Investing In Secular Trends: Adoption Of AI

Summary

- AI development has potential to create job losses, new jobs, and enhance current jobs, with early winners, including Nvidia, Microsoft, and Alphabet.

- Downstream beneficiaries of AI include businesses that can reduce headcount or accelerate growth, such as medical research, content creation, and cybersecurity.

- Investing in AI should involve a diversified approach, with a focus on owning capital in a world where the value of labor may decrease.

Shutthiphong Chandaeng

The excitement and hype around artificial intelligence, its development, and its potential uses and consequences is well established at this point. With any new and potentially groundbreaking technology, analysts and commentators share countless perspectives, positive and negative, about how they think the new technology will change our society.

Typically, on the rosy end of the spectrum commentators speak to efficiency gains, rising profitability of companies, increased standard of living, and new opportunities for individuals for work and play. While some of these best-case scenarios might come to fruition, many will not, at least for the foreseeable future.

On the other end of the spectrum are the naysayers. Advances in technology are often met with fear as the future consequences are unknown. However, despite the mixed feelings that typically accompany new technology, the reality tends to be not as bad as feared.

Much of the fear as it pertains to AI is caused by the potential negative impacts on the job market. However, despite these fears, the result is usual a combination of three possible outcomes: job losses (obsolescence), new jobs (those that design and produce the new technology and those whose functions were created directly or indirectly as result of adoption), and enhancement of current jobs through the use of the new technology. The balance of these three outcomes will be determined over time, although most media will focus on job losses as negative news sells.

Early Winners

At this early stage of development, there are some early winners that are directly involved in the development of the technology and therefore are benefitting. These include those building the actual infrastructure and hardware that serves as the backbone to AI. Nvidia (NVDA) is in a league of its own on this front, at least for the time being, by providing the chips necessary to run non-parallel processes. Other companies making rapid gains include some mega cap tech incumbents including Microsoft (MSFT) with its investment in Open.AI, Alphabet (GOOGL) with Bard, and numerous other smaller players that are less well known. Amazon (AMZN) has been developing its own AI for many years, the most well-known application being Alexa.

Whether these incumbents continue to drive AI forward is yet to be seen. Regardless of the hype and ultimate outcome of the future of AI, the companies listed above are unbelievable companies that should be expected to continue to generate shareholder value for the long term.

Downstream Beneficiaries

Who will be these downstream beneficiaries? First, it’s important to understand how AI might create value for companies. While the immediate thought, and concern, might be to look for businesses that will be able to reduce headcount, that is only one lever to be pulled. Sure, cost savings will be important, but those businesses able to grow faster and generate more revenue while managing expenses will be the standout beneficiaries.

Those benefiting through reduced headcount include businesses employing many people to complete tedious, repetitive work. These might include roles within insurance companies (processing claims), credit analysis (both credit agencies and credit card companies), medical diagnosis (in exam rooms and telehealth services), customer service/call centers, paperwork for transactions within real estate and automobile sales, title insurance, etc.

Other currently high value services may experience loss of headcount as the direct result of AI. These could include legal services, pharmacy, and accounting. In most cases, however, human oversight will remain critical for safety and quality control.

High value areas that might be able to accelerate growth, revenue, and profitability include medical and pharmaceutical research, content creation/advertising/marketing, cyber security (improving the protection especially as bad actors leverage the technology), autonomous vehicles, and any areas involving managing and monetizing large quantities of data. Within the medical and pharmaceutical fields, for example, AI will enable faster experimentation and R&D, resulting in faster, more effective, and ideally, less expensive treatments that drive revenue and profits for drug companies.

By replacing some headcount or leveraging the technology to extend the efforts of workers (research), this creates the potential for higher trend GDP growth as output isn’t as closely tied to the number of workers and hours worked. This can be improved further by AI enabled robotics in manufacturing and other tasks. The result is a push toward a nonlinear economy in which what is produced is not necessarily linearly related to what goes in (specifically in terms of quantity and time of labor.)

Risks and Other Consequences

There are many cons to the widespread adoption of AI. While loss of jobs is top of mind, other concerns include dependency on machines, moral and ethical considerations, and increased economic inequality.

