THOR Industries: Solid Q3, Resilient Business, A Sleep Well Investment?

Summary

- THOR Industries faces a challenging FY2023 with decreasing revenues and backlog orders but shows promise in its European segment with increased sales and gross margin.

- The company has a strong competitive advantage due to its scale, market leadership, and vertical integration, making it difficult for competitors to replicate its success.

- Despite risks such as supplier dependencies and increasing leverage, THOR's undemanding valuation and resilience make it a buy recommendation for long-term investors.

simon2579

THOR overview

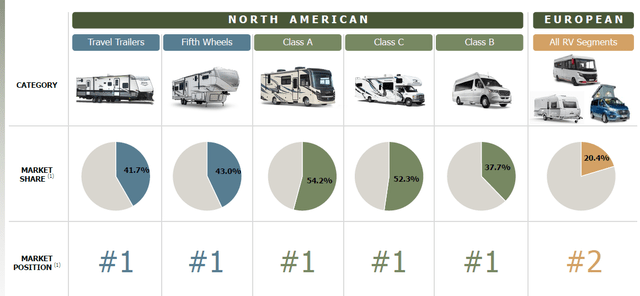

THOR (NYSE:THO) was founded in 1980 and is the world's largest manufacturer of recreational vehicles (“RVs”), with a steady 40%+ market share in North America and 20% in Europe.

The Company manufactures a wide variety of RVs. It sells those vehicles and related parts and accessories primarily to 3500+ independent, non-franchise dealers throughout North America (2400 dealerships) and Europe (1100 dealerships, only two are company-owned, 45% sell EHG brands exclusively).

They produce RVs by assembling key components like chassis, windows, and frames from a limited number of suppliers and thousands of other parts from numerous suppliers. They have 400+ facilities and 32,000 employees worldwide.

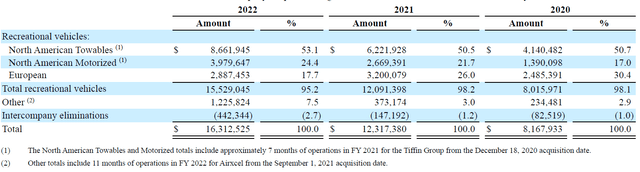

THOR has three segments, NA Towables, NA Motorized, and European.

THOR's FY22 Annual Statement

Recent financials - Q3’23

THOR’s recent Q3’23 results show a continued challenging period for the leisure industry.

Revenue was $2.93 billion, a decrease of 37.1% YoY and 15.3% over the same quarter of fiscal year 2021. The revenue decline continues from Q2’23 and Q1’23 declines of 39% and 22%, respectively, but is slowing down slightly.

Q3’23 | Q2’22 | Q1’23 | Q4’22 | Q3’22 | |

Revenue YoY | -37% | -39% | -22% | 6% | 35% |

The decline is mirrored by the steep fall of 55% in backlog orders in the largest segment, NA Towables, representing over 50% of the business.

However, positives are seen in the newly acquired segment - European, where sales increased by 20% and gross margin was 17.5%, higher than the 14% compared to the same quarter in fiscal 2022.

Overall, management sees a challenging FY2023. Hence they have lowered the sales guidance for the year to $10.75B at the midpoint (previously $11B). But they see a slight improvement in the gross profit margin range of 13.8% to 14.2% (previously 13.4% to 14.2%) as they continue to stick with the price hikes. Finally, earnings per share will be in the range of $5.80 to $6.50 (previously $5.50 to $6.50), representing a slight improvement.

I am more interested in looking at the business with a long-term view, and I believe THOR has many positives despite a challenging year.

Why is THOR a good business?

