Bank of Marin: Its Solid Fundamentals Can Navigate The Rugged Market

Summary

- Bank of Marin Bancorp faces macroeconomic headwinds but shows steady revenue growth and stable margins.

- BMRC's financial positioning remains the cornerstone of its business.

- Dividends are well-covered with high yields.

- The stock price keeps decreasing, making it an ideal bargain.

NoSystem images/E+ via Getty Images

Amidst the elevated prices and interest rates, banks have a higher risk exposure. The Bank of Marin Bancorp (NASDAQ:BMRC) is no exception. It sees the favorable and disruptive impact of macroeconomic indicators on its operations. Despite this, it maintains a stable performance with steady revenue growth and returns. It also has a strategic financial positioning, giving it excess liquidity. This aspect allows it to sustain its current operating capacity and raise dividends. However, the stock price downtrend remains divorced from the fundamentals. Nevertheless, it may become an opportunity to buy shares at a discount. It shows enticing upside potential.

Most Recent Performance

The Bank of Marin Bancorp operates in a highly cyclical and volatile landscape. In the past year, inflationary headwinds have intensified, prompting The Fed to tighten the US monetary policy. Interest rates have risen substantially, which proved effective. Yet, the bank must deal with the continued changes in its portfolio. These are most visible in its loan demand, deposit inflows, and investment yields.

Despite all these, the company went along with the macroeconomic trends. It had steady revenue growth, particularly in loan yields and fees. Interest income reached $34.65 million, a 13% year-over-year increase. This double-digit growth was impressive amidst the decreasing borrower and investor confidence. Again, we can attribute it to its loan portfolio, comprising 71% of the total interest income. It proved the positive correlation between interest rate hikes and loan yields. Higher interest rates mean higher interest on loans. Thanks to its active loan repricing, helping it keep its organic loan growth stable. Even better, it held on to its conservative approach to sustaining growth. It was reflected by its excellent loan quality.

In its most recent release, the company had no non-performing loans. With that, it minimized the risk of loan defaults and delinquencies. Another aspect was its strategic loan portfolio diversification. The majority of its loans were from the real estate segment. It may be risky, given the extreme changes in the real estate market. Even so, most of its real estate loans were from the commercial sector. These loans had more secure collaterals, so non-payments can be resolved faster than in the residential sector. Also, changes in fair value would be more manageable. We will discuss it in the following section.

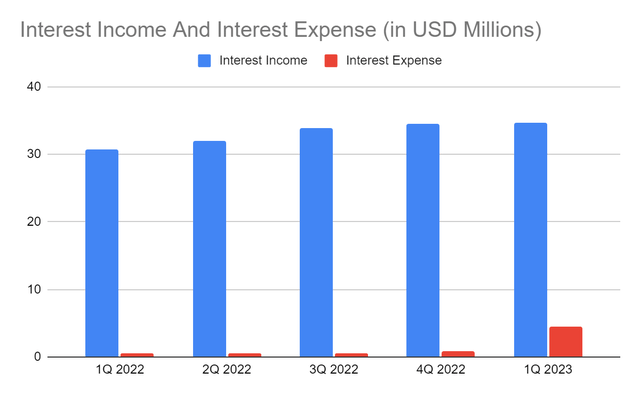

Interest Income And Interest Expense (MarketWatch)

Meanwhile, its yields on investment securities comprised 29% of the total revenues. Indeed, BMRC was more diverse in its asset portfolio. Many banks would have loans comprising about 80-90% of their yields, opposite to it. Its year-over-year increase was 50%, the highest among the three revenue components. We can attribute it primarily to prudent investment diversification. In fact, over 90% of them were in the form of mortgage-backed securities, debentures, and notes. They were from the state government and government-sponsored enterprises. The good thing about government-backed securities is their higher flexibility to macroeconomic changes. They have better yields and better hedges against valuation changes.

Likewise, higher interest rates raised deposit and borrowing costs. Its interest expense reached $4.45 million, about eight times the amount in 1Q 2022. Interest on borrowings comprised over half of the interest expenses. It rose by about two-thousand times. Likewise, interest on deposits increased substantially. Thankfully, the increase in interest income partially offset it. The net interest income before provisions rose to $30.2 million versus $30.16 million in 1Q 2022.

