As compared to the benchmark, currently, the portfolio of the scheme is overweight in auto, industrial products, capital goods and telecom.

ICICI Prudential Bluechip Fund, which is among the biggest actively managed equity funds, has completed 15 years in existence. The scheme had assets under management (AUM) of Rs 37,016 crore as of May end.

The scheme is a large-cap fund and is benchmarked against the Nifty 100 Total Return Index.

Returns

ICICI Prudential Bluechip Fund was launched amid the global financial crisis in 2008 and as per the fund house, the scheme has delivered a compounded annual growth rate (CAGR) of 13.98 percent since inception.

This means that Rs 10 lakh invested during the new fund offer (NFO) period of the scheme have grown to Rs 71.5 lakh currently. Further, in the same year, an investment in the benchmark of the scheme would have fetched the investor Rs 46.8 lakh.

A systematic investment plan (SIP) in the scheme since its inception would have delivered a CAGR of 14 percent to investors. If Rs 10,000 were invested in the scheme every month for 15 years, an investment of Rs 18 lakh would have grown to Rs 56.4 lakhs.

Anish Tawakley, Deputy CIO-Equity and Head of Research at ICICI Prudential Asset Management Company, who has been managing this scheme for the past five years, says, “Over the years, picking high conviction stocks with a buy-and-hold approach in large-cap companies with a proven track record, quality management and good growth potential has worked well for the scheme."

Holdings

As compared to the benchmark, currently, the portfolio of the scheme is overweight in auto, industrial products, capital goods and telecom.

