TotalEnergies: Buy More

Summary

- Saudi Arabia has unilaterally cut oil production by 1 million barrels per day, aiming to stabilize oil prices around $80 per barrel.

- TotalEnergies is expected to benefit from the oil price increase, with a strong balance sheet and a commitment to renewable energy generation.

- Higher dividend yield among the sector with a lower valuation. Our buy is then confirmed.

HJBC

Saudi Arabia is the only OPEC+ member to have sufficient spare and storage capacity to easily reduce and increase oil production. Yesterday, Saudi Arabia announced a unilateral cut in oil production of 1 million barrels per day (bpd). This cut, which goes into effect next month, will reduce production from about 9.9 million barrels per day this month to 8.9 million barrels per day next month. With no surprise, WTI grew by 1.80% to $73.07 per barrel in line with BRENT at plus 1.69% to $77.42 per barrel. Russia has decided not to follow and, in the meantime, Moscow continues to flood the market with large volumes of cheap oil, thereby undermining Saudi efforts to prop up prices. Added to this are the sanctions imposed by the West, which push Moscow to concentrate its exports towards the Asia region, entering into direct competition with Saudi Arabia.

That said, here at the Lab, we believe the measures approved should help stabilize the oil price around $80/bbl (Saudi Arabia's target is $81/bbl), in line with our forecasts and slightly above the current market price, supporting the cash flow of integrated oil companies. As of May 2023, the cartel's production has already dropped by about 0.5 million bpd, to 28 million bpd. Therefore, in the coming months, OPEC production could fall below 28 million barrels per day. This figure compares with IEA and OPEC forecasts of 29.6 and 29.3 million barrels per day respectively and implies a significant supply shortfall, likely to result in much lower inventory levels in the next months. With this latest cut, the Saudis decided to avoid oil price speculation with a clear aim to stabilize prices not too low and not too high. A market with a supply below 1.5 million bpd could see prices rise, but the further upside could be limited by uncertain demand and a slower Chinese economic recovery. However, even if we are wrong and crude prices do not return to $80 a barrel, at the very least, we see OPEC+'s message providing support to oil companies, even in a recessionary environment. Therefore, here at the Lab, we are confident that this news is positive for oil E&P and integrated companies, which will directly benefit from the expected price increase. Following this news, after a few months, we decided to analyze TotalEnergies (NYSE:NYSE:TTE). The company has always been one of our preferred oil companies. Why?

- It is Our Favourite Pick In The Renewable Energy Transition. Oil investments have a higher IRR than renewable energy projects and "even if our internal team recognized that this oil environment will last, the company's long-term strategy is likely the right one - and what the current market dislikes is probably going to be the company's clear competitive advantage in the future";

- Despite COVID-19 impact and Russian Exposure, the company confirmed its dividend policy;

- One of the strongest management teams within the sector;

- A solid balance sheet.

Q1 Results and Total Renewable Energy Transition

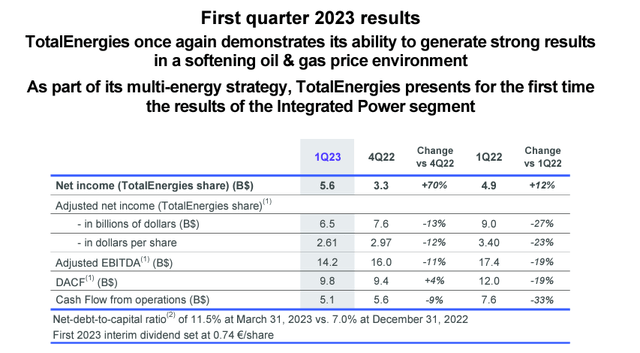

The company reported a Q1 adjusted net profit of $6.5 billion which was in line with Wall Street estimates set at $6.57 billion. Looking at the divisional level, Total was broadly in line in the E&P segment while recording better margins at the Refining and Chemicals division. What is more important to report is the fact that this was the first quarter in which the company disclosed the integrated Power ROACE results. On a twelve-month basis, the segment delivered a ROACE of 9.9%. This new transparency highlights (and there was no doubt) that this division has the lowest return among the Total portfolio; however, these details are very much appreciated.