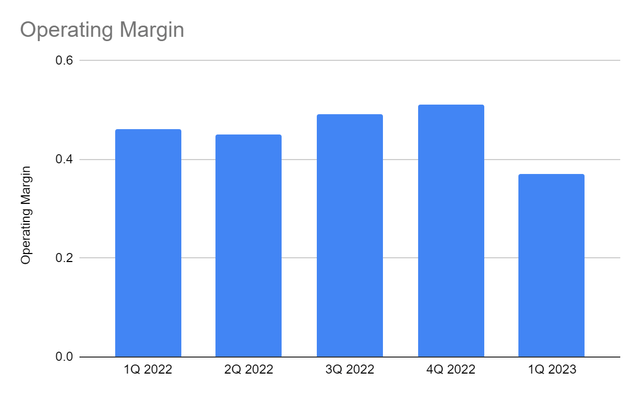

Also, its non-interest segment remained relatively flatter. It showed well-maintained demand for its banking services and efficient management of fixed costs. The operating margin decreased to 37% versus 46% in 1Q 2022. But the fact that it stayed viable with $13 million in operating income showed its core strength amidst a stormy environment. However, it must not be too complacent since market volatility is still far from over.

Operating Margin (MarketWatch)

The company may face the same challenges this year as interest rates increase. It must be more careful with its core operations. Also, it must note that the sequential increase rate in the past five quarters has slowed down. But opportunities are also present, which may help it cushion the impact of market blows. We will discuss more of these in the following section.

How Bank Of Marin Bancorp May Stay Afloat This Year

Bank of Marin Bancorp faces more intense market changes. Risks are higher as interest rates stay elevated. We already saw the impact of continued interest rate hikes. Although interest income growth continued, the sequential increase appears to have slowed down in the past year. Also, it has already driven the massive increase in borrowing and deposit costs. If interest rates increase further, borrowing and paying capacity may decrease. The company may have to reprice its loan rate to stabilize loan volume and repayments. Meanwhile, borrowing and deposit interest may increase and lower revenues and margins.

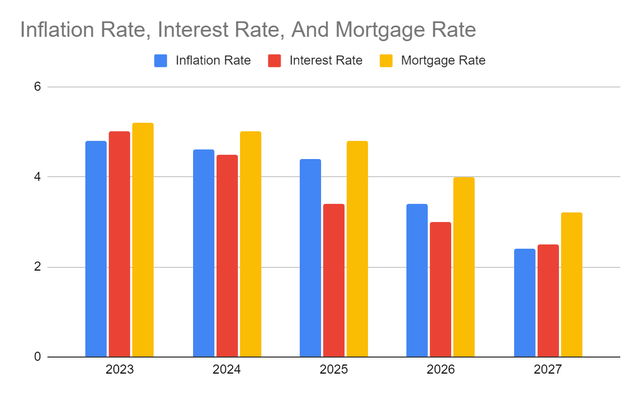

The only consolation is that interest rate hikes have cooled down recently. It decreased from 75 bps to 25 bps. It was still an increase, but it became more manageable. Moreover, inflation has already relaxed at 4.9%, a 46% difference from the 9.1% peak in 2022. The continued decrease showed the success of the conservative action of The Fed. By the looks of it, The Fed may not give another interest rate increment or keep it flat at the current rate. With that, inflation may continue to decrease, making prices more stable. In turn, interest rates may decrease. While the impact may not materialize easily, it will have a better grip on its operations. The trends can make mortgage rates more scalable.

Meanwhile, the property market sees changes in property prices and demand. While buyers, investors, and analysts are apprehensive, the cycle stays logical. Also, I disagree with the view of a massive market crash. The first essential reason is that home price increases were driven by demand in the first place. When interest rates dropped, loans became more accessible and appealing. The demand influx created an imbalance to help supply catch up. The second reason is connected to the first one. Property shortages are high, driven by the demand in the last two years. At the start of the year, the US was short of 6.5 million housing units. But as of this writing, shortages are now 7.3 million. We can attribute it to the 9% decrease in median home prices in 1Q 2023. It led to a slight rebound in home sales and loan demand in the same quarter. Third, property builders have stayed conservative ever since The Great Recession. With that, there is no overbuying and speculative mania in the market.