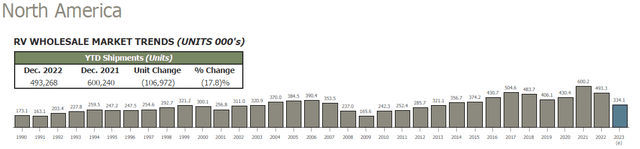

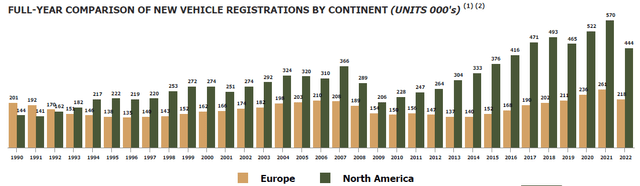

It operates in an industry where the demand is steady and growing. It’s difficult to see that people will stop choosing to go on cost-effective holidays in nature. In the past 20 years, the market has grown steadily by about 5%.

THOR's Q3 presentation

THOR's Q3 presentation

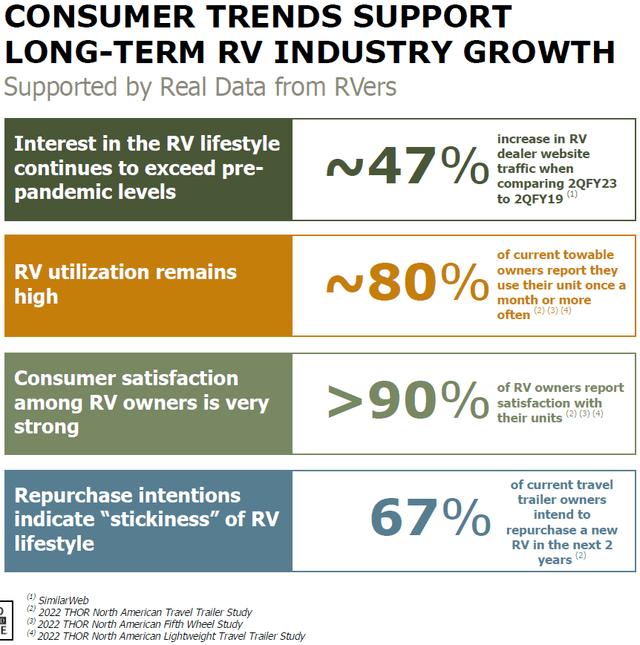

Consumer trends support long-term growth with increasing interest in an RV lifestyle (healthy and close to nature), high satisfaction among RV owners, and stickiness, as 67% of current owners intend to repurchase in the next two years.

Similarweb

Additionally, the desire to recreate in the outdoors is constant, if not growing. Thus, there is little risk of disruption or drastic changing needs. Moreover, camping is a low-cost alternative to more expensive travel options, particularly those requiring flying and staying in hotels.

2. It’s a tricky business to succeed over a long period because it’s very competitive - primarily competing on price, low margin, and cyclical. There are many competitors, with 80 manufacturers in NA. and 30 in Europe, and then there is competition against the second-hand RVs market too. Yet, THOR has been able to grow revenue per share and free cash flow per share by almost 20% CAGR in the past ten years and maintain a high ROE and ROIC of roughly 20%+ and above its median WACC of roughly 13%.

3. It's a complex business to replicate because THOR has a considerable scale advantage. It has 3500+ dealerships (customers), who have little bargaining power over THOR as they are independent, evidenced by the recent price increase, despite challenging post-covid soft demand and inventory glut issues. THOR also has an extensive network of suppliers for thousands of parts, although a few are in critical components, which makes it difficult to replicate. These parts are assembled in 400+ facilities, a considerable investment in scale for new competitors.

4. THOR is also working towards being vertically integrated with the acquisition of Tiffins (2020), Togo (2021), and Airxcel (2021), who are manufacturers of components and producers of applications specifically for RVs.

5. THOR is the leader in the market with a 40% market share, 8% more than Forest River (34%), and 4x the size of Trigano, Patrick Industries (PATK), and Winnebago (WGO). Its market shares have gained steadily in the past ten years to 40%+ in the US and 20%+ in Europe, partly thanks to acquisitions. Although their shares have declined by 5% in the US Towables segment to 41% from 46% pre-covid, it could be explained by their strategy to balance between growing market share and gross margin. Between 2019-2022, the gross margin has increased by 7%, showing pricing power as the leader.