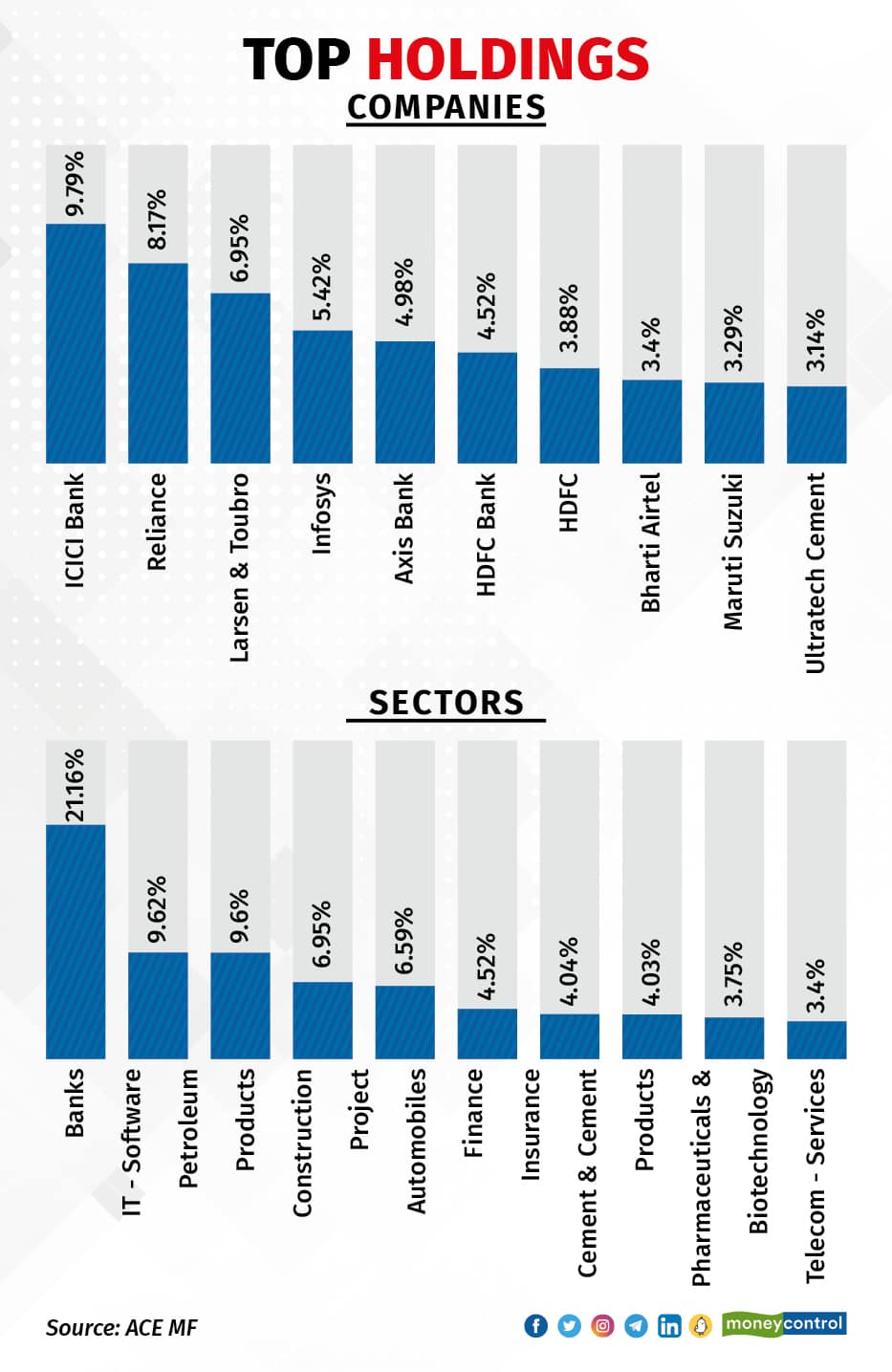

As per data available with ACE MF, the scheme's top stock holdings include ICICI Bank (9.79 percent), Reliance (8.17 percent), Larsen & Toubro (6.95 percent), Infosys (5.42 percent and Axis Bank (4.98 percent).

In terms of sectors, the top weightage is to banks (21.16 percent), IT (9.62 percent), Petroleum Products (9.6 percent), Construction Project (6.95 percent) and Automobiles (6.59 percent).

Performance

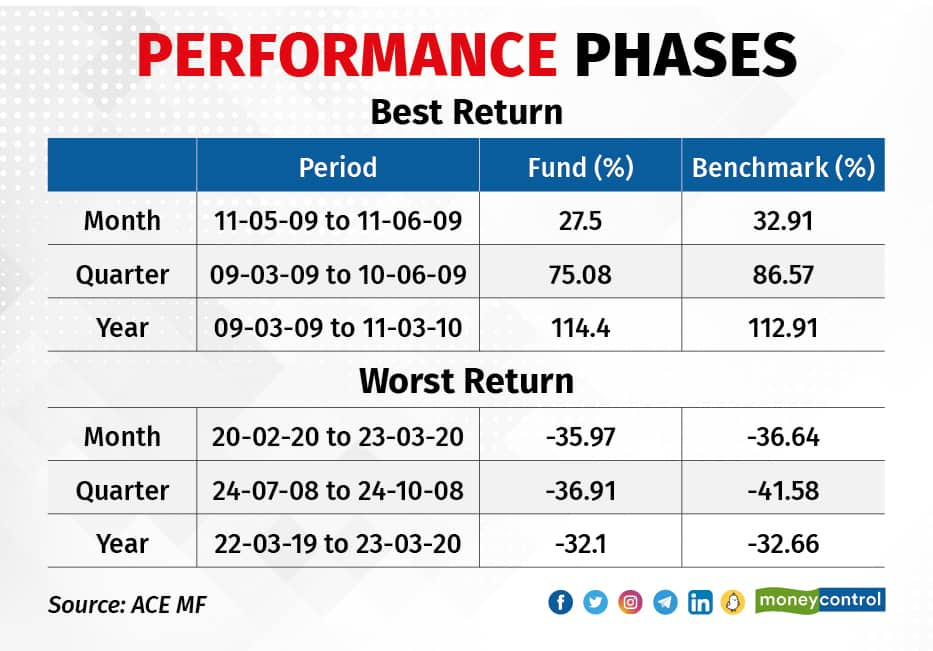

Large-cap stocks are less volatile compared to mid-cap and small-cap stocks. As on May 31, the scheme has outperformed the Nifty 100 Total Return Index across timeframes such as – since inception, one year, three years, five years, 10 years and 15 years.

