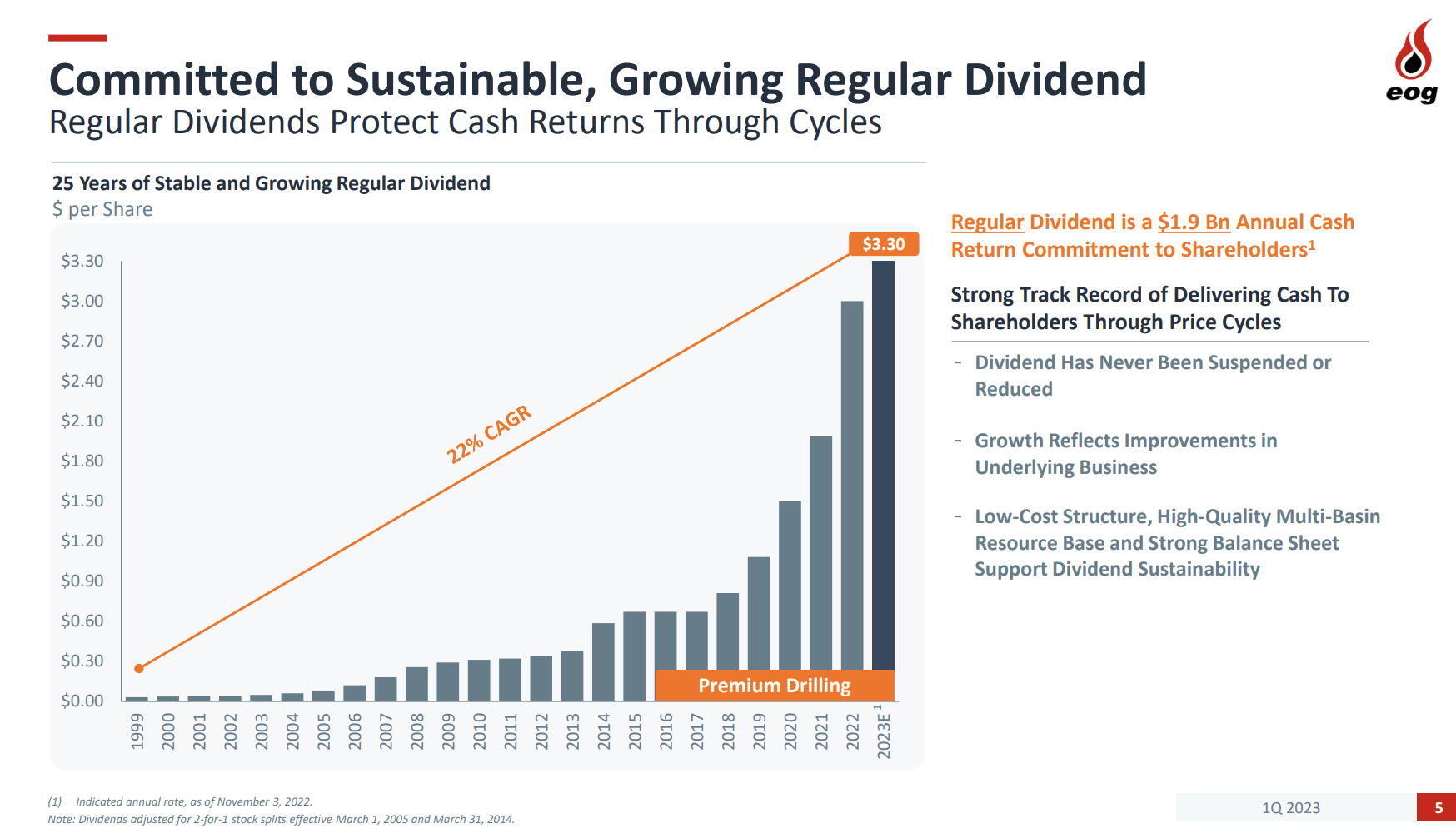

On June 3, I wrote an article covering EOG Resources (EOG).

EOG is a Houston-based driller with similar outperformance, efficient operations, inventories, and shareholder distributions consisting of dividends, special dividends, and buybacks.

EOG Resources

Now, here's my takeaway:

Takeaway

In anticipation of a potential energy crisis and the shift from growth to value, it is essential to strategically position oneself in the oil market. The recent decision by OPEC to cut oil output further underscores the tightening supply-demand dynamics. Amid weakening supply growth and a rebounding demand, oil prices are poised to surge.

Two notable picks that align with my outlook are Pioneer Natural Resources and Canadian Natural Resources.

PXD shines with its extensive inventory of high-quality reserves in the Permian region, leading to impressive breakeven prices and strong production margins.

The company's commitment to maximizing shareholder value is visible through its distribution of excess free cash flow via regular and special dividends.

CNQ stands out due to its substantial reserves in Canada's oil sands, poised to benefit from improved pricing and infrastructure developments. The company's efficient operations and low breakeven point make it a reliable cash generator.

Just like PXD, CNQ's dedication to shareholder returns is based on consistent dividend increases and the potential for aggressive special dividends, especially if oil prices reach or exceed my projected target of $100 per barrel.

By strategically investing in these companies, investors can position themselves to benefit from the tightening oil supply and the subsequent surge in prices, ultimately capitalizing on the evolving energy landscape.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PXD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.