The replacement of workers with AI combined with the hoped-for efficiency gains means that widespread adoption of AI will likely be deflationary. While this is a positive attribute in some areas of the economy (e.g. drug costs), it may also means that a disproportionate benefit of AI will accrue to large companies. This will further the gap between the capabilities of large companies that can invest in and leverage the technology versus small companies who do not possess the resources to do so. The result of these dynamics will be an increase in economic inequality.

Beyond inequality and possible dehumanizing of businesses, AI can and will make mistakes. AI is dependent on algorithms, which for the time being are written by people. People make mistakes and exhibit systematic biases, so AI will do the same. AI should be used to reduce noise in data and decision making, but programmers and users must be aware of the possibility of bias within the output generated by AI. Otherwise, it will make us worse off in many cases. For more information on this concept, see the book Noise: A Flaw in Human Judgment by Daniel Kahneman, Oliver Sibony, and Cass Sunstein.

Picking Winners Won’t Be Easy

The early stage of AI makes the future path of development unpredictable, making choosing winners and losers with any level of precision nearly impossible. There will be unforeseen consequences, good and bad. This will lead to missed opportunities on one hand and destruction of value on the other. How this technology and its use will shape, or not shape, our world 1, 5, 10 or more years from now is uncertain. So rather than attempt to make precise picks, it might be better to be directionally correct and make broad bets.

Portfolio Strategy

Given the opportunity and uncertainty presented by AI, I think that an enhanced indexing strategy makes sense. In general, most individual investors should select well-diversified funds to make sure they have coverage and avoid missing out on this opportunity completely. However, I understand that most will want to take a shot at catching the next big winner. My advice for that portion of the strategy is to size positions appropriately. Generally, this means sizing individual stock positions at about 1%-5% of stock allocations. In that case, if some of your picks go to zero, it’s annoying, but not devastating. If you happen to hold a winner that grows 10x, or 100x, or more, then it will move the needle on your total portfolio.

The biggest decision at this time for choosing individual names is betting on the incumbents like Nvidia, Microsoft, and Alphabet, or newcomers – those new, small (and currently under the radar), or yet to be formed businesses. The latter category will be difficult to navigate as some companies will seemingly come out of nowhere, stay private, or will go public much later in life, resulting in most value accruing to founders and early investors.

Beyond choosing individual names, I think it makes sense to also hold some broader coverage through ETFs. This can be done through ETFs focused on a specific niche, theme, sector, or the broader U.S. stock market. The key here is that in a market-weighted index the winners will rise to the top and create value at all levels. However, the impact of that value will become more dilated as the strategy becomes more diversified.

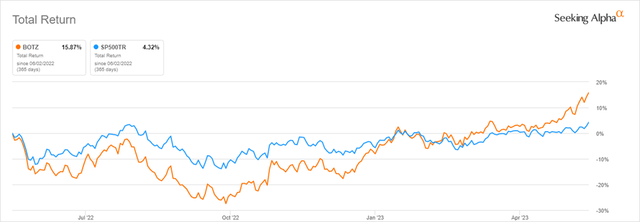

The Global X Robotics & Artificial Intelligence ETF (BOTZ) is a niche fund that currently has about 50 holdings, including Nvidia as the largest, and is invested about 48% in the U.S., 32% in Japan and 20% across the rest of the world (mostly Europe.) The expense ratio for the fund is 0.69%. As the name of the fund implies, it is focused on companies involved in the development of robotics and AI and supporting businesses that generally serve industrial and corporate end users.

The fund has outperformed the S&P 500 on a total return basis year-to-date and over the last 1-year but underperformed during periods longer than that. The sharp rise in Nvidia is a material contributor to recent outperformance.

1-Year Total Return: BOTZ versus S&P 500 (Seeking Alpha)

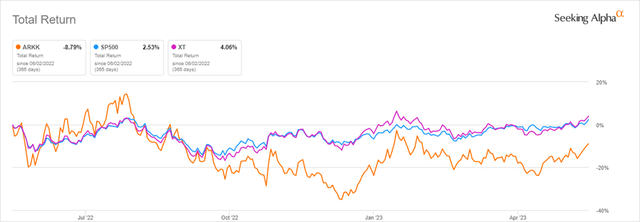

Another well-known and established thematic ETF is the ARK Innovation ETF (ARKK). While the fund recently took profits and exited its position in Nvidia, it continues to hold the stock in its other funds. According to Ark Invest CEO and CIO Cathie Wood, the NVDA position was a top four contributor to ARKK’s total return since purchased in 2014.