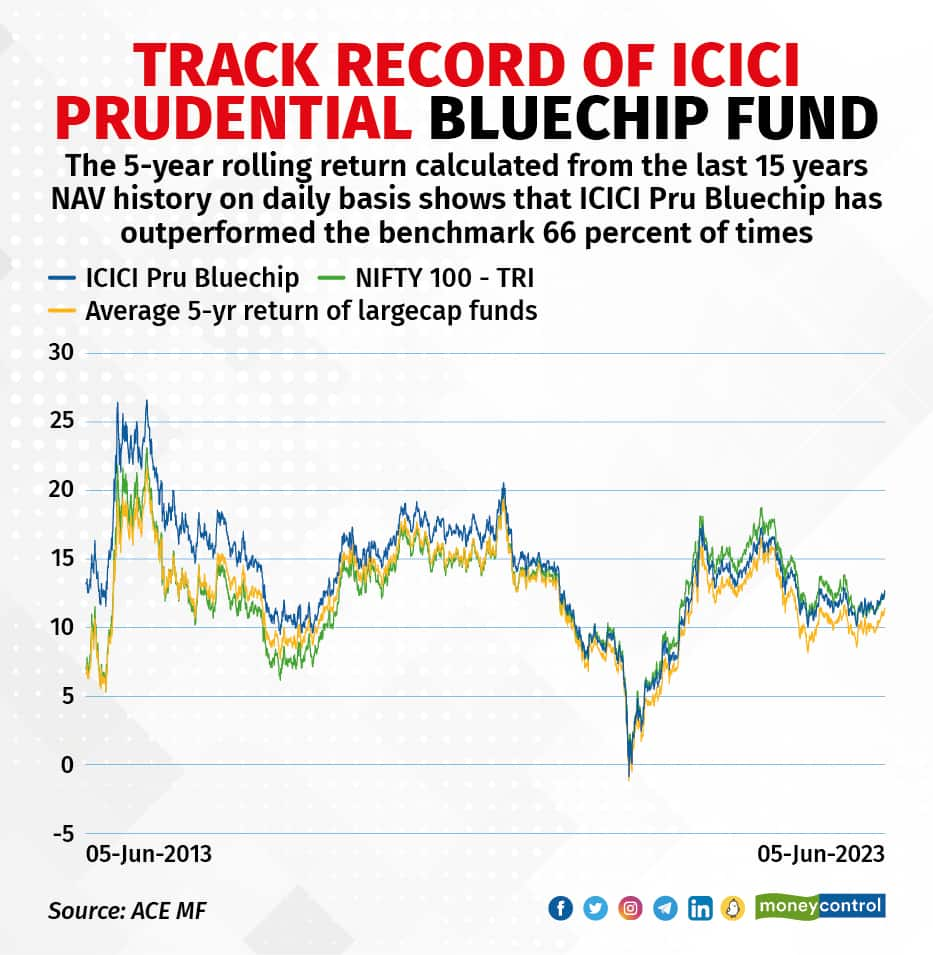

Further, the 5-year rolling return calculated from the last 15 years of net asset value (NAV) history on a daily basis shows that ICICI Pru Bluechip has outperformed the benchmark 66 percent of times.

As per data available with Value Research, over the last 10 years, the scheme has beaten the Nifty 50 index on seven occasions on a yearly returns basis.

Notably, the scheme had a series of underperformance years from 2018 to 2020.

“The underperformance of the fund during certain periods could be because of the approach a fund house follows during a particular cycle. The valuations were high during 2018-2019 and the fund would have followed a more cautious approach during that stage. However, over the two-three years, the performance has regained its pace along with some moderation in valuations. From the portfolio point of view, the fund hasn’t tried to mimic the index, which has helped their outperformance,” said Harshad Chetanwala, co-founder of MyWealthGrowth.

The path ahead

For large-cap funds, the road ahead is not going to be as smooth as it has been in the past. Already it has become tougher for large-cap funds to beat their benchmark indices consistently. How ICICI Prudential Bluechip Fund performs from here on, remains to be seen.

As per the Moneycontrol Mutual Fund Ratings and Rankings, ICICI Prudential Bluechip Fund scored a superior risk-adjusted return and was rated four-star within the large-cap category.