TotalEnergies Q1 Financials in a Snap

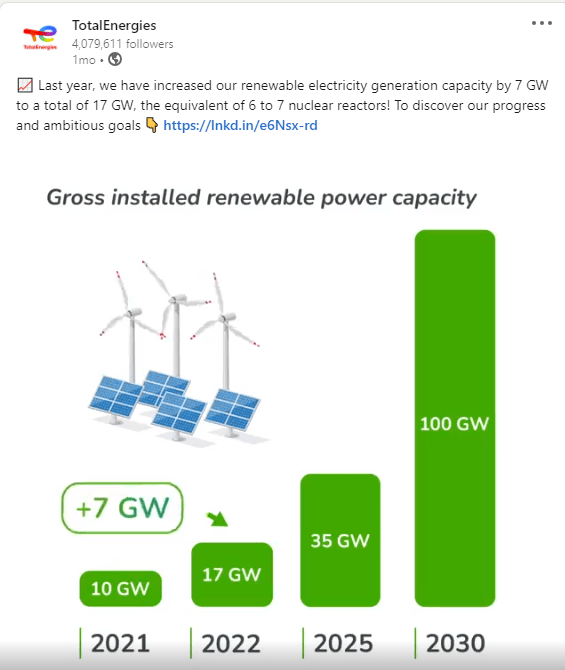

According to our estimates, this will be the new Total engine to fuel the company's 2030 growth. As a reminder, in 2022, the company increased its renewable electricity generation capacity by 7 GW and now there is a total production capacity of 17 GW which is equivalent to six nuclear reactors (Fig 1). In addition, Total is currently investing more than $1 billion per year in R&D projects.

TotalEnergies gross ren. energy install capacity

Fig 1

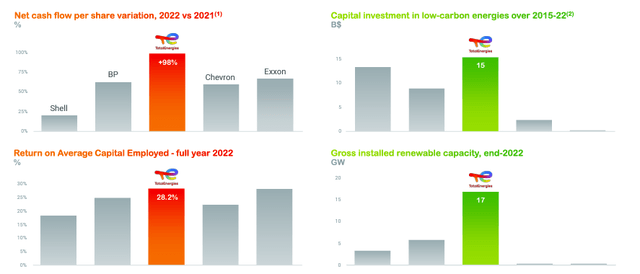

Looking at the latest news, the company also announced that it has accepted Suncor's offer for the Canadian assets. The total transaction value is set at approximately CAD$5.5 billion in cash with a potential earn-out of CAD$0.6 billion. According to our calculation, this values Total's Canadian assets at circa 3.5x forward the cash flows from operations, which is a slight discount to the market. However, this is a clean sale and outweighs a potential IPO discount and dividend in kind. Someone might say that by investing in non-oil projects, the company has failed to keep up with returns. This is not true. The company was able to deliver superior returns and results while transforming and growing the business.

Total delivered superior returns

Q1 CAPEX investments reached $6.4 billion, of which organic capex stood at $3.2 billion. First quarter M&A activity was more pronounced than usual. With $3.2 billion of acquisitions split between E&P for $1.9 billion in UAE, Integrated gas for $0.8 billion in Qatar, and Power for $0.5 billion in Brazil.

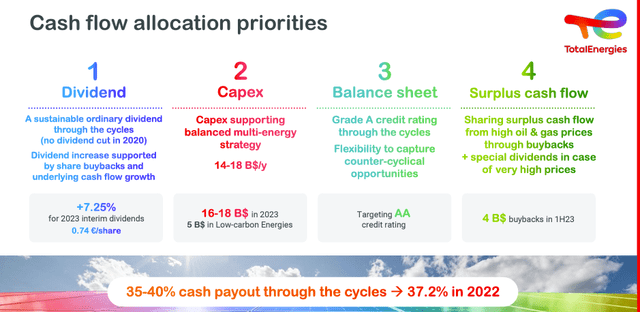

Conclusion and Valuation

Going to our Q2 estimates, we see LNG selling price between $10-12/MMbtu with a production expected around 2.5mboe per day, forecasting European and Asian gas prices stable at $15/MMBtu. The company announced the $2 billion share repurchase completion for the second quarter. But, more important to report is the higher shareholder capital distribution. For the year, the company will now pay out "at least 40%" of Total's cash flow from operations including dividends and buybacks. This is above the guidance of 35-40% and is a reflection of anticipated disposals (such as the Canadian assets) but also Total retail networks in the Netherlands and Germany. In parallel, the company confirmed its CAPEX investments between $16-18 billion. Based on an EV/Debt-adjusted cash flow of 6x, we decided to raise our target price from €60 per share to €65 per share, confirming our buy rating target. This is also supported by a lower P/E compared to the sector (Total at 4.66x vs US oil > 7x) and a higher dividend yield. We positively view management's commitment to raising capital distribution and Wall Street analysts should reprice Total's investment case.

Total's capital priorities

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TTE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.