Even without Nvidia (a position that may be added back in the future), ARKK remains well-positioned to benefit from the secular trend in AI. The largest position is Tesla (TSLA), which will ultimately be a significant beneficiary of AI as it continues to develop its full self-driving capabilities. Tesla continues to develop its own AI chips, removing NVIDIA from the manufacture of its cars. In a recent interview, ARK’s Cathie Wood stated that she and her team expect Tesla stock to rise by 10x over the next four years. That aggressive projection is based on the adoption of self-driving capabilities that are dependent on the continued development of AI hardware and software.

Other beneficiaries within the ARKK portfolio include those that will be able to refine and accelerate processes as discussed above such as Exact Sciences (EXAS), CRISPR Therapeutics (CRSP), and several of the other biotech names. The downsides to this fund include its relatively high expense ratio of 0.75%, high volatility, and concentrated portfolio that may not fully capture the value creation potential of AI.

The iShares Exponential Technologies ETF (XT) is interesting in that it combines exposure to large incumbent players in the AI space with many rapidly growing and innovative companies that will likely be beneficiaries of AI technology. The portfolio consists of over 200 holdings with NVIDIA, Meta (META), and Palantir (PLTR) the top three positions. The expense ratio is lower than ARKK at 0.46%, as is the volatility. Like ARKK, this fund has meaningful exposure to healthcare and biotech, areas that are likely to benefit from AI.

1-Year Total Return: ARKK versus XT versus S&P 500 (Seeking Alpha)

For those seeking broader exposure than the thematic funds discussed above, I continue to believe that most investors will be well-served holding the Invesco QQQ Trust ETF (QQQ) and SPDR S&P 500 ETF Trust (SPY). Both are market-weighted with the major difference being that QQQ is more concentrated and focused mainly on the technology, communication services, and consumer cyclical sectors and only holds about 100 positions. The top six positions are the same in each with Microsoft, Apple (AAPL), Nvidia, Amazon, Alphabet, and Meta representing 26.1% of SPY and 51.3% of QQQ. I view this as evidence that supports the idea that the winners rise to the top and that diversified investors will benefit from the growth in AI.

1-Year Total Return: SPY versus QQQ (Seeking Alpha)

Final Thoughts

Admittedly, this is an incomplete review of the potential consequences of the growing adoption of AI. There are countless ways that this technology could impact businesses and individuals, and we are in the early innings of this development. If this technology does in fact create widespread disruptions in the economy and financial markets, then it is reasonable to expect social issues of similar magnitude.

Predicting the future is a futile exercise. There is simply too much randomness in our world. However, it is reasonable to prepare for a wide range of possible outcomes. Even if you’re wrong, or have planned inadequately, those who have done something will be better off for it. The technology is too new, and its potential not fully understood. There will be winners and losers, but it may be too early to pick them. Like with most portfolio strategy suggestions, employing a broadly diversified approach is probably best for most investors. While you won’t get rich by picking the next company to return 1,000x, you won’t miss it either. Winners rise to the top, and the value they create along the way can be captured, at least in part, through the ownership of broad swaths of the market. That is assuming that these companies are already publicly traded, or new companies and those yet to be formed, will someday list as well.

The focus on efficiency and advancement makes sense. It is rational. But it may not always be reasonable. Some of the most extreme predictions involving significant portions of the labor force losing their jobs are dire. At some point it might make sense to ask the question, “Do we really want this?” If yes, great, then let’s continue unabated. If not, then who determines how and where to stop? Only time will answer these questions. We have a lot to learn.

The trend toward more intangible assets and digitization will be accelerated by AI. This will increase the value of capital and reduce the value of labor over time. So, I suggest, in a world in which the value of labor is evaporating, own the capital.

Thank you for reading. I look forward to seeing your feedback and comments below.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN GOOGL MSFT EXAS SPY QQQ XT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.