Market share | 2022 | 2019 |

US towable | 41% | 46% |

US motorized | 49% | 36% |

Europe | 22% | 22% |

Source: THOR's annual statements, Sleep Well Investments

The slide below breaks down THOR’s position in different RV classes.

THOR's Q3'23 presentation

With the acquisition of EHG in 2019, THOR is the number 2 player in Europe, with a 21% market share in all RV segments compared to 24% in 2018. The fall in market share can be explained by the substantial market share growth of Trigano, who captured a 15% market share, rising from 11% in 2015.

THOR has undoubtedly gained a lot of market share compared to the overall market growth of 5% in the past two decades. However, the market share has been steady in the past three years. It depends on their M&A and how competitors do, but I believe THOR can maintain its top position without gaining more market share.

6. Last, the business has been resilient in past turbulences. In particular, they survived the 50% decline of business in 2008/9 without making a loss or burning cash. They also recover fully in just three years.

Management

I judge management quality based on competency, long-term mindset, aligned interest, and capital allocation capability.

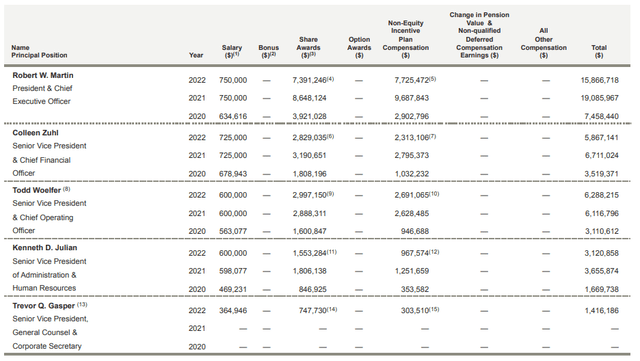

The CEO, CFO, and COO are competent, given their background and long tenure at the company. The CEO, Robert Martin, has been at the company since 2001, while the CFO, Colleen Zuhl, has been since 2011, and the COO, Kenneth Julian, since 2012.

With their long-term tenure, track record of growing the company, and acquisitions to strengthen its supply chain (moving vertically), they are long-term oriented and want to build a company to last.

The management team is adequately and correctly incentivized for performance as 95% of their pay is variable performance rewards, tied in with the net before-tax income, ROIC, and free cash flow.

THOR's FY22 annual statement

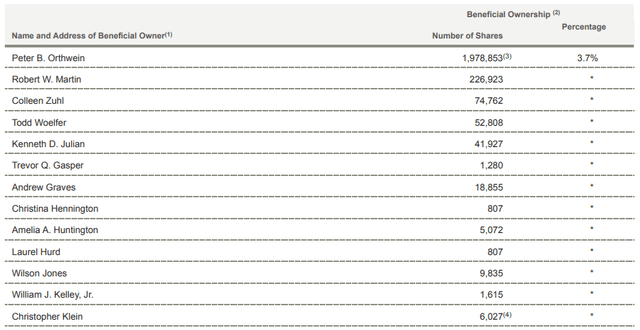

They are, however, low on the fixed salary compared to the size of the business, and collectively, they own only 1% of the outstanding shares (53M). Peter Orthwein, the co-founder of THOR Industries, owns 3.7% of the company.

THOR's FY22 annual statement

Management’s capital allocation is strong given ROIC spread over WACC has been 8%+ over the last 20 years, with an ROIC average above 20% and WACC around 13%.

However, management’s capital allocation has been rather aggressive in the past few years, given the heavy spending on M&A, dividends, and share repurchases, partly funded by the $1.7B issuance of debts.

FY2022, THOR has:

- Repurchased $165M worth of shares at $84/share,

- Paid $95M in dividends, and

- Spend $200M+ on CAPEX

Meanwhile, the acquisitions of Tiffin, Togo, and Airxcel amounted to $2.8B

However, the cash balance of $288M and estimated free cash flow of $500M+ in FY2023 should cover their aggressive capital allocation plans for now. Time will tell if this is sustainable, but at the moment, I am favoring the management to slow down on the dividend increase and share repurchase and repay more of the debts, given the interest expense is around $100M/year.