Inflation Rate, Interest Rate, And Mortgage Rate (Author Estimation)

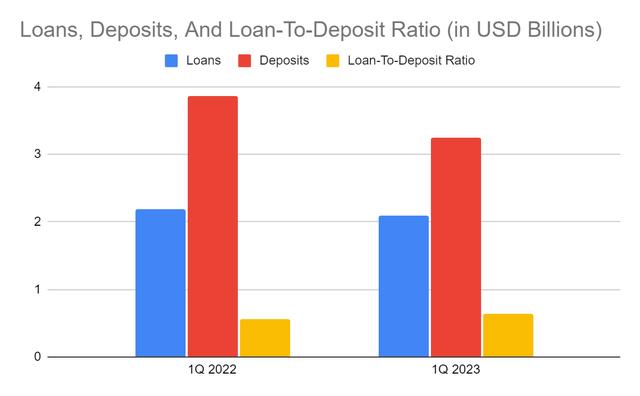

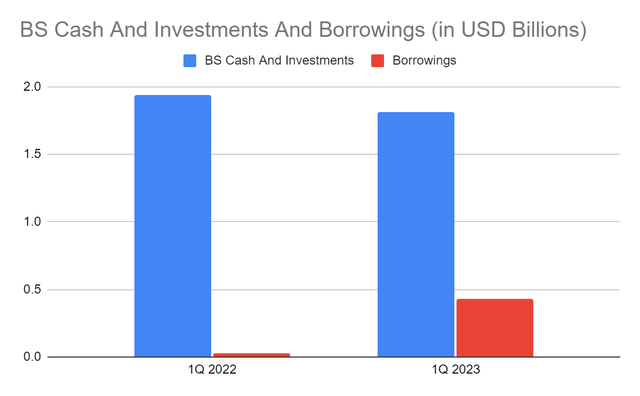

But what makes Bank of Marin Bancorp secure is its sound financial positioning. We can see it in its stellar Balance Sheet, given its excess liquidity. First, the changes in loans and deposits are almost proportionate. It is no wonder that its loan-to-deposit ratio remains low at 64%. It still has high reserves to cover potential defaults and delinquencies. It can still expand its loan volume to realize more revenues. Given the current performance and of loan and deposit volume, BMRC is well-capitalized. Meanwhile, cash and investments are stable, comprising 44% of the total assets. So, the bank has adequate liquid assets. They can also cover all borrowings in a single payment. BMRC can withstand disruptions while sustaining its operating capacity and capital returns. The company maintains the balance between viability and sustainability.

Loans, Deposits, And Loan-To-Deposit Ratio (BMRC 1Q) Cash And Investments And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of Bank of Marin Bancorp has decreased over the years. There were some rebounds, but the downtrend persisted in 2022 and sped up recently. At $18.06, the stock price is 45% lower than last year's value. It may be logical, given the volatile market, but it appears swift and excessive. The PB Ratio may show it, given the current BVPS and PB Ratio of 26.7 and 0.70x. If we use the current BVPS and the average PB Ratio of 1.31x, the target price will be $33.11.

Moreover, it is a secure dividend stock with consistent payouts and high yields. Its yields of 6% are way better than the S&P 600 and NASDAQ average of 1.68% and 1.55%. They remain well-covered, given the Dividend Payout Ratio of 47%. To assess the stock price better, we will use the DCF Model.

FCFF $36,080,000

Cash $37,990,000

Borrowings $431,240,000

Perpetual Growth Rate 4.4%

WACC 9.2%

Common Shares Outstanding 16,107,000

Stock Price $18.06

Derived Value $26.52

The derived value adheres to the supposition of a potential upside. There may be a 47% upside in the next 12-18 months. Hence, investors may take this opportunity to buy shares at a discount.

Bottomline

Bank of Marin Bancorp is doing well despite its high-risk exposure. Its operational stability and strategy allow it to navigate the rugged market. Even better, its solid financial positioning remains the cornerstone of its business. The stock price is a good entry point to buy shares. The recommendation is that Bank of Marin Bancorp is a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.