Overall, the management is competent, long-term oriented, adequately incentivized, and capable of capital allocation. Mainly, I like the acquisition of Aircel and Tiffin. Both promise to strengthen the supply chain for THOR and reduce the dependencies on other suppliers.

Competitive advantage

The industry is highly cyclical and competitive. Thus, it benefits dominant players such as THOR Industries, who can survive the toughest time and use the reserves to acquire struggling businesses and gain more shares.

THOR can defend its earning and go through tough times like the current period because it has a considerable scale advantage. It resembles Costco's razor-thin gross and net margin business. The scale advantage allows it to keep margins steady in the past 20 years while compounding its top-line and free cash flow per share by 14% and 18% CAGR.

It has been shown to have pricing power too. In recent quarters, it has raised prices despite the challenges of the down cycle, allowing an uplift in gross margin in the past two years. It shows it can balance gaining market share and growing margins flexibly.

THOR can keep operating at a low margin yet continue to compound as it has a strong ROIC record and reinvestment opportunities in e-RVs, younger demographic, vertical integrations, and Asia.

Overall, THOR has a considerable competitive advantage over peers and can defend its margin and still grow its business as the new entrance needs to invest a lot to reach THOR’s scale (>400 facilities, 3.5K dealers, complex supply chain, and vertically integrated business). Even the next competitors will find it difficult to match as they are not 100% focused on RVs. For example, Trigano is only in Europe and has 10% of its business in children's playground and camping equipment, Patrick Industries has 50% of its business in Marine and Housing, and Winnebago is focused on the high-end RVs and also has 10% of its business in Marine.

Risks

Some dependencies on suppliers of key components, such as chassis and engines, have come under pressure with the shortage of semiconductors and drive trains. THOR also relies on LCI Industries, the key supplier of windows, doors, towable frames, and axles.

Some dependencies on a key dealer (customer) - FreedomRoads, LLC, accounted for approximately 13.0% of consolidated net sales in FY2022, despite falling from 15.0% FY2020.

Unknown risks on the trend towards electric RVs - need more time to understand.

There is little margin of error as THOR operates in a razor-thin margin business with little product differentiation. THOR needs to maintain the scale advantage by being productive in adapting rapidly to changing customer needs and improving production processes to continue expanding the razor-thin margins.

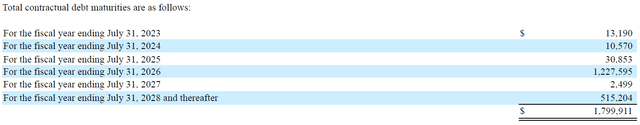

Increasingly leveraged while aggressively returning capital to shareholders (share buybacks and dividends - more on capital allocation section later). THOR increased debts by $1.7B in 2019 to acquire the European business EGH in 2019, Tiffin, and Togo in 2020. The terms are reasonable and serviceable at roughly a 5% interest rate and maturity to 2027 (with 1.2B in 2026) compared to the current Fed rate of 5.25% and estimated free cash flow of $500M in the next few years.

THOR's FY22 annual statement

Having said that, it would be a risk worth taking if the acquisitions of EHG and Tiffins were successful. Time will tell. THOR can also refinance at better rates, given that the next big debt repayment date is 2026.

Valuation

THOR PE has ranged between 19x and 4x from peak to trough. At the current price, it’s trading at around 6x PE. At the worst period in 2008/9, it was trading at 11x.

Then, if we look at THOR’s estimated free cash flow of around $500M for the next few years, it's trading at 10x, on par with 2008’s multiple.

So considering the macroeconomic backdrop, market position, and likely industry-wide recovery in the next few years. THOR’s valuation is undemanding.

Conclusion

THOR is a resilient, hard-to-replicate business with competitors who are not 100% focused on RVs, a setup that makes it a likely winner in the future. Valuation is also undemanding despite the positive market reaction after Q3’23 results. I rate THOR